The approval of spot Bitcoin ETFs within the US marked a big milestone within the crypto market, symbolizing a triumph after years of regulatory hurdles and debates. The journey to approval was lengthy and arduous, full of issues over market manipulation, liquidity, and investor safety. Nonetheless, the eventual approval by the Securities and Change Fee (SEC) signaled a brand new period of mainstream acceptance of Bitcoin by the standard monetary market.

Simply six months after buying and selling started within the US, spot Bitcoin ETFs have emerged as a formidable power within the crypto market. These ETFs have quickly amassed substantial holdings, now possessing over $50 billion as of July 2024. This development has made them the fastest-growing ETFs ever launched within the US, completely illustrating their immense attraction to each retail and institutional traders.

Their fast rise hasn’t solely elevated the credibility and accessibility of BTC — it has additionally launched a brand new dimension to the crypto market and investor habits. Understanding the flows and balances of those ETFs is now essential for understanding the crypto market.

Six months have handed for the reason that launch of spot Bitcoin ETFs within the US, making it an ideal time to attract a line and analyze the traits we’ve seen within the 12 months’s first half.

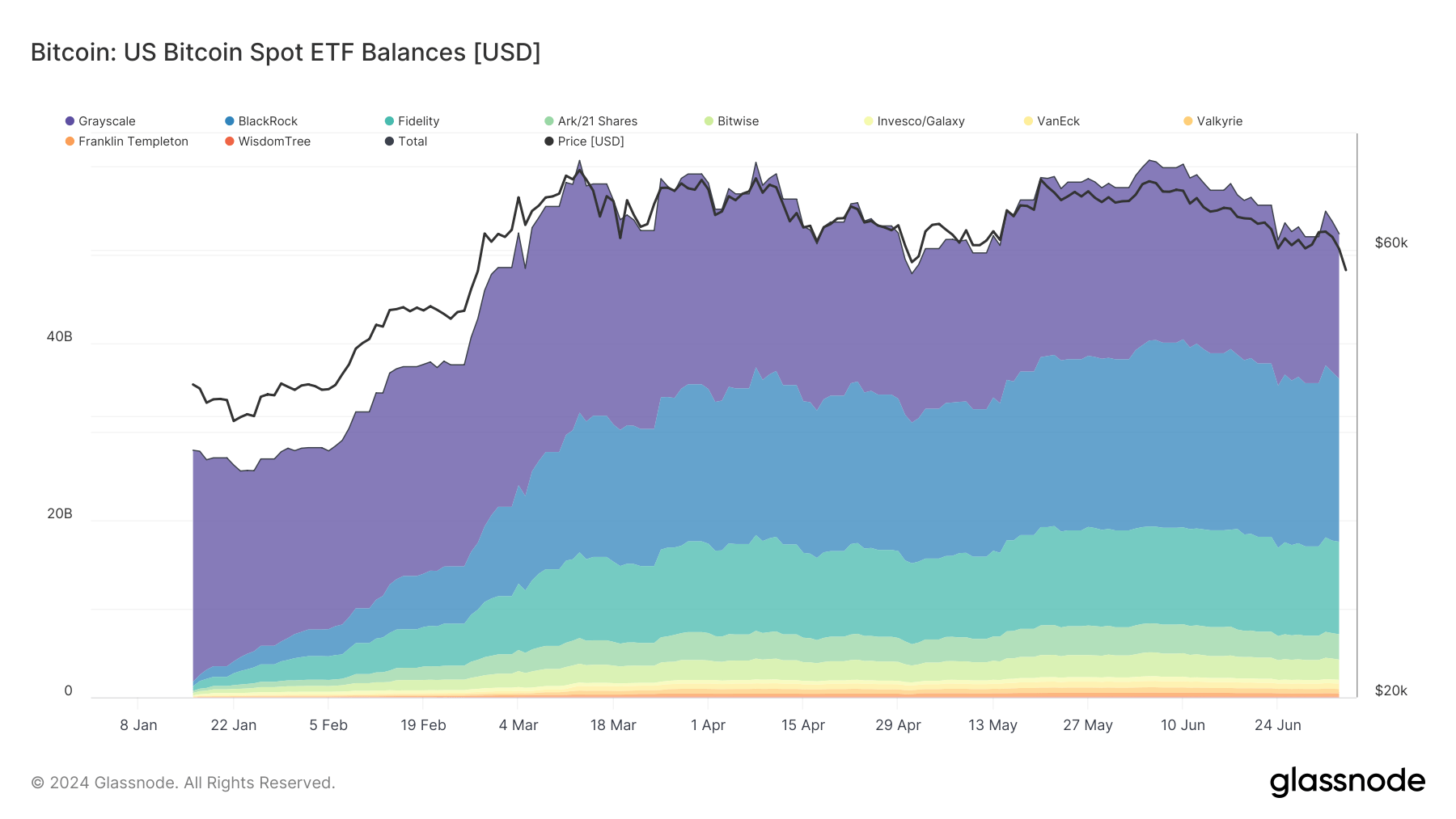

Wanting on the broader image, we see that the steadiness of Bitcoin ETFs confirmed a common rising development from January to June. The entire steadiness began at roughly $27.89 billion in mid-January and fluctuated, reaching peaks and troughs however settling at over $52 billion by the start of July.

Grayscale’s GBTC held the biggest steadiness among the many ETFs, beginning at over $26 billion. Nonetheless, GBTC misplaced its dominant place on the finish of Might, when BlackRock’s IBIT surpassed it because the ETF with the very best steadiness. Constancy’s Bitcoin Belief confirmed immense development, starting the 12 months with balances round $517 million and getting into July with over $10 billion.

Most ETFs confirmed development all through the primary half of the 12 months. Nonetheless, the market noticed intervals of excessive volatility and investor exercise, resulting in vital steadiness fluctuations. The bigger the balances, the upper the volatility, with ETFs with smaller balances displaying considerably much less volatility in the course of the 12 months.

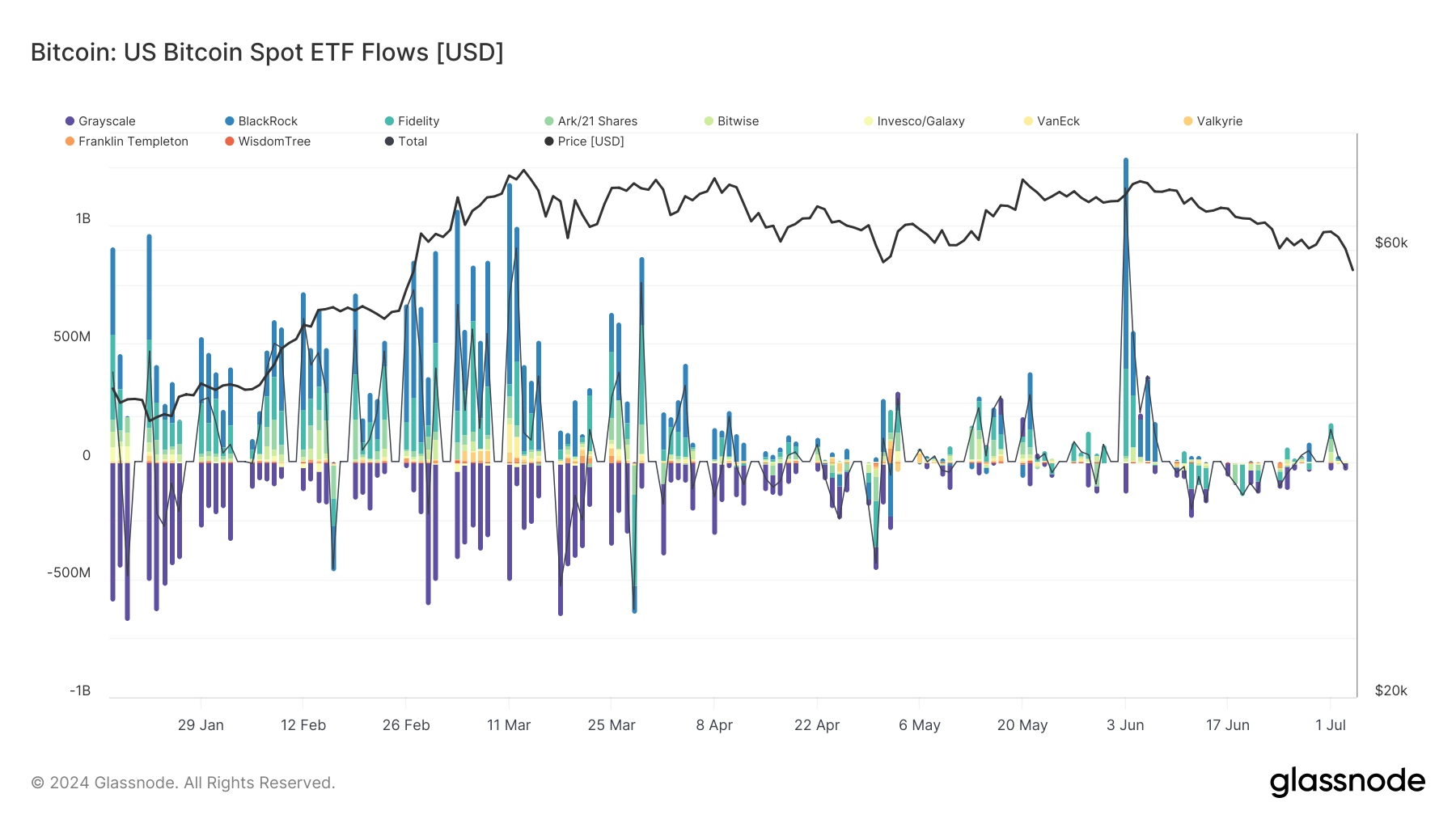

Analyzing flows helps us get a extra granular view of how the market trades. The early a part of the 12 months noticed substantial inflows, benefiting from a optimistic market momentum and investor confidence. This robust influx momentum lasted properly into March, with BlackRock’s IBIT seeing the very best price of inflows amongst all ETFs. Because the second quarter of the 12 months started, the market noticed a notable lower in inflows. This was most certainly pushed by a number of components, with Bitcoin’s value consolidation at round $62,000 being the principle driver.

The primary quarter of the 12 months was additionally characterised by huge outflows from GBTC, which exceeded $672 million within the second half of January. Excessive outflows, typically exceeding $200 million, continued till the second quarter when the relative calmness of the market additionally appeared to have subdued the outflows.

In June, the market appeared to have woke up a brand new urge for food for ETFs. Nonetheless, the urge for food seems to have been reserved just for BlackRock’s ETF, as IBIT noticed over $894 million in inflows on June 3. The sharp burst in inflows most certainly exhausted the market, which noticed modest exercise all through the month and entered July with unremarkable numbers.

The publish Spot Bitcoin ETFs six months on – explosive development, reshaping investor landscapes appeared first on CryptoSlate.