Tether (USDT), the world’s largest stablecoin and the third largest crypto in market cap, has asserted its dominance within the cryptocurrency market and is now near attaining a big milestone. Latest knowledge exhibits a large inflow of cash into the crypto trade up to now week, with over $1 billion going into stablecoins.

Associated Studying

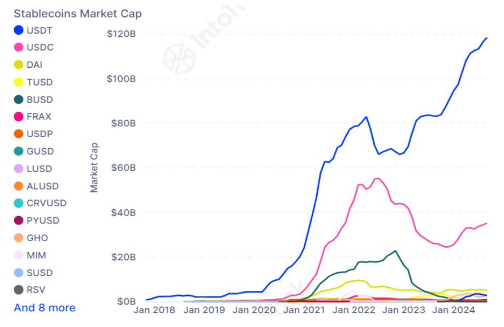

Naturally, most of this influx has gone into Tether (USDT), pushing its market cap nearer to an unprecedented $120 billion.

Tether (USDT) Leads The Stablecoin Market

Stablecoins are one of many progressive functions of blockchain know-how. Their use circumstances have grown through the years from buying and selling different cryptocurrencies to a rising use in lending platforms and funds for items and providers. The stablecoin market has witnessed large development for the reason that starting of the yr. This development has been largely pushed by elevated investments within the crypto trade for the reason that starting of the yr, contributing to their adoption.

Based on knowledge from IntoTheBlock, the stablecoin market had a complete market cap of $122 billion in October 2023. Nevertheless, the bull run since then has pushed the whole market cap to over $169 billion in September 2024, representing a rise of 38.5%. Moreover, knowledge exhibits that the influx has elevated by 1.71% from final month.

On the helm of the stablecoin market is Tether, which has the biggest share of the market cap. As of this writing, Tether’s market cap sits simply shy of the $120 billion mark, with a constant circulate of latest capital pouring into the stablecoin. Notably, Tether at the moment has a market cap of $119 billion, representing a 70.4% stake amongst all stablecoins. USDC, the second-largest stablecoin, is available in at a present market cap of $35.88 billion.

This development has been largely as a result of USDT’s potential to keep up its worth pegged to the U.S. greenback through the years, making it a horny choice for merchants in search of stability amid market turbulence.

What Lies Forward For Tether And Stablecoins?

The inflow of capital into the stablecoin sector highlights the rising curiosity in secure digital property, particularly with rising issues of inflation and the weakening of fiat currencies in growing nations. At this fee, Tether dominance amongst stablecoins is about to continue to grow.

Simply final week, the Tether Treasury minted $1 billion USDT on the Ethereum blockchain and one other $100 million USDT on the Tron blockchain.

Curiously, different decrease market cap stablecoins have additionally been benefiting from this curiosity surge in stablecoins. Considered one of these is First Digital USD (FDUSD), whose market cap has seen a rise of 47% up to now 30 days and now stands at $2.94 billion.

Associated Studying

Including to this momentum is Ripple, the corporate behind XRP. Ripple not too long ago introduced plans to enter the stablecoin house with its Ripple USD (RUSD) stablecoin with plans to attach world monetary corporations and establishments. Given Ripple’s established presence within the world banking sector, RUSD is predicted to expertise vital development after its launch.

Featured picture from Pexels, chart from TradingView