Fast Take

Amid Bitcoin’s latest 12% worth decline, information means that short-term holders — those that have held the digital property for lower than 155 days — have exhibited comparatively muted sell-off habits in comparison with earlier dips.

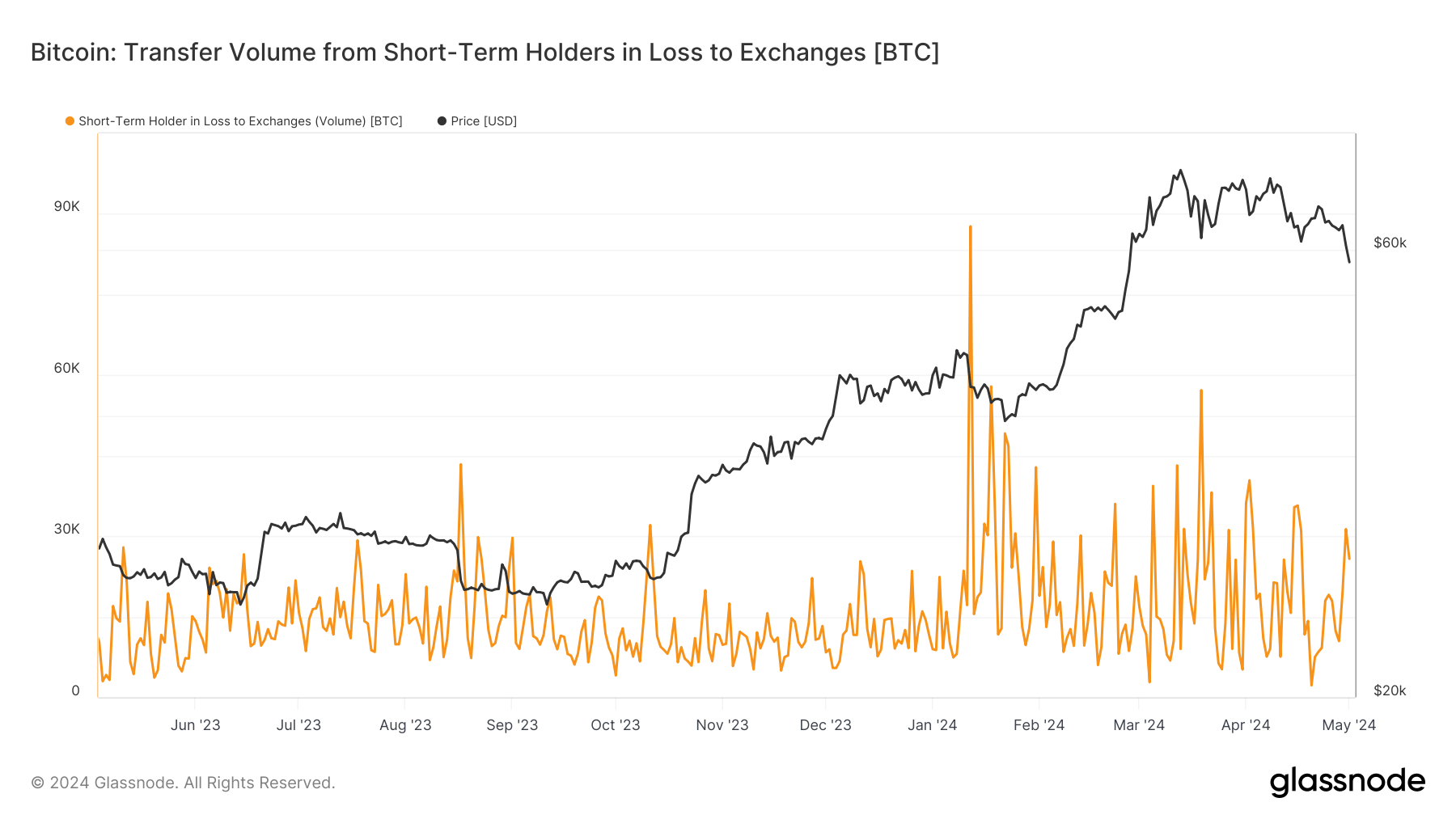

On Might 1, roughly 26,000 BTC have been despatched to exchanges at a loss by short-term holders, whereas the day prior to this noticed round 31,000 BTC offloaded similarly. Given the double-digit proportion drop in Bitcoin’s worth, one may need anticipated a extra aggressive sell-off from this usually skittish cohort.

Curiously, when inspecting earlier sell-offs since Bitcoin’s all-time excessive in March, a sample emerges—every successive worth dip has been met with diminishing promote stress from short-term holders to exchanges. This development implies that this group is steadily turning into much less reactive to cost fluctuations and extra more likely to transition into long-term holders who’ve held Bitcoin for over 155 days.

If this habits persists, it may sign a maturing market dynamic, the place short-term hypothesis offers option to extra affected person, long-term funding methods.