The US spot Ethereum ETFs are set to launch on Tuesday, July twenty third, with projections indicating potential month-to-month inflows of $1.2 billion. This forecast comes from ASXN, a analysis agency specializing in crypto finance analytics.

US Spot Ethereum ETFs Might Shock To The Upside

On the core of ASXN’s evaluation is the comparability between the newly launched Ethereum ETFs and the beforehand launched Bitcoin ETFs. One of many essential differentiators highlighted within the report is the payment construction. The Ethereum ETFs, whereas mirroring the payment method of Bitcoin ETFs, introduce a notably aggressive twist with Grayscale’s new ‘mini belief’ Ethereum product. Initially disclosed at a 0.25% administration payment, the payment was rapidly adjusted to 0.15% after aggressive pressures from different low-fee merchandise like Blackrock’s ETHA ETF.

Grayscale has strategically re-positioned 10% of its Ethereum Belief (ETHE) Belongings Underneath Administration (AUM) to this mini belief, providing ETHE holders an change to the brand new ETF at no tax legal responsibility—a transfer aimed toward retaining capital inside its ecosystem and offering a extra engaging payment construction to fee-sensitive traders.

“Grayscale’s strategic adjustment of its payment construction and the revolutionary mini belief providing are more likely to redefine the aggressive panorama of Ethereum ETFs,” an ASXN analyst commented within the report. “This might not solely stem potential outflows but in addition entice a broader base of institutional traders because of the extra favorable payment dynamics.”

Associated Studying

ASXN’s report additionally covers the potential market affect of the influx of funds into Ethereum ETFs. Using international knowledge from current crypto Alternate Traded Merchandise (ETPs), the analysis attracts parallels and contrasts between the Ethereum and Bitcoin markets. Traditionally, ETPs have been chubby in Bitcoin relative to Ethereum based mostly on AUM ratios in comparison with market cap ratios. This has shifted barely with Ethereum gaining extra traction and funding confidence.

Referring to different analysis reviews on potential ETF inflows, the report notes: “There have been many estimates for the ETF flows, a few of which we have now highlighted beneath. Taking the estimates and standardizing them yields a median estimate within the $1bn/month area. Commonplace Chartered Financial institution gives the very best estimate with $2bn/month, whereas JP Morgan is on the low finish at $500m/month.”

ASXN’s estimate lies at $800 to $1.2 billion per thirty days. “This was calculated by taking a market cap weighted common of month-to-month Bitcoin inflows and scaling this by the market cap of ETH,” the agency notes. Moreover, they backed their estimates with the worldwide crypto ETP knowledge and “are open to an upside shock given the distinctive dynamics of ETHE buying and selling at par previous to the launch and the introduction of the mini belief.”

The Reflexivity Of ETH

When it comes to liquidity, the report means that Ethereum’s market dynamics are distinct from these of Bitcoin. Though Ethereum’s general liquidity is barely decrease, the affect of recent ETF inflows may very well be extra pronounced as a result of Ethereum’s decrease ‘float’—the quantity of an asset available for buying and selling. “Ethereum’s liquidity profile, compounded by its smaller float relative to Bitcoin, implies that inflows into the ETF might have a disproportionately optimistic impact on its worth,” states the report.

Associated Studying

Furthermore, ASXN’s evaluation is dedicated to the reflexivity inherent in Ethereum’s market. Based on the report, inflows into Ethereum ETFs might result in greater Ethereum costs, which in flip might improve exercise and investments within the decentralized finance (DeFi) sector and different Ethereum-based functions. This suggestions loop is supported by Ethereum’s tokenomics, particularly the EIP-1559 mechanism which burns a portion of transaction charges, successfully lowering the overall provide of Ethereum over time.

“The reflexivity of Ethereum’s market extends past easy provide and demand dynamics as a result of its integral function in DeFi and different blockchain-based functions,” ASXN explains and provides, “as the worth of Ethereum will increase, it might considerably improve the underlying fundamentals of the DeFi platforms, driving additional investments and making a self-reinforcing cycle of worth appreciation.”

The report concludes with strategic insights for conventional finance (TradFi) establishments contemplating Ethereum investments. It argues that the narrative round Ethereum as a multi-faceted platform for decentralized functions supplies a compelling worth proposition past the “digital gold” narrative usually related to Bitcoin.

ASXN additionally speculates on the longer term potential for a staked ETH ETF, which might entice TradFi gamers with its yield-generating capabilities. “The potential for a staked ETH ETF might develop into a game-changer, providing conventional finance a solution to interact with crypto property that not solely admire in worth but in addition generate yield,” the report suggests.

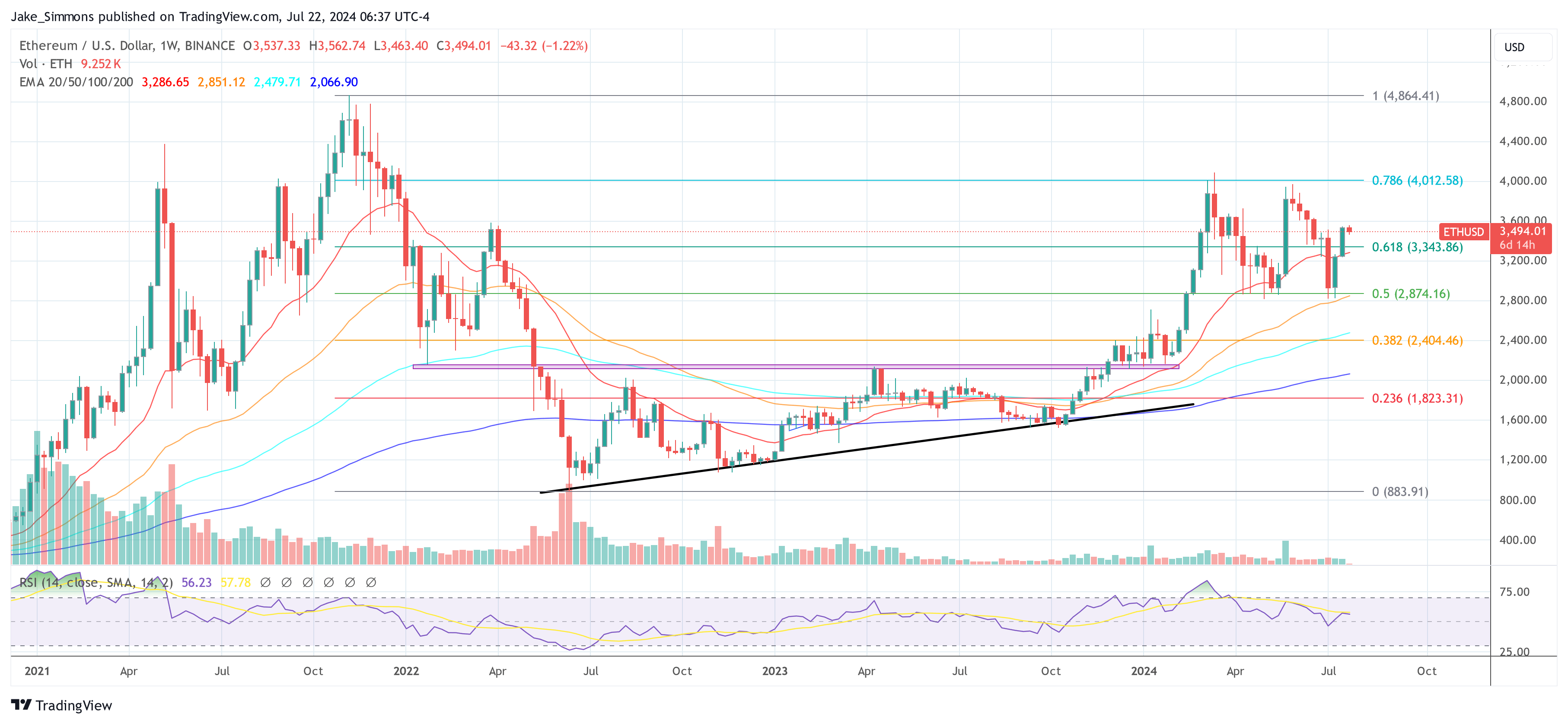

At press time, ETH traded at $3,494.

Featured picture created with DALL·E, chart from TradingView.com