Ethereum (ETH) has been displaying a stable efficiency recently, leaving traders each ecstatic and cautious. The world’s second-largest cryptocurrency, boasting a market capitalization of practically $480 billion, lately surpassed the coveted $4,000 mark for the primary time since December 2021, igniting a flurry of bullish predictions. However is that this a real resurgence, or are we witnessing a brief blip earlier than a possible correction?

Let’s dissect the forces at play. Proponents of a sustained uptrend level to a confluence of constructive elements. The long-awaited approval of a US-based Ethereum ETF is a scorching matter, with hypothesis swirling {that a} inexperienced gentle might set off a big inflow of institutional capital, doubtlessly injecting billions into the Ethereum ecosystem.

Moreover, the upcoming Bitcoin halving, an occasion that cuts Bitcoin’s mining reward in half, is anticipated to have a constructive spillover impact on your entire cryptocurrency market, doubtlessly propelling Ethereum additional.

Surge In Quick-Time period Ethereum Holders Indicators Optimism

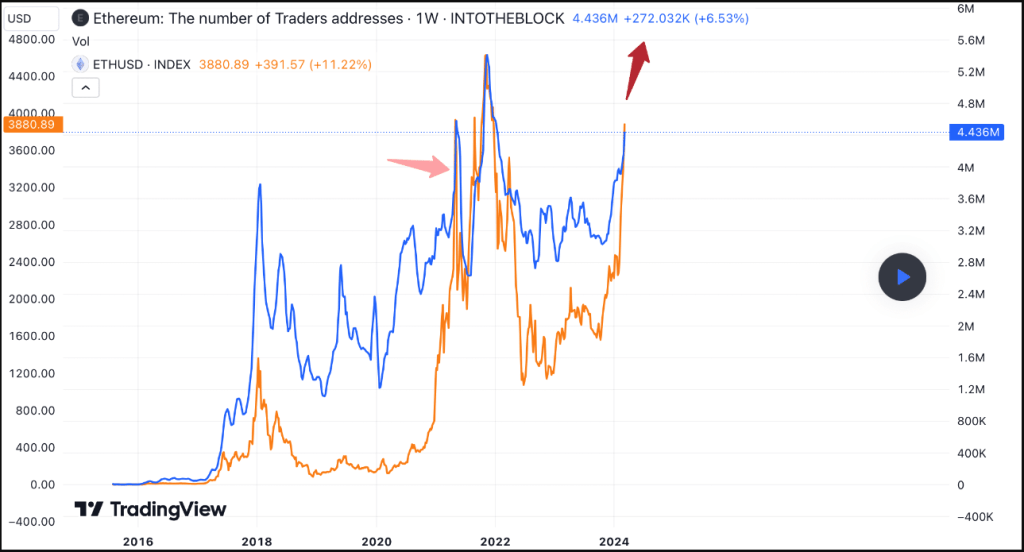

This optimistic outlook is bolstered by a surge in on-chain exercise. Knowledge from IntoTheBlock reveals a big improve within the variety of short-term Ethereum holders.

Supply: TradingView/IntoTheBlock

Traditionally, this pattern, with its 60% month-to-month worth surge for ETH, aligns with bull markets, signifying an inflow of recent customers coming into the crypto area and actively collaborating within the community. Consider it as a crowded celebration – the extra individuals present up (at present approaching the highs of the final bull cycle), the livelier the ambiance turns into (and doubtlessly the upper the worth goes).

However, there’s extra to the story. A more in-depth inspection of technical indicators paints a barely totally different image. The Relative Power Index (RSI) and Chaikin Cash Movement (CMF) are at present hovering in overbought territory, with RSI particularly nearing the 70 mark.

Whole crypto market cap is at present at $2.677 trillion. Chart: TradingView

In easier phrases, this means that Ethereum’s worth at barely above $4,000 is perhaps stretched a bit skinny and due for a possible pullback. Think about a bounce rope competitors – in the event you’re swinging too onerous and quick (like an RSI over 70), ultimately you’ll journey your self up.

Supply: Coingecko

Ethereum’s Future: Balancing Act

Including a layer of intrigue, the sentiment amongst traders appears geographically divided. Whereas the “Coinbase Premium,” a metric reflecting shopping for stress, is prospering within the US, its Korean counterpart signifies ongoing promoting exercise.

This regional disparity could possibly be attributed to numerous market dynamics and investor preferences. Maybe American traders, with a inexperienced Coinbase Premium, are extra optimistic concerning the regulatory panorama surrounding crypto, whereas their Korean counterparts, with a crimson Korea Premium, are taking a extra cautious strategy.

So, what does this all imply for Ethereum’s future? The reply, sadly, isn’t as clear-cut as we’d like. The confluence of constructive elements like potential ETF approval, elevated community exercise with a surge in short-term holders, and a possible Bitcoin halving enhance paint a bullish image.

Nevertheless, technical indicators hinting at an overbought market and contrasting investor sentiment throughout areas introduce a be aware of warning. Ethereum is at present strolling a tightrope – will it preserve its momentum or face a actuality examine within the type of a worth correction? It’s anyone’s guess.

Featured picture from Pixabay, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site fully at your personal danger.