In a analysis report launched on July 18, 2024, Thor Hartvigsen, a crypto researcher, strongly cautioned towards the funding technique of buying high-beta altcoins throughout the Ethereum ecosystem as a leveraged tactic, significantly with the forthcoming launch of the spot Ethereum ETFs in america.

Hartvigsen’s evaluation titled “ETH Beta – a Recipe for Catastrophe?” offers an evaluation of whether or not shopping for ETH-correlated altcoins, generally known as ‘ETH betas,’ constitutes a very good funding technique. These belongings, together with tokens like OP, ARB, MANTA, MNT, METIS, GNO, CANTO, IMX, STRK (all L2’s), MKR, AAVE, SNX, FXS, LDO, PENDLE, ENS, LINK (all DeFi) PEPE, DOGE (all memes), SOL, AVAX, BNB and TON (different L1’s) are historically considered as providing leveraged publicity to actions in Ethereum’s worth, assuming the next volatility relative to Ethereum itself.

The report dissects a number of vital areas: worth efficiency comparability between these altcoins and Ethereum, their correlation and beta coefficients relative to Ethereum, and their risk-adjusted returns measured by the Sharpe ratio. The researcher highlights the inherent dangers and inefficiencies in banking on these altcoins for enhanced Ethereum publicity.

Why Shopping for ‘Ethereum Beta’ Altcoins Is Usually A Dangerous Concept

Discussing worth efficiency, Hartvigsen factors out, “The TOTAL3 (altcoin market cap) towards the ETH market cap is at round 1.48. Since 2020, this chart has solely been this low on just a few uncommon events, signaling the outperformance of ETH towards most alts.” This historic context units a grim precedent for these hoping for altcoin outperformance concurrent with Ethereum’s progress. The researcher elaborates that regardless of periodic recoveries at these ranges, the overarching pattern has been certainly one of decline—a troubling sign for altcoin buyers.

Associated Studying

“Notably, not a single L2 token has outperformed ETH YTD, with one of the best performing token, GNO, up 34%, whereas ETH has seen a 44% achieve. Worst performers embody MANTA, STRK, and CANTO, all down greater than 60% this yr,” Hartvigsen acknowledged. With regard to the highest different L1’s, AVAX is the one one down on the yr vs ETH. “Of the 8 DeFi tokens on this basket, 3 have outperformed ETH, specifically PENDLE (+254%), ENS (+163%) and MKR (+78%). The remaining 5 are all down on the yr with FXS because the worst performer down 73%,” the researcher added.

In the meantime, memecoins have been one of the best wager this yr to this point. “This may also be seen within the efficiency of the biggest Ethereum-native memecoins. PEPE is the biggest gainer of the pattern, up +708% whereas SHIB is up 74% and DOGE 31%,” in line with Hartvigsen.

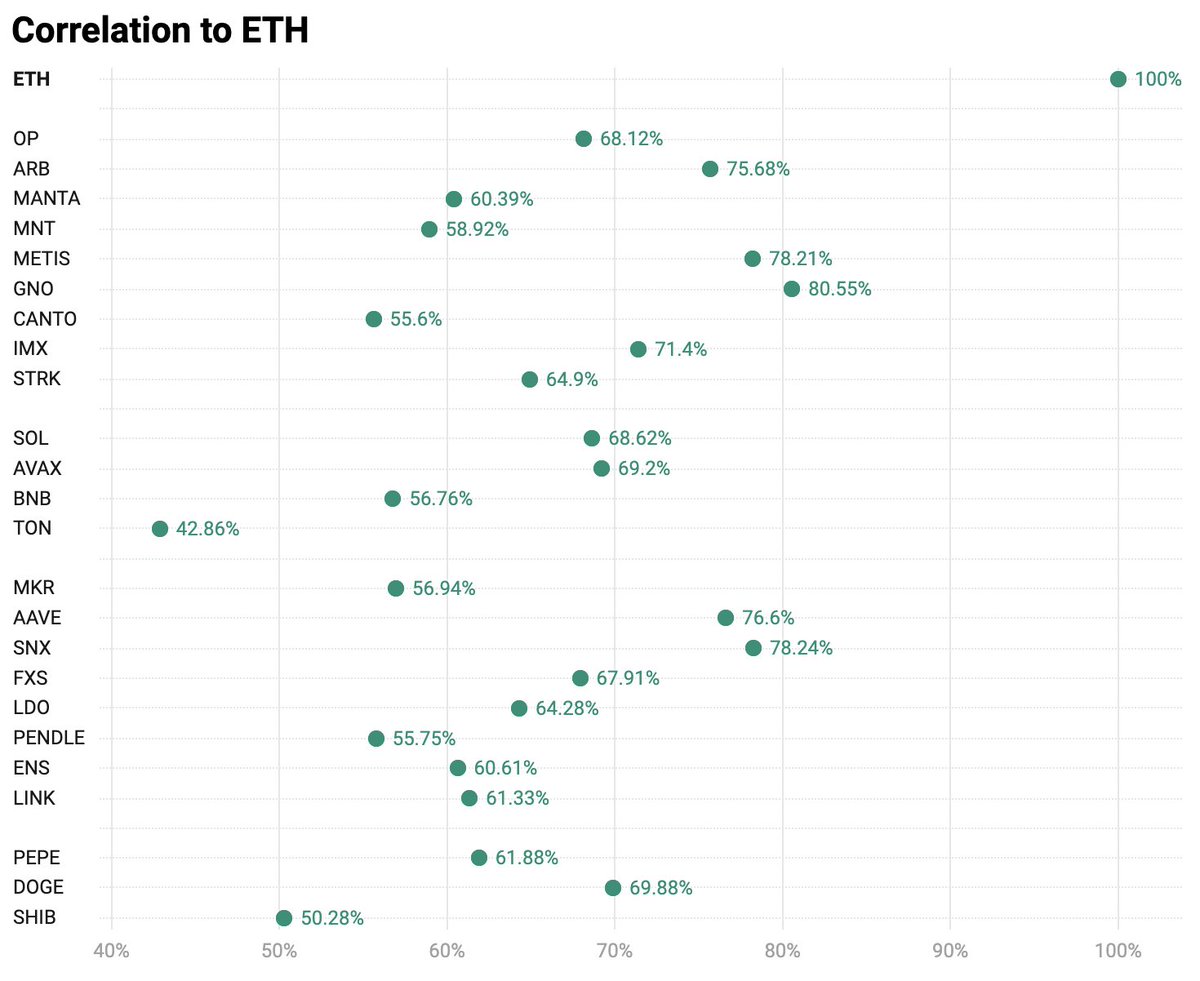

The correlation part of the report digs deeper into the connection these altcoins have with Ethereum. “The pattern of altcoins has not been chosen at random however consists of tokens normally assumed to be correlated with the efficiency of ETH,” Hartvigsen explains.

Associated Studying

He additional notes that “Correlation between ETH and ETH is clearly good and due to this fact is 100%. The alts most correlated with ETH are GNO, SNX, METIS, AAVE, and ARB.” Nevertheless, regardless of some tokens exhibiting an honest correlation with Ethereum, the researcher cautions that these don’t essentially assure related efficiency outcomes, particularly on this crypto cycle.

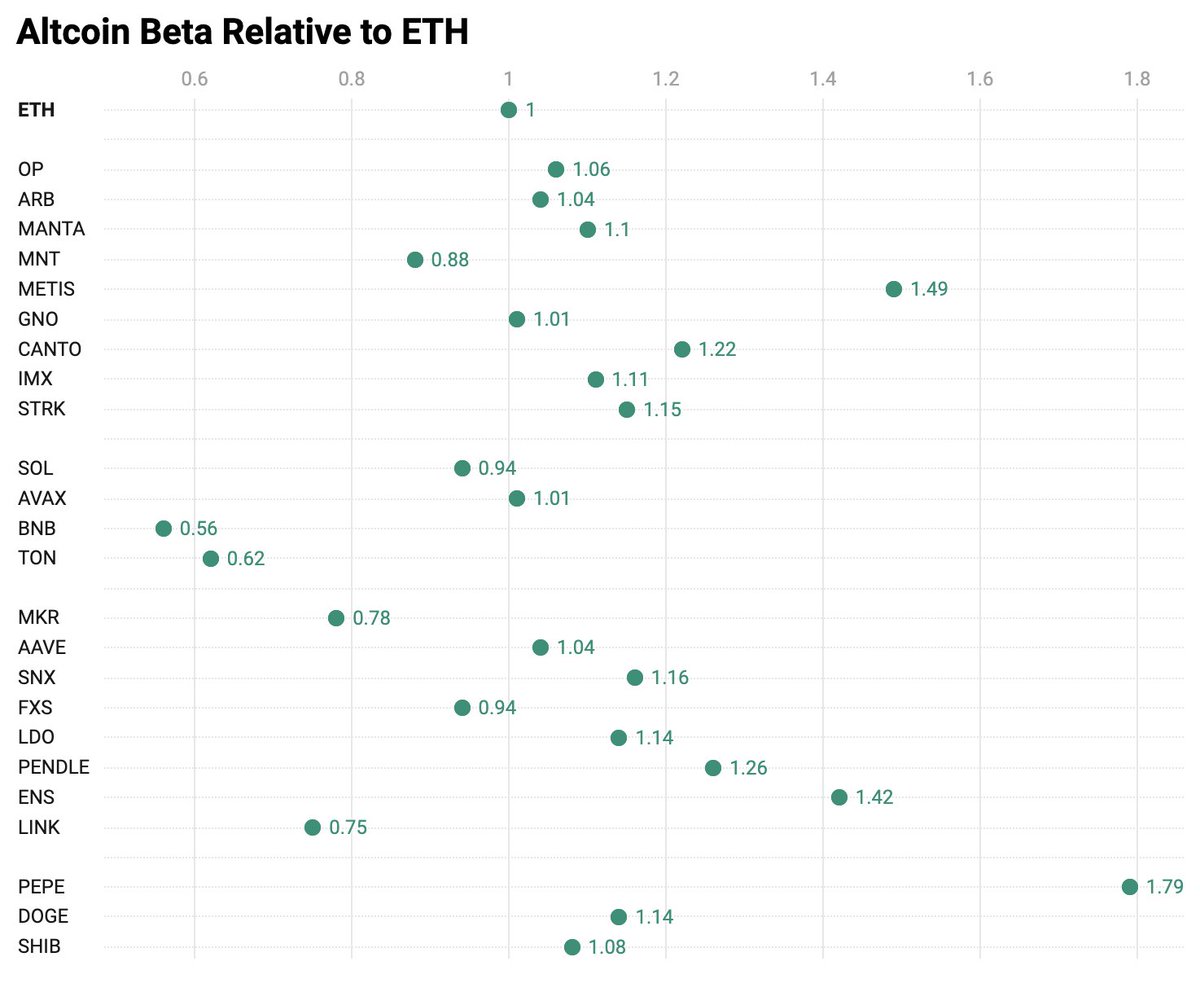

By way of beta, which measures the volatility of an asset in comparison with the market, the findings are telling. “From this evaluation, it’s clear that just a few alts have a excessive beta coefficient in relation to ETH, specifically PEPE, METIS, ENS, and PENDLE,” Hartvigsen states. This implies that whereas sure altcoins exhibit larger volatility and thus potential for higher returns relative to Ethereum, additionally they carry a proportionately larger threat.

The calculation of the Sharpe ratio, which offers a measure of risk-adjusted return, brings one other dimension to the evaluation. Hartvigsen remarks, “The Sharpe ratio calculations underscore the volatility-adjusted returns of those altcoins, which have diverse considerably. That is vital as buyers usually overlook the elevated threat these ‘ETH beta’ belongings carry.”

Wrapping up his findings, Hartvigsen presents a transparent verdict: “Shopping for these altcoins as a option to get leveraged publicity to Ethereum is, for my part, a silly sport as you’re taking up a variety of extra threat you may not concentrate on. In the event you’re searching for leveraged ETH publicity, merely placing on a 2x ETH lengthy on e.g., Aave is extra wise.” He emphasizes that such a technique ensures a 100% correlation and a beta worth of two, with out the pointless problems.

At press time, ETH traded at $3,439.

Featured picture created with DALL·E, chart from TradingView.com