As a Bitcoin dealer, the dangers but additionally rewards are fairly excessive, making it a fascinating endeavor for these keen to delve into the world of digital forex buying and selling. Bitcoin’s distinctive mixture of volatility and potential for vital returns has captured the eye of merchants globally. On this complete information, we’ll discover the right way to commerce Bitcoin successfully, guaranteeing you’re well-equipped with the data to navigate this dynamic market. From the fundamentals of Bitcoin buying and selling methods to figuring out the finest platform to commerce Bitcoins, we’ll cowl all of it.

What Is A Bitcoin Dealer?

A Bitcoin dealer is a person who participates within the cryptocurrency market by shopping for and promoting Bitcoin with the intention of creating a revenue. In contrast to long-term traders who might maintain property for longer durations, Bitcoin merchants typically have interaction in additional frequent transactions. This will vary from long-term positions, the place they maintain Bitcoin with the expectation of worth appreciation, to a short-term day-trade, the place they capitalize in the marketplace’s volatility.

Being a Bitcoin dealer entails a deep understanding of the market traits, evaluation of technical and elementary indicators, and a capability to make knowledgeable choices primarily based on present market circumstances. Profitable Bitcoin merchants use varied methods like day-trading, scalping, swing buying and selling, and place buying and selling, every requiring totally different ability units and ranges of market engagement.

Furthermore, being a Bitcoin dealer means staying up to date with the most recent information and developments within the cryptocurrency world, as these can considerably impression market costs. Additionally, danger administration is an important facet of buying and selling Bitcoin, because the market is thought for its fast worth fluctuations.

Why Commerce Bitcoin?

Buying and selling Bitcoin has develop into more and more standard for a number of compelling causes. Firstly, Bitcoin provides distinctive volatility, which, whereas dangerous, offers distinctive alternatives for substantial earnings. Secondly, Bitcoin operates 24/7, in contrast to conventional inventory markets. This round the clock buying and selling permits merchants to react instantly to market information and international occasions.

Another excuse to commerce Bitcoin is its potential for top returns. Bitcoin has proven a outstanding capability to extend in worth over time, outperforming conventional investments over the previous greater than 14 years (since inception). Merchants who can skillfully navigate the market’s ups and downs stand to realize considerably.

Bitcoin’s decentralized nature additionally provides a level of freedom from conventional monetary establishments. This independence from central banks and governments appeals to merchants who search alternate options to conventional monetary programs.

Moreover, the growing mainstream acceptance and adoption of Bitcoin by giant firms like MicroStrategy or monetary service suppliers like BlackRock, Constancy and Invesco have added legitimacy to its buying and selling. As extra folks use and put money into Bitcoin, its market grows, offering extra buying and selling alternatives and liquidity.

How To Commerce Bitcoin: Every little thing You Want To Know

Buying and selling Bitcoin successfully requires a strong understanding of the market and a well-thought-out technique. The method begins with establishing a buying and selling account on a cryptocurrency trade or platform. As soon as your account is ready up and funded, you can begin buying and selling. Right here’s a fundamental overview:

- Market Evaluation: Earlier than any commerce, it’s essential to investigate the market. This entails learning worth charts, understanding market traits, and protecting up-to-date with the most recent information that might impression Bitcoin’s worth.

- Selecting A Buying and selling Technique: Relying in your targets and danger tolerance, select a buying and selling technique that fits you finest. This could possibly be day buying and selling, swing buying and selling, scalping, or long-term investing.

- Threat Administration: Resolve in your danger tolerance and set stop-loss orders to restrict potential losses. Efficient danger administration is essential to sustainable buying and selling.

- Executing Trades: Primarily based in your evaluation and technique, purchase or promote Bitcoin. This may be accomplished via market orders (purchase/promote at present worth) or restrict orders (purchase/promote at a predetermined worth).

- Monitoring And Adjusting: Constantly monitor the market and alter your methods as wanted. Bitcoin’s market can change quickly, and adaptability could be a vital benefit.

- Studying And Evolving: At all times be open to studying. The Bitcoin market is continually evolving, and staying knowledgeable is essential for profitable buying and selling.

Bitcoin Buying and selling Methods

In the case of buying and selling Bitcoin, using the precise technique is essential for fulfillment. Every dealer’s strategy might differ primarily based on their danger urge for food, funding dimension, and buying and selling targets. On this part, we’ll introduce varied Bitcoin buying and selling methods which can be generally used available in the market.

Day-Commerce Bitcoin

Day-trading Bitcoin is a fast-paced technique centered on making the most of Bitcoin’s short-term worth actions inside a single buying and selling day. It requires a deep understanding of market traits and the power to rapidly interpret technical evaluation, together with chart patterns and buying and selling indicators.

Success in day buying and selling hinges on immediate decision-making and expert-level data of chart patterns and technical indicators.. Efficient danger administration is significant, with strict adherence to stop-loss orders to mitigate potential losses. Day merchants should additionally keep consistently knowledgeable about market circumstances and information to make well timed, knowledgeable choices.

Bitcoin Scalping

Bitcoin scalping is a meticulous buying and selling strategy the place merchants capitalize on minute worth fluctuations within the Bitcoin market. This technique entails making quite a few trades over brief durations, generally only a few minutes, to build up small however frequent earnings.

Scalping calls for an distinctive degree of market evaluation, precision, and fast execution. Scalpers should keep intensely centered, typically dedicating a number of hours to monitoring market actions intently. They rely closely on technical evaluation instruments and real-time information to determine worthwhile commerce alternatives, utilizing totally different scalping methods.

Because of the excessive frequency of trades, managing charges and sustaining a disciplined strategy to keep away from vital losses is essential in Bitcoin scalping.

Swing Buying and selling

Swing buying and selling within the Bitcoin market entails holding positions for a number of days or even weeks to capitalize on anticipated directional strikes or worth ‘swings’. This technique requires a mix of elementary and technical evaluation to foretell potential worth actions.

Swing merchants concentrate on bigger worth actions than day merchants, permitting for a extra relaxed buying and selling tempo. The important thing to success in swing buying and selling is figuring out traits and momentum in Bitcoin’s worth, which regularly entails understanding market sentiment and macroeconomic components influencing the cryptocurrency market.

Bitcoin merchants who make the most of this technique should be affected person, as holding positions for longer durations can imply enduring some volatility. Nevertheless, this technique can yield substantial returns if market traits are precisely anticipated.

Bitcoin Place Buying and selling

Place buying and selling in Bitcoin is a long-term technique the place merchants maintain their positions for prolonged durations, typically weeks, months, and even years. This strategy is much less in regards to the short-term fluctuations and extra in regards to the long-term development potential of Bitcoin.

The Bitcoin merchants base their choices on intensive elementary evaluation, contemplating components like market traits, upcoming technological developments, and potential regulatory adjustments within the cryptocurrency panorama. In contrast to day buying and selling or scalping, place buying and selling requires much less time devoted to frequent market monitoring however calls for an intensive understanding of the broader financial and technological components affecting the market.

Persistence and a powerful perception in Bitcoin’s long-term potential are important for place buying and selling, because it entails weathering short-term market volatility with an eye fixed on long-term positive factors.

Step-By-Step Information: How To Commerce Bitcoin

Buying and selling Bitcoin can appear daunting at first, however by following a structured strategy, you’ll be able to navigate the market successfully. Here’s a step-by-step information that will help you begin your Bitcoin buying and selling journey:

- Educate Your self: Earlier than diving into buying and selling, it’s essential to familiarize your self with the fundamentals of blockchain expertise, Bitcoin, and its historic market traits.

- Select A Dependable Buying and selling Platform: Choose a good Bitcoin trade or buying and selling platform. Search for platforms with sturdy safety measures, user-friendly interfaces, and affordable charges. Take into account components like liquidity, accessible buying and selling pairs, and buyer assist.

- Set Up And Safe Your Account: Create your buying and selling account. Make sure you use sturdy passwords and allow all accessible safety features like two-factor authentication.

- Deposit Funds: Fund your account with fiat forex, which you’ll then use to purchase Bitcoin.

- Develop A Buying and selling Technique: Resolve in your buying and selling model (day buying and selling, swing buying and selling, scalping, or place buying and selling). Take into account your danger tolerance and set clear targets.

- Conduct Market Evaluation: Use each technical and elementary evaluation to tell your buying and selling choices. Keep up to date with the most recent Bitcoin information and market traits.

- Begin Buying and selling: Start with small trades to get a really feel for the market. You may both place market orders (purchase/promote at present costs) or restrict orders (purchase/promote at a predetermined worth).

- Monitor Your Trades And Handle Dangers: Preserve an in depth eye in your trades. Use danger administration instruments like stop-loss orders to guard your funding.

- Overview And Study: Commonly evaluation your buying and selling exercise and be taught from each successes and failures. Modify your methods and keep knowledgeable about components that might impression the Bitcoin worth.

How To Commerce Bitcoin And Make Revenue

Reaching profitability as a Bitcoin dealer hinges on a nuanced understanding of market dynamics and disciplined technique execution. Success entails figuring out and capitalizing on Bitcoin’s worth actions, underpinned by a strong grasp of market traits and drivers.

Key to profiting is the applying of superior technical evaluation, incorporating chart patterns and predictive indicators to gauge future worth actions. Moreover, astute danger administration, characterised by calculated place sizing and the even handed use of stop-loss orders, performs a pivotal function in safeguarding in opposition to market volatility.

Seasoned merchants typically emphasize the significance of emotional self-discipline, avoiding impulsive choices pushed by market euphoria or panic.

How To Commerce Bitcoins For Novices (Spot Market)

For newby Bitcoin merchants, the spot market is a perfect start line. Within the spot market, merchants purchase and promote Bitcoin for instant supply, reflecting real-time provide and demand. The instant buying and selling actions of merchants instantly decide Bitcoin’s worth on this market. It provides a direct and clear buying and selling technique, with transactions settled immediately at prevailing market costs.

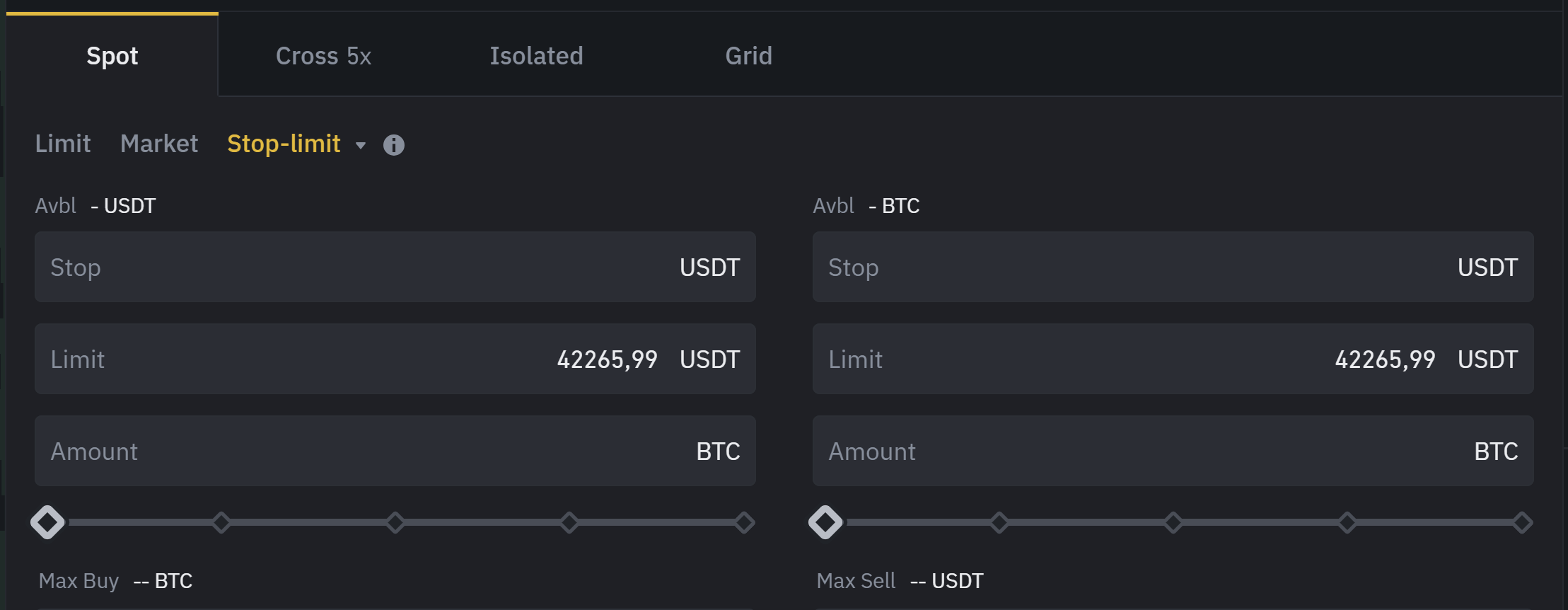

Varieties Of Orders Defined

- Market Orders: These orders are executed instantly on the present market worth. For instance, if Bitcoin is listed at $30,000 and also you place a market order to purchase, you’ll buy it on the nearest accessible worth to $30,000.

- Restrict Orders: These can help you set a selected worth at which you need to purchase or promote Bitcoin. As an illustration, you would possibly place a restrict order to purchase Bitcoin when its worth drops to $28,000, guaranteeing you solely buy at this worth or decrease.

- Cease Orders: Typically used as a danger administration software, a cease order triggers a purchase or promote motion as soon as Bitcoin reaches a predetermined worth. For instance, setting a cease order to promote at $27,000 might help restrict potential losses if the market drops.

How To Commerce Bitcoins On The Spot Market

Novices ought to choose buying and selling platforms recognized for his or her ease of use, strong safety features, and academic sources. Search for platforms with a excessive status and low Bitcoin buying and selling charges.

Navigating the order ebook will be essential. The order ebook is a real-time ledger of all purchase and promote orders available in the market. It exhibits the depth of the market, indicating what number of orders exist at varied worth ranges. Novices can use this to gauge market sentiment and potential worth motion instructions.

Novices ought to begin with small investments to attenuate potential losses. Perceive the volatility of the Bitcoin market and be ready for worth fluctuations. Use stop-loss orders to mechanically promote your Bitcoin if the worth falls to a sure degree, thus limiting your loss.

How To Commerce Bitcoin Futures

Buying and selling Bitcoin futures primarily entails coping with perpetual contracts, a definite sort of futures contract with out an expiry date. This enables merchants to carry positions indefinitely, offering extra flexibility in comparison with conventional futures. Right here’s a information on the right way to commerce Bitcoin futures:

- Understanding Perpetual Contracts: Perpetual futures contracts, in contrast to conventional futures, don’t have any expiration date, enabling merchants to keep up positions indefinitely. This indefinite holding interval is counterbalanced by the funding price mechanism.

- Leverage In Depth: Leverage permits merchants to manage giant positions with a comparatively small quantity of capital. As an illustration, with 10x leverage, you’ll be able to management a place value 10 occasions your preliminary margin. Whereas this may enlarge earnings, it additionally amplifies potential losses, making danger administration essential.

- Mechanics Of Liquidation: Liquidation happens when your place’s worth falls to a degree the place it might probably now not assist the leveraged quantity. For instance, in a extremely leveraged place, even a small drop in Bitcoin’s worth can set off liquidation, ensuing within the lack of your preliminary margin. It’s very important to know the trade’s liquidation course of and margin necessities.

- Choosing The Proper Change: Select an trade that provides complete options for buying and selling perpetual Bitcoin futures (e. G. Binance, BitMEX or Bitget), together with clear liquidation protocols, aggressive funding charges, and strong platform safety.

- Threat Administration: Given the excessive dangers related to leverage, using efficient danger administration methods is important. Use stop-loss orders to guard your positions, and take into account decrease leverage ranges to scale back the danger of liquidation.

How To Commerce Bitcoin Choices

Bitcoin choices are monetary derivatives that give the holder the precise, however not the duty, to purchase or promote Bitcoin at a predetermined worth earlier than a sure expiration date. Right here’s a information on the right way to commerce Bitcoin choices:

Choices Varieties: Perceive the 2 varieties of choices – ‘Name choices’ enable shopping for Bitcoin at a selected worth, whereas ‘Put choices’ enable promoting it at a set worth.

- Strike Worth And Expiration Date: Every choice has a strike worth and an expiration date. The strike worth determines the worth at which Bitcoin will be purchased or offered, whereas the expiration date marks when the choice turns into void.

- Choose A Buying and selling Platform: Select a platform that provides Bitcoin choices buying and selling (Deribit is the biggest). Guarantee it offers enough safety, liquidity, and instruments for evaluation.

- Premiums: Choices are purchased for a premium, which is the worth paid for the choice itself. The premium varies primarily based on components just like the strike worth, present Bitcoin worth, and time till expiration.

- Market Evaluation: Just like futures, buying and selling choices requires an intensive evaluation of the market. Predict whether or not Bitcoin’s worth will go up or down earlier than the choice expires.

- Threat Evaluation: Choices will be much less dangerous than futures as the utmost potential loss is the premium paid. Nevertheless, it’s nonetheless vital to know the volatility of the market and to make use of danger administration methods.

- Strategic Use: Choices can be utilized for varied methods, from simple hypothesis to complicated combos like spreads, straddles, and collars for danger administration.

Selecting The Greatest Platform To Commerce Bitcoins

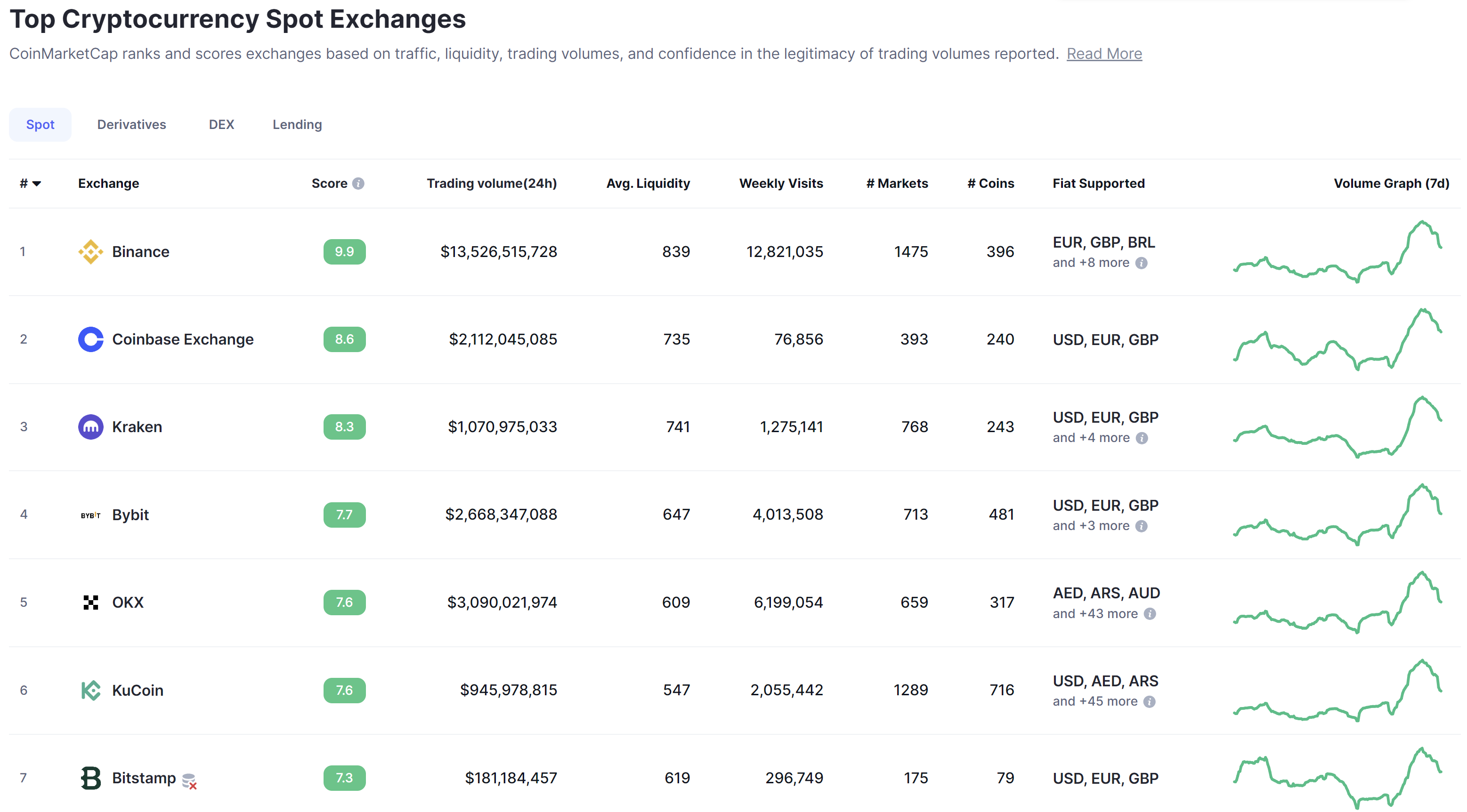

Selecting the very best platform to commerce Bitcoins requires contemplating varied components similar to safety, consumer interface, charges, liquidity, and accessible options. Primarily based on the most recent information from CoinMarketCap relating to spot buying and selling quantity, listed below are a few of the high cryptocurrency exchanges:

- Binance: Identified for its excessive buying and selling quantity and intensive checklist of obtainable cryptocurrencies, Binance provides a strong platform with aggressive charges and robust safety measures. It helps a number of fiat currencies like EUR, GBP, and BRL.

- Coinbase: Common particularly in the USA, Coinbase is thought for its user-friendly interface and robust regulatory compliance. It helps main fiat currencies similar to USD, EUR, and GBP, making it a handy choice for merchants in these areas.

- Kraken: Kraken is acknowledged for its complete safety features and vary of supported cryptocurrencies. It additionally helps a number of fiat currencies together with USD, EUR, and GBP, and is thought for its detailed and informative consumer interface.

- Bybit: This trade is famous for its superior buying and selling options and is a well-liked alternative for spinoff buying and selling. Bybit helps a number of fiat currencies together with USD, EUR, GBP, amongst others.

- OKX: OKX provides a variety of cryptocurrencies and is thought for its superior buying and selling options. It helps quite a lot of fiat currencies together with AED, ARS, AUD, and extra, catering to a worldwide consumer base.

- KuCoin: KuCoin is thought for its big selection of supported cryptocurrencies and user-friendly interface. It helps a number of fiat currencies together with USD, AED, ARS, and extra, making it a flexible alternative for international merchants.

The place To Commerce Bitcoin? Key Standards

Choosing the precise platform is a important step in your Bitcoin buying and selling journey. The most effective platform for buying and selling Bitcoins not solely aligns along with your buying and selling model and targets but additionally provides safety, performance, and reliability. Listed here are key components to contemplate when selecting your buying and selling platform:

- Safety: The platform’s safety features ought to be given high precedence. Search for platforms with a powerful observe report of safety, using measures like two-factor authentication, encryption, and chilly storage of funds.

- Person Interface And Expertise: The platform ought to supply a user-friendly interface, particularly for newbies. It ought to be intuitive, with easy-to-use buying and selling instruments and accessible buyer assist.

- Charges And Prices: Perceive the charge construction of the platform. This contains buying and selling charges, withdrawal charges, and some other hidden fees. Decrease charges can considerably impression your general profitability, particularly in case you are participating in frequent trades.

- Liquidity: Excessive liquidity is important for executing trades rapidly and at fascinating costs. A platform with a excessive buying and selling quantity sometimes provides higher liquidity, resulting in tighter spreads and extra environment friendly commerce execution.

- Vary Of Options And Instruments: Search for platforms that supply a spread of options similar to superior charting instruments, quite a lot of order varieties, and danger administration instruments.

- Leverage and Margin Buying and selling Choices: If you’re thinking about buying and selling with leverage, confirm the accessible leverage choices on the platform. Bear in mind that buying and selling with leverage carries greater dangers.

- Regulatory Compliance: Select platforms which can be compliant with related regulatory requirements in your nation. This compliance can present an extra layer of safety and legitimacy.

- Market Selection: A very good platform ought to supply quite a lot of markets, not simply Bitcoin.

How To Commerce Bitcoin? Key Indicators

Profitable Bitcoin buying and selling typically hinges on using key indicators to make knowledgeable choices. These indicators present insights into market traits and potential future actions. Listed here are some important indicators utilized in Bitcoin buying and selling:

- Shifting Averages: They clean out worth information over a specified time interval, aiding merchants in figuring out the pattern course. Probably the most generally used are the Easy Shifting Common (SMA) and the Exponential Shifting Common (EMA).

- Relative Energy Index (RSI): RSI is a momentum indicator that measures the velocity and alter of worth actions. It helps determine overbought or oversold circumstances available in the market.

- MACD (Shifting Common Convergence Divergence): This software identifies potential purchase and promote indicators by monitoring the convergence and divergence of short-term and long-term transferring averages.

- Quantity: The commerce quantity of Bitcoin is an important indicator of market energy and sentiment. Excessive volumes typically sign a powerful market curiosity, both bullish or bearish.

- Bollinger Bands: These bands present a graphical illustration of market volatility. Narrowing bands counsel low market volatility, whereas widening bands point out elevated volatility.

- Fibonacci Retracement: This software identifies potential assist and resistance ranges utilizing Fibonacci ratios derived from worth adjustments.

- Stochastic Oscillator: This momentum indicator compares the closing worth of Bitcoin to its worth vary over a sure interval, aiding in figuring out potential reversal factors.

Commerce Bitcoin With On-Chain-Indicators

Along with conventional technical indicators, on-chain indicators particular to Bitcoin present deep insights into the underlying blockchain dynamics, serving to merchants make knowledgeable choices. Glassnode, a number one blockchain information and intelligence platform, highlights a number of key on-chain indicators:

- Bitcoin Community Hash Price: Signifies the well being and safety of the blockchain. A rising hash price suggests elevated community safety and miner confidence.

- Energetic Addresses: The variety of distinctive addresses actively transacting on the community. A rising variety of lively addresses might point out elevated consumer adoption and community exercise.

- % Of Whole Provide In Revenue: Observing the provision distribution, particularly throughout bear markets, can sign a large-scale provide redistribution. It signifies when the % of provide in revenue for newer patrons surpasses that of long-term holders.

- Realized Revenue/Loss Ratio: It tracks whether or not the combination quantity of realized earnings exceeds that of realized losses. When the 30-day SMA of this ratio returns above 1.0, it signifies a macro pattern shift in the direction of worthwhile on-chain quantity.

- aSOPR (Adjusted Spent Output Revenue Ratio): This indicator, particularly its 90-day SMA, helps determine worthwhile on-chain spending, indicating broader market profitability.

Combining these on-chain indicators with conventional technical instruments provides a complete strategy to buying and selling Bitcoin, permitting merchants to glean insights from each market sentiment and elementary blockchain information.

Commerce Bitcoin: Dangers And Rewards

Buying and selling Bitcoin, like every monetary enterprise, comes with its personal set of dangers and rewards. Understanding and balancing these elements is essential for profitable buying and selling.

Managing Dangers As Bitcoin Dealer

- Volatility: Bitcoin’s worth will be extraordinarily unstable, resulting in fast and vital worth adjustments. Managing this danger entails setting stop-loss orders, not overleveraging, and solely investing funds you’ll be able to afford to lose.

- Safety Dangers: The digital nature of Bitcoin makes it prone to hacking and fraud. Use safe buying and selling platforms, allow two-factor authentication, and apply secure storage.

- Regulatory Adjustments: Bitcoin’s authorized standing varies by nation and is topic to altering laws, which may impression its worth and legality of buying and selling.

- Market Information: Lack of expertise of the Bitcoin market can result in poor buying and selling choices. Steady studying and staying up to date with market traits is significant.

The Reward Potential In Bitcoin Commerce

- Excessive Return Potential: Bitcoin has seen durations of great worth will increase, providing excessive return potential for savvy merchants.

- Market Accessibility: Bitcoin buying and selling is accessible 24/7, providing flexibility and steady alternatives for merchants worldwide.

- Revolutionary Market: Being a part of the Bitcoin market means participating with cutting-edge blockchain expertise, which has the potential to supply new buying and selling alternatives and reshape monetary programs.

- Diversification: Bitcoin offers another funding choice, which will be part of a diversified funding portfolio.

FAQ: How To Commerce Bitcoin?

How To Day Commerce Bitcoin?

Day buying and selling Bitcoin entails executing short-term trades to capitalize on worth fluctuations inside a single day. It requires an intensive understanding of market traits, technical evaluation, and disciplined danger administration.

How To Commerce Bitcoin and Make Revenue?

Worthwhile Bitcoin buying and selling entails a deep understanding of market traits, using efficient buying and selling methods, and using strong danger administration to mitigate dangers whereas capitalizing on market alternatives.

The place To Commerce Bitcoin?

Bitcoin will be traded on varied cryptocurrency exchanges and platforms. Common exchanges embrace Binance, Coinbase, Kraken, Bybit, OKX, and KuCoin.

How Do You Commerce In Bitcoins?

Buying and selling in Bitcoins entails shopping for and promoting on a cryptocurrency trade, utilizing totally different buying and selling methods like day buying and selling, swing buying and selling, or place buying and selling.

Can You Day Commerce Bitcoin?

Sure, you’ll be able to day commerce Bitcoin. It entails making a number of trades inside a single day, making the most of Bitcoin’s worth volatility.

How To Commerce Bitcoins?

Buying and selling Bitcoins entails selecting a dependable buying and selling platform, analyzing the market, executing trades primarily based in your technique, and managing your dangers.

How To Commerce In Bitcoin?

To commerce in Bitcoin, arrange an account on a cryptocurrency trade, deposit funds, determine on a buying and selling technique, and begin executing purchase or promote orders primarily based on market evaluation.

How To Commerce Bitcoin Choices?

Buying and selling Bitcoin choices entails shopping for or promoting choices contracts on Bitcoin, predicting future worth actions. It requires understanding of choices buying and selling and market evaluation.

How To Commerce Bitcoins For Money?

You may commerce Bitcoins for money by shopping for and promoting your Bitcoin on a cryptocurrency trade.

How Do You Commerce Bitcoin?

Buying and selling Bitcoin entails analyzing the market, establishing a commerce on a cryptocurrency trade, and managing the commerce with correct danger administration methods.

How To Commerce Bitcoin Futures?

Bitcoin futures buying and selling entails getting into contracts to purchase or promote Bitcoin at a future date at a predetermined worth. It requires data of futures markets and danger administration.

Find out how to Commerce Bitcoins For Novices?

Novices ought to begin by understanding the fundamentals of Bitcoin, selecting a user-friendly buying and selling platform, working towards with small quantities, and utilizing easy buying and selling methods on the spot market.

How To Commerce Bitcoins For Revenue?

To commerce Bitcoins for revenue, implement a well-researched buying and selling technique. You additionally have to handle dangers successfully, and keep knowledgeable about market traits and information.

How To Commerce Bitcoins On-line?

Buying and selling Bitcoins on-line entails registering on a cryptocurrency trade, depositing funds, conducting market evaluation, and executing trades via the platform’s interface.

How To Commerce Bitcoins To Make Cash?

To earn money buying and selling Bitcoins, develop a strong buying and selling technique, make the most of technical evaluation, handle dangers correctly, and keep adaptive to market adjustments.

Featured picture from Shutterstock

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site fully at your personal danger.