The subject of mining centralization has been an important one over the previous few weeks. GHASH.io, the Bitcoin community’s largest mining pool, has for the previous month directed over 40% of the Bitcoin community’s hashpower, and two weeks in the past briefly spiked over 50%, theoretically giving it monopoly management over the Bitcoin community. Though miners quidkly left the pool and diminished its hashpower to 35%, it is clear that the issue will not be solved. On the identical time, ASICs threaten to additional centralize the very manufacturing . One strategy to fixing the issue is the one I advocated in my earlier put up: create a mining algorithm that’s assured to stay CPU-friendly in the long run. One other, nonetheless, is to abolish mining fully, and exchange it with a brand new mannequin for searching for consensus.

The first second contender up to now has been a method referred to as “proof of stake”, the instinct behind which is as follows. In a conventional proof-of-work blockchain, miners “vote” on which transactions got here at what time with their CPU energy, and the extra CPU energy you have got the proportionately bigger your affect is. In proof-of-stake, the system follows an analogous however completely different paradigm: stakeholders vote with their {dollars} (or reasonably, the inner foreign money of the actual system). By way of how this works technically, the best setup is a mannequin that has been referred to as the “simulated mining rig”: basically, each account has a sure probability per second of producing a legitimate block, very like a chunk of mining {hardware}, and this opportunity is proportional to the account’s stability. The only system for that is:

SHA256(prevhash + deal with + timestamp) <= 2^256 * stability / diff

prevhash is the hash of the earlier block, deal with is the deal with of the stake-miner, timestamp is the present Unix time in second, stability is the account stability of the stack-miner and diff is an adjustable international problem parameter. If a given account satisfies this equation at any specific second, it could produce a legitimate block, giving that account some block reward.

One other strategy is to make use of not the stability, however the “coin age” (ie. the stability multiplied by the period of time that the cash haven’t been touched), because the weighting issue; this ensures extra even returns however on the expense of probably a lot simpler collusion assaults, since attackers have the flexibility to build up coin age, and attainable superlinearity; for these causes, I favor the plain balance-based strategy normally, and we are going to use this as our baseline for the remainder of this dialogue.

Different options to “proof of X” have been proposed, together with excellence, bandwidth, storage and identification, however none are significantly handy as consensus algorithms; reasonably, all of those techniques have lots of the identical properties of proof of stake, and are thus greatest applied not directly – by making them purely mechanisms for foreign money distribution, after which utilizing proof of stake on these distributed cash for the precise consensus. The one exception is probably the social-graph-theory based mostly Ripple, though many cryptocurrency proponents take into account such techniques to be far too trust-dependent to be able to be thought-about really “decentralized”; this level may be debated, however it’s best to give attention to one matter at a time and so we are going to give attention to stake.

Strengths and Weaknesses

If it may be applied accurately, in concept proof of stake has many benefits. Specifically are three:

- It doesn’t waste any vital quantity of electicity. Positive, there’s a want for stakeholders to maintain attempting to provide blocks, however nobody beneficial properties any profit from making multiple try per account per second; therefore, the electrical energy expenditure is corresponding to another non-wasteful web protocol (eg. BitTorrent)

- It will probably arguably present a a lot increased stage of safety. In proof of labor, assuming a liquid marketplace for computing energy the price of launching a 51% assault is the same as the price of the computing energy of the community over the course of two hours – an quantity that, by commonplace financial rules, is roughly equal to the overall sum of block rewards and transaction charges supplied in two hours. In proof of stake, the edge is theoretically a lot increased: 51% of the whole provide of the foreign money.

- Relying on the exact algorithm in query it could possibly probably enable for a lot quicker blockchains (eg. NXT has one block each few seconds, in comparison with one per minute for Ethereum and one per ten minutes for Bitcoin)

Word that there’s one necessary counterargument that has been made to #2: if a big entity credibly commits to buying 51% of foreign money items after which utilizing these funds to repeatedly sabotage the community, then the value will fall drastically, making it a lot simpler for that entity to puchase the tokens. This does considerably mitigate the good thing about stake, though not almost fatally; an entity that may credibly commit to buying 50% of cash is probably going additionally one that may launch 51% assaults in opposition to proof of labor.

Nevertheless, with the naive proof of stake algorithm described above, there’s one major problem: as some Bitcoin builders describe it, “there’s nothing at stake”. What meaning is that this: within the context of a proof-of-work blockchain, if there’s an unintentional fork, or a deliberate transaction reversal (“double-spend”) try, and there are two competing forks of the blockchain, then miners have to decide on which one they contribute to. Their three decisions are both:

- Mine on no chain and get no rewards

- Mine on chain A and get the reward if chain A wins

- Mine on chain B and get the reward if chain B wins

As I’ve commented in a earlier put up, word the placing similarity to SchellingCoin/Truthcoin right here: you win should you go together with what everybody else goes with, besides on this case the vote is on the order of transactions, not a numerical (as in SchellingCoin) or binary (as in TruthCoin) datum. The inducement is to assist the chain that everybody else helps, forcing speedy convergence, and stopping profitable assaults supplied that at the very least 51% of the community will not be colluding.

Within the naive proof of stake algorithm, then again, the alternatives of whether or not or to not vote on A and whether or not or to not vote on B are impartial; therefore, the optimum technique is to mine on any fork that you will discover. Thus, to be able to launch a profitable assault, an attacker want solely overpower the entire altruists who’re keen to vote solely on the proper chain.

The issue is, sadly, considerably basic. Proof of labor is good as a result of the property of hash verification permits the community to concentrate on one thing outdoors of itself – specifically, computing energy, and that factor serves as a kind of anchor to make sure some stability. In a naive proof of stake system, nonetheless, the one factor that every chain is conscious of is itself; therefore, one can intuitively see that this makes such techniques extra flimsy and fewer secure. Nevertheless, the above is merely an intuitive argument; it’s certainly not a mathematical proof {that a} proof-of-stake system can’t be incentive-compatible and safe, and certainly there are a selection of potential methods to get across the difficulty.

The primary technique is the one that’s employed within the Slasher algorithm, and it hinges on a easy realization: though, within the case of a fork, chains usually are not conscious of something within the outdoors world, they’re conscious of one another. Therefore, the best way the protocol prevents double-mining is that this: should you mine a block, the reward is locked up for 1000 blocks, and should you additionally mine on another chain then anybody else can submit the block from the opposite chain into the unique chain to be able to steal the mining reward. Word, nonetheless, that issues usually are not fairly so easy, and there’s one catch: the miners must be identified upfront. The issue is that if the algorithm given above is used instantly, then the problem arises that, utilizing a probabilistic technique, double mining turns into very simple to cover.

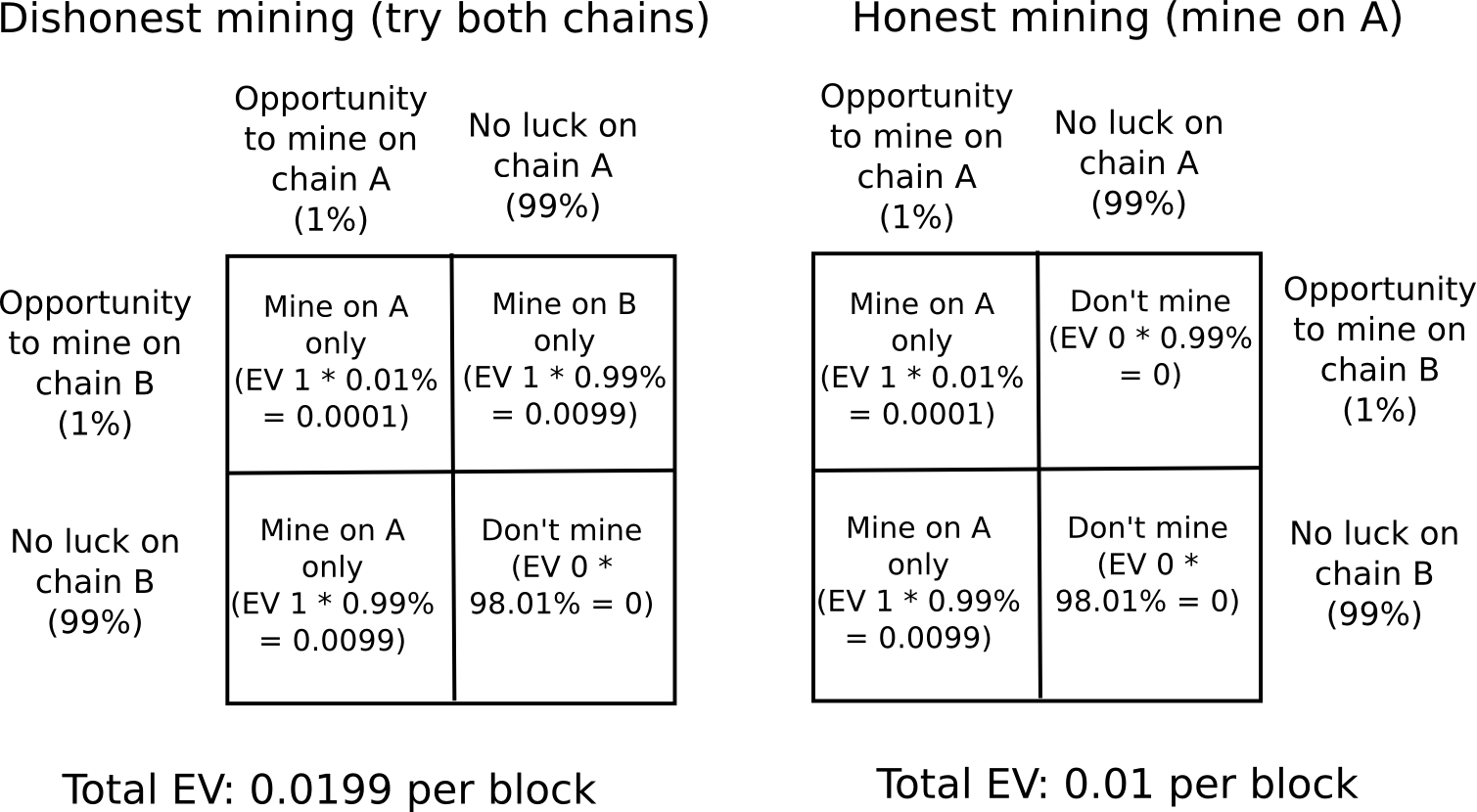

The difficulty is that this: suppose that you’ve 1% stake, and thus each block there’s a 1% probability that it is possible for you to to provide (hereinafter, “signal”) it. Now, suppose there’s a fork between chain A and chain B, with chain A being the “right” chain. The “sincere” technique is to attempt to generate blocks simply on A, getting an anticipated 0.01 A-coins per block. An alternate technique, nonetheless, is to attempt to generate blocks on each A and B, and should you discover a block on each on the identical time then discarding B. The payout per block is one A-coin should you get fortunate on A (0.99% probability), one B-coin should you get fortunate on B (0.99% probability) and one A-coin, however no B-coins, should you get fortunate on each; therefore, the anticipated payout is 0.01 A-coins plus 0.0099 B-coins should you double-vote. If the stakeholders that have to signal a selected block are determined upfront, nonetheless (ie. particularly, determined earlier than a fork begins), then there isn’t a chance of getting the chance to vote on A however not B; you both have the chance on each or neither. Therefore, the “dishonest” technique merely collapses into being the identical factor because the “sincere” technique.

The Block Signer Choice Downside

However then if block signers are determined upfront, one other difficulty arises: if finished flawed, block signers may “mine” their blocks, repeatedly attempting to create a block with completely different random information till the ensuing block triggers that very same signer having the privilege to signal a block once more very quickly. For instance, if the signer for block N+1000 was merely chosen from the hash of block N, and an attacker had 1% stake, then the attacker may hold rebuilding the block till block N+1000 additionally had the attacker as its signer (ie. an anticipated 100 iterations). Over time, the attacker would naturally achieve signing privilege on different blocks, and thus ultimately come to utterly saturate the blockchain with length-1000 cycles managed by himself. Even when the hash of 100 blocks put collectively is used, it is attainable to govern the worth. Thus, the query is, how can we decide what the signers for future blocks are going to be?

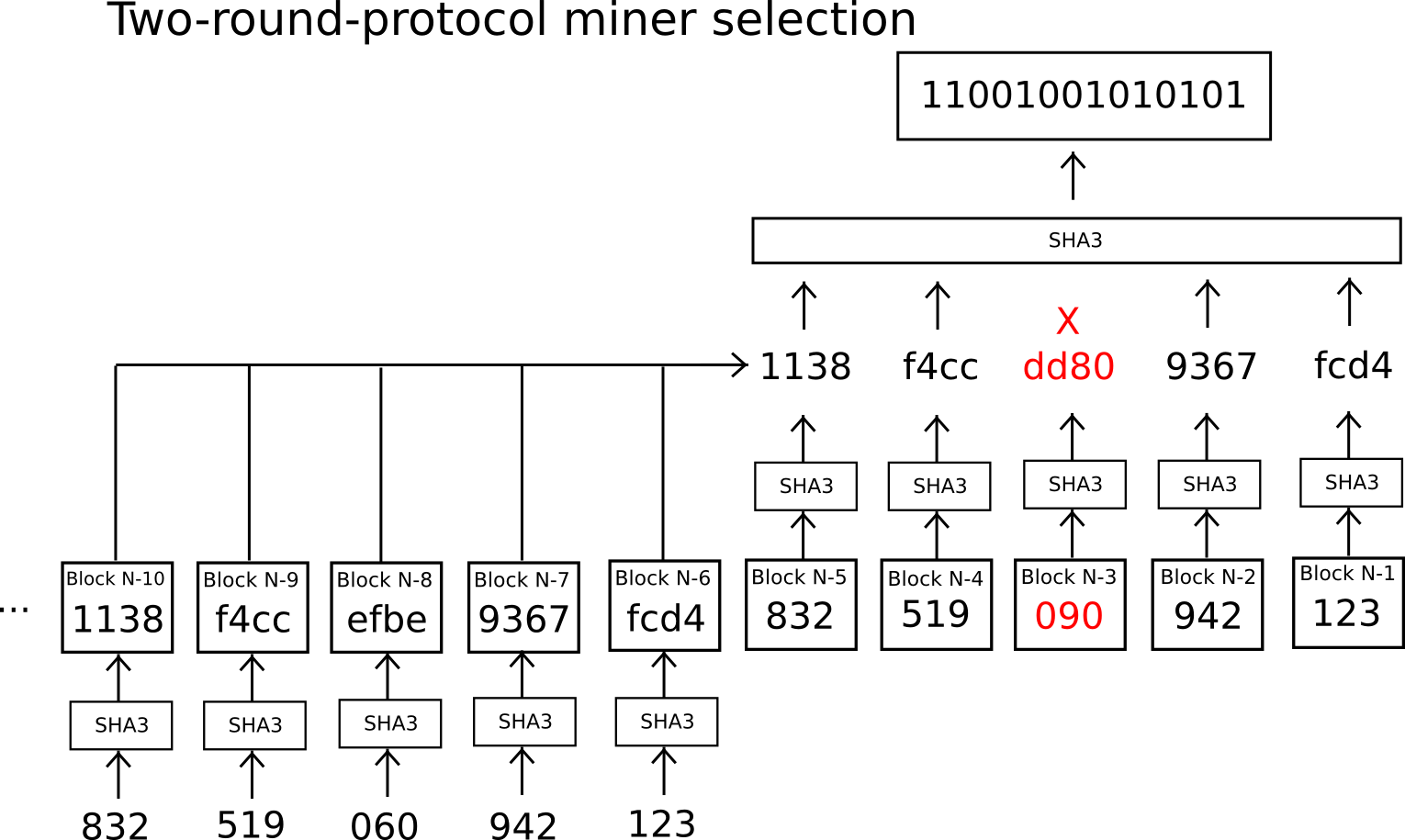

The answer utilized in Slasher is to make use of a safe decentralized random quantity generator protocol: many events are available in, first undergo the blockchain the hashes of their values, after which submit their values. There isn’t a probability of manipulation this fashion, as a result of every submitter is sure to submit within the second spherical the worth whose hash they supplied within the first spherical, and within the first spherical nobody has sufficient info to be able to interact in any manipulation. The participant nonetheless has a selection of whether or not or to not take part within the second spherical, however the two countervailing factors are that (1) this is just one little bit of freedom, though it turns into larger for giant miners that may management a number of accounts, and (2) we will institute a rule that failing to take part causes forfeiture of 1’s mining privilege (miners in spherical N select miners for spherical N+1 throughout spherical N-1, so there is a chance to do that if sure round-N miners misbehave throughout this choice step).

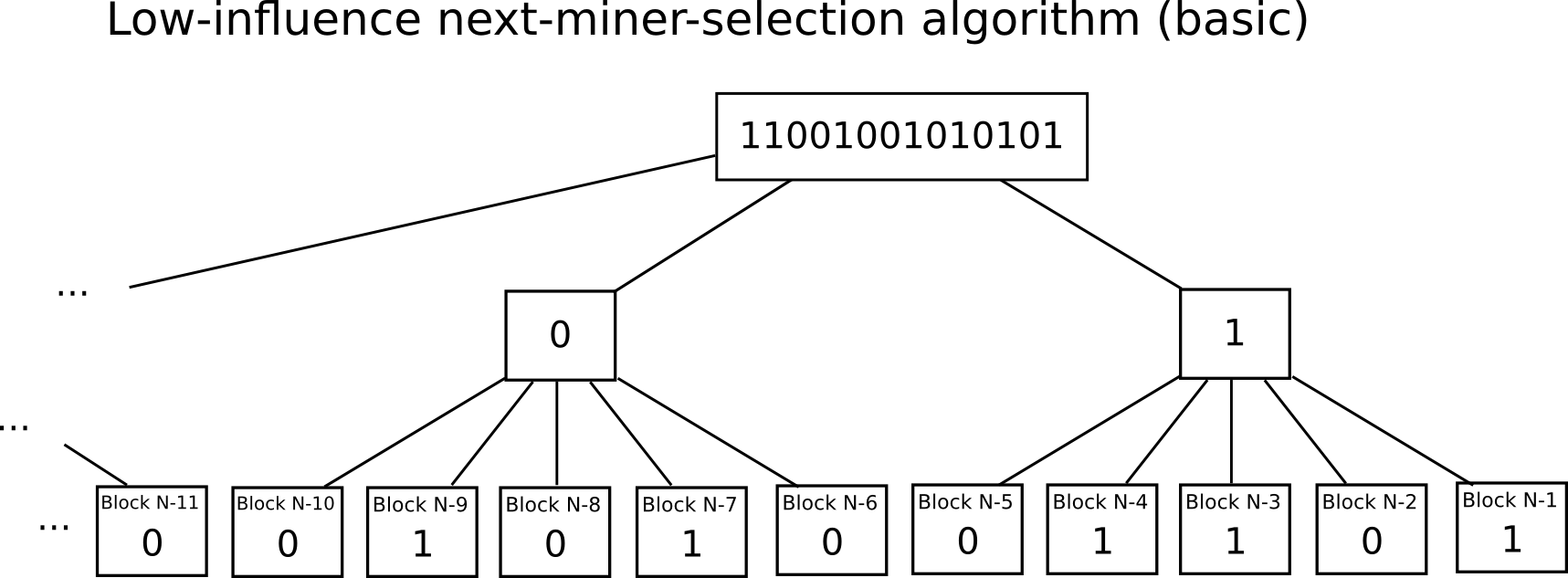

One other thought, proposed by Iddo Bentov and others of their “Cryptocurrencies With out Proof of Work” paper, is to make use of one thing referred to as a “low-influence” perform – basically, a perform such that there’s solely a really low probability {that a} single actor will be capable to change the consequence by altering the enter. A easy instance of an LIF over small units is majority rule; right here, as a result of we try to choose a random miner, we’ve a really massive set of choices to select from, so majority rule per bit is used (eg. you probably have 500 events and also you need to choose a random miner out of a billion, assign them into thirty teams of 17, and have every group vote on whether or not their specific bit is zero or one, after which recombine the bits as a binary quantity on the finish). This removes the necessity for an advanced two-step protocol, permitting it to probably be finished rather more shortly and even in parallel, decreasing the danger that the pre-chosen stake-miners for some specific block will get collectively and collude.

A 3rd fascinating technique, utilized by NXT, is to make use of the addresses of the stake-miners for blocks N and N+1 to decide on the miner for block N+2; this by definition offers just one selection for the following miner in every block. Including a criterion that each miner must be locked in for 1440 blocks to be able to take part prevents sending transactions as a type of double-mining. Nevertheless, having such speedy stake-miner choice additionally compromises the nothing-at-stake resistance property as a result of probabilistic double-mining downside; that is the explanation why intelligent schemes to make miner dedication occur in a short time are finally, past a sure level, undesirable.

Lengthy-Vary Assaults

Whereas the Slasher strategy does successfully remedy the nothing-at-stake downside in opposition to conventional 51% assaults, an issue arises within the case of one thing referred to as a “long-range assault”: as an alternative of an attacker beginning mining from ten blocks earlier than the present block, the attacker begins ten thousand blocks in the past. In a proof-of-work context, that is foolish; it mainly means doing hundreds of occasions as a lot work as is critical to launch an assault. Right here, nonetheless, making a block is almost computationally free, so it is a cheap technique. The rationale why it really works is that Slasher’s course of for punishing multi-mining solely lasts for 1000 blocks, and its course of for figuring out new miners lasts 3000 blocks, so outdoors the “scope” of that vary Slasher features precisely just like the naive proof-of-stake coin. Word that Slasher continues to be a considerable enchancment; in actual fact, assuming customers by no means change it may be made absolutely safe by introducing a rule into every consumer to not settle for forks going again greater than 1000 blocks. The issue is, nonetheless, what occurs when a brand new person enters the image.

When a brand new person downloads a proof-of-stake-coin consumer for the primary time, it’ll see a number of variations of the blockchain: the longest, and subsequently professional, fork, and plenty of pretenders attempting to mine their very own chains from the genesis. As described above, proof-of-stake chains are utterly self-referential; therefore, the consumer seeing all of those chains has no thought about any surrounding context like which chain got here first or which has extra worth (word: in a hybrid proof-of-stake plus social graph system, the person would get preliminary blockchain information from a trusted supply; this strategy is affordable, however will not be absolutely decentralized). The one factor that the consumer can see is the allocation within the genesis block, and the entire transactions since that time. Thus, all “pure” proof-of-stake techniques are finally everlasting nobilities the place the members of the genesis block allocation at all times have the final word say. It doesn’t matter what occurs ten million blocks down the highway, the genesis block members can at all times come collectively and launch an alternate fork with an alternate transaction historical past and have that fork take over.

When you perceive this, and you’re nonetheless okay with pure proof of stake as an idea (the precise cause why you would possibly nonetheless be okay is that, if the preliminary issuance is completed proper, the “the Aristocracy” ought to nonetheless be massive sufficient that it can’t virtually collude), then the conclusion permits for some extra imaginative instructions by way of how proof of stake can play out. The only thought is to have the members of the genesis block vote on each block, the place double-mining is punished by everlasting lack of voting energy. Word that this technique really solves nothing-at-stake points utterly, since each genesis block holder has a mining privilege that has worth without end into the longer term, so it’ll at all times not be price it to double-mine. This method, nonetheless, has a finite lifespan – particularly, the utmost life (and curiosity) span of the genesis signers, and it additionally offers the the Aristocracy a everlasting profit-making privilege, and never simply voting rights; nonetheless, nonetheless the existence of the algorithm is encouraging as a result of it means that long-range-nothing-at-stake may be essentially resolvable. Thus, the problem is to determine a way to verify voting privileges switch over, whereas nonetheless on the identical time sustaining safety.

Altering Incentives

One other strategy to fixing nothing-at-stake comes on the downside from a totally completely different angle. The core downside is, in naive proof-of-stake, rational people will double-vote. The Slasher-like options all attempt to remedy the issue by making it not possible to double-vote, or on the very least closely punishing such a method. However what if there’s one other strategy; particularly, what if we as an alternative take away the motivation to take action? In the entire proof of stake techniques that I described above, the motivation is clear, and sadly basic: as a result of whoever is producing blocks wants an incentive to take part within the course of, they profit in the event that they embrace a block in as many forks as attainable. The answer to this conundrum comes from an imaginative, out-of-the-box proposal from Daniel Larimer: transactions as proof of stake.

The core thought behind transactions as proof-of-stake is straightforward: as an alternative of mining being finished by a separate class of people, whether or not laptop {hardware} house owners or stakeholders, mining and transaction sending are merged into one. The naive TaPoS algorithm is as follows:

- Each transaction should include a reference (ie. hash) to the earlier transaction

- A candidate state-of-the-system is obtained by calculating the results of a ensuing transaction chain

- The proper chain amongst a number of candidates is the one which has both (i) the longest coin-days-destroyed (ie. variety of cash within the account * time since final entry), or (ii) the best transaction charges (these are two completely different choices that we’ll analyze individually)

This algorithm has the property that this can be very unscalable, breaking down past about 1 transaction per 2-5 seconds, and it isn’t the one which Larimer suggests or the one that can really be used; reasonably, it is merely a proof of idea that we’ll analyze to see if this strategy is legitimate in any respect. Whether it is, then there are doubtless methods to optimize it.

Now, let’s have a look at what the economics of this are. Suppose that there’s a fork, and there are two competing variations of the TaPoS chain. You, as a transaction sender, made a transaction on chain A, and there’s now an upcoming chain B. Do you have got the motivation to double-mine and embrace your transaction in chain B as effectively? The reply is not any – in actual fact you really need to double-spend your recipient so you wouldn’t put the transaction on one other chain. This argument is particularly potent within the case of long-range assaults, the place you already obtained your product in trade for the funds; within the quick time period, after all, the motivation nonetheless exists to verify the transaction is shipped, so senders do have the motivation to double-mine; nonetheless, as a result of the fear is strictly time-limited this may be resolved through a Slasher-like mechanism.

One concern is that this: given the presence of forks, how simple is it to overwhelm the system? If, for instance, there’s a fork, and one specific entity needs to double-spend, beneath what circumstances is that attainable? Within the transaction-fee model, the requirement is fairly easy: it’s essential spend extra txfees than the remainder of the community. This appears weak, however in actuality it is not; we all know that within the case of Bitcoin, as soon as the foreign money provide stops growing mining will rely solely on transaction charges, and the mechanics are precisely the identical (because the quantity that the community will spend on mining will roughly correspond to the overall variety of txfees being despatched in); therefore, fee-based TaPoS is on this regard at the very least as safe as fee-only PoW mining. Within the second case, we’ve a special mannequin: as an alternative of mining along with your cash, you’re mining along with your liquidity. Anybody can 51% assault the system if and provided that they’ve a sufficiently massive amount of coin-days-destroyed on them. Therefore, the price of spending a big txfee after the actual fact is changed by the price of sacrificing liquidity earlier than the actual fact.

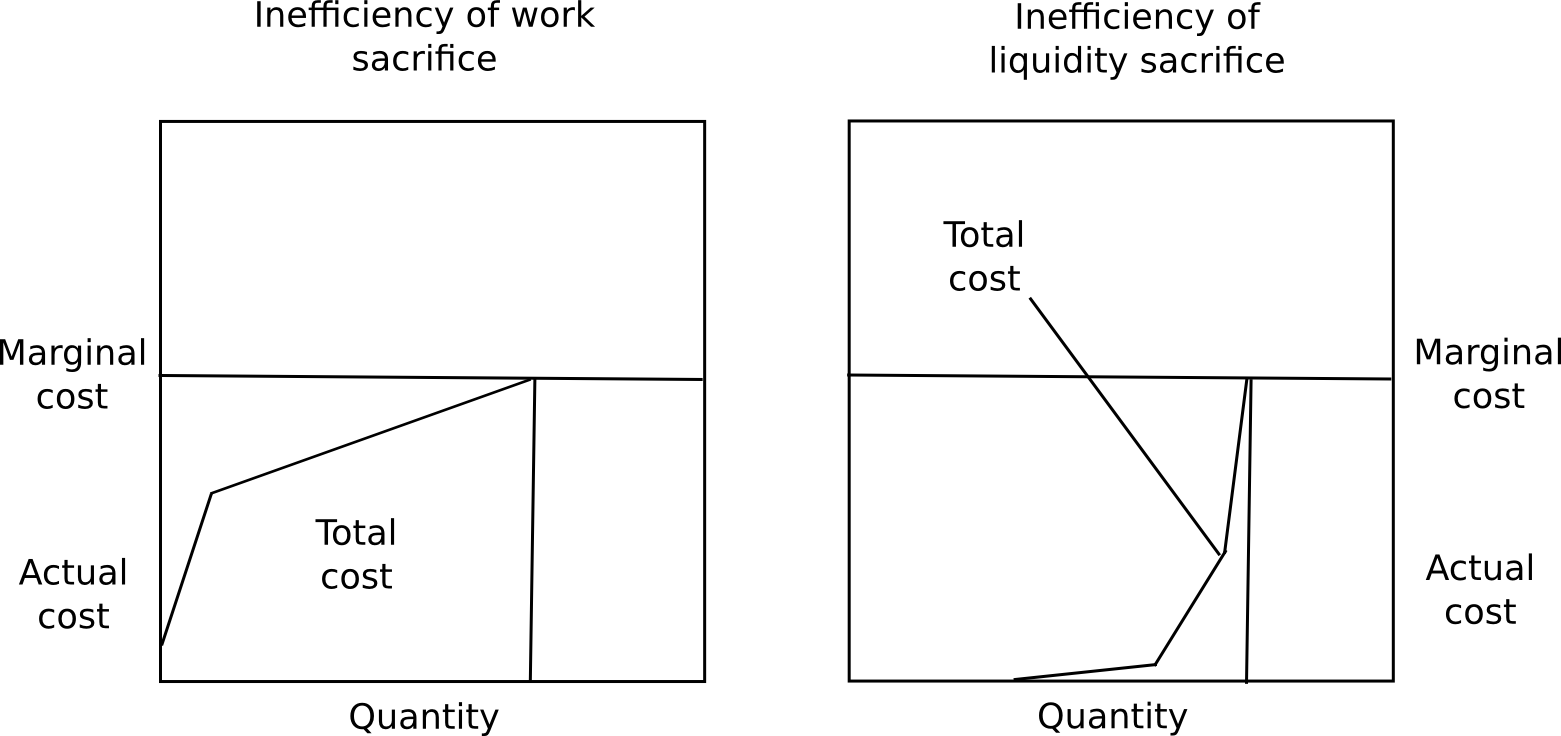

Value of Liquidity

The dialogue round liquidity results in one other necessary philosophical level: safety can’t be cost-free. In any system the place there’s a block reward, the factor that’s the prerequisite for the reward (whether or not CPU, stake, or one thing else) can’t be free, since in any other case everybody could be claiming the reward at infinitum, and in TaPoS transaction senders should be offering some form of charge to justify safety. Moreover, no matter useful resource is used to again the safety, whether or not CPU, foreign money sacrifices or liquidity sacrifices, the attacker want solely get their palms on an identical quantity of that useful resource than the remainder of the community. Word that, within the case of liquidity sacrifices (which is what naive proof of stake is), the related amount right here is definitely not 50% of cash, however reasonably the privilege of accessing 50% of cash for a number of hours – a service that, assuming a wonderfully environment friendly market, would possibly solely price a number of hundred thousand {dollars}.

The answer to this puzzle is that marginal price will not be the identical factor as common price. Within the case of proof of labor, that is true solely to a really restricted extent; though miners do earn a constructive nonzero revenue from mining, all of them pay a excessive price (except they’re CPU miners heating their houses, however even there there are substantial effectivity losses; laptops operating hash features at 100%, although efficient at heating, are essentially much less efficient than techniques designed for the duty). Within the case of foreign money sacrifices, everybody pays the identical, however the cost is redistributed as a dividend to everybody else, and this revenue is simply too dispersed to be recovered through market mechanisms; thus, though the system is expensive from a neighborhood perspective, it’s costless from a world perspective.

The final possibility, liquidity sacrifice, is in between the 2. Though liquidity sacrifice is expensive, there’s a substantial quantity of disparity in how a lot individuals worth liquidity. Some individuals, like particular person customers or companies with low financial savings, closely worth liquidity; others, like savers, don’t worth liquidity in any respect (eg. I couldn’t care much less if I misplaced the flexibility to spend ten of my bitcoins for some length). Therefore, though the marginal price of liquidity shall be excessive (particularly, essentially equal to both the mining reward or the transaction charge), the typical price is far decrease. Therefore, there’s a leverage impact that enables the price of an assault to be a lot increased than the inefficiency of the community, or the quantity that senders spend on txfees. Moreover, word that in Larimer’s scheme particularly, issues are rigged in such a a means that all liquidity that’s sacrificed in consensus is liquidity that was being sacrificed anyway (specifically, by not sending cash earlier), so the sensible stage of inefficiency is zero.

Now, TaPoS does have its issues. First, if we attempt to make it extra scalable by reintroducing the idea of blocks, then there ideally must be some cause to provide blocks that isn’t revenue, in order to not reintroduce the nothing-at-stake downside. One strategy could also be to drive a sure class of enormous transaction senders to create blocks. Second, attacking a series continues to be theoretically “cost-free”, so the safety assurances are considerably much less good than they’re in proof-of-work. Third, within the context of a extra difficult blockchain like Ethereum, and never a foreign money, some transactions (eg. finalizing a guess) are literally worthwhile to ship, so there shall be incentive to double-mine on at the very least some transactions (although not almost all, so there’s nonetheless some safety). Lastly, it is a genesis-block-nobility system, similar to all proof-of-stake essentially is. Nevertheless, so far as pure proof-of-stake techniques go, it does appear a a lot better spine than the model of proof of stake that emulated Bitcoin mining.

Hybrid Proof of Stake

Given the attractiveness of proof of stake as an answer for growing effectivity and safety, and its simultaneous deficiencies by way of zero-cost assaults, one average resolution that has been introduced up many occasions is hybrid proof of stake, in its newest incantation referred to as “proof of exercise“. The concept behind proof of exercise is straightforward: blocks are produced through proof of labor, however each block randomly assigns three stakeholders that have to signal it. The subsequent block can solely be legitimate as soon as these signatures are in place. On this system, in concept, an attacker with 10% stake would see 999 of his 1000 blocks not being signed, whereas within the professional community 729 out of 1000 blocks could be signed; therefore, such an attacker could be penalized in mining by an element of 729.

Nevertheless, there’s a downside: what motivates signers to signal blocks on just one chain? If the arguments in opposition to pure proof of stake are right, then most rational stake-miners would signal each chains. Therefore, in hybrid PoS, if the attacker indicators solely his chain, and altruists solely signal the professional chain, and everybody else indicators each, then if the attacker can overpower the altruists on the stake entrance that implies that the attacker can overtake the chain with lower than a 51% assault on the mining entrance. If we belief that altruists as a gaggle are extra highly effective in stake than any attacker, however we do not belief that an excessive amount of, then hybrid PoS looks as if an inexpensive hedge possibility; nonetheless, given the reasoning above, if we need to hybridize one would possibly ask if hybrid PoW + TaPoS won’t be the extra optimum method to go. For instance, one may think about a system the place transactions have to reference current blocks, and a blockchain’s rating is calculated based mostly on proof of labor and coin-days-destroyed counts.

Conclusion

Will we see proof of stake emerge as a viable different to proof of labor within the subsequent few years? It could be. From a pure effectivity perspective, if Bitcoin, or Ethereum, or another PoW-based platform get to the purpose the place they’ve related market cap to gold, silver, the USD, EUR or CNY, or another mainstream asset, then over 100 billion {dollars} price of latest foreign money items shall be produced per 12 months. Beneath a pure-PoW regime, an quantity of financial energy approaching that shall be spent on hashing yearly. Thus, the associated fee to society of sustaining a proof-of-work cryptocurrency is about the identical as the price of sustaining the Russian army (the analogy is especially potent as a result of militaries are additionally proof of labor; their solely worth to anybody is defending in opposition to different militaries). Beneath hybrid-PoS, that may safely be dropped to $30 billion per 12 months, and beneath pure PoS it could be nearly nothing, besides relying on implementation perhaps a number of billion {dollars} of price from misplaced liquidity.

In the end, this boils all the way down to a philosophical query: precisely how a lot does decentralization imply to us, and the way a lot are we keen to pay for it? Keep in mind that centralized databases, and even quasi-centralized ones based mostly on Ripple consensus, are free. If good decentralization is certainly price 100 billion price ticket, then we must always simply centralize and let a number of governments run the databases. But when we’ve a strong, viable proof of stake algorithm, then we’ve a 3rd possibility: a system which is each decentralized and cost-free (word that helpful proof of labor additionally suits this criterion, and could also be simpler); in that case, the dichotomy doesn’t exist in any respect and decentralization turns into the apparent selection.