Just lately, a preferred crypto dealer and YouTuber has predicted a considerable surge in Solana value, forecasting it may attain as excessive as $360 quickly.

This prediction is underpinned by a technical sample on Solana’s chart—a bullish sign suggesting a possible reversal from bearish to bullish momentum.

Technical Insights Into SOL Potential $360 Rise

In line with the dealer, CryptoJack on X, SOL has developed a “rounding backside sample” over an prolonged interval, indicating it’s getting ready to a major breakout.

Notably, the ’rounding backside’ sample, characterised by a gradual decline adopted by a stabilizing development and an upward breakout, is a basic bullish indicator in technical evaluation.

CryptoJack’s evaluation factors out that Solana is organising for a major uptick, aiming for a value goal double its present worth of roughly $146.

Solana fashioned a rounding backside sample over many weeks and is primed for an explosion any second now.

I entered a Lengthy place on $SOL and anticipate it to interrupt ATHs this yr! #Solana pic.twitter.com/ApUazaXXz5

— CryptoJack (@cryptojack) Might 8, 2024

Not solely does CryptoJack see a vivid future for Solana, however different analysts, resembling Altcoin Sherpa, additionally keep a bullish stance, with projections of the token probably surpassing $500 this yr.

This may symbolize a 300% enhance from its present degree, including to the 589% development it has already achieved year-to-date.

Solana Challenges Ethereum

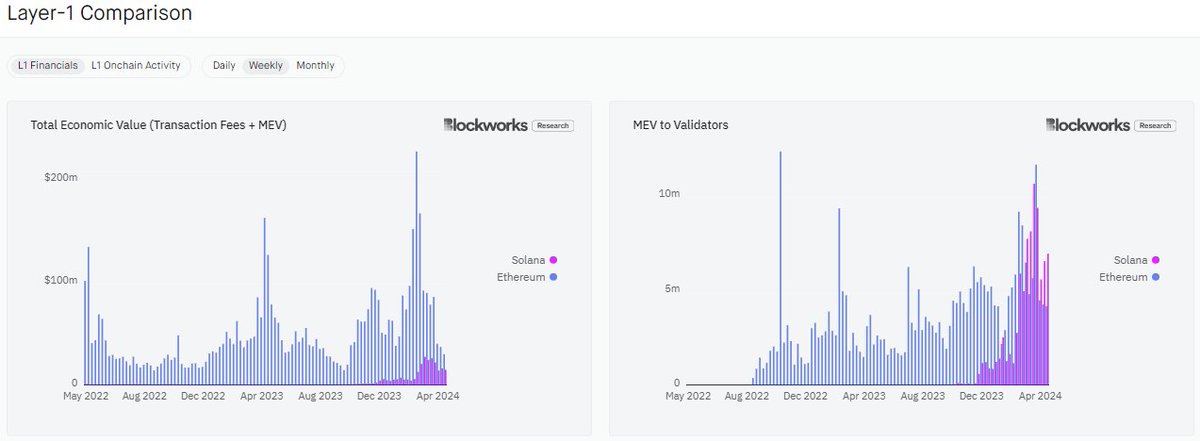

Whereas Solana has proven notable development, a few of its key metrics are additionally starting to maintain up the tempo. Dan Smith, a senior analysis analyst at Blockworks, means that Solana may quickly surpass Ethereum concerning transaction charges and seize Maximal Extractable Worth (MEV).

Smith’s evaluation of X highlights that Solana’s complete financial worth is nearing Ethereum’s, indicating its growing relevance within the blockchain area.

Solana will flip Ethereum in transaction charges + captured MEV this month, possibly even this week

— Dan Smith (@smyyguy) Might 7, 2024

Regardless of this competitors, Ethereum maintains a major lead in every day transaction charges and complete worth locked (TVL). Within the final 24 hours, Ethereum generated over $2.75 million in charges, in comparison with Solana’s $1.49 million.

Furthermore, in accordance with information from DeFillama, Ethereum’s TVL of over $53 billion dwarfs Solana’s $3.96 billion, representing nearly 7.2% of Ethereum’s scale.

In the meantime, Ethereum doesn’t come near Solana when it comes to market efficiency. Solana has seen fairly excellent development prior to now yr, surging by over 500%. Then again, Ethereum has solely seen a 66% surge over the identical interval.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal threat.