Terraform Labs is seeking to offload Pulsar, Station, Warp, and Enterprise.

Terraform Labs, the agency behind the collapsed Terra blockchain, is seeking to promote 4 of its companies amid Chapter 11 chapter course of.

On July 9, the corporate introduced it’s in search of a purchaser for Pulsar Finance, a cross-chain portfolio tracker that the corporate acquired in November 2023 in an try and rebuild the ecosystem after its collapse. Terraform Labs (TFL) can also be seeking to promote Station, a non-custodial Cosmos-based scorching pockets, Enterprise, a no-code DAO administration platform, and Warp, an on-chain automation protocol for executing good contracts.

“The sale course of represents a major step in TFL’s efforts to maximise worth for its collectors and different stakeholders, as a part of its broader wind-down of operations,” Terraform Labs stated. “Such a sale is a part of TFL’s broader wind-down of operations below the phrases of its settlement with the U.S. Securities and Trade Fee.”

The information failed to maneuver LUNA, the native token of the Terra 2.0 community, which posted a modest every day achieve of 1.4% in step with the broader crypto markets. Nevertheless, LUNA is down 34% prior to now 30 days at a $263 million market cap — roughly the place it was in November 2023 when TFL bought Pulsar Finance.

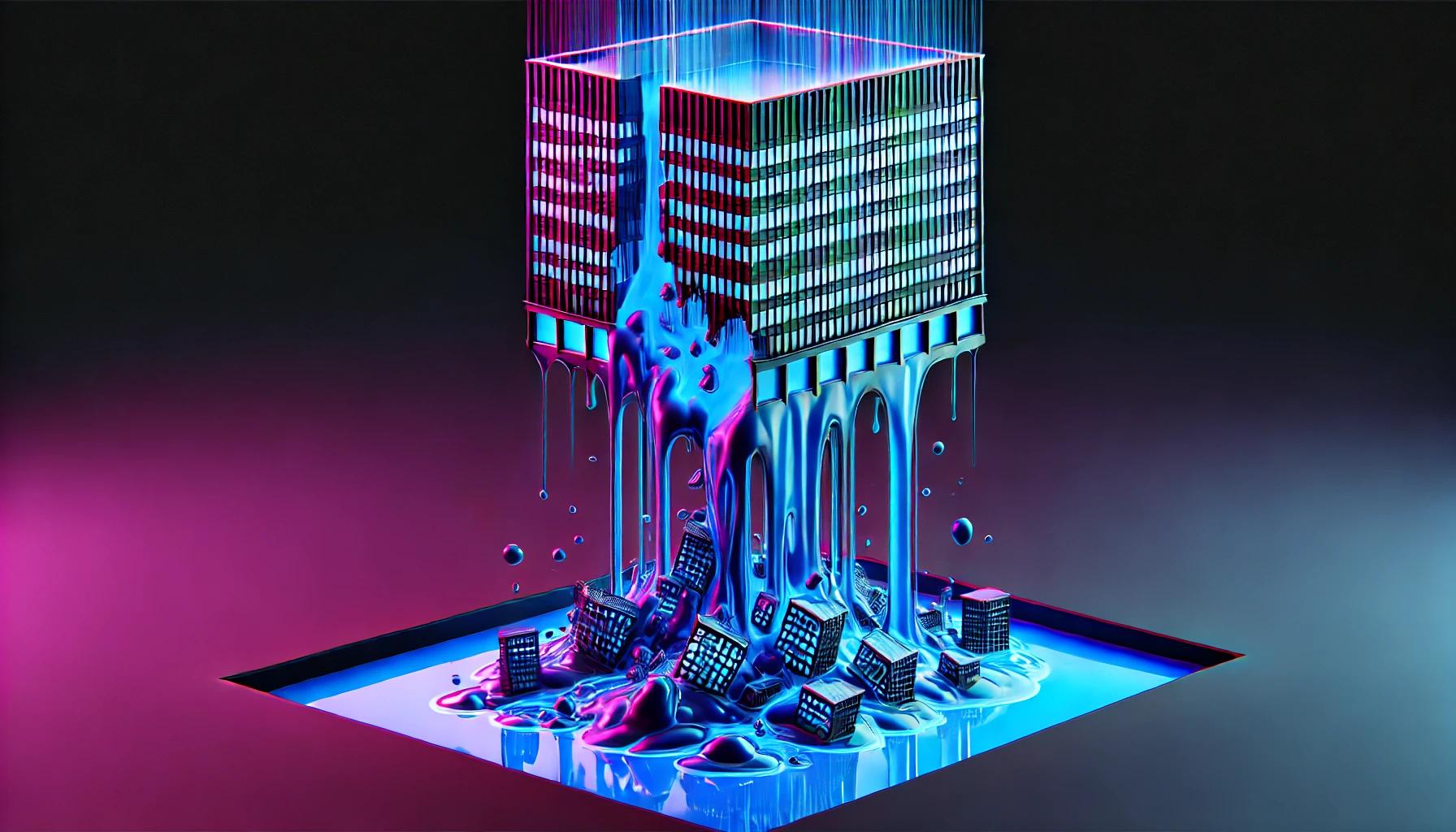

Throughout its heyday in April 2022, TFL’s Layer 1 community, Terra Basic, boasted a complete worth locked (TVL) of greater than $31.3 billion, buoying the Luna Basic token (LUNC) to a $41 billion market cap.

Its spectacular development was propelled by the runaway success of its uncollateralized “algorithmic” stablecoin UST, which grew to a greater than $18.7 billion market cap on the promise of a 20% annual return for holders.

Nevertheless, in early Could, Terra Basic and UST shed greater than 97% of their worth over only a few days amid an abrupt lack of confidence in UST’s uncollateralized design. In keeping with DefiLlama, simply $2.15 million stays on the community right now.

Terraform Labs filed for chapter in the US in January. In April, Do Kwon, the co-founder of TFL, and his firm had been discovered liable for orchestrating a $40 billion fraud. Do Kwon was additionally sentenced for deceptive traders, and performing recklessly.

In early June, Terraform settled with the U.S. Securities and Trade Fee for $4.47 billion, together with roughly $400 million from Do Kwon.