In a brand new essay titled “Group of Fools,” Arthur Hayes, the outspoken co-founder of crypto change BitMEX, casts a important eye over latest macroeconomic developments and their implications for the crypto market. Hayes, recognized for his direct and infrequently provocative commentary, employs a mix of technical evaluation, central banking critique, and foreign money market insights to construct a case for what he believes is the return of a Bitcoin and crypto bull market.

A “Group Of Fools”

He begins by emphasizing the importance of the dollar-yen change charge as a macroeconomic barometer. In line with Hayes, this metric crucially influences world monetary stability and coverage choices. “The dollar-yen change charge is the most essential macroeconomic indicator,” he asserts.

Hayes revisits his earlier proposal for the US Federal Reserve (Fed) to interact in in depth dollar-for-yen swaps with the Financial institution of Japan (BOJ), a transfer he argues would empower the Japanese Ministry of Finance to bolster the yen by means of focused interventions within the foreign exchange markets. Regardless of the theoretical advantages of this technique, Hayes notes with a mixture of irony and frustration that the G7 nations, which he refers to because the “Group of Fools,” have opted for a special route.

Associated Studying

The narrative then shifts to a important examination of the G7’s central banking methods. Hayes factors out the stark discrepancies in rates of interest among the many main economies, with Japan sustaining a near-zero charge whereas different nations hover round 4-5%. He critiques the standard knowledge that helps charge cuts as a software to handle inflation, which universally targets a 2% charge amongst G7 nations, regardless of their numerous financial situations.

“The G7 central banks—aside from the BOJ—have all raised charges aggressively in response to inflation spikes,” Hayes writes. Nonetheless, he highlights yesterday’s sudden charge cuts by the Financial institution of Canada and the European Central Financial institution regardless of prevailing inflation traits, suggesting a deeper, unspoken financial technique aimed toward bolstering the yen in opposition to a backdrop of geopolitical and financial tensions with China.

He describes this transfer as a cessation of what he phrases “charge hike Kabuki theatre,” a maneuver he believes is designed to keep up the dominance of the Pax Americana-led world monetary system.

Why The Bitcoin And Crypto Bull Run Returns

It’s on this context that Hayes pivots to the implications for the crypto market. Trying forward, Hayes turns his gaze to the crypto markets, suggesting that these latest shifts sign a fortuitous atmosphere for funding in digital property. Hayes speculates that the coordinated actions of central banks to regulate rates of interest downward, regardless of excessive inflation, are setting the stage for elevated liquidity in world markets, which historically advantages riskier property like Bitcoin and subsequently altcoins.

Associated Studying

“The June central banking fireworks kicked off this week by the BOC and ECB charge cuts will catapult crypto out of the northern hemispheric summer time doldrums. This was not my anticipated base case. I believed the fireworks would begin in August, proper round when the Fed hosts its Jackson Gap symposium,” Hayes famous.

He argues that these financial coverage shifts are more likely to ignite a bull market in Bitcoin and crypto, notably as central banks seem like coming into a cycle of charge easing. “We all know easy methods to play this recreation. It’s the identical recreation we’ve got been enjoying since 2009 when our Lord and Saviour Satoshi gave us the weapon to defeat the TradFi satan. Go lengthy Bitcoin and subsequently shitcoins.” Hayes declares, referencing the pseudonymous creator of Bitcoin.

Because the G7 assembly from June 13-15 looms, Hayes anticipates additional developments that might affect world monetary markets. He expects the communiqué from this gathering will doubtless deal with foreign money and bond market manipulations explicitly, or at the least sign continued accommodative insurance policies. Moreover, Hayes forecasts that regardless of standard warning in opposition to coverage shifts close to main political occasions just like the US presidential election, uncommon circumstances may immediate sudden strikes.

Hayes concludes his essay by reinforcing his bullish stance on Bitcoin and crypto, pushed by his evaluation of G7 financial insurance policies and their impression on world change charges and monetary stability. His name to motion for the crypto neighborhood is to capitalize on these developments, positioning themselves for what he predicts can be a profitable part within the markets.

“For my extra liquid crypto synthetic-dollar money, […] it’s time to deploy it once more on conviction shitcoins. […] However suffice it to say, the crypto bull is reawakening and is about to gore the hides of profligate central bankers,” Hayes concludes.

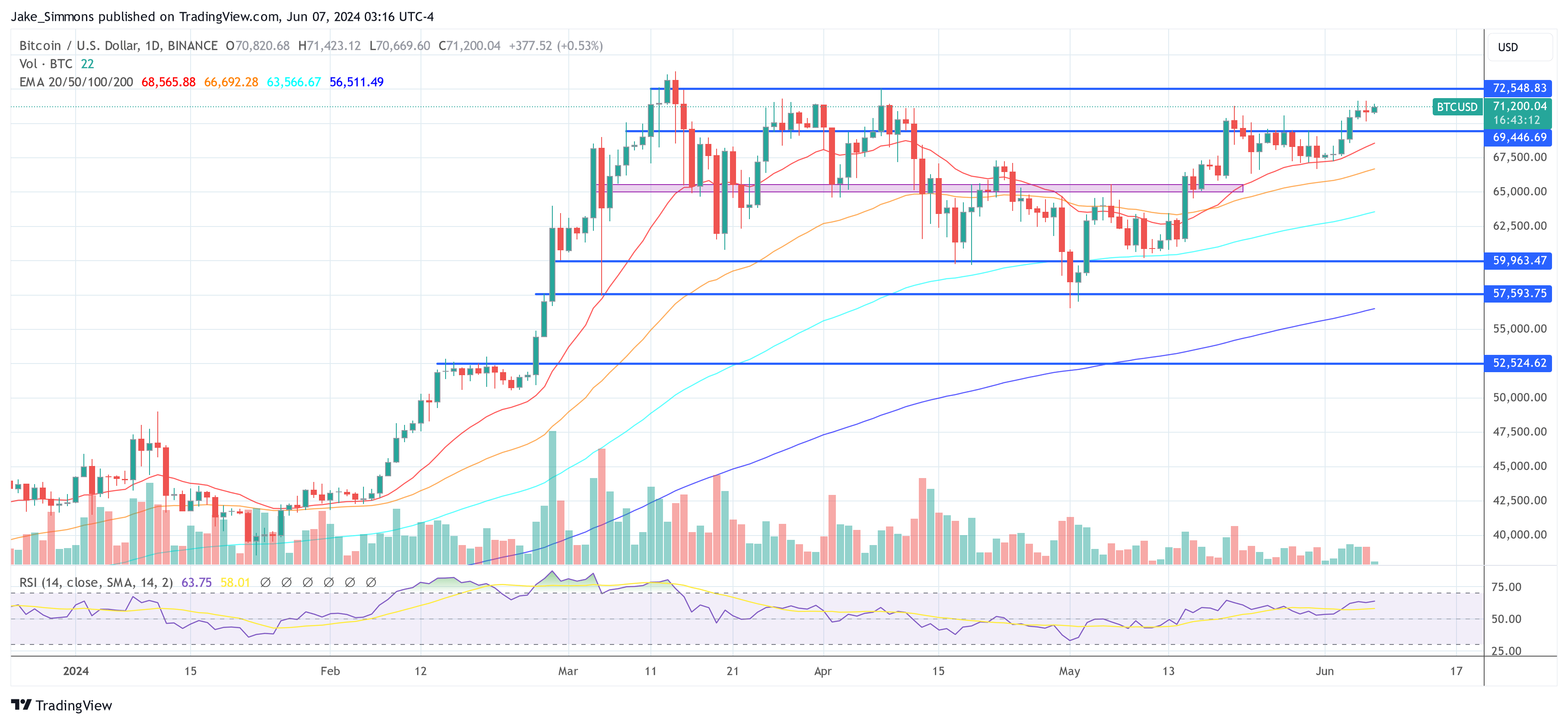

At press time, BTC traded at $71,200.

Featured picture created with DALL·E, chart from TradingView.com