At spot charges, Bitcoin is agency, however merchants doubt the uptrend following the sudden dump on June 11. At the moment, Bitcoin is secure, trending above $67,000 and down regardless of positive factors on June 12.

Nonetheless, even at this degree, there are considerations as a result of the coin, regardless of all the boldness throughout the board, stays under $72,000. This response line is rising as a key liquidation space. If damaged, BTC may unleash a wave of brief liquidation, accelerating the lift-off to $74,000 and past.

Will Bitcoin Demand Soar In Spot Markets?

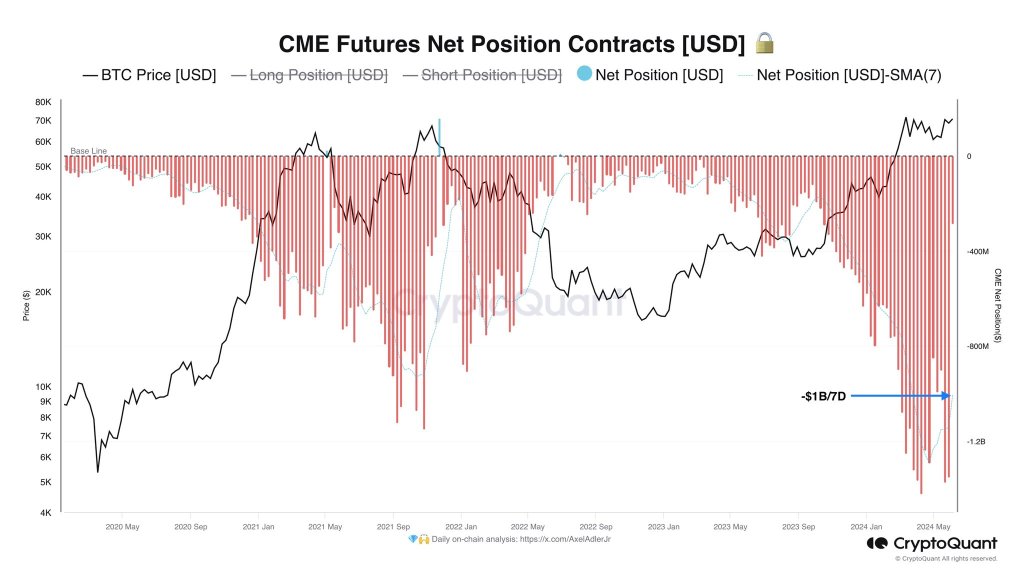

Taking to X, one on-chain analyst stated that Bitcoin is stagnating at spot ranges under $72,000 as a result of hedge funds are brief on futures.

Associated Studying: Solana On-Chain Indicators Suggests A Return Of Bullish Sentiment, Is It Time To Purchase SOL?

Although this has been a identified improvement for some time, hedge funds have stacked their BTC shorts by way of the Chicago Mercantile Alternate (CME) by over $1 billion within the final week alone.

Subsequently, the analyst says two issues should occur to reverse this impact and help costs. Though the BTC shorting on CME isn’t essentially a bearish sign, hedge funds are hedging by enjoying a complicated arbitrate technique, and coin holders should take a look at fundamentals.

Hedge funds are concurrently shorting BTC futures on CME and shopping for on the spot market. Subsequently, for the coin to interrupt $72,000 and pierce $74,000, the analyst stated customers should purchase at the least 2X the quantity of BTC futures shorted within the spot market.

BTC Costs Should Fall For Quick Sellers To Exit

If there isn’t any incentive to carry spot costs greater, then Bitcoin costs should fall. Falling costs will encourage brief sellers, on this case, the hedge funds, to exit their positions lest they proceed paying funding charges. In a bearish market, and when futures costs start to fall, brief sellers should pay longs for the index to not deviate.

Whether or not there will likely be a spike in demand within the spot market stays to be seen. Nonetheless, what’s evident is that institutional curiosity in Bitcoin is there, solely that hedge funds, as seen from their arbitrage commerce utilizing CME, need to revenue, no matter worth actions.

Associated Studying

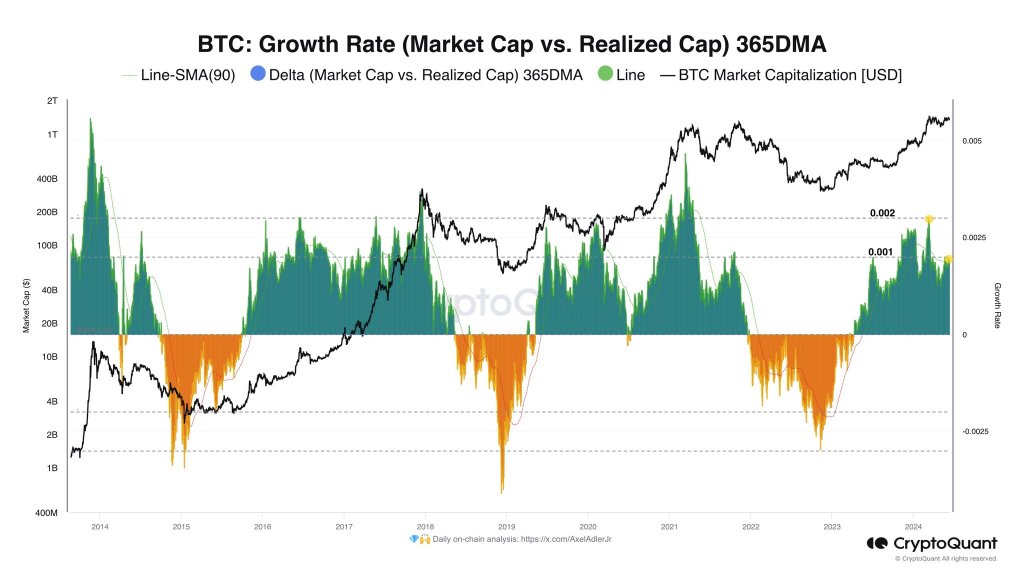

The analyst additionally shared one other chart to solidify the bullish outlook. The dealer used the “Progress Price” metric to check adjustments in Bitcoin’s market and realized cap.

At the moment, the metric is at round 0.001, means under 0.002, which means the market is very probably overheated. Bulls could be getting ready to make a comeback.

Function picture from DALLE, chart from TradingView