Cobie, a distinguished determine within the crypto buying and selling circles recognized for his insightful and infrequently correct predictions, made a put up on Aug. 23, 2023, that outlined the spot Bitcoin ETF state of affairs to a frighteningly correct diploma.

Cobie’s put up, which delved into the intricacies of Bitcoin (BTC) and the anticipated approval of a Bitcoin ETF, showcased his deep understanding of the market dynamics.

His prediction of a big rise in BTC’s worth, doubtlessly reaching $50,000 by the 12 months’s finish, alongside an in depth evaluation of the potential influence of the ETF approval, displays a stage of study that few within the subject can match.

Foresight

The dealer additionally predicted when the SEC would approve the ETFs and mentioned on the time that it was principally “free” to lengthy Bitcoin till then and advisable promoting as soon as the approval got here in, or shortly earlier than that.

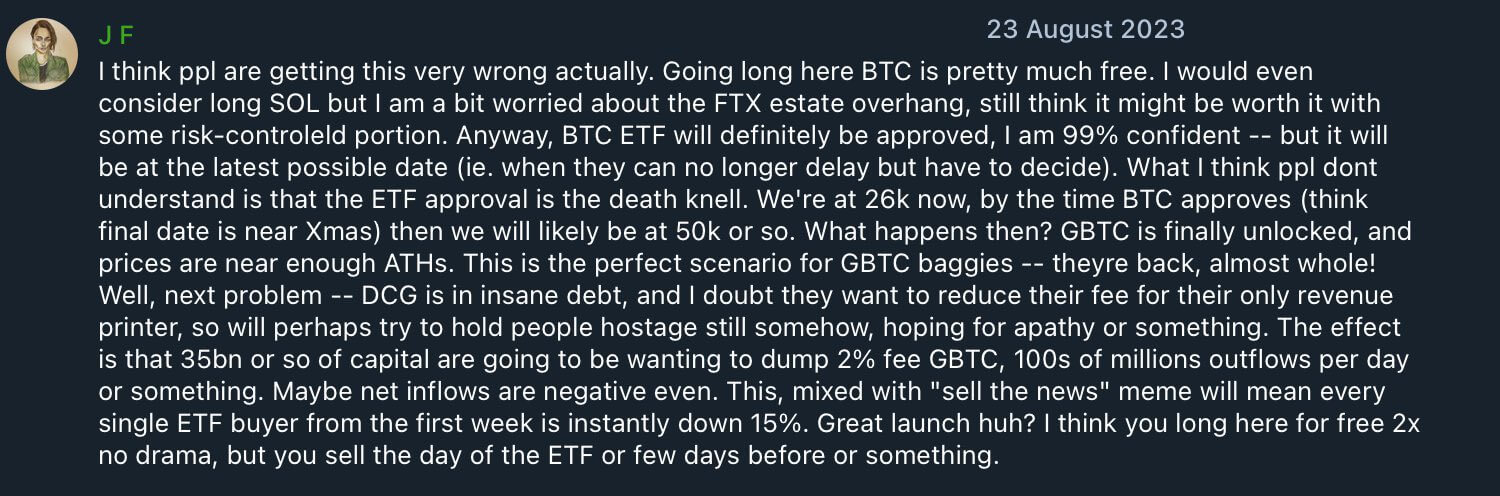

Cobie wrote:

“Anyway, BTC ETF will certainly be authorised, I’m 99% assured however will probably be on the newest doable date (ie. after they can now not delay however must determine).”

He added that after the ETFs had been authorised, it could be a “demise knell” which might doubtless drive the worth down on account of excessive ranges of promote stress coming in from Grayscale’s GBTC holders, who’ve been ready for an alternative to promote as soon as they’re near being complete once more.

Contemplating the worth motion, following that recommendation would have been the most effective transfer in hindsight. This has drawn widespread admiration from crypto Twitter. Nevertheless, Cobie feels the admiration is undue.

Cobie’s reflective response

In a candid response to the social media ruckus, Cobie emphasised monetary predictions’ dynamic and infrequently unsure nature.

“I can’t even keep in mind, man,” he started, highlighting the problem of preserving observe of ever-changing market views. He identified how straightforward it’s to seek out previous predictions that appear correct in hindsight, given the frequent shifts in opinions and market situations.

He cautioned in opposition to over-reliance on remoted predictions, stating:

“The screenshot in isolation ‘seems cool’ however doesn’t imply very a lot in actuality, , misses principally half a 12 months of shit and different components that pollute the pondering.”

His feedback provide a humble reminder of the transient nature of market evaluation. Regardless of his evaluation, he mentioned he didn’t persist with that thesis within the ensuing months. Cobie added:

“The fact (at the least for me) is that it’s fairly straightforward for me to void my very own opinions 3 weeks later, provide you with new concepts that I really feel counter them, and many others., so it’s only a complete mess of doubt and indecision and stuff alongside the way in which.”

This attitude resonates deeply within the cryptocurrency neighborhood, the place speedy modifications and volatility are the norms. Cobie’s reflection on the method of forming and reforming opinions in response to new info and market shifts highlights the advanced, non-linear nature of economic forecasting.

Cobie’s full put up is offered to learn under: