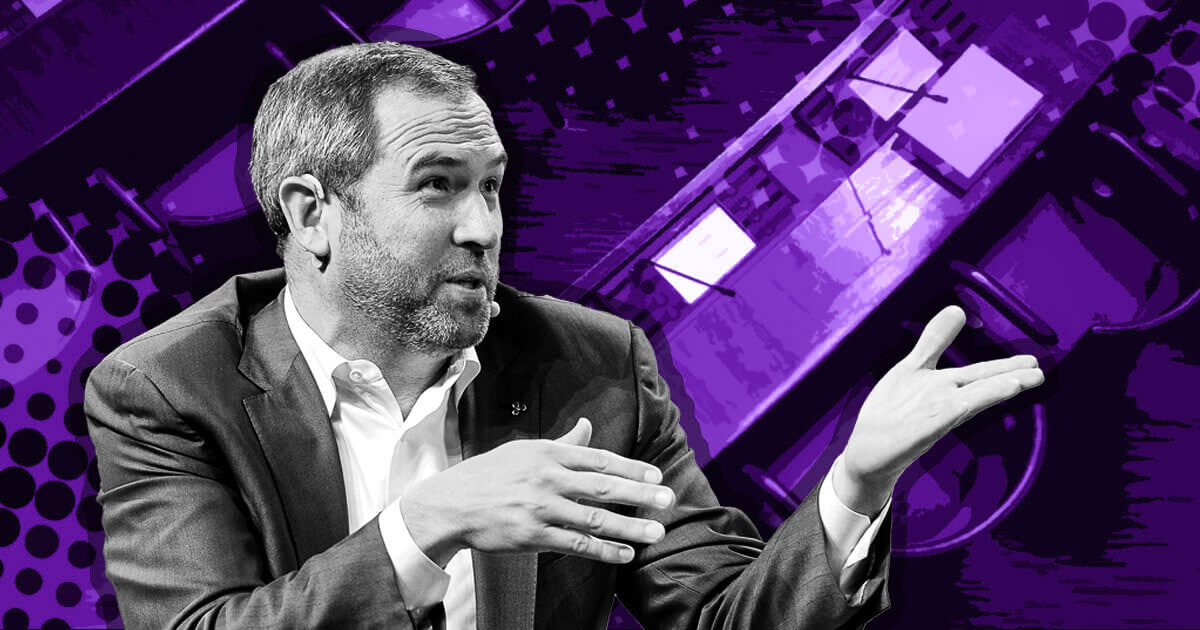

Ripple CEO Brad Garlinghouse overtly criticized SEC chair Gary Gensler and mentioned his inflexible stance towards crypto regulation and repeated authorized actions have made him a “political legal responsibility.”

Garlinghouse made the assertion throughout an interview with CNBC on the World Financial Discussion board in Davos on Jan. 16. He additionally shared his ideas on potential ETFs related to different cryptocurrencies and Ripple’s outlook for 2024.

Political agenda

Garlinghouse described Gensler’s method as unchanging and overly inflexible, even after the SEC authorised a Bitcoin ETF. He accused Gensler of not performing in “the perfect curiosity of the citizenry” and hindering the “long-term progress of the economic system.”

He questioned the rationale behind Gensler’s constant labeling of most crypto belongings as securities, suggesting it displays a political agenda fairly than an financial or protecting one. Garlinghouse added:

“I believe Gary Gensler is doing the identical factor over and over, anticipating to win in courtroom, regardless of repeated losses.”

The Ripple CEO contrasted the U.S. regulatory surroundings with extra proactive approaches within the EU and different jurisdictions. He expressed concern concerning the U.S. lagging in establishing complete crypto rules, probably impacting its aggressive stance globally.

Nevertheless, he additionally forecasted attainable legislative actions in 2024 as a result of it’s an election 12 months. He added that the U.S. has not been left behind but and can stay aggressive if the regulatory panorama shifts to a extra optimistic path.

Garlinghouse mentioned that stablecoin regulation was the most definitely to return into power quickly as a consequence of their widespread use — echoing the feelings of Circle CEO Jeremy Allaire.

ETFs and 2024 outlook

The Ripple CEO additionally shared his ideas on the broader implications of the SEC’s resolution to approve a Bitcoin ETF and the way it may have an effect on the way forward for ETFs for different cryptos, equivalent to Ethereum (ETH).

Garlinghouse mentioned the fast enhance in ETH’s worth following the approval of spot Bitcoin ETFs signifies the market’s urge for food for broader ETF choices. He mentioned:

“I believe it’s a certainty. I’m not going to place a horizon on the time, however I believe there might be different ETFs for certain.”

Nevertheless, he didn’t affirm whether or not Ripple would pursue an ETF providing.

Shifting the main target to Ripple, Garlinghouse talked concerning the firm’s growth into new markets and companies, together with fee options and custody companies. He talked about Ripple’s sturdy monetary standing as a basis for future progress and attainable acquisitions.

He shared a optimistic outlook for the crypto market in 2024, emphasizing the corporate’s dedication to compliance and fixing actual buyer issues. He additionally commented on the evolving dynamics of tech investments, indicating a shift in direction of extra secure and mature market environments.