Solana (SOL), the high-speed blockchain community, is dealing with a balancing act. Whereas experiencing a short-term worth bump, analysts warn of a possible plunge if a key technical stage crumbles.

Associated Studying

Bullish Flicker Amidst Bearish Gloom

SOL’s worth has seen a latest uptick of three.60%, presently hovering round $162. Nevertheless, this seemingly optimistic motion comes in opposition to the backdrop of a broader downward development. Analysts attribute this shift to a change in market sentiment.

In the meantime, the altcoin’s RSI is 48, which denotes a impartial place. In consequence, SOL has room to maneuver in both course as a result of it’s neither overbought nor oversold.

A drop in buying and selling exercise has been noticed, which is typical of durations of consolidation. A spike in commerce quantity following a breakout ought to affirm the trajectory of the commerce.

Lifeline Or Looming Abyss?

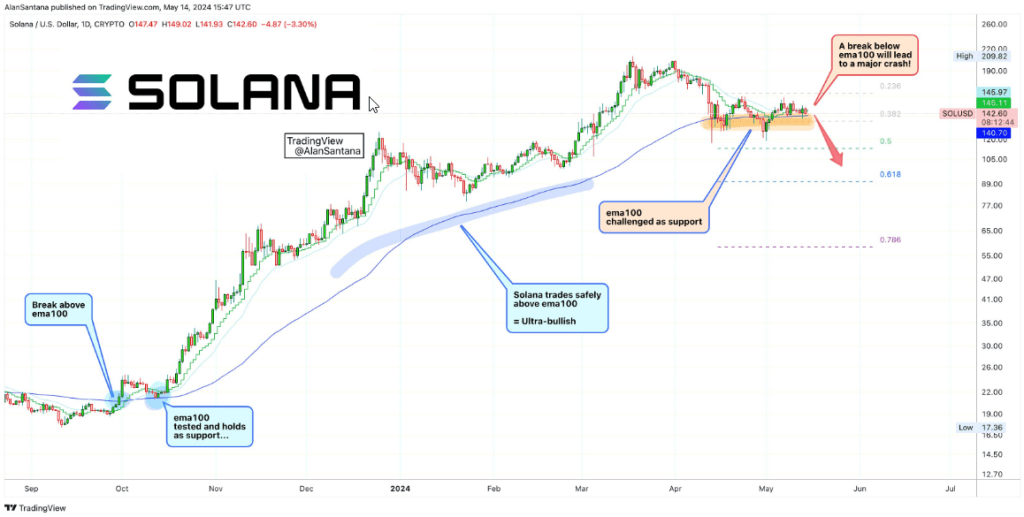

Crypto analyst Alan Santana emphasizes the importance of the Exponential Transferring Common 100 (EMA 100) as a important help stage for SOL. The EMA 100 acts as a technical indicator, reflecting the typical worth over the previous 100 days.

✴️ Help Weakens | Solana To Crash Beneath 100#SOL | #Solana

A development following system makes use of a shifting common as the primary instrument to generate buying and selling indicators for a system dealer; the shifting common is just like the holy grail of technical evaluation, along with the RSI.

The shifting… pic.twitter.com/9d5NrjuWWR

— Alan Santana (@lamatrades1111) Could 14, 2024

Traditionally, SOL has discovered help at this stage throughout bullish durations. In September and October 2023, worth breakouts above the EMA 100 signaled optimistic market sentiment. Nevertheless, the latest development reversal has forged a shadow over this as soon as dependable indicator.

A Potential Value Plunge

Santana warns {that a} drop under the present EMA 100, sitting at roughly $140, may set off a big downturn for SOL.

This breach may instill worry amongst buyers, probably resulting in a sell-off and pushing the worth even decrease. The analyst cautions of a attainable plunge under $100 if such a situation unfolds.

Solana: Past The Technical

Whereas the technical evaluation paints a regarding image, it’s essential to recollect the inherent volatility of the cryptocurrency market.

Brief-term predictions primarily based on technical indicators might not all the time maintain true. Different components, similar to trade information, laws, and broader market traits, can even play a big function in worth actions.

Associated Studying

For example, a optimistic regulatory stance in direction of cryptocurrencies may increase investor confidence and result in a worth enhance, even when technical indicators counsel a downtrend.

Conversely, destructive information surrounding a blockchain hack or safety vulnerabilities may set off a sell-off, defying bullish technical indicators.

The Street Forward

Solana’s future trajectory stays unsure. Will the $140 worth level turn out to be a launchpad for a restoration, or will it crumble, sending SOL tumbling down deeper?

Featured picture from Pngtree, chart from TradingView