Since reaching its peak for the 12 months at $0.00004749 over a month in the past, on March 5, the value of Shiba Inu (SHIB) has fallen by roughly 40%. Nonetheless, there could also be brighter days forward. Following a meteoric rise of 390% in simply eight days from the top of February until the start of March, a interval of consolidation was inevitable for the SHIB value. Nevertheless, this part may very well be drawing to a detailed.

Shiba Inu Worth About To Surge 65%?

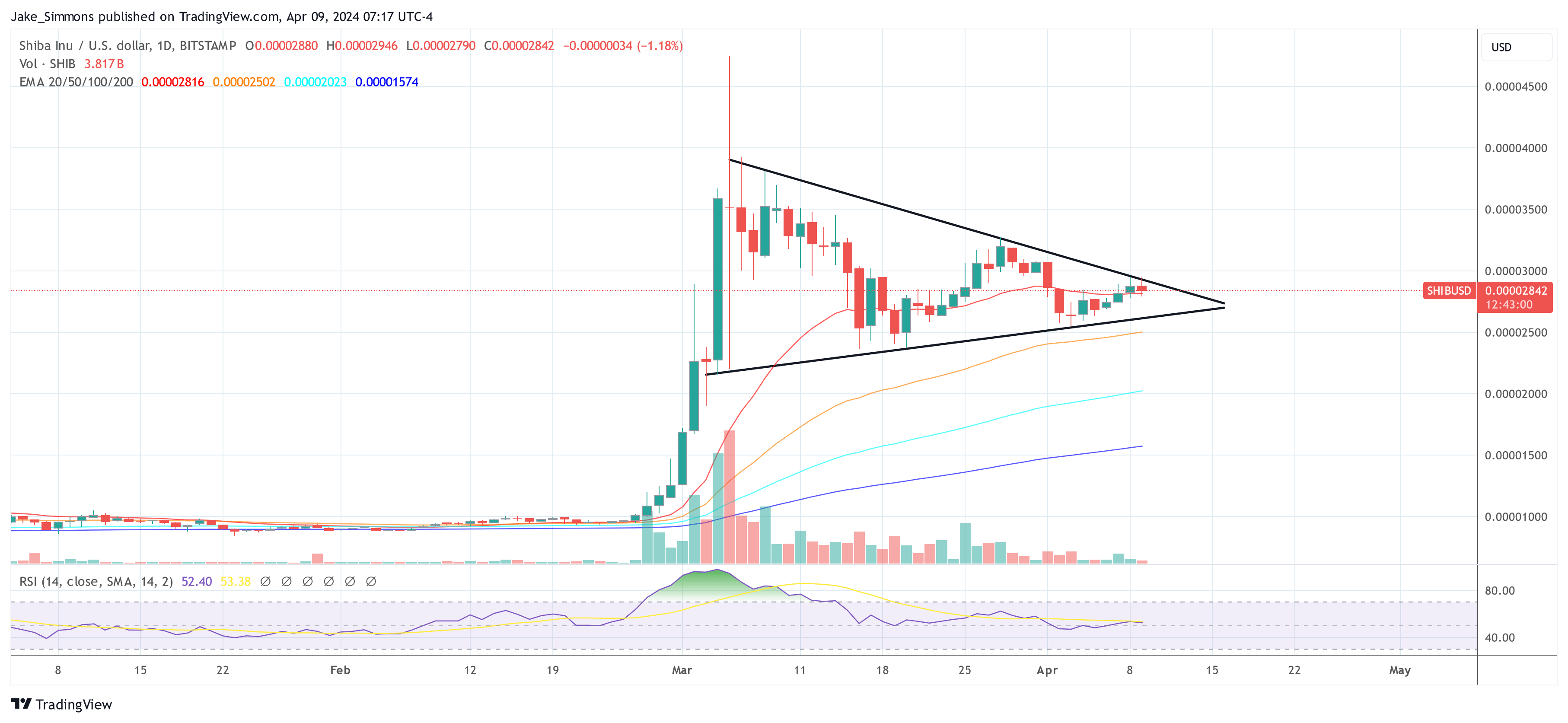

On the each day chart, the meme coin is exhibiting a essential chart sample that means a big value motion could also be imminent. The evaluation of the each day SHIB/USD chart reveals the emergence of a symmetrical triangle sample. This basic chart sample is mostly thought of a continuation sample, sometimes heralding an uptick in volatility. On condition that SHIB has been on a notably sturdy uptrend, the momentum may swing again in favor of the bulls.

Over the previous 5 weeks, the value of SHIB has been making a sequence of decrease highs and better lows, which is obvious from the converging pattern traces which can be containing the value motion. The apex of the triangle is quick approaching, suggesting {that a} breakout is imminent. This kind of consolidation suggests market indecision, and because the sample reaches its conclusion, we will anticipate a big transfer in both path.

The present value on the time of the evaluation is $0.00002842. Notably, the quantity has been declining because the sample developed, which is typical in the course of the formation of a symmetrical triangle and additional validates the sample.

Exponential Transferring Averages (EMAs) additionally paint an important image. The 20-day EMA is flatlining, suggesting a impartial short-term pattern, whereas the 50, 100, and 200-day EMAs are all trending upward, offering sturdy help ranges. Significantly, the value is at present above the 20-day EMA, which is positioned at roughly $0.00002817, and this stage may act as a robust help within the close to time period.

The Relative Energy Index (RSI) is hovering close to the 52.40 stage, which is barely above the midpoint of fifty that separates bullish momentum from bearish momentum. The RSI stage signifies a impartial stance out there momentum however leaves room for an rise ought to the market sentiment sway positively.

When it comes to deriving value targets from this sample, technical analysts sometimes measure the peak of the triangle at its widest half and challenge that distance from the purpose of breakout.

If SHIB breaks above the triangle, the value may surge, concentrating on the peak of the triangle, which may very well be within the area of the yearly excessive at roughly $0.000048, contemplating the widest a part of the sample. This could translate right into a 65% value rally from the present value. Conversely, a downward breakout may ship the value to check the $0.00001500 stage, which might be the equal goal on the draw back.

You will need to point out that whereas symmetrical triangles can result in a considerable breakout, the path will not be sure till a transparent breakout happens with an accompanying improve in quantity. Merchants and buyers want to observe for a each day shut outdoors of the triangle’s boundaries, with elevated quantity, to substantiate the path of the breakout.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site totally at your personal danger.