The Shiba Inu (SHIB) value has emerged from a persistent downtrend that dominated the previous two months. An in depth evaluation of the every day and weekly (SHIB/USD) charts signifies a sequence of important technical components which are at the moment influencing SHIB’s value actions.

Shiba Inu Bulls Take Over

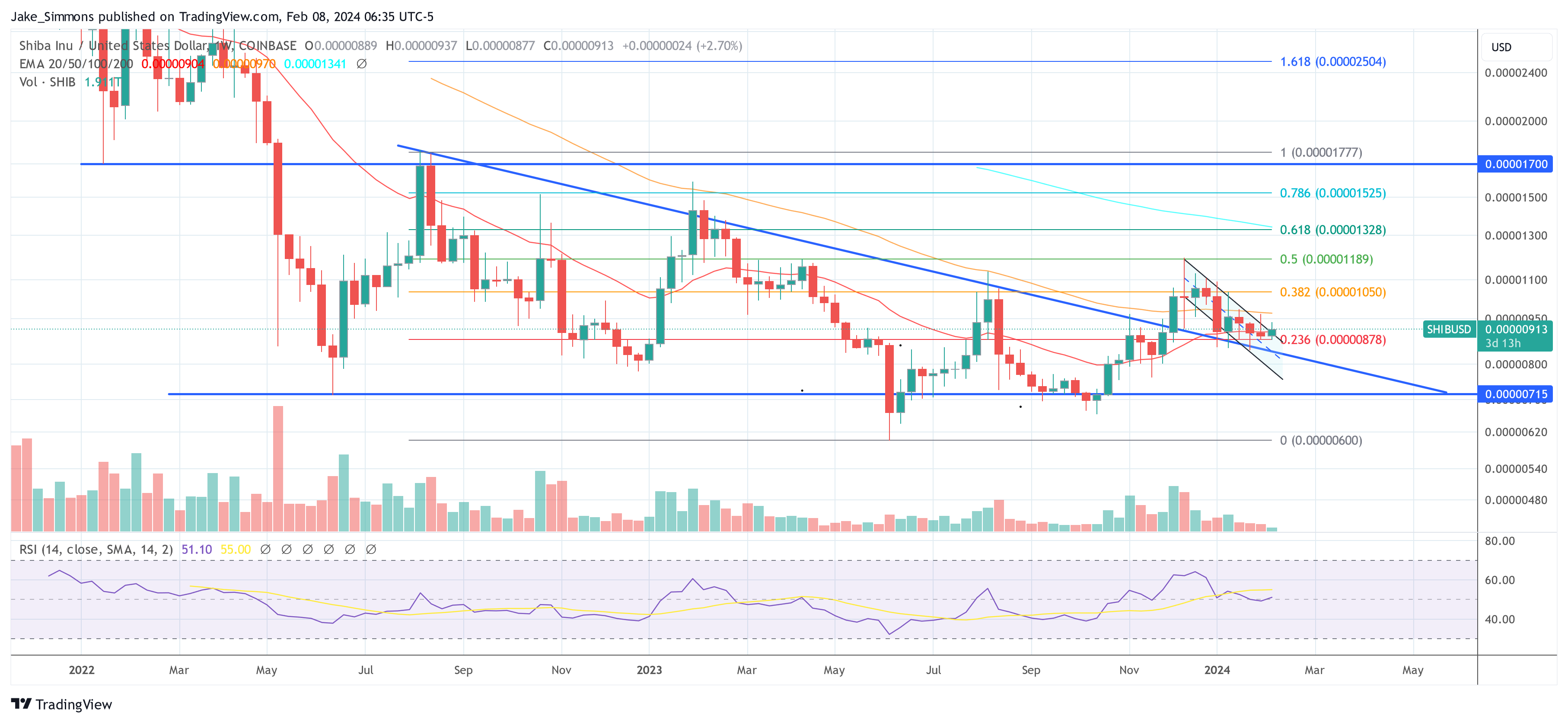

On the every day chart, SHIB has damaged by way of the higher boundary of the descending channel sample that had been in place for the reason that excessive at $0.00001193 reached in mid-December final 12 months. This channel, characterised by decrease highs and decrease lows, had been containing the worth motion, however a current surge in quantity and shopping for strain has allowed SHIB to breach this confinement.

The breakout was confirmed by an in depth above the 200-day Exponential Shifting Common (EMA, blue line), which is now performing as a assist degree. Nonetheless, with the 20-day, 50-day, and 100-day EMAs converging simply above present value ranges (between $0.00000912 and $0.00000932), the bulls nonetheless have some work to do.

Notably, the Fibonacci retracement ranges, drawn from the height to the trough of the current main transfer, reveal the next key value ranges: the 0.236 degree at $0.00000878 continues to be an important assist, adopted by the 0.382 degree at $0.00001050, the 0.5 degree at $0.00001189, and the 0.618 degree at $0.00001328 as the subsequent essential value targets. These ranges typically act as resistance throughout recoveries and, as such, are essential targets for merchants to look at.

The Relative Power Index (RSI) on the every day chart is hovering across the 51 mark, indicating a impartial momentum with a slight bias in the direction of shopping for strain. This leaves room for the RSI to climb earlier than reaching overbought circumstances, that are sometimes thought of to be above the 70 degree.

Finish Of The Consolidation Part?

On the weekly time-frame, a bigger pattern line, which is offering assist derived from an ascending triangle sample, suggests a longer-term bullish sentiment underlying the current bearish part. This assist line is important because it has been revered quite a few occasions up to now, making it a big degree for long-term holders.

A decisive weekly shut above the 20-week EMA at $0.00000904 this Sunday may pave the way in which for vital momentum. Subsequently, consideration shifts to the 50-week EMA at $0.00000970, signaling potential additional advances.

The quantity profile on each time frames has been comparatively excessive throughout the breakout, offering additional affirmation of the transfer. Nonetheless, merchants ought to be cautious as excessive quantity may precede volatility and potential value retracements.

In abstract, SHIB has exhibited a transparent breakout from a two-month downtrend with instant assist and resistance ranges identifiable by way of EMAs and Fibonacci retracements. Merchants and buyers ought to be carefully monitoring these ranges to gauge the sustainability of the breakout and the potential for a pattern reversal.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site solely at your individual threat.