Particular due to Vlad Zamfir for a lot of the pondering behind multi-chain cryptoeconomic paradigms

First off, a historical past lesson. In October 2013, once I was visiting Israel as a part of my journey across the Bitcoin world, I got here to know the core groups behind the coloured cash and Mastercoin tasks. As soon as I correctly understood Mastercoin and its potential, I used to be instantly drawn in by the sheer energy of the protocol; nonetheless, I disliked the truth that the protocol was designed as a disparate ensemble of “options”, offering a subtantial quantity of performance for individuals to make use of, however providing no freedom to flee out of that field. Searching for to enhance Mastercoin’s potential, I got here up with a draft proposal for one thing referred to as “final scripting” – a general-purpose stack-based programming language that Mastercoin might embody to permit two events to make a contract on an arbitrary mathematical components. The scheme would generalize financial savings wallets, contracts for distinction, many sorts of playing, amongst different options. It was nonetheless fairly restricted, permitting solely three phases (open, fill, resolve) and no inside reminiscence and being restricted to 2 events per contract, nevertheless it was the primary true seed of the Ethereum thought.

I submitted the proposal to the Mastercoin workforce. They have been impressed, however elected to not undertake it too shortly out of a need to be sluggish and conservative; a philosophy which the venture retains to to this present day and which David Johnston talked about on the current Tel Aviv convention as Mastercoin’s main differentiating characteristic. Thus, I made a decision to exit alone and easily construct the factor myself. Over the subsequent three weeks I created the unique Ethereum whitepaper (sadly now gone, however a nonetheless very early model exists right here). The fundamental constructing blocks have been all there, besides the progamming language was register-based as a substitute of stack-based, and, as a result of I used to be/am not expert sufficient in p2p networking to construct an unbiased blockchain consumer from scratch, it was to be constructed as a meta-protocol on high of Primecoin – not Bitcoin, as a result of I wished to fulfill the issues of Bitcoin builders who have been indignant at meta-protocols bloating the blockchain with further knowledge.

As soon as competent builders like Gavin Wooden and Jeffrey Wilcke, who didn’t share my deficiencies in skill to jot down p2p networking code, joined the venture, and as soon as sufficient individuals have been excited that I noticed there could be cash to rent extra, I made the choice to right away transfer to an unbiased blockchain. The reasoning for this alternative I described in my whitepaper in early January:

The benefit of a metacoin protocol is that it may possibly permit for extra superior transaction sorts, together with customized currencies, decentralized change, derivatives, and so on, which can be not possible on high of Bitcoin itself. Nonetheless, metacoins on high of Bitcoin have one main flaw: simplified cost verification, already troublesome with coloured cash, is outright not possible on a metacoin. The reason being that whereas one can use SPV to find out that there’s a transaction sending 30 metacoins to handle X, that by itself doesn’t imply that deal with X has 30 metacoins; what if the sender of the transaction didn’t have 30 metacoins to start out with and so the transaction is invalid? Discovering out any half of the present state basically requires scanning by way of all transactions going again to the metacoin’s unique launch to determine which transactions are legitimate and which of them usually are not. This makes it not possible to have a really safe consumer with out downloading your complete 12 GB Bitcoin blockchain.

Basically, metacoins do not work for mild shoppers, making them slightly insecure for smartphones, customers with outdated computer systems, internet-of-things units, and as soon as the blockchain scales sufficient for desktop customers as nicely. Ethereum’s unbiased blockchain, however, is particularly designed with a extremely superior mild consumer protocol; in contrast to with meta-protocols, contracts on high of Ethereum inherit the Ethereum blockchain’s mild client-friendliness properties totally. Lastly, lengthy after that, I spotted that by making an unbiased blockchain permits us to experiment with stronger variations of GHOST-style protocols, safely pulling down the block time to 12 seconds.

So what is the level of this story? Basically, had historical past been totally different, we simply might have gone the route of being “on high of Bitcoin” proper from day one (in actual fact, we nonetheless might make that pivot if desired), however stable technical causes existed then why we deemed it higher to construct an unbiased blockchain, and these causes nonetheless exist, in just about precisely the identical kind, right now.

Since numerous readers have been anticipating a response to how Ethereum as an unbiased blockchain could be helpful even within the face of the current announcement of a metacoin primarily based on Ethereum expertise, that is it. Scalability. In the event you use a metacoin on BTC, you acquire the good thing about having simpler back-and-forth interplay with the Bitcoin blockchain, however if you happen to create an unbiased chain then you could have the power to attain a lot stronger ensures of safety significantly for weak units. There are actually functions for which a better diploma of connectivity with BTC is necessary ; for these circumstances a metacoin will surely be superior (though observe that even an unbiased blockchain can work together with BTC fairly nicely utilizing principally the identical expertise that we’ll describe in the remainder of this weblog put up). Thus, on the entire, it would actually assist the ecosystem if the identical standardized EVM is accessible throughout all platforms.

Past 1.0

Nonetheless, in the long run, even mild shoppers are an unpleasant resolution. If we really anticipate cryptoeconomic platforms to change into a base layer for a really great amount of world infrastructure, then there might nicely find yourself being so many crypto-transactions altogether that no pc, besides perhaps just a few very massive server farms run by the likes of Google and Amazon, is highly effective sufficient to course of all of them. Thus, we have to break the elemental barrier of cryptocurrency: that there must exist nodes that course of each transaction. Breaking that barrier is what will get a cryptoeconomic platform’s database from being merely massively replicated to being really distributed. Nonetheless, breaking the barrier is tough, significantly if you happen to nonetheless wish to preserve the requirement that the entire totally different elements of the ecosystem ought to reinforce one another’s safety.

To realize the purpose, there are three main methods:

- Constructing protocols on high of Ethereum that use Ethereum solely as an auditing-backend-of-last-resort, conserving transaction charges.

- Turning the blockchain into one thing a lot nearer to a high-dimensional interlinking mesh with all elements of the database reinforcing one another over time.

- Going again to a mannequin of one-protocol (or one service)-per-chain, and arising with mechanisms for the chains to (1) work together, and (2) share consensus energy.

Of those methods, observe that solely (1) is finally appropriate with conserving the blockchain in a kind something near what the Bitcoin and Ethereum protocols assist right now. (2) requires a large redesign of the elemental infrastructure, and (3) requires the creation of hundreds of chains, and for fragility mitigation functions the optimum strategy will probably be to make use of hundreds of currencies (to cut back the complexity on the person facet, we will use stable-coins to basically create a standard cross-chain foreign money customary, and any slight swings within the stable-coins on the person facet could be interpreted within the UI as curiosity or demurrage so the person solely must preserve observe of 1 unit of account).

We already mentioned (1) and (2) in earlier weblog posts, and so right now we are going to present an introduction to a number of the ideas concerned in (3).

Multichain

The mannequin right here is in some ways just like the Bitshares mannequin, besides that we don’t assume that DPOS (or some other POS) will probably be safe for arbitrarily small chains. Somewhat, seeing the final robust parallels between cryptoeconomics and establishments in wider society, significantly authorized programs, we observe that there exists a big physique of shareholder regulation defending minority stakeholders in real-world corporations in opposition to the equal of a 51% assault (specifically, 51% of shareholders voting to pay 100% of funds to themselves), and so we attempt to replicate the identical system right here by having each chain, to a point, “police” each different chain both immediately or not directly by way of an interlinking transitive graph. The form of policing required is straightforward – policing aganist double-spends and censorship assaults from native majority coalitions, and so the related guard mechanisms could be applied solely in code.

Nonetheless, earlier than we get to the exhausting drawback of inter-chain safety, allow us to first focus on what really seems to be a a lot simpler drawback: inter-chain interplay. What will we imply by a number of chains “interacting”? Formally, the phrase can imply one in all two issues:

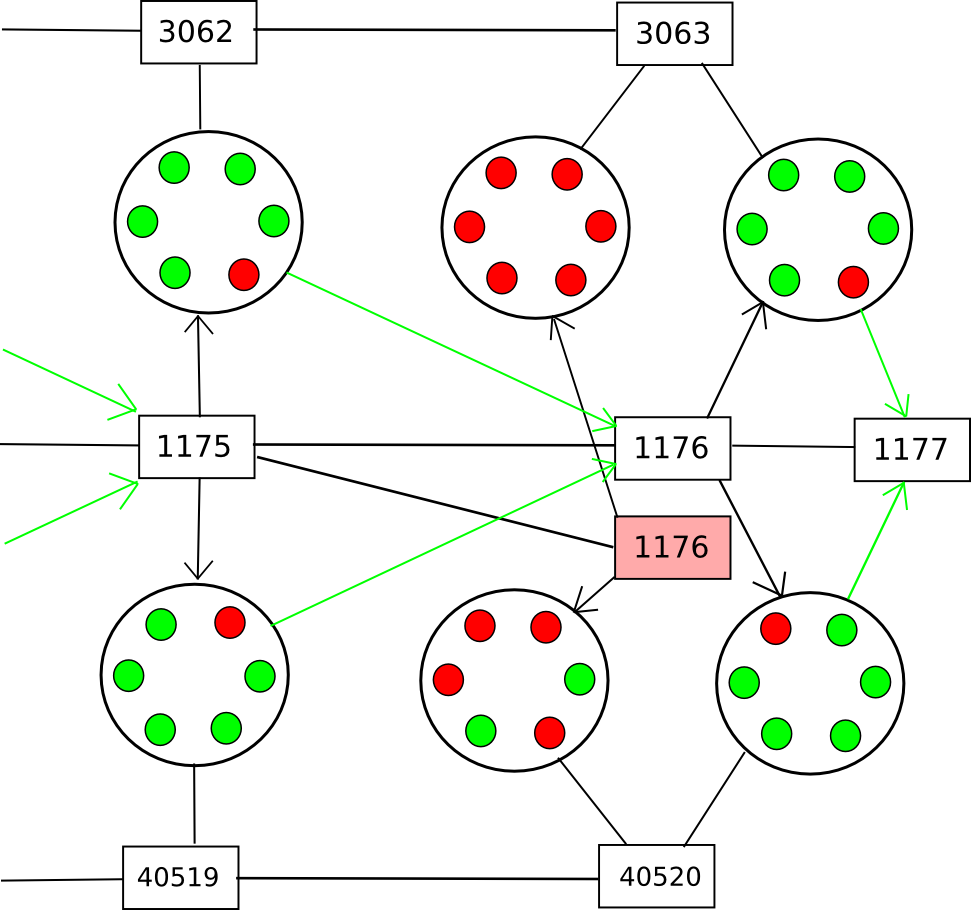

- Inner entities (ie. scripts, contracts) in chain A are in a position to securely be taught information concerning the state of chain B (info switch)

- It’s potential to create a pair of transactions, T in A and T’ in B, such that both each T and T’ get confirmed or neither do (atomic transactions)

A sufficiently normal implementation of (1) implies (2), since “T’ was (or was not) confirmed in B” is a reality concerning the state of chain B. The only approach to do that is by way of Merkle bushes, described in additional element right here and right here; basically Merkle bushes permit your complete state of a blockchain to be hashed into the block header in such a approach that one can give you a “proof” {that a} explicit worth is at a selected place within the tree that’s solely logarithmic in measurement in your complete state (ie. at most just a few kilobytes lengthy). The overall thought is that contracts in a single chain validate these Merkle tree proofs of contracts within the different chain.

A problem that’s better for some consensus algorithms than others is, how does the contract in a sequence validate the precise blocks in one other chain? Basically, what you find yourself having is a contract performing as a fully-fledged “mild consumer” for the opposite chain, processing blocks in that chain and probabilistically verifying transactions (and conserving observe of challenges) to make sure safety. For this mechanism to be viable, no less than some amount of proof of labor should exist on every block, in order that it isn’t potential to cheaply produce many blocks for which it’s exhausting to find out that they’re invalid; as a normal rule, the work required by the blockmaker to supply a block ought to exceed the fee to your complete community mixed of rejecting it.

Moreover, we must always observe that contracts are silly; they don’t seem to be able to fame, social consensus or some other such “fuzzy” metrics of whether or not or not a given blockchain is legitimate; therefore, purely “subjective” Ripple-style consensus will probably be troublesome to make work in a multi-chain setting. Bitcoin’s proof of labor is (totally in idea, principally in apply) “goal”: there’s a exact definition of what the present state is (specifically, the state reached by processing the chain with the longest proof of labor), and any node on this planet, seeing the gathering of all obtainable blocks, will come to the identical conclusion on which chain (and due to this fact which state) is right. Proof-of-stake programs, opposite to what many cryptocurrency builders assume, could be safe, however should be “weakly subjective” – that’s, nodes that have been on-line no less than as soon as each N days for the reason that chain’s inception will essentially converge on the identical conclusion, however long-dormant nodes and new nodes want a hash as an preliminary pointer. That is wanted to stop sure courses of unavoidable long-range assaults. Weakly subjective consensus works advantageous with contracts-as-automated-light-clients, since contracts are at all times “on-line”.

Observe that it’s potential to assist atomic transactions with out info switch; TierNolan’s secret revelation protocol can be utilized to do that even between comparatively dumb chains like BTC and DOGE. Therefore, typically interplay shouldn’t be too troublesome.

Safety

The bigger drawback, nonetheless, is safety. Blockchains are weak to 51% assaults, and smaller blockchains are weak to smaller 51% assaults. Ideally, if we wish safety, we wish for a number of chains to have the ability to piggyback on one another’s safety, in order that no chain could be attacked until each chain is attacked on the similar time. Inside this framework, there are two main paradigm selections that we will make: centralized or decentralized.

| Centralized | Decentralized |

|

|

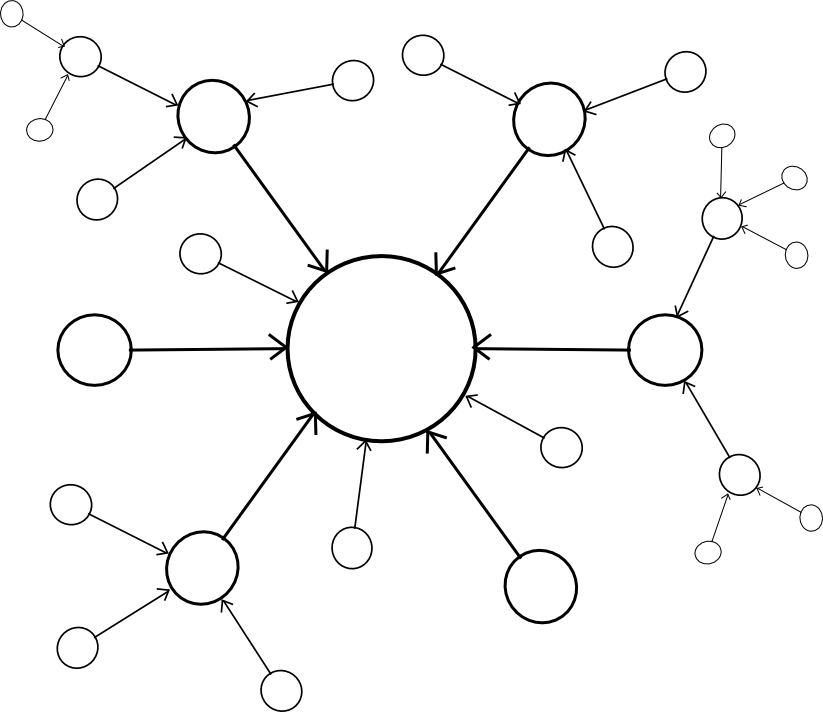

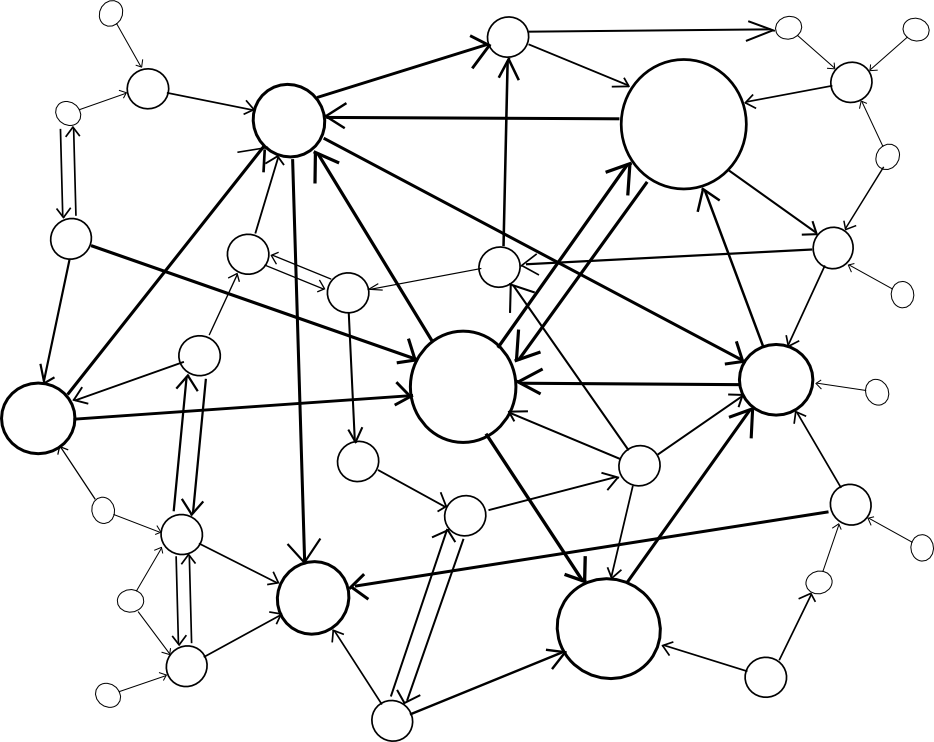

A centralized paradigm is basically each chain, whether or not immediately or not directly, piggybacking off of a single grasp chain; Bitcoin proponents typically like to see the central chain being Bitcoin, although sadly it could be one thing else since Bitcoin was not precisely designed with the required degree of general-purpose performance in thoughts. A decentralized paradigm is one that appears vaguely like Ripple’s community of distinctive node lists, besides working throughout chains: each chain has a listing of different consensus mechanisms that it trusts, and people mechanisms collectively decide block validity.

The centralized paradigm has the profit that it is easier; the decentralized paradigm has the profit that it permits for a cryptoeconomy to extra simply swap out totally different items for one another, so it doesn’t find yourself resting on many years of outdated protocols. Nonetheless, the query is, how will we really “piggyback” on a number of different chains’ safety?

To offer a solution to this query, we’ll first give you a formalism referred to as an assisted scoring perform. On the whole, the way in which blockchains work is that they have some scoring perform for blocks, and the top-scoring block turns into the block defining the present state. Assisted scoring capabilities work by scoring blocks primarily based on not simply the blocks themselves, but in addition checkpoints in another chain (or a number of chains). The overall precept is that we use the checkpoints to find out {that a} given fork, regardless that it could look like dominant from the standpoint of the native chain, could be decided to have come later by way of the checkpointing course of.

A easy strategy is {that a} node penalizes forks the place the blocks are too far other than one another in time, the place the time of a block is decided by the median of the earliest identified checkpoint of that block within the different chains; this could detect and penalize forks that occur after the very fact. Nonetheless, there are two issues with this strategy:

- An attacker can submit the hashes of the blocks into the checkpoint chains on time, after which solely reveal the blocks later

- An attacker might merely let two forks of a blockchain develop roughly evenly concurrently, after which ultimately push on his most popular fork with full power

To take care of (2), we will say that solely the legitimate block of a given block quantity with the earliest common checkpointing time could be a part of the primary chain, thus basically utterly stopping double-spends and even censorship forks; each new block would have to level to the final identified earlier block. Nonetheless, this does nothing in opposition to (1). To unravel (1), one of the best normal options contain some idea of “voting on knowledge availability” (see additionally: Jasper den Ouden’s earlier put up speaking a few related thought); basically, the individuals within the checkpointing contract on every of the opposite chains would Schelling-vote on whether or not or not your complete knowledge of the block was obtainable on the time the checkpoint was made, and a checkpoint could be rejected if the vote leans towards “no”.

Observe that there are two variations of this technique. The primary is a technique the place individuals vote on knowledge availability solely (ie. that each a part of the block is on the market on-line). This permits the voters to be slightly silly, and be capable to vote on availability for any blockchain; the method for figuring out knowledge availability merely consists of repeatedly doing a reverse hash lookup question on the community till all of the “leaf nodes” are discovered and ensuring that nothing is lacking. A intelligent approach to power nodes to not be lazy when doing this examine is to ask them to recompute and vote on the basis hash of the block utilizing a distinct hash perform. As soon as all the info is accessible, if the block is invalid an environment friendly Merkle-tree proof of invalidity could be submitted to the contract (or just printed and left for nodes to obtain when figuring out whether or not or to not rely the given checkpoint).

The second technique is much less modular: have the Schelling-vote individuals vote on block validity. This is able to make the method considerably easier, however at the price of making it extra chain-specific: you would wish to have the supply code for a given blockchain so as to have the ability to vote on it. Thus, you’d get fewer voters offering safety in your chain robotically. No matter which of those two methods is used, the chain might subsidize the Schelling-vote contract on the opposite chain(s) by way of a cross-chain change.

The Scalability Half

Up till now, we nonetheless haven’t any precise “scalability”; a sequence is just as safe because the variety of nodes which can be prepared to obtain (though not course of) each block. In fact, there are answers to this drawback: challenge-response protocols and randomly chosen juries, each described in the earlier weblog put up on hypercubes, are the 2 which can be at the moment best-known. Nonetheless, the answer right here is considerably totally different: as a substitute of setting in stone and institutionalizing one explicit algorithm, we’re merely going to let the market determine.

The “market” is outlined as follows:

- Chains wish to be safe, and wish to save on assets. Chains want to pick a number of Schelling-vote contracts (or different mechanisms doubtlessly) to function sources of safety (demand)

- Schelling-vote contracts function sources of safety (provide). Schelling-vote contracts differ on how a lot they should be backed with a purpose to safe a given degree of participation (value) and the way troublesome it’s for an attacker to bribe or take over the schelling-vote to power it to ship an incorrect outcome (high quality).

Therefore, the cryptoeconomy will naturally gravitate towards schelling-vote contracts that present higher safety at a lower cost, and the customers of these contracts will profit from being afforded extra voting alternatives. Nonetheless, merely saying that an incentive exists shouldn’t be sufficient; a slightly massive incentive exists to treatment growing old and we’re nonetheless fairly removed from that. We additionally want to indicate that scalability is definitely potential.

The higher of the 2 algorithms described within the put up on hypercubes, jury choice, is straightforward. For each block, a random 200 nodes are chosen to vote on it. The set of 200 is nearly as safe as your complete set of voters, for the reason that particular 200 usually are not picked forward of time and an attacker would wish to regulate over 40% of the individuals with a purpose to have any important probability of getting 50% of any set of 200. If we’re separating voting on knowledge availability from voting on validity, then these 200 could be chosen from the set of all individuals in a single summary Schelling-voting contract on the chain, because it’s potential to vote on the info availability of a block with out really understanding something concerning the blockchain’s guidelines. Thus, as a substitute of each node within the community validating the block, solely 200 validate the info, after which just a few nodes must search for precise errors, since if even one node finds an error it will likely be in a position to assemble a proof and warn everybody else.

Conclusion

So, what’s the finish results of all this? Basically, we’ve hundreds of chains, some with one software, but in addition with general-purpose chains like Ethereum as a result of some functions profit from the extraordinarily tight interoperability that being inside a single digital machine presents. Every chain would outsource the important thing a part of consensus to a number of voting mechanisms on different chains, and these mechanisms could be organized in several methods to ensure they’re as incorruptible as potential. As a result of safety could be taken from all chains, a big portion of the stake in your complete cryptoeconomy could be used to guard each chain.

It might show essential to sacrifice safety to some extent; if an attacker has 26% of the stake then the attacker can do a 51% takeover of 51% of the subcontracted voting mechanisms or Schelling-pools on the market; nonetheless, 26% of stake remains to be a big safety margin to have in a hypothetical multi-trillion-dollar cryptoeconomy, and so the tradeoff could also be value it.

The true good thing about this sort of scheme is simply how little must be standardized. Every chain, upon creation, can select some variety of Schelling-voting swimming pools to belief and subsidize for safety, and by way of a personalized contract it may possibly regulate to any interface. Merkle bushes will should be appropriate with the entire totally different voting swimming pools, however the one factor that must be standardized there’s the hash algorithm. Completely different chains can use totally different currencies, utilizing stable-coins to offer a fairly constant cross-chain unit of worth (and, in fact, these stable-coins can themselves work together with different chains that implement numerous sorts of endogenous and exogenous estimators). In the end, the imaginative and prescient of one in all hundreds of chains, with the totally different chains “shopping for providers” from one another. Providers may embody knowledge availability checking, timestamping, normal info provision (eg. value feeds, estimators), personal knowledge storage (doubtlessly even consensus on personal knowledge by way of secret sharing), and way more. The final word distributed crypto-economy.