HodlX Visitor Submit Submit Your Submit

LRTs (liquid restaking tokens) and the emergence of layer two resolution Blast are powering a brand new wave in DeFi staking.

On this article, we’ll take a look at the backdrop behind this improvement, what it means for DeFi staking and what the key developments are within the area.

Liquid restaking tokens he latest innovation in LSDs

Supply: Bing Ventures

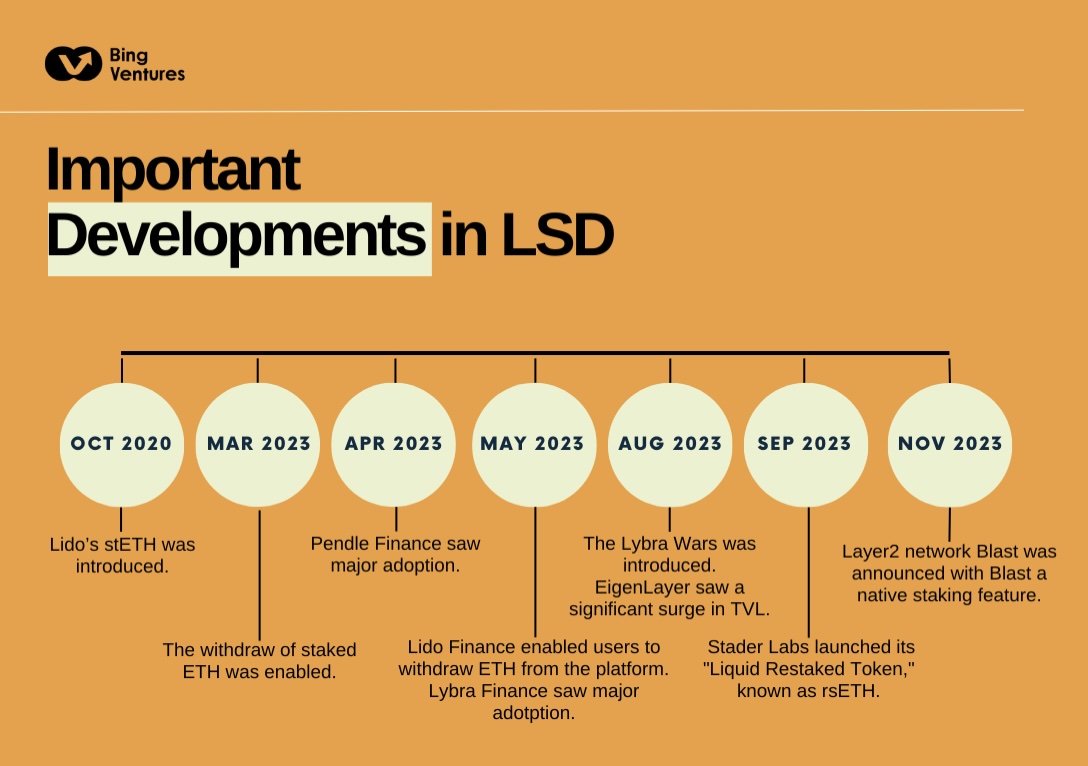

LSD (liquid staking derivatives) have been an space within the Ethereum ecosystem that has demonstrated exemplary innovation and adaptableness, particularly after the Shanghai improve.

Lido Finance, a platform that performed a important position in refining the Ethereum staking mechanism, was the place it began.

With its modern resolution, Lido unlocked the liquidity of staked property in Ethereum, fixing a serious concern within the Ethereum staking mechanism.

Lido permits customers to earn staking rewards on Ethereum with out locking up property, marking a serious shift from the standard inflexible paradigm of staking.

Pendle Finance was the following to chart new territories within the LSD area. It pioneered yield tokenization on Ethereum, enabling customers to commerce yield and earn a set yield on their property.

This new mannequin opened up new approaches for yield optimization and danger administration.

The hunt for larger yields and fuller utilization of staked property, nonetheless, has no finish. Restaking protocol Eigenlayer emerged with a extra complicated mannequin.

Eigenlayer permits stakers to reallocate their staked property to safe further decentralized companies on the Ethereum community.

This not solely will increase stakers’ general rewards but in addition enhances cryptoe-conomic safety and resilience of the complete Ethereum community.

Nevertheless, a serious problem emerged. Restaked property turned fragmented and illiquid, hampering the exercise and composability within the DeFi area. This was the place LRT got here into play.

This innovation unlocks the liquidity of restaked property and additional will increase stakers’ rewards by enabling them to take part in DeFi.

Customers can deposit LRTs to liquid restaking protocols for added earnings.

With these developments, the LSD area has developed from a place to begin of single-layer staking right into a extra complicated and multifaceted ecosystem.

Some more moderen happenings, such because the emergence of Blast, mirror this development. Blast is an EVM-compatible Ethereum layer two networks that provides native yield staking of ETH and stablecoins on its chain.

This has additional democratized staking rewards and elevated the general consumer expertise by streamlining the method.

The evolvement of the LSD area demonstrated the dynamic atmosphere and adaptableness of the Ethereum ecosystem the place improvements are continuously being created to fulfill customers’ wants for larger liquidity and yield whereas navigating the intricacy and dangers of DeFi.

DeFi’s subsequent large factor LRTs

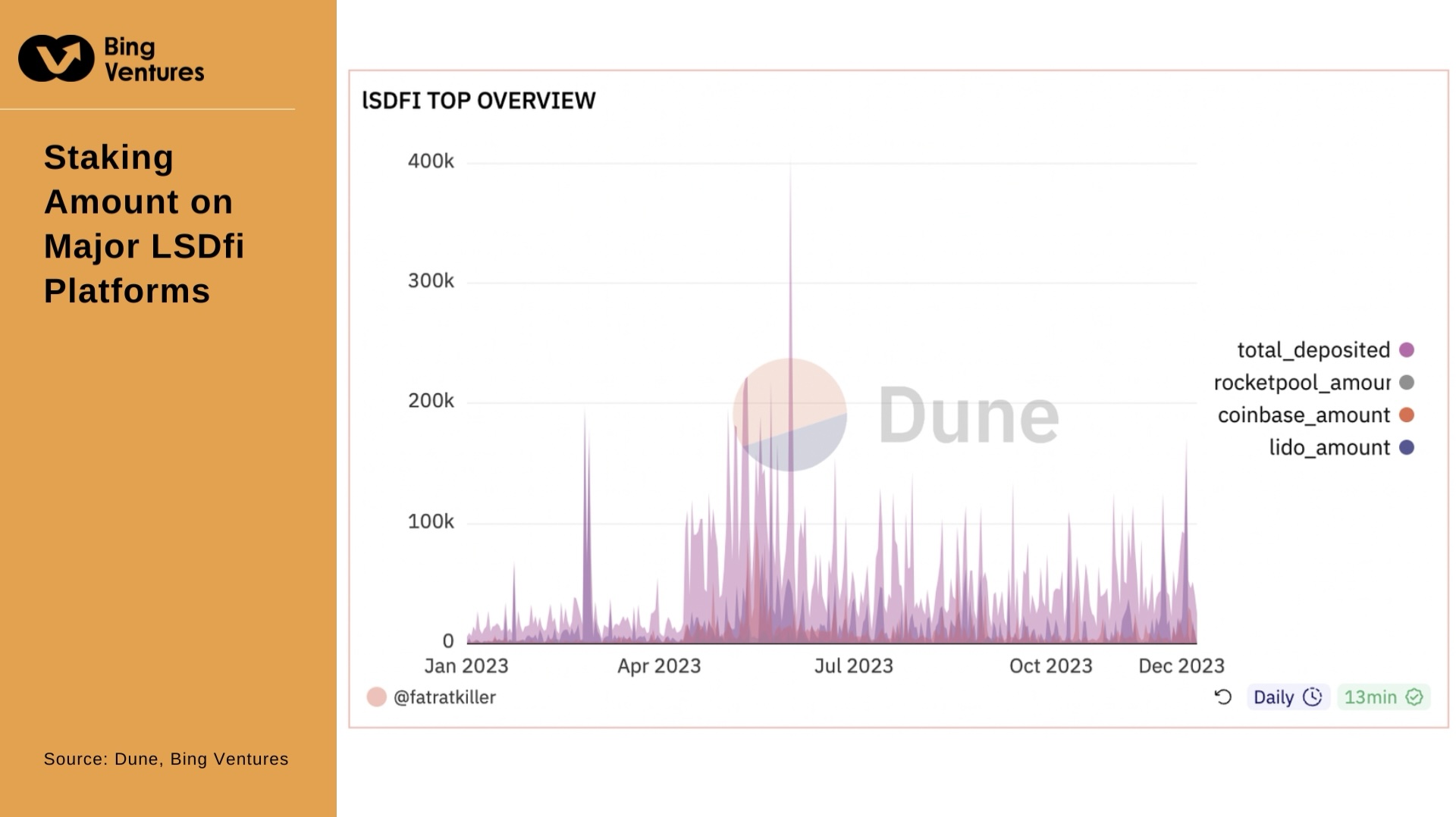

Supply: Dune, Bing Ventures

Within the realm of DeFi, the emergence of LRTs represents a profound revolution within the conventional staking paradigm.

LRTs characterize a breakthrough not solely by considering out of the field of single-asset staking but in addition by introducing and facilitating the event of multi-protocol staking.

By way of EigenLayer, customers can transcend the boundaries of a single protocol and diversify their rewards by staking ETH property throughout a number of AVS (actively validated companies) on Eigenlayer i.e., purposes and networks which can be secured through restaking.

This considerably enhances community safety and in doing so injects a extra intricate layer of safety into the entire DeFi ecosystem.

The benefits embodied by LRTs are manifold a big enchancment in capital effectivity, enhanced community safety and substantial financial savings for builders in useful resource allocation.

Nevertheless, we should stay vigilant concerning the accompanying dangers, together with potential penalty dangers, protocol centralization considerations and income dilution brought on by fierce market competitors.

Concerning the market prospects of LRTs, we imagine LRT protocols can have an incredible attract for customers with their excessive earnings potential.

LRT protocols supply further income streams for ETH stakers, encompassing not solely the essential staking rewards but in addition rewards from EigenLayer and the potential advantages of token issuance.

Furthermore, by way of incentive measures similar to airdrops, LRTs have the potential to draw a wider vary of individuals, thereby driving general DeFi development and making a development that would replicate and even surpass the warmth of the DeFi summer time of 2020.

The development is price listening to. With LRT offering contemporary impetus, the DeFi area is predicted to see elevated competitors much like the earlier ‘Curve Conflict,’ and token economics could evolve towards extra complicated veTokenomics fashions.

Within the meantime, as extra AVS are launched, the extra rewards that they provide to LRT holders might develop into a key driver for consumer acquisition within the LRT area.

In conclusion, LRTs have demonstrated their distinctive worth in unlocking liquidity, enhancing yields and optimizing governance and danger administration.

As such, LRTs aren’t solely a staking instrument but in addition a vital catalyst for DeFi innovation and development.

Their improvement and utility might carry profound modifications to the DeFi ecosystem, opening new prospects for customers, builders and the complete blockchain world.

Related dangers and challenges

Stader Labs has not too long ago emerged as a darkish horse with its launch of Ethereum mainnet’s first LRT rsETH garnering widespread consideration.

With rsETH, customers will have the ability to ‘restake’ liquid staked tokens, similar to Coinbase’s wrapped staked ETH (cbETH), Lido’s staked ETH (stETH) and Rocket Pool’s rETH on a number of totally different networks, minting a liquid token to characterize their share in a restaking contract.

This enables better liquidity and suppleness of staked property.

With the help of EigenLayer, rsETH has efficiently achieved large-scale restaking of ETH by streamlining the method for customers getting into the restaking ecosystem, additional reinforcing the decentralization of the Ethereum community.

Nevertheless, such improvements additionally carry dangers.

Ethereum’s founder, Vitalik Buterin, and the co-founders of EigenLayer have each identified that restaking could result in complicated eventualities, posing a menace to the safety of the primary community.

Moreover, with the proliferation of AVSs and LRTs, extreme dispersion of trade funds and a focus might lead to market instability and weakened governance buildings.

As an rising pressure, layer two community Blast added extra vitality to the area with its distinctive computerized compounding function.

Its innovation lies within the design that it not solely offers customers with fundamental staking yields by working with liquid staking protocols similar to Lido, however it additionally permits customers to obtain further yields from its auto-rebasing stablecoin USDB by working with protocols like MakerDAO.

Though such a mannequin is user-friendly and provides customers extra returns, owing to its influence on the TVL (whole worth locked) composition, it additionally brings in centralization considerations and will increase its sensitivity to market danger.

How Blast’s technique influences the precise utilization of property and the dynamics of capital flows inside its ecosystem would be the key.

Blast ought to intention for its TVL composition to shift extra from capital preservation to asset development in order that it will probably keep good community exercise and ample liquidity in DApps.

Solely on this manner can it really obtain its objective of driving the expansion of its blockchain community, reasonably than merely serving as a deposit platform.

Total, whereas each Stader Labs and Blast signify innovation and progress within the staking fashions of the DeFi sector, they don’t seem to be with out dangers that we should always stay vigilant about to make sure the protection and well-being of the Ethereum community in the long term.

A sturdy and sustainable steadiness must be reached between these improvements and danger administration sooner or later.

Different new paradigms for Ethereum staking

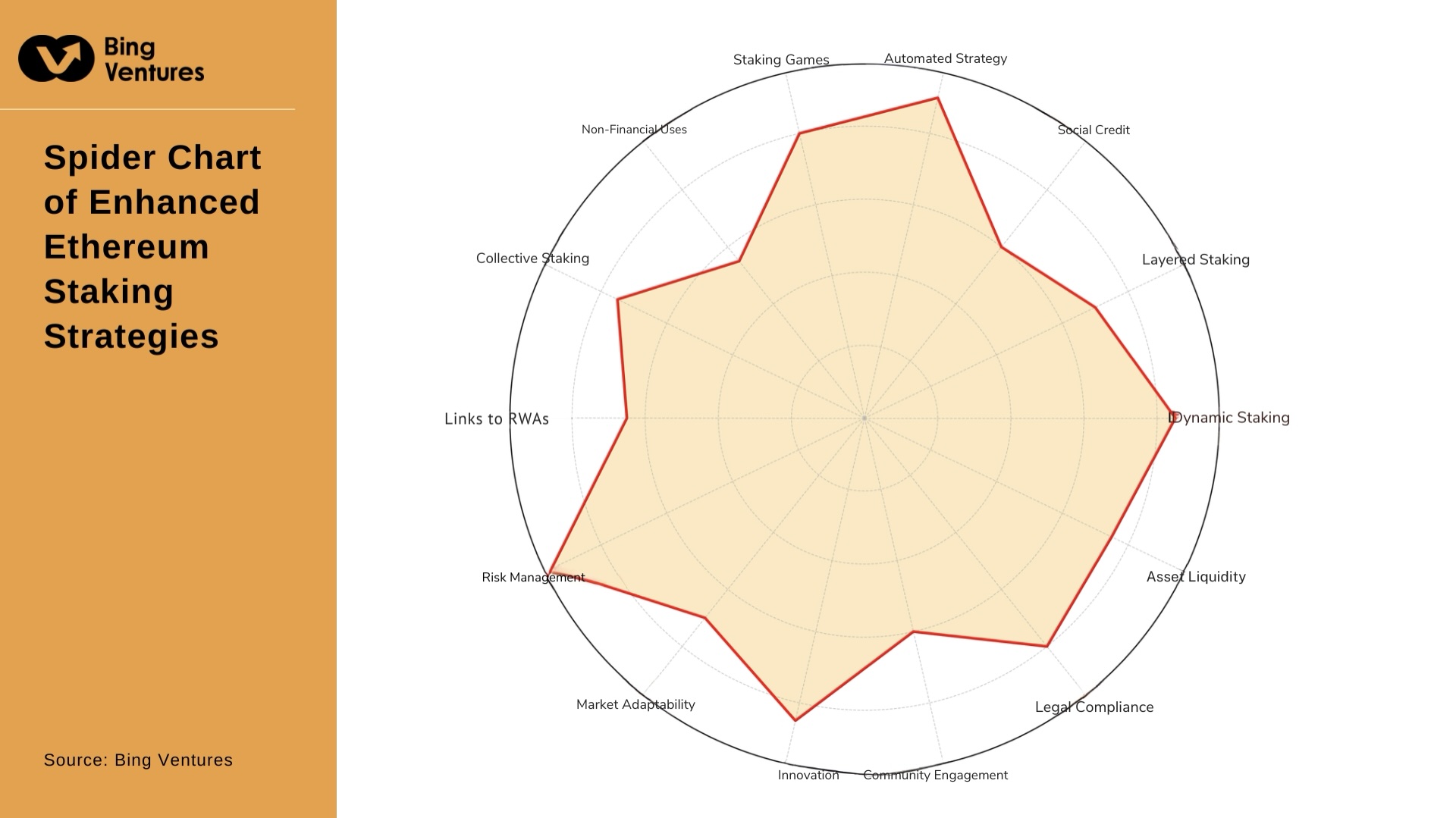

We imagine dynamic staking methods like LRTs are having a profound influence on the Ethereum staking market.

Firstly, the automation and effectivity of those methods have lowered the funding threshold, attracting extra particular person traders.

Secondly, as extra funds circulate in, market liquidity considerably improves, contributing to the soundness of the complete DeFi ecosystem.

Furthermore, dynamic staking methods by providing diversified and customised funding choices are driving market innovation and improvement.

Nevertheless, implementing these methods faces technical challenges, notably in establishing environment friendly and correct algorithmic fashions and guaranteeing system safety and resilience towards community assaults.

Supply: Bing Ventures

In the meantime, there are different new paradigms of staking underneath exploration. Let’s have a look.

A brand new mannequin often known as the ‘layered staking system’ emerged in response to a maturing market with various investor calls for.

This technique distributes staked property throughout totally different danger layers, every with various revenue potential and danger configurations.

Low-risk layers supply comparatively steady returns, appropriate for risk-averse traders, whereas high-risk layers cater to these with the next danger tolerance.

The flexibleness of this technique permits traders to allocate property based mostly on their danger preferences and market forecasts.

Implementing a layered staking system requires complicated sensible contracts and complex danger administration methods to make sure liquidity and safety between totally different layers.

Its introduction offers traders with extra decisions and suppleness, propelling the Ethereum staking market in the direction of maturity and diversification.

Contract-based automated staking methods are an attention-grabbing improvement too.

They improve asset administration effectivity and effectiveness by mechanically executing staking, unstaking and asset reallocation.

The chance administration functionality of automated staking methods is enhanced by way of particular danger parameters set inside sensible contracts.

As soon as market situations set off these parameters, sensible contracts mechanically alter staking positions.

Regardless of challenges similar to guaranteeing the safety and reliability of sensible contracts, because the safety of sensible contracts strengthens with the development of expertise, automated staking methods are anticipated to see broader purposes.

Moreover, collective staking and profit-sharing fashions allow a number of traders to collectively stake their property and share the generated earnings proportionally.

This mannequin makes use of sensible contracts to mechanically distribute earnings, providing collaborative wealth development alternatives for small-scale traders.

Good contracts play a pivotal position in collective staking by executing revenue distribution and guaranteeing honest returns for every participant.

Collective staking offers small-scale traders with alternatives to cut back danger and prices, enhancing inclusivity throughout the DeFi ecosystem.

Lastly, linking staked property with RWAs (real-world property) is one other modern method within the DeFi area.

Beneath this mannequin, real-world property similar to actual property and art work are tokenized on the blockchain and function the underlying property for staked property.

This method offers liquidity for sometimes illiquid property and provides new sources of funding for homeowners of real-world property.

Though this mannequin faces challenges similar to correct evaluation and tokenization of real-world property in addition to coping with regulatory and compliance points associated to those property the long run holds the promise of broader purposes for linking staked property with RWAs.

This could present conventional asset holders with new funding channels and supply cryptocurrency traders new funding alternatives, deepening the mixing of cryptocurrency markets with conventional finance markets.

In conclusion, the way forward for DeFi staking guarantees additional developments. It’s an space price listening to for each traders and DeFi gamers.

Kyle Liu is the funding supervisor at Bing Ventures and a seasoned crypto analyst and author. He offers insightful evaluation and analysis on a variety of matters together with market developments, sector evaluation and rising tasks. He’s particularly robust at offering forward-looking evaluation on DeFi associated matters.

Comply with Us on Twitter Fb Telegram

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney