Fast Take

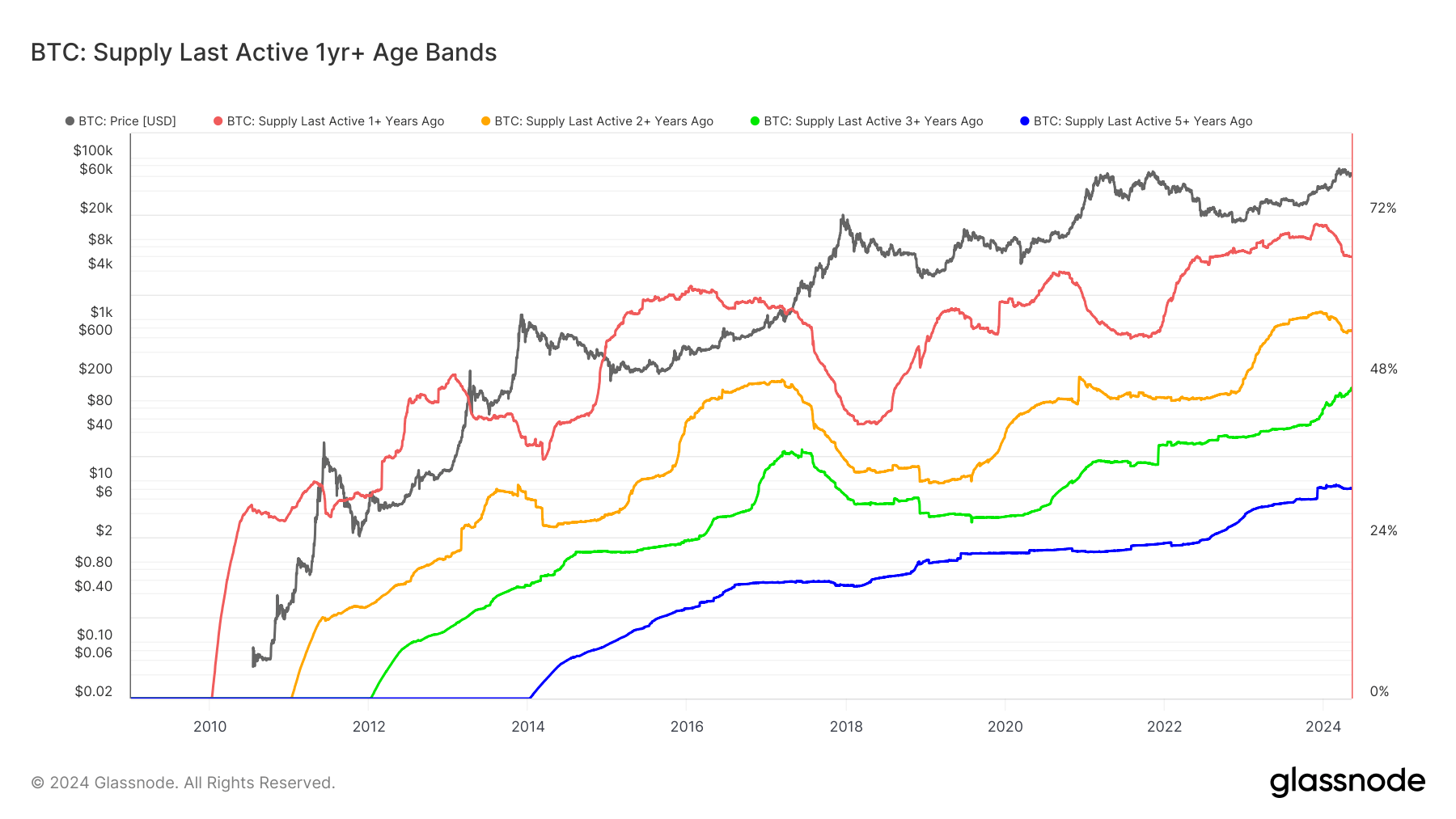

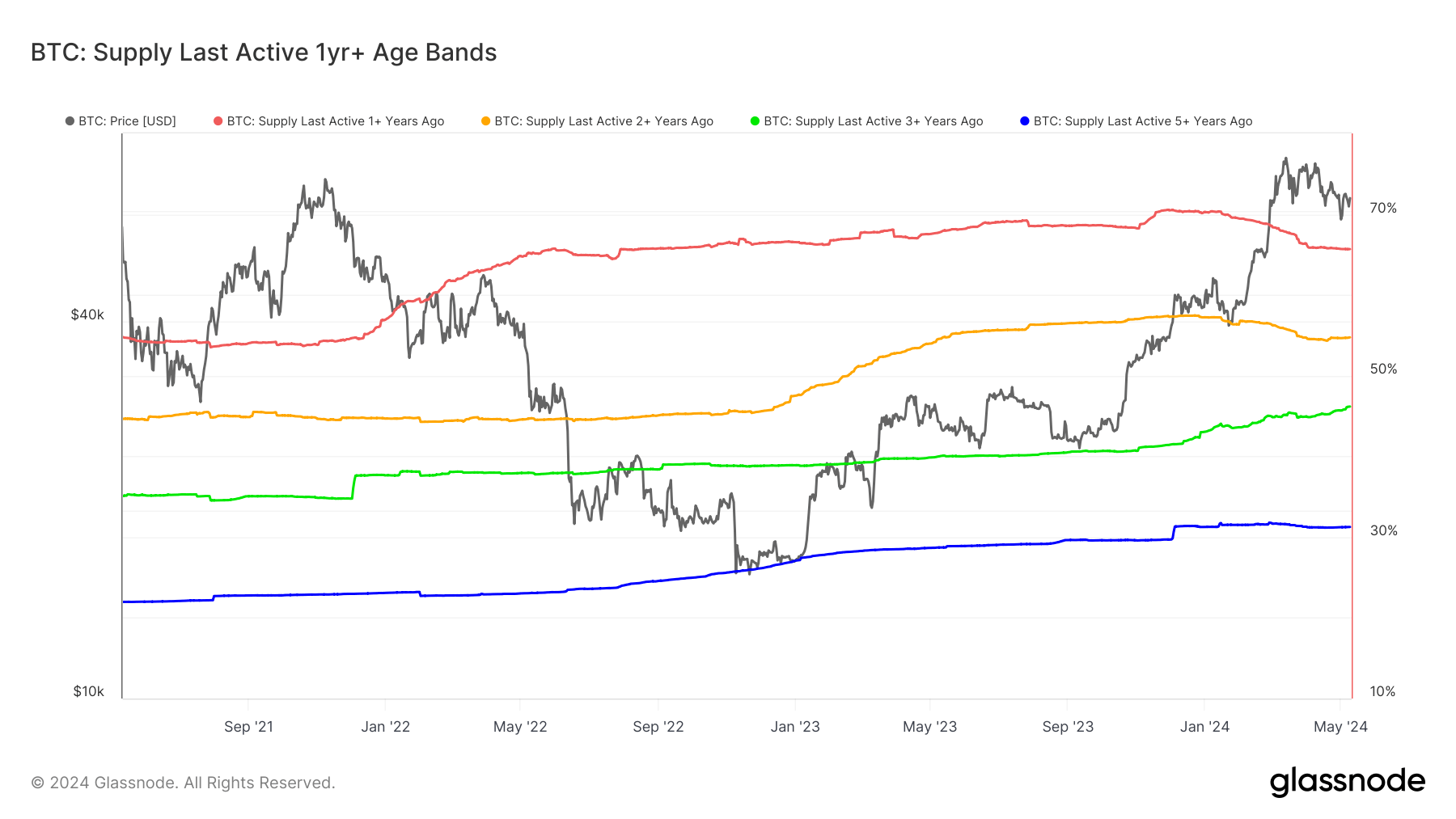

The Glassnode provide final energetic (SLA) chart overlays a number of cohorts, every representing a proportion of the circulating provide primarily based on the length for the reason that cash had been final energetic. These cohorts embody 1+ years, 2+ years, 3+ years, and 5+ years. As cash are collected by long-term holders (LTHs), these metrics are inclined to rise, reflecting their dedication to holding onto their belongings.

Information from Glassnode exhibits that in late 2023, all SLA cohorts reached their all-time highs. Nonetheless, the US Bitcoin ETF launch and subsequent outflows by GBTC, mixed with LTHs promoting, led to a brief decline within the SLA cohorts. Notably, the SLA 1+ 12 months cohort dropped from over 70% to 66%, whereas the SLA 2+ years cohort fell from over 57% to over 54% and has now plateaued.

Curiously, the SLA 3+ years cohort, which incorporates cash held for the reason that begin of the 2021 bull run, remained resilient, rising from over 42% to only over 46%, reaching an all-time excessive. This means that many buyers from that interval have maintained their positions. Moreover, the upcoming months will present insights into the conduct of holders who held by way of the Bitcoin worth drop from $50,000 to $30,000 between Might and July 2021 through the China mining ban.

The publish Over 46% of Bitcoin’s circulating provide hasn’t moved in 3+ years appeared first on CryptoSlate.