Solana is now buying and selling round a crucial help stage after experiencing a 15% decline from its native highs at $162.36. Whereas Solana has proven relative power in comparison with different altcoins, the latest value motion has launched heightened volatility and potential dangers for traders.

Associated Studying

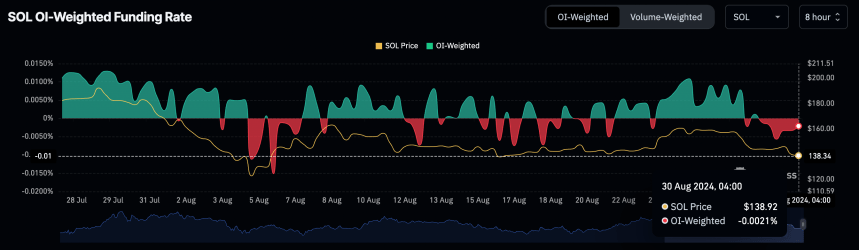

Worry and uncertainty at present dominate the market, with key knowledge from Coinglass revealing a bearish sentiment amongst merchants. This sentiment shift displays the broader market issues as Solana approaches this significant help stage.

The approaching days will likely be pivotal in figuring out whether or not Solana can stabilize or face further draw back stress. Notably, some high traders are ready for a decline to the $130 space, a shy 7% drop from present costs, as a possible entry level.

Given the present market setting, merchants and traders are intently monitoring Solana’s efficiency at this stage to gauge its subsequent transfer. If Solana holds its floor, it might point out resilience and potential for restoration; nevertheless, a failure to take care of this help might result in additional declines.

Solana’s Funding Charge Turns Detrimental

Solana’s latest decline has turned merchants bearish, at the least within the brief time period. Essential knowledge from Coinglass reveals that the funding price for SOL has turned detrimental for the primary time since August 23.

A detrimental funding price signifies that brief positions now outweigh lengthy positions, which means merchants are paying to take care of their brief bets in opposition to SOL. This shift in sentiment means that merchants are more and more anticipating additional declines in Solana’s value.

Including to the bearish sentiment, a number of merchants and analysts are anticipating a drop in direction of key help ranges. High dealer AlienOvich on X shared an evaluation suggesting that Solana might fall additional, focusing on the $135-$128 space.

If Solana fails to carry its present ranges, this bearish state of affairs might materialize, bringing Solana nearer to AlienOvich’s predicted vary. Such a decline wouldn’t solely validate the bearish sentiment at present driving the market but in addition problem Solana’s capacity to take care of its latest beneficial properties.

Associated Studying

The following few days will likely be essential for Solana because it assessments these decrease ranges. Merchants will likely be intently watching to see if Solana can discover help or if the detrimental sentiment will push the worth down additional. Because the market reacts to this stress, Solana’s capacity to get well and doubtlessly bounce again will likely be key to figuring out its short-term trajectory.

Solana Value Motion

Solana (SOL) is at present buying and selling at $139.87, considerably beneath its day by day 200 transferring common (MA) of $152.28, and is now testing the day by day 200 exponential transferring common (EMA) after briefly dipping beneath it. The first distinction between these two indicators is that an EMA is a weighted common, giving extra significance to latest knowledge factors, whereas an MA treats all knowledge factors equally.

For SOL to carry this crucial help stage, it must reclaim the EMA and consolidate across the $140 mark. Failing to take action might result in an extra decline towards the lows seen on August 5.

This value stage is essential for figuring out whether or not SOL can keep its present uptrend or if it’ll proceed to face downward stress. Merchants are intently watching this stage, as dropping it would point out a deeper correction is imminent.

Cowl picture from Dall-E, Charts from Tradingview