Knowledge reveals that Bitcoin sentiment has cooled off to impartial from greed following the asset’s newest plunge to the $57,000 stage.

Bitcoin Concern & Greed Index Has Returned To Impartial Ranges

The “Concern & Greed Index” is an indicator created by Different that reveals the typical sentiment amongst buyers within the Bitcoin and wider cryptocurrency market.

This index estimates sentiment by contemplating 5 components: volatility, buying and selling quantity, social media information, market cap dominance, and Google Developments.

The metric makes use of a scale that runs from zero to 100 to symbolize this common sentiment. All values below 46 recommend that buyers are fearful, whereas these above 54 indicate a grasping market. The zone between these two cutoffs naturally corresponds to the territory of impartial mentality.

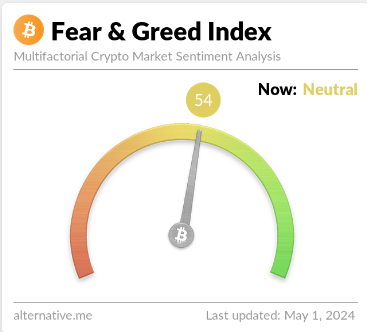

Now, here’s what the Bitcoin sentiment seems to be like proper now, in keeping with the Concern & Greed Index:

The worth of the metric seems to be 54 in the meanwhile | Supply: Different

As displayed above, the Bitcoin Concern & Greed Index is at a worth of 54, implying that buyers share a impartial sentiment at the moment. Nevertheless, the neutrality is just simply, because the metric is true on the boundary of the greed area.

This can be a important departure from yesterday’s sentiment: 67. The chart under reveals how the indicator’s worth has modified lately.

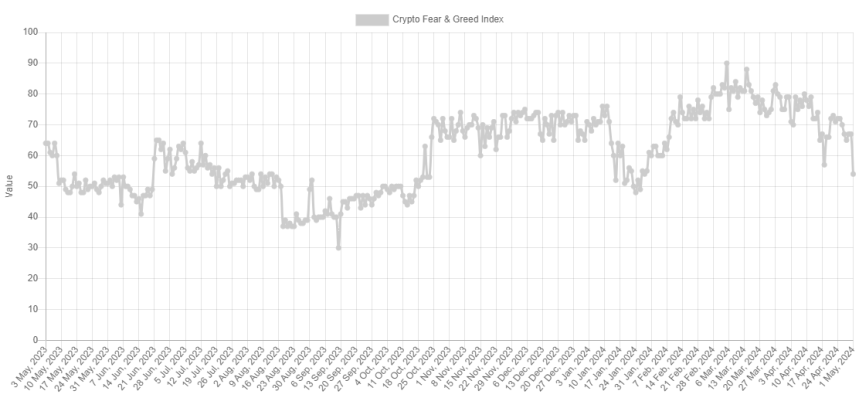

The development within the Concern & Greed Index over the previous 12 months | Supply: Different

Because the graph reveals, the Bitcoin Concern & Greed Index has been declining lately. For many of February and March, in addition to the primary half of April, the indicator was in or close to a particular zone known as excessive greed.

The market assumes this sentiment at values above 75. Because the asset value struggled lately, the mentality cooled off from this excessive zone and entered the traditional greed area. With the newest crash in BTC, the index has seen a pointy plunge, now exiting out of greed altogether.

Traditionally, cryptocurrency has tended to maneuver in opposition to the bulk’s expectations. The stronger this expectation, the upper the likelihood of such a opposite transfer.

This expectation is taken into account the strongest in excessive sentiment zones, in addition to excessive worry and greed. As such, main bottoms and tops have usually occurred in these territories.

The all-time excessive (ATH) value final month, which continues to be the highest of the rally to this point, additionally occurred alongside excessive values of the Bitcoin Concern & Greed Index.

With the sentiment now cooled to impartial, some buyers could also be awaiting a fall into worry. That is pure as a result of a rebound would develop into extra possible the more severe the sentiment will get now.

BTC Value

Throughout Bitcoin’s newest plunge, its value briefly slipped under $57,000 earlier than surging again to $57,300.

Seems like the value of the asset has registered a pointy drop over the previous two days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Different.me, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site fully at your individual danger.