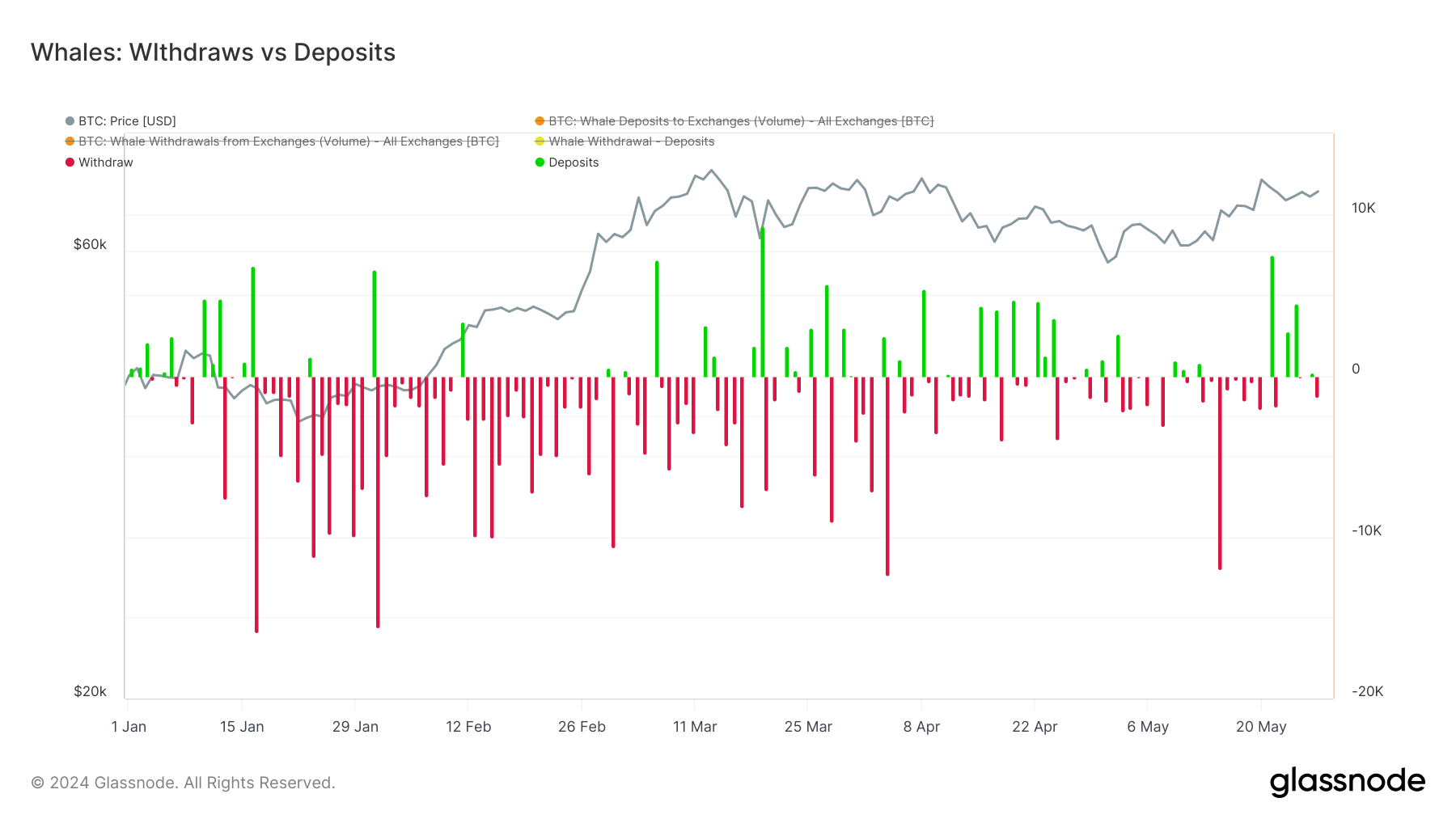

Glassnode defines Bitcoin whales because the variety of distinctive entities holding at the least 1k cash. Yr to this point, these whales have primarily been making withdrawals, influenced by Bitcoin US ETFs. Notably, within the previous ten buying and selling days, there have been important outflows from US ETFs, however a brand new development has emerged: whale deposits onto exchanges.

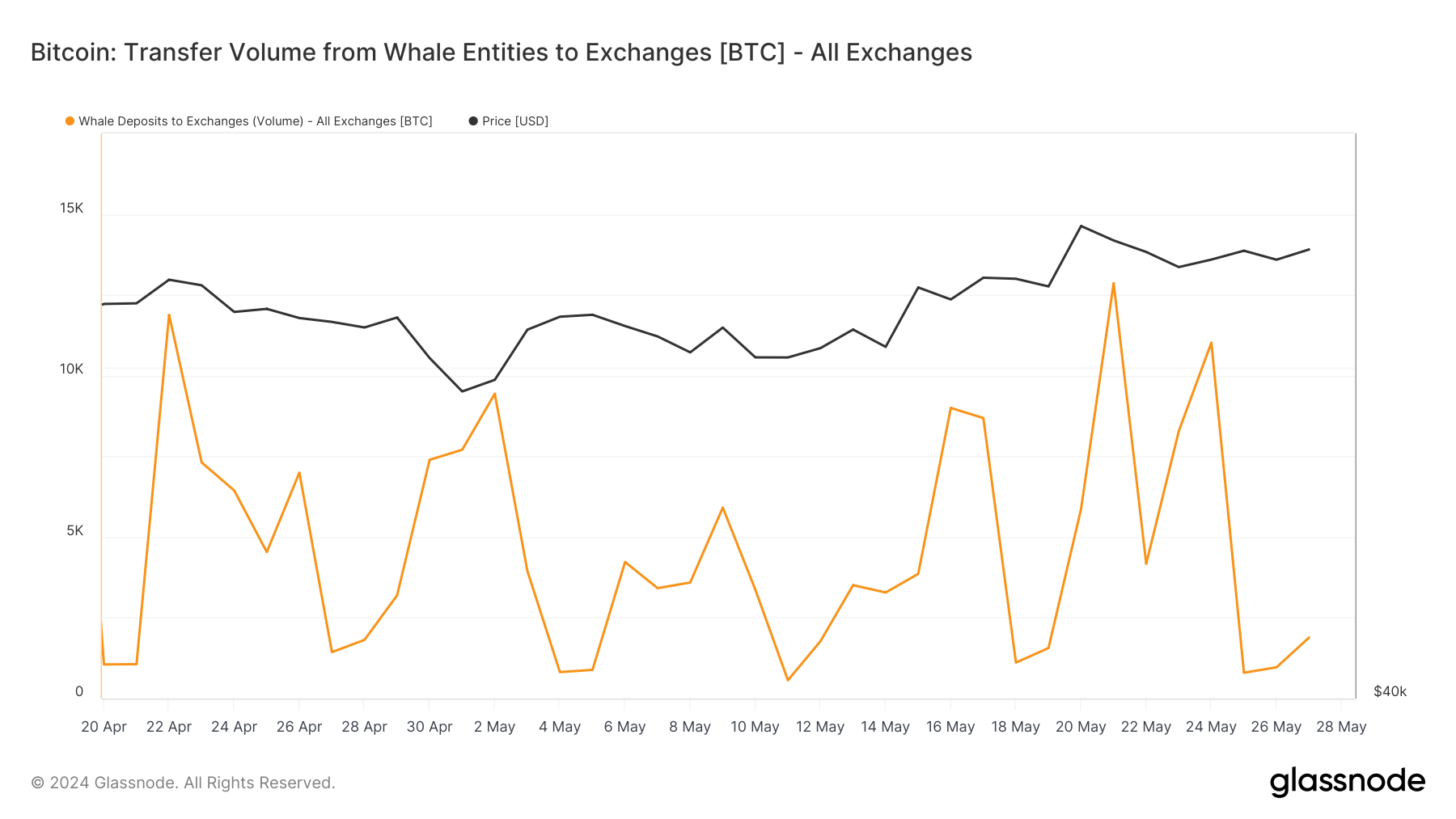

In accordance with Glassnode knowledge, round 13,000 BTC have been deposited beginning Might 21, with extra massive deposits on Might 24 and 25. These deposits coincide with Bitcoin’s value rally, indicating that whales are promoting into value power. It is a essential development to observe.

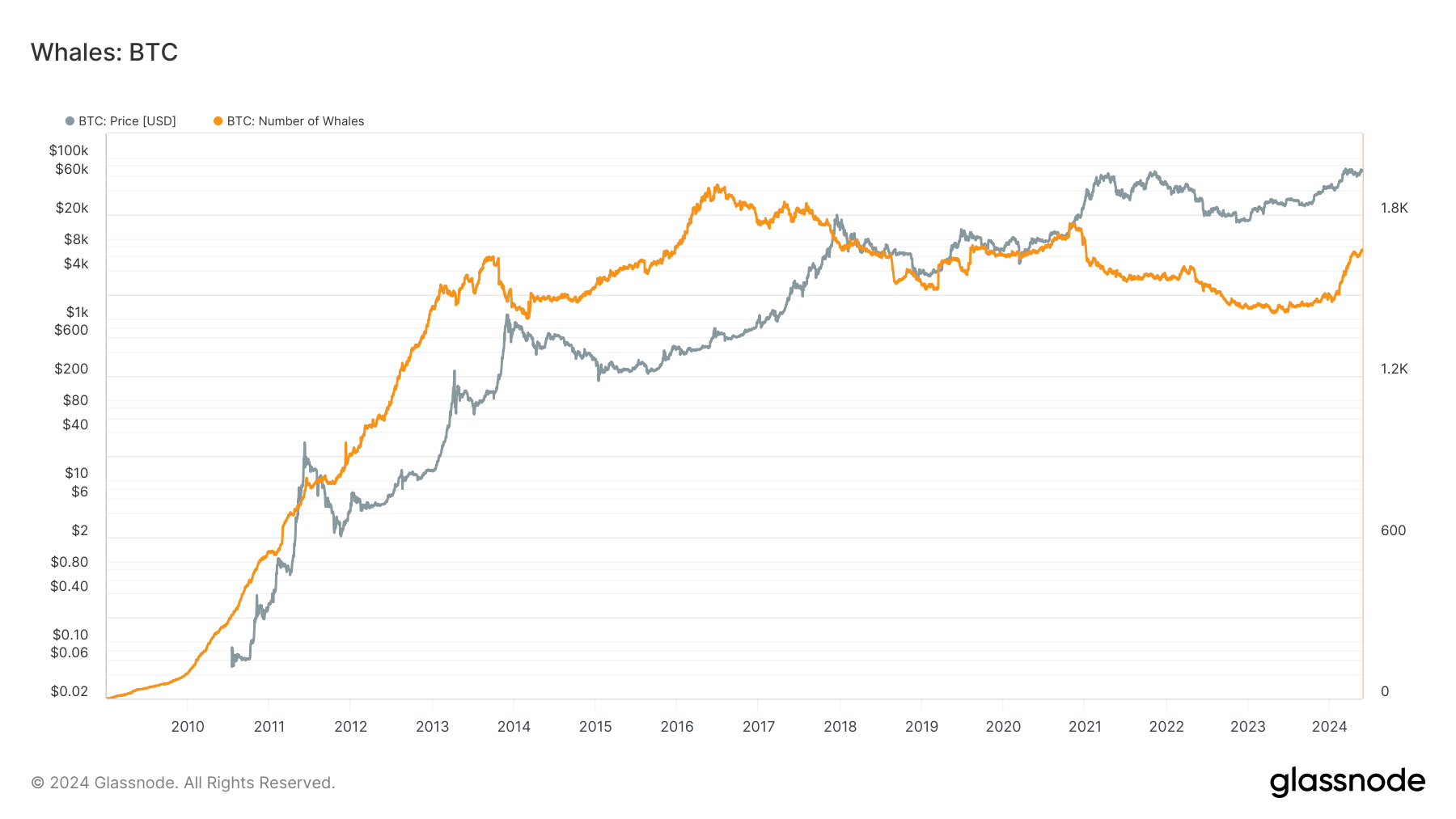

Regardless of these actions, the variety of distinctive entities holding at the least 1,000 BTC has continued to rise, reaching 1,668.

It’s important to notice that wallets with balances over 1,000 BTC usually embody ETFs similar to Grayscale, which spreads its Bitcoin throughout a number of addresses. ETFs with property beneath administration exceeding $68 million now fall into the whale class.

The put up Sharp rise in Bitcoin whale deposits amid ETF outflows appeared first on CryptoSlate.