I didn’t publish The Markets Compass Crypto Candy Sixteen Research in its entirety final Saturday. I used to be a “little busy” with my daughter’s marriage ceremony on Saturday, however I wish to share my ideas on the technical situation of the broader cryptocurrency market using worth charts of the CCi30 Index*

*For individuals who are usually not acquainted, the CCi30 Index is a registered trademark and was created and is maintained by an unbiased crew of mathematicians, quants and fund managers lead by Igor Rivin. It’s a rules-based index designed to objectively measure the general development, day by day and long-term motion of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding secure cash (extra particulars may be discovered at www.CCi30.com.

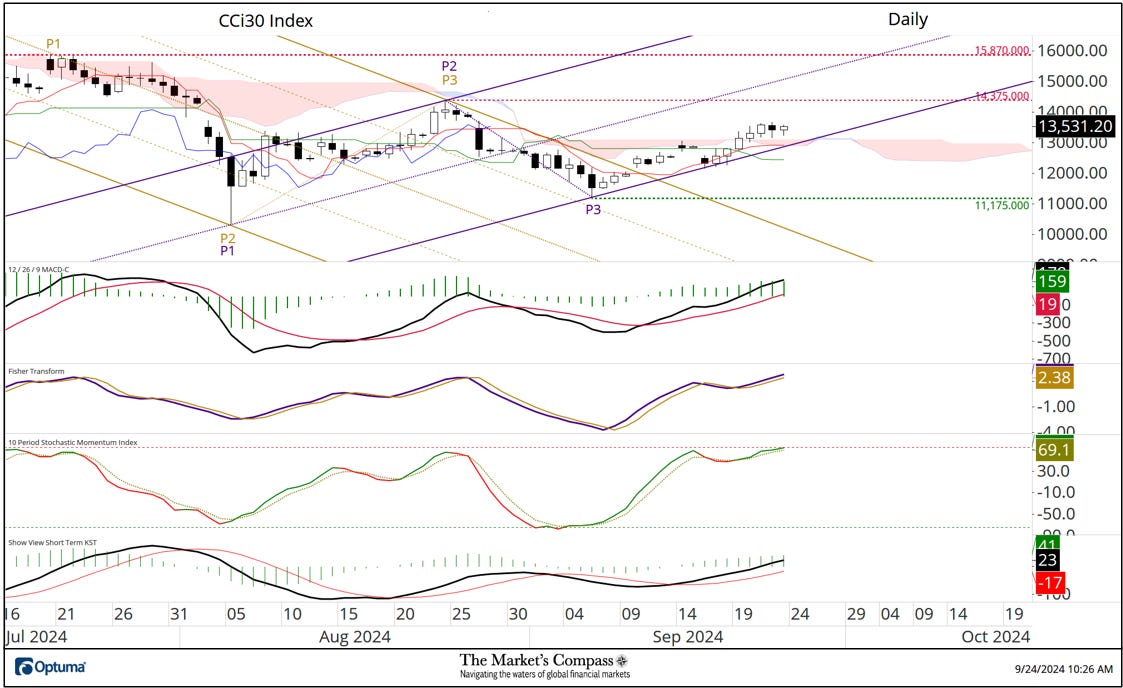

The CCi30 Index Cloud Chart with Momentum Oscillators

When the CCi30 Index overtook the Higher Parallel (strong gold line) of the longer-term Inverse Customary Pitchfork which is drawn from a worth pivot excessive (gold P1) to a worth pivot low (gold P2) to cost pivot decrease excessive (gold P3) I added a second Customary Pitchfork (violet P1 via P3). For the reason that violet P3 low costs have walked the “tight rope” of the Decrease Parallel (strong violet line). Final Friday the index overtook Cloud resistance at what is often known as the “twist” (the best level for costs to overhaul Cloud resistance) and costs have held Cloud help since then (costs are as of yesterday). All 4 momentum oscillators recommend the index nonetheless has the wind at its again, however it might, within the very short-term be a tad prolonged. I now mark first short-term resistance at 14,375. The subsequent Day by day Chart reveals one concern.

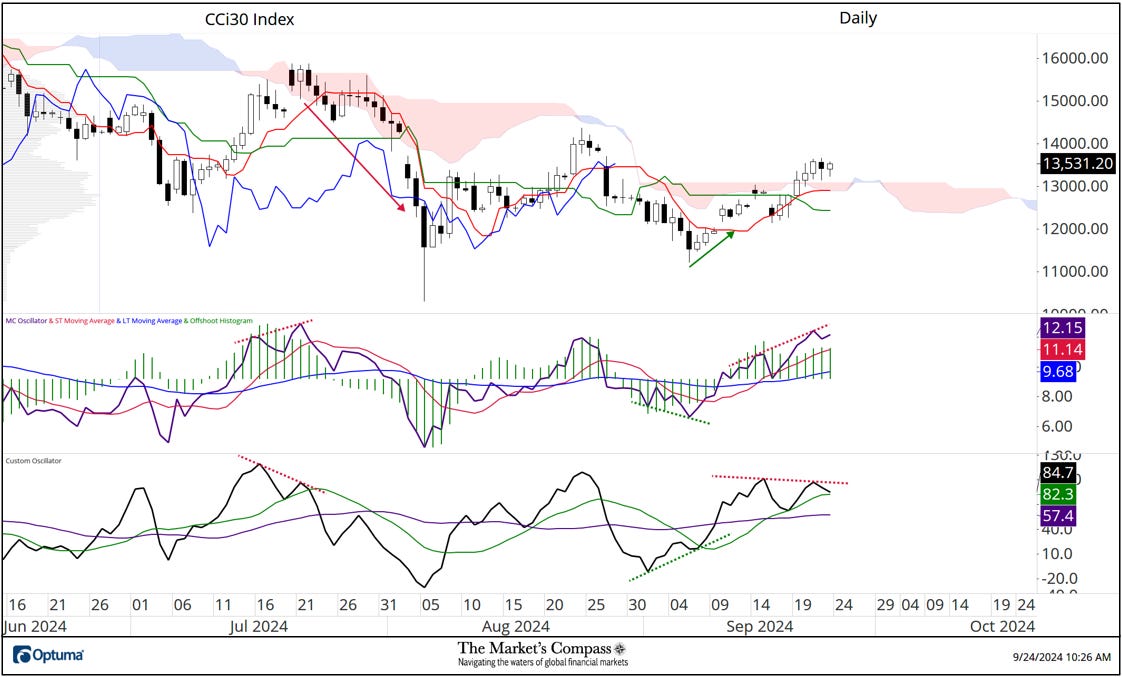

The CCi30 Index Day by day Cloud Chart with the MC Oscillator and the Customized Oscillator

The Customized Oscillator (decrease panel) is an unbound momentum oscillator that has an embedded momentum calculation that removes the normalization vary restrictions which can be within the MC Oscillator (center panel). That signifies that it’s not sure between 0 and 100. I’ve highlighted three divergences. The primary was in July, which was a bearish divergence and is highlighted with the purple dashed traces. You possibly can see what occurred after that (purple arrow). The second early September divergence is a bullish divergence highlighted with the inexperienced dashed traces suggesting a possible worth low was in place and is highlighted with the inexperienced arrow. In the course of this month a bearish divergence started to develop. The present bearish divergence just isn’t as “full blown” because the one in July and is probably going signaling solely a shallow pullback of a lesser diploma or a “pause to refresh” within the index. That short-term technical thesis is doubtlessly bolstered by the weekly technical situation (charted under) that displays the present place of the identical two oscillators that printed a bullish divergence within the third quarter.

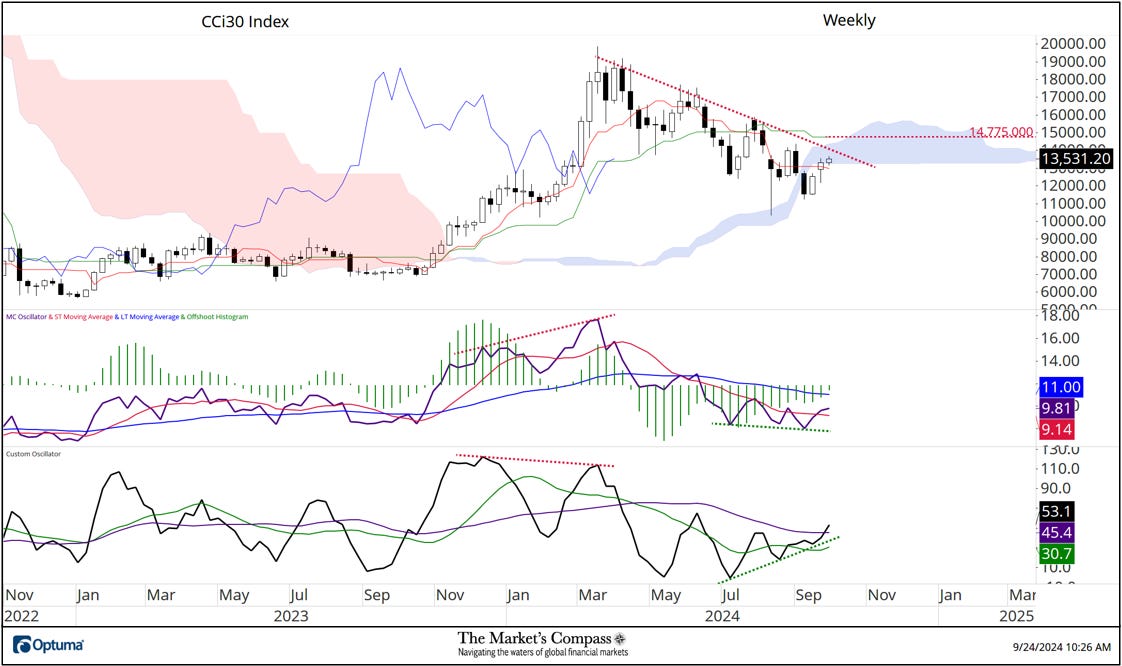

The CCi30 Index Weekly Cloud Chart with the MC Oscillator and the Customized Oscillator

Costs have remained mired within the multi-month downtrend (purple dashed line) since March highs however there’s one ray of hope for the cryptocurrency bulls, which is the latest bullish divergence between the 2 oscillators (inexperienced dashed traces). It needs to be famous that the divergence is lower than good due to the time between the lows however it’s nonetheless noteworthy. The week just isn’t over but, however the index has edged above the Decrease Span of the Cloud. Three key hurdles stay. First is resistance on the downtrend from the March highs (purple dashed line), second is the Higher Span of the Cloud mannequin and lastly the Kijun Plot (the mid-point between the bottom low and highest excessive over the previous 26-weeks) which at the moment at 14,775. If these hurdles are overtaken, I might be capable of confidently declare that the CCi30 Index is “out of the woods” and on its technique to greater worth ranges!

All the charts are courtesy of Optuma whose charting software program allows customers to chart any worth information such because the CCi30 Index.

To obtain a 30-day trial of Optuma charting software program go to…

A 3 half tutorial on Median Line Evaluation AKA Andrews Pitchfork and a primary tutorial on the Instruments Technical Evaluation is on the market on my web site…