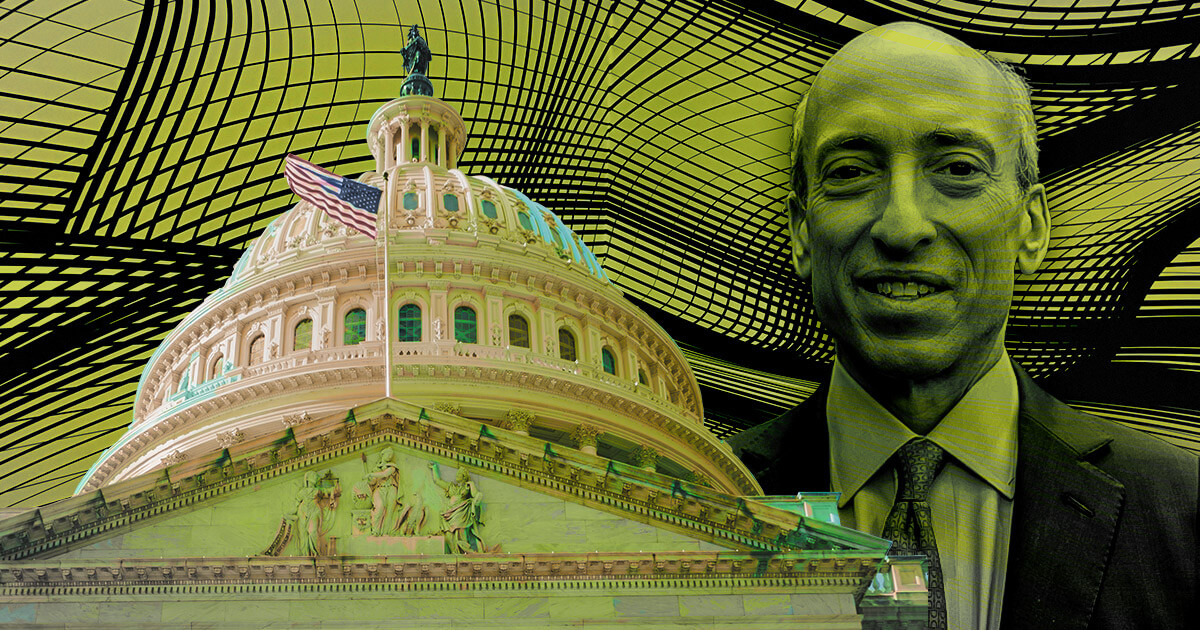

In a daring transfer, U.S. Congressman Warren Davidson, with help from Home Majority Whip Tom Emmer, has advocated for the firing of SEC Chair Gary Gensler in 2024, attributing his stance to alleged corruption and abuses of energy.

This improvement comes amid escalating tensions between the SEC and the digital asset sector all through 2023.

Restructuring the SEC

Davidson, voicing important considerations over Gensler’s enforcement-first regulatory method, believes this has strained the SEC’s relationship with the digital asset trade. To deal with these points, Davidson launched the SEC Stabilization Act earlier this 12 months.

The Act, aiming to restructure the SEC and take away Gensler, cites a “lengthy collection of abuses” underneath Gensler’s management. It proposes including a sixth commissioner and an Government Director to supervise day-to-day operations, with all rulemaking, enforcement, and investigation powers remaining with the commissioners.

The proposed restructuring goals to stop a single political get together from holding greater than three commissioner seats, thereby safeguarding U.S. capital markets from potential political agendas.

Davidson emphasised the necessity for reform, stating:

“U.S. capital markets should be shielded from a tyrannical Chairman, together with the present one. It’s time for actual reform and to fireplace Gary Gensler as Chair of the SEC.”

Emmer supported Davidson’s sentiments, highlighting the need for clear and constant oversight within the curiosity of American traders and the trade quite than political maneuvering.

Along with Davidson’s legislative efforts, tweets from varied supporters echo the sentiment for Gensler’s removing and the Act’s passage.

One tweet highlighted the objective of ending the accredited investor rule, asserting it protects the pursuits of a privileged class. One other tweet accused Gensler’s SEC of favoring Wall Road over Predominant Road, endorsing Davidson’s invoice as a way to carry the SEC accountable.

These developments and the proposed SEC Stabilization Act mark a important juncture within the ongoing dialogue about regulatory approaches and accountability inside the U.S. monetary regulatory framework.