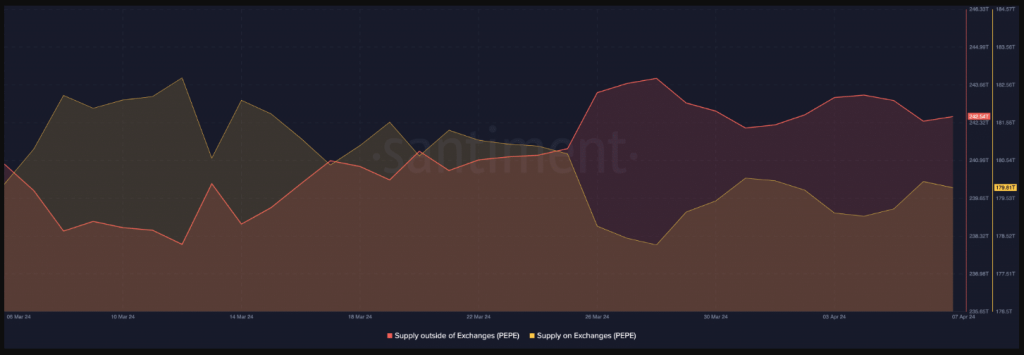

The world of memecoins continues to be a rollercoaster experience, and Pepe (PEPE) isn’t any exception. Current on-chain knowledge reveals a surge in tokens shifting out of exchanges, doubtlessly signaling a bullish sentiment amongst traders. Nonetheless, conflicting indicators solid a shadow of doubt on the sustainability of this upward pattern.

Pepe Soars Out Of Exchanges, Suggesting Investor Confidence

A major improvement for PEPE is the motion of numerous tokens away from exchanges. In line with Santiment, a blockchain analytics platform, the provision of PEPE exterior exchanges reached a staggering 243 trillion on April seventh. This sharp rise in comparison with March twelfth signifies a possible lower in promoting stress.

Supply: Santiment

Worth Restoration, Rising Quantity Trace At Potential Upswing

Additional bolstering the bullish case for PEPE is the current value enhance. During the last 24 hours, the memecoin has skilled a virtually 10% surge, suggesting a possible restoration from a current hunch.

Along with the noticed value fluctuations and projected value vary for Pepe, it’s price noting the numerous enhance in buying and selling quantity surrounding the cryptocurrency. This surge in buying and selling exercise not solely displays a heightened degree of engagement inside the Pepe group but in addition suggests rising curiosity from exterior traders and merchants.

Bitcoin is now buying and selling at $71.879. Chart: TradingView

The uptick in buying and selling quantity serves as a key indicator of market sentiment and will doubtlessly function a catalyst for additional value features. Traditionally, elevated buying and selling exercise has been related to durations of value appreciation, because it indicators a higher degree of market participation and liquidity. In flip, this heightened liquidity can entice new patrons to the market, additional bolstering demand and doubtlessly driving costs greater.

Investor Sentiment Tells A Totally different Narrative

Nonetheless, not all indicators level in the direction of a transparent path to success for PEPE. Whereas the token actions recommend some bullishness, an important metric paints a contrasting image. The Weighted Sentiment, which displays investor sentiment in the direction of PEPE, has lately declined.

This might point out a weakening of investor confidence and doubtlessly foreshadow a lower in demand for the memecoin. If this metric continues to fall, it might invalidate the present bullish bias surrounding PEPE, making a big value hike much less doubtless.

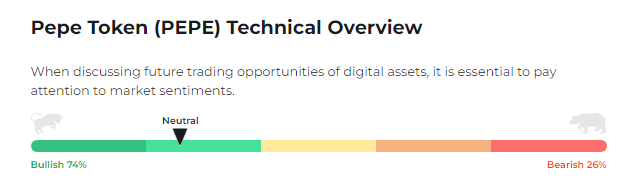

Fast Technical Overview

On a brighter notice, PEPE exhibits robust bullish momentum with a 74/26 cut up favoring constructive sentiment. This aligns with the current value enhance and suggests continued investor optimism.

Nonetheless, it’s essential to watch social media chatter and information articles for any potential shifts in sentiment that might impression value motion. Whereas the present outlook is constructive, remaining vigilant is vital on this unstable market.

Supply: Changelly

PEPE Worth Prediction

In the meantime, amidst the volatility of the cryptocurrency market, Pepe’s value fluctuations have captured the eye of crypto specialists, prompting projections for its trajectory in April 2024. Analyses point out an anticipated common PEPE charge of $0.0000140 throughout this era, reflecting each the potential for progress and the inherent uncertainty inside the market.

Whereas these projections provide insights into the anticipated common value, it’s important to acknowledge the vary of prospects. Consultants recommend that Pepe’s minimal and most costs in April 2024 might differ considerably, with estimates starting from 0.00000745 to .

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site totally at your individual threat.