Binance Coin (BNB), regardless of experiencing a big decline earlier this yr resulting from market volatility and the SEC lawsuit in opposition to Binance and its founder Changpeng Zhao (CZ), has proven outstanding restoration and promising prospects.

Latest knowledge signifies a resurgence within the BNB worth, pushed by the rising utilization of decentralized purposes (DApps) on the Binance Good Chain (BSC).

Moreover, BNB’s fundamentals, together with spectacular market cap figures and elevated income, additional contribute to the constructive momentum.

BNB Value Rally Fueled By DApp Adoption?

After witnessing a pointy decline from its yearly excessive of $350, BNB skilled a drop to the $203 degree following the SEC lawsuit in opposition to Binance and CZ. Nonetheless, latest worth actions present indicators of restoration and bullish sentiment.

Over the previous 24 hours, BNB has gained 4.5%, and its efficiency within the seven, fourteen, and thirty-day time frames demonstrates an upward development, with features of 20%, 24%, and 38%, respectively.

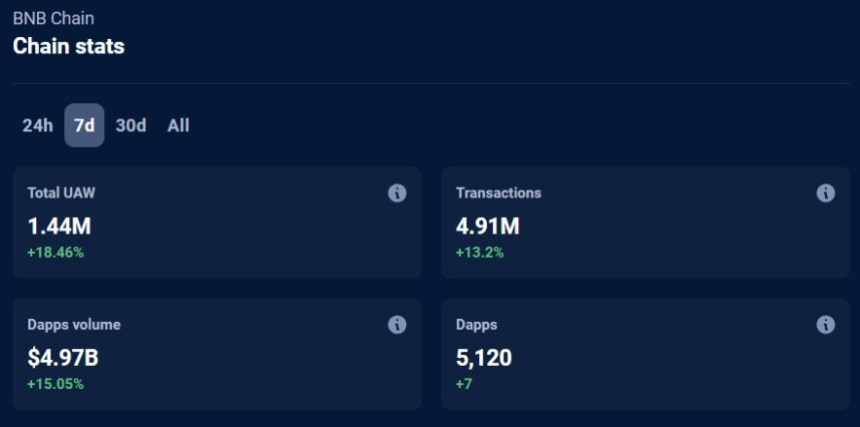

One of many driving elements behind BNB’s worth rally is the rising use of DApps on the Binance Good Chain. Information from DappRadar reveals a surge in DApp quantity, presently at $4.83 billion, representing a 12% improve.

The BNB chain boasts an ecosystem of 5,120 DApps and has recorded 4.89 million transactions, reflecting a 12.73% surge prior to now seven days. These figures point out a rising demand for BNB because it serves as the first token inside the BSC ecosystem.

Evaluating BNB to Ethereum (ETH), DappRadar knowledge highlights BNB’s superior efficiency in varied indicators corresponding to contracts, whole distinctive energetic wallets (UAW), decentralized finance (DeFi) whole worth locked (TVL), and non-fungible token (NFT) quantity.

The BNB chain has held the highest place over the previous 24 hours, showcasing its utilization and adoption. This outperformance contributes to the constructive market sentiment surrounding BNB and bolsters its worth.

Binance Coin Market Cap Surges To $48 Billion

Additional boosting the Binance Coin prospects, Token Terminal knowledge reveals spectacular market cap figures for BNB, with a circulating market cap of $48.02 billion, marking a 14.18% improve.

Moreover, BNB’s absolutely diluted market cap stands on the identical worth, reflecting a 28.32% progress. The income generated by BNB prior to now 30 days has elevated by 28.51%, reaching $1.47 million.

Moreover, BNB has recorded important price progress, with a 27.98% price improve over the previous 30 days and an annualized income of $187.56 million. These fundamentals contribute to the constructive sentiment surrounding BNB.

General, Binance Coin has staged a robust restoration, demonstrating a notable worth rally pushed by the rising utilization of DApps on the Binance Good Chain. Nonetheless, there’s a daring prediction by a crypto analyst that might additional enhance the sentiment and pleasure surrounding the token.

Binance Coin To Attain New Yearly Excessive?

In accordance to Captain Faibik, a distinguished crypto analyst on X (previously Twitter), Binance Coin is poised to realize a brand new yearly excessive within the first half of 2024.

This prediction is predicated on an evaluation of BNB’s 1-week chart, revealing a breakout from a descending triangle sample, signaling the tip of the macro downtrend and initiating a brand new uptrend part for BNB.

Wanting on the chart under, Faibik means that BNB’s worth may probably expertise a formidable uptrend of 171% within the preliminary weeks of 2024. This surge would propel the token’s worth above the present all-time excessive (ATH) of $686.

Nonetheless, a number of resistance ranges should be overcome for this projection to materialize. Notably, on the present buying and selling worth of $307, BNB faces a big seven-month resistance barrier, which presently hinders its ascent to the $314 degree, the subsequent resistance degree within the close to time period.

Analyzing the 1-day chart, it turns into evident that reaching the all-time excessive degree would require surpassing further macro resistance ranges, together with $329, $402, $450, $563, $607, $639, and $653.

Whereas the speculation proposed by Faibik holds promise, the precise realization of Binance Coin’s new yearly excessive within the early months of 2024, together with a sustained uptrend, stays to be noticed.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site totally at your personal threat.