Onchain Highlights

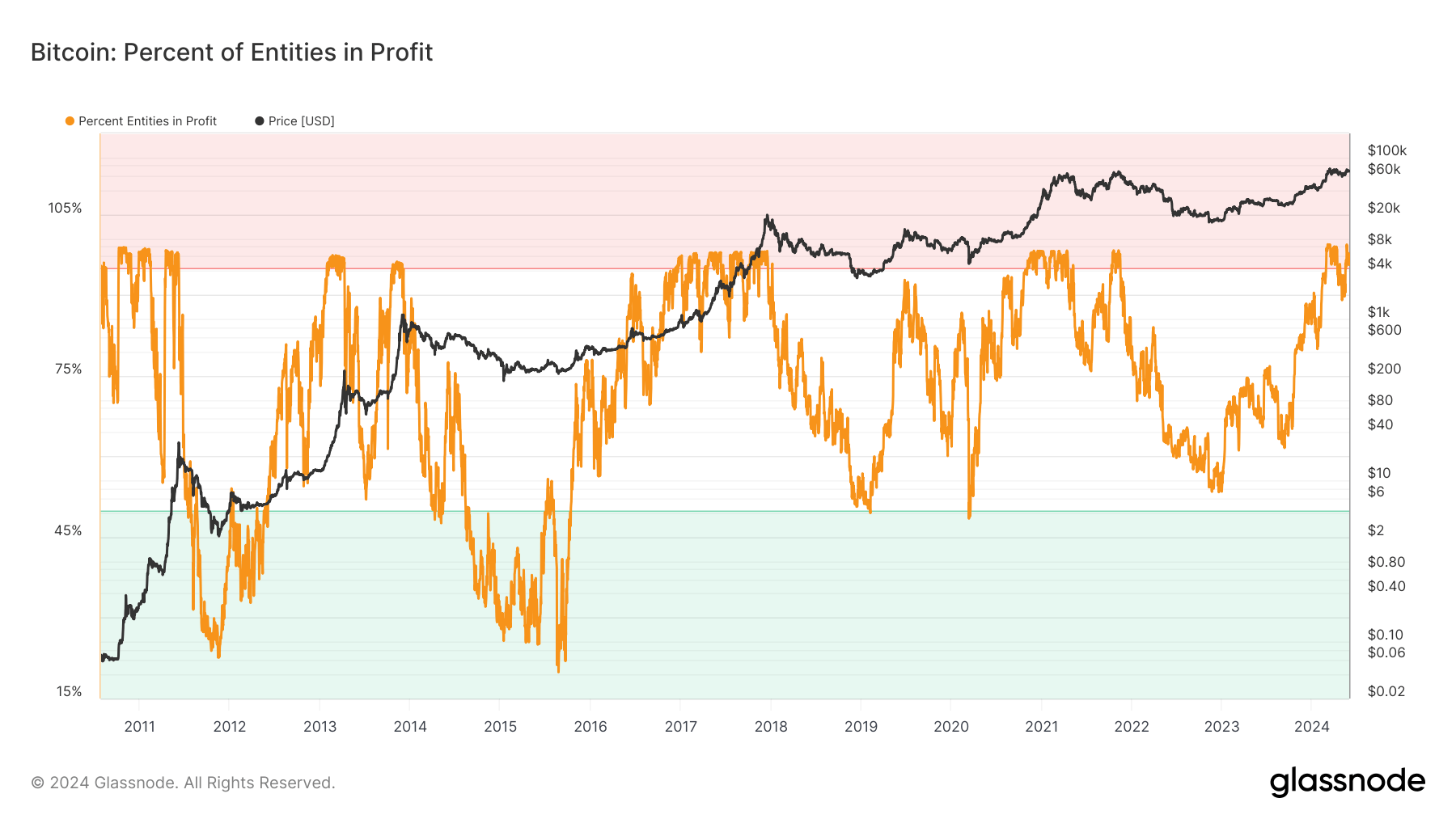

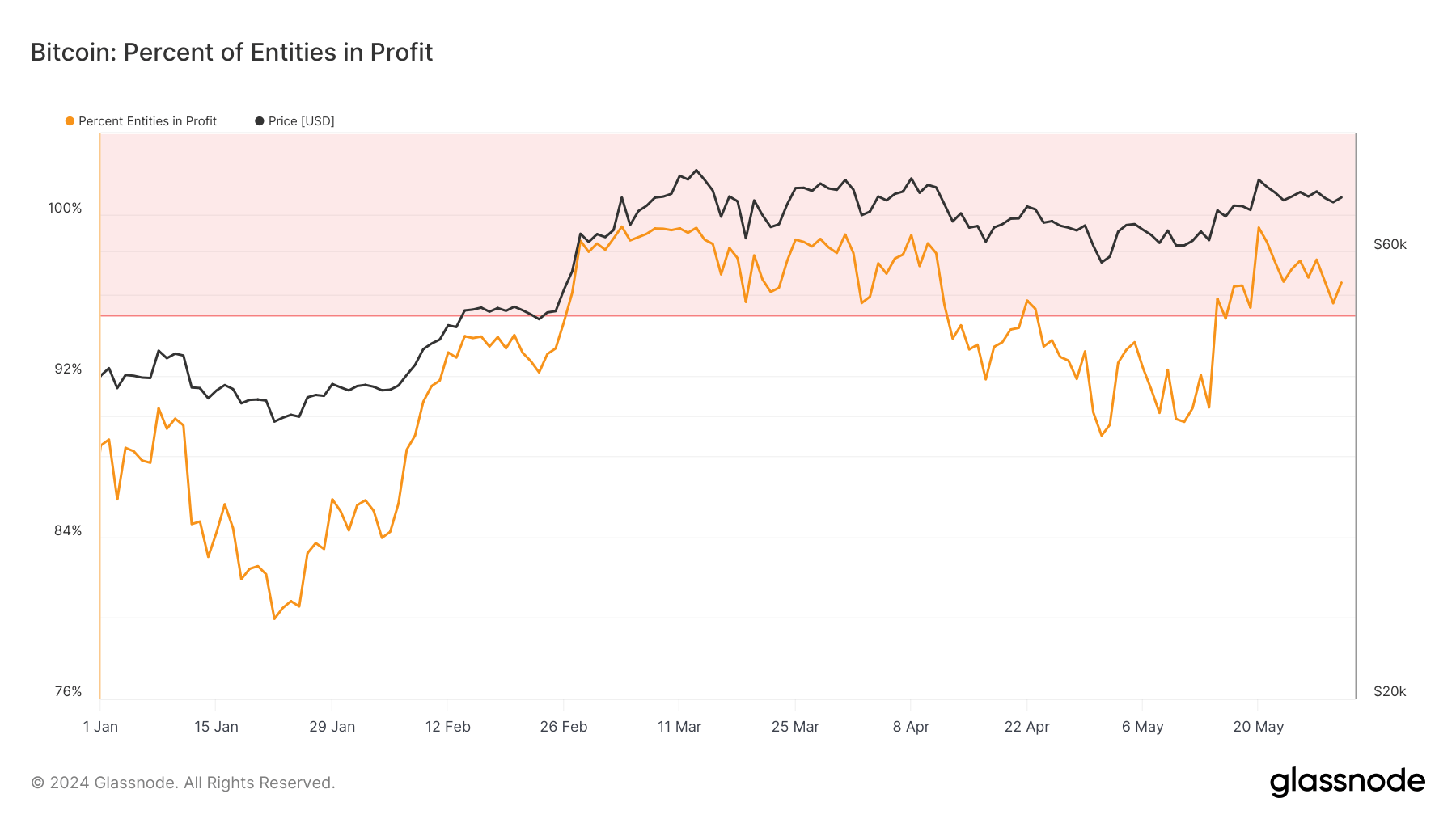

DEFINITION: The proportion of entities within the community which can be presently in revenue is predicated on the quantity of Bitcoin purchased cheaper than the present value. The “Purchase value” is outlined as the value at which cash had been transferred to addresses managed by the entity.

Bitcoin’s present market developments present a nuanced interplay between value fluctuations and the profitability of entities holding the asset.

Latest knowledge from Glassnode reveals a considerable portion of Bitcoin holders stay in revenue regardless of latest volatility — with over 90% of the provision being worthwhile as of Could.

This development signifies that holders are sustaining their positions amid market swings, reflecting a resilient help degree for the flagship digital asset.

Moreover, Bitcoin’s value actions in 2024 have been harking back to its risky durations seen in earlier years, notably in 2017. The asset has skilled a number of vital declines and surges, contributing to an general rollercoaster sample of market conduct.

This volatility highlights the speculative nature of the market and highlights the influence of exterior components, corresponding to regulatory developments and macroeconomic circumstances, on Bitcoin’s valuation.

Glassnode knowledge additionally signifies that the Bitcoin market is experiencing help ranges that bolster the arrogance of holders, even because the asset undergoes typical cyclical corrections.

The consolidation of Bitcoin’s value round key help ranges and the sustained profitability of a majority of holders recommend a robust underlying market construction that would mitigate excessive downturns and supply stability shifting ahead.