Tether, the issuer of the ever-present USDT stablecoin, cemented its dominance in 2023, ballooning its market share to a staggering 71%. This explosive development, nonetheless, comes with a chilling undercurrent: a United Nations report linking USDT to a surge in cybercrime and cash laundering in Southeast Asia.

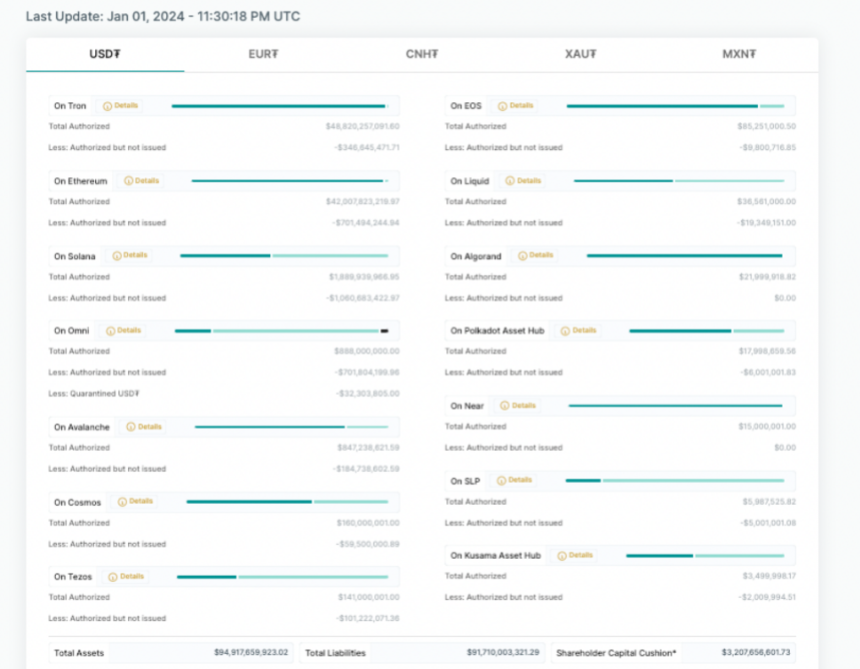

Glassnode information paints a stark image of Tether’s ascent. Its market capitalization reached a file $95 billion in January 2024, fueled by a 40% enhance in USDT provide over the previous 12 months. In the meantime, rivals like Circle’s USDC noticed their market share shrink, with USDT now commanding over 7 occasions the circulation of its nearest rival.

Tether Market Dominance Soars

USDT dominance proven in inexperienced. Supply: Glassnode

Paolo Ardoino, Tether’s new CEO, has prioritized cooperation with U.S. legislation enforcement. The corporate boasts of freezing wallets linked to sanctions lists and recovering over $435 million in illicit funds.

Nevertheless, the UN report casts a shadow on these efforts, detailing how USDT facilitates “sextortion,” “pig butchering” scams, and underground banking throughout Asia.

Whereas Tether has proactively banned over 1,260 addresses linked to legal exercise, the sheer quantity of illicit transactions raises considerations concerning the effectiveness of those measures.

USDT market cap at present at $94.904 billion. Chart: TradingView.com

Critics level to Tether’s opaque reserve backing as a breeding floor for misuse, calling for larger transparency to fight cash laundering.

Tether’s Reign At Danger: Regulatory Challenges

The stablecoin market, as soon as touted as a bridge between conventional finance and the crypto world, now faces a reckoning. Tether’s dominance is plain, however its affiliation with legal exercise threatens to erode belief and set off stricter rules.

Tether whole property nearing the $95 billion stage. Supply: Gabor Gurbacs X put up.

In the meantime, Circle’s latest IPO submitting hints at a possible shift within the panorama. With regulatory scrutiny intensifying, Tether’s future hinges on its potential to handle considerations about transparency and fight illicit exercise.

Can it clear up its act and preserve its crown, or will the tide flip in the direction of its extra clear rivals? Solely time will inform if Tether’s reign because the king of stablecoins will climate the storm of controversy.

With its historic 71% market share, Tether’s reign over the stablecoin realm is plain. But, the shadow of illicit exercise threatens to eclipse its success.

As regulators sharpen their focus and rivals like Circle step into the ring, the query looms: will Tether clear home and retain its crown, or will this be the tipping level for a stablecoin revolution, reshaping the way forward for crypto itself?

Solely time will inform if Tether’s dominance indicators a vivid new period for digital currencies or serves as a cautionary story, paving the best way for a extra clear and accountable crypto panorama. The gloves are off, and the battle for the way forward for stablecoins is simply starting.

Featured picture from Shutterstock

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal threat.