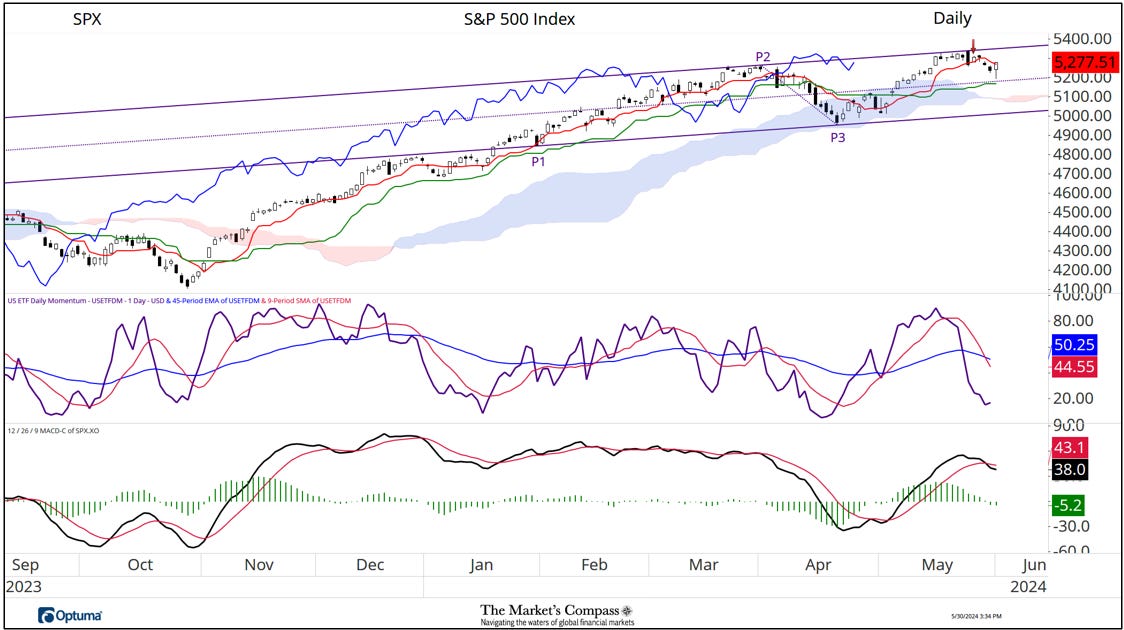

In Tuesday’s US Index and Sector ETF Examine that I despatched to my paid Substack subscribers, I reviewed the short-term technical situation of the S&P 500 Index titled, “Ideas on the brief time period technical situation of the SPX Index” which is just one a part of the entire Examine. At the moment (that I’ve highlighted at this time with a purple arrow), I wrote… “In early Might when the SPX Index regained the bottom above the Each day Cloud Chart, I utilized a Schiff Modified Pitchfork (violet P1 by way of P3). Since per week in the past final Wednesday costs have been capped by the Higher Parallel (stable violet line) of that pitchfork. Final Thursday the index produced a nasty exterior day or in candle parlance an engulfing candle however up to now it has not unfolded right into a full-fledged reversal. What has developed up to now has been a pointy flip in my US ETF Each day Momentum / Breadth indicator which has fallen sharply regardless of costs holding close to to the current highs. MACD has additionally not confirmed the current worth highs and is starting to roll over. I imagine that odds favor a level of backing and filling that can drive costs to key short-term help on the Median Line (violet dotted line) of the pitchfork, the Kijun Plot (inexperienced line) and the Cloud”. The technical thesis that I recommended at the moment has unfolded as anticipated. The SPX traded decrease till it examined help on the Median Line yesterday and an intraday reversal drove the big cap Index to the highs of the day. It stays to be seen whether or not that’s the extent of the value pullback, however my US ETF Momentum / Breadth Oscillator is approaching “oversold territory” and regardless of what have been an “finish of month markup” there’s nonetheless an underlying bid within the SPX.

Develop into a paid subscriber to have the Market’s Compas ETF Research, the Candy Sixteen Crypto Research and the brand new Weekly Speculator despatched to your e-mail straight.

For readers who’re unfamiliar with the technical phrases or instruments referred to within the feedback on the technical situation of the SPX can avail themselves of a short tutorial titled, Instruments of Technical Evaluation or the Three-Half Pitchfork Papers that’s posted on The Markets Compass web site…

https://themarketscompass.com

Charts are courtesy of Optuma.

To obtain a 30-day trial of Optuma charting software program go to…