Layer 2 (L2) scaling resolution Optimism reported a sequence of robust community metrics within the first quarter (Q1) 2024, with its native OP token surging 9% on the again of this bullish momentum.

Optimism Sees Larger Exercise And Rising Transaction Charges

In accordance with a latest Messari report, Optimism’s circulating market cap elevated 11% quarter-over-quarter (QoQ) to $3.7 billion, whereas its absolutely diluted market cap rose 1% to $15.7 billion.

Regardless of the broader crypto market rally, with Bitcoin (BTC) and Ethereum (ETH) gaining 69% and 53% QoQ, respectively, OP’s market cap rating slipped from twenty sixth to thirty ninth amongst all blockchain networks. Nevertheless, throughout the Ethereum ecosystem, OP stays one of many prime 4 rollups by market capitalization.

Driving this development was a big uptick in Optimism community exercise. Day by day lively addresses reached 89,000 in Q1 2024, a 23% QoQ enhance, whereas each day transactions surged 39% to 470,000 over the identical interval. These metrics approached, however didn’t fairly attain, their all-time highs in Q3 2023.

Associated Studying

The community’s income additionally noticed a considerable 78% QoQ enhance to $16 million, pushed by greater exercise and a 48% rise within the common transaction payment to $0.42. Nevertheless, this common payment dropped considerably within the latter half of March as a result of implementation of Ethereum Enchancment Proposal (EIP) 4844, which diminished L1 submission prices by 99%.

Whole Worth Locked Jumps 18% In Q1

Regardless of the payment discount, Optimism’s on-chain revenue for Q1 2024 elevated 14% QoQ to $2 million. The community’s Whole Worth Locked (TVL) additionally grew by 18% to $1.2 billion, although its TVL rating amongst all networks fell to eleventh place.

Inside Optimism’s TVL, the DeFi sector dominated, accounting for 86% of lively addresses. In accordance with Messari, non-fungible token (NFT) functions and gaming adopted with 6.9% and 6.7%, respectively.

TVL’s main protocols included Synthetix ($307 million, +4% QoQ), Aave ($270 million, +52% QoQ), and Velodrome ($171 million, +10% QoQ).

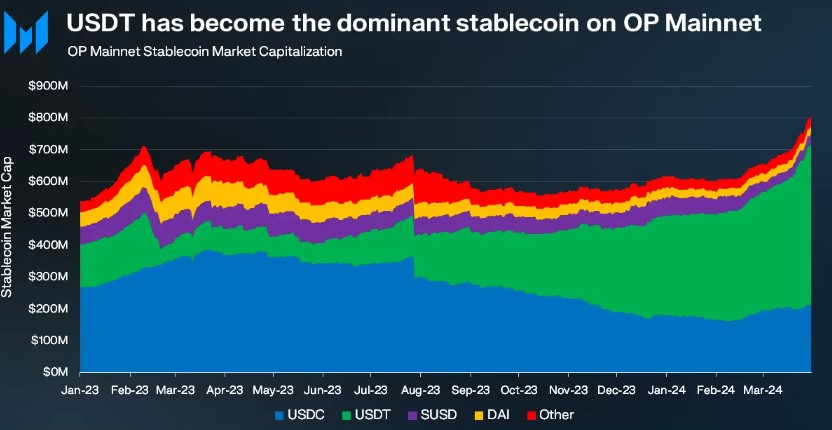

Optimism’s stablecoin market capitalization additionally grew considerably, reaching $809 million (+32% QoQ) by the top of Q1 2024. Circle’s USDC stablecoin and Tether’s USDT made up most of this, with USDT seeing a 64% QoQ surge to $512 million, or 63% of the full stablecoin market cap on Optimism.

OP Rebounds Alongside Crypto Market Resurgence

Regardless of Optimism’s robust efficiency throughout key metrics in Q1 2024, the community’s native token, OP, didn’t see a corresponding worth enhance on the finish of Q1. As a substitute, OP adopted the broader market downtrend, hitting an annual low of $1.80 only one month after hitting an all-time excessive of $4.84 in March.

Nevertheless, OP has adopted swimsuit as the general cryptocurrency market has seen a resurgence of bullish momentum prior to now few days. Previously 24 hours, the token has recorded a 9% worth enhance and a 3% uptick prior to now week, presently buying and selling at $2.56.

Moreover, CoinGecko knowledge reveals a 19% enhance in OP’s buying and selling quantity over the previous 48 hours, reaching $290 million.

Associated Studying

Whereas this renewed bullish sentiment is encouraging, OP nonetheless trades 46% beneath its all-time excessive and faces vital resistance ranges quickly earlier than a possible retest of this milestone.

The primary key resistance is at $2.65, adopted by $2.90, which should be overcome earlier than the token can push in the direction of the $3.00 stage. Conversely, the $2.34 assist stage has confirmed essential and should be monitored carefully in case of any bearish resurgence.

Featured picture from Shutterstock, chart from TradingView.com