Robinhood, a big participant in the USA monetary know-how sector, has recorded main development. The platform has seen a notable rise in month-to-month consumer influx.

Robinhood Month-to-month Deposits Surges To New Peak

A correspondent at CNBC, Kate Rooney, not too long ago shared the event with the crypto neighborhood on the X (previously Twitter) platform. The CNBC reporter stated Robinhood recorded elevated income in its most up-to-date quarterly outcomes.

Rooney identified that the platform is making some headway in its try to overtake established “brokerage firms” for market dominance. Moreover, Robinhood goals to develop past its “authentic base of inexperienced and youthful merchants” within the crypto market.

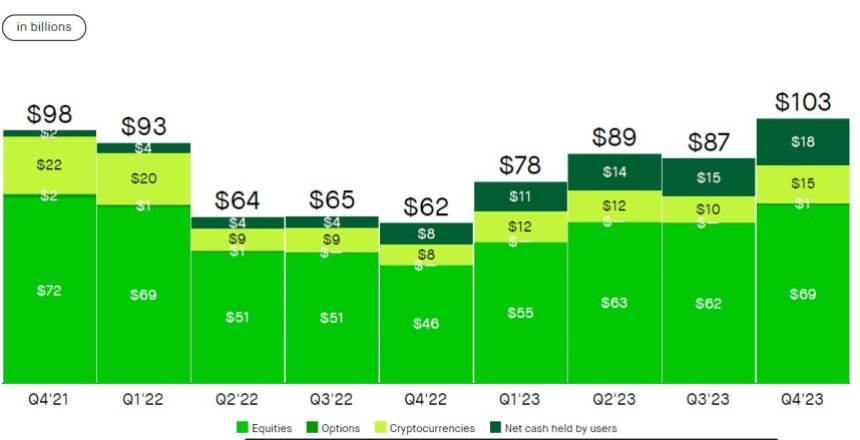

She additional highlighted that over $100 billion of the agency’s property are at the moment “below custody.” As well as, a “internet constructive switch from each main brokerage competitor” drove the This fall deposits to roughly $4.6 billion.

Consequently, this implies its growing reputation amongst traders seeking to embrace digital property of their portfolios for diversification. It additionally signifies the rising confidence and inclination towards the buying and selling agency amongst crypto traders.

The CNBC correspondent asserted that the numbers above include an “common buyer switch steadiness” of $100,000.

As per Rooney’s X submit, Robinhood noticed a considerable rise in month-to-month deposits valued at $4 billion in January. Thus far, the latest uptick signifies the web buying and selling platform’s strongest month since early 2021.

Throughout the identical quarter final yr, the buying and selling platform misplaced $166 million, or $0.19 per share. Nonetheless, this yr, it made a revenue of $30 million, or $0.3 per share.

As was revealed, Robinhood’s revenue rose on account of elevated internet curiosity and transaction-based and different income streams. Over the three months, its internet curiosity revenue grew by 4% to $236 million.

Taking Over The Lively Dealer Market

Vlad Tenev, Robinhood’s Chief Government Officer (CEO), has revealed Robinhood’s intentions to take over the energetic dealer market. Tenev not too long ago disclosed this goal throughout a quarterly earnings name.

He acknowledged that the agency’s consumer base and income have grown “almost seven instances” prior to now 4 years. “taking a look at what’s in entrance of us, we’re excited by the chance to proceed rising considerably from right here,” he added.

Robinhood has gained market share and attracted internet asset inflows from its main rivals. In line with Tenev, the corporate will repeatedly spend money on its “consumer expertise on cell” to realize its objective.

Presently, the crypto enterprise stands out because the dominant participant in market share. Tenev has confirmed the addition of futures and index choices to the platform within the coming months of this yr.

Featured picture from Shutterstock, chart from Tradingview.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site totally at your individual threat.