The first expense that should be paid by a blockchain is that of safety. The blockchain should pay miners or validators to economically take part in its consensus protocol, whether or not proof of labor or proof of stake, and this inevitably incurs some price. There are two methods to pay for this price: inflation and transaction charges. Presently, Bitcoin and Ethereum, the 2 main proof-of-work blockchains, each use excessive ranges of inflation to pay for safety; the Bitcoin group presently intends to lower the inflation over time and finally change to a transaction-fee-only mannequin. NXT, one of many bigger proof-of-stake blockchains, pays for safety completely with transaction charges, and in reality has destructive internet inflation as a result of some on-chain options require destroying NXT; the present provide is 0.1% decrease than the unique 1 billion. The query is, how a lot “protection spending” is required for a blockchain to be safe, and given a selected quantity of spending required, which is one of the simplest ways to get it?

Absolute dimension of PoW / PoS Rewards

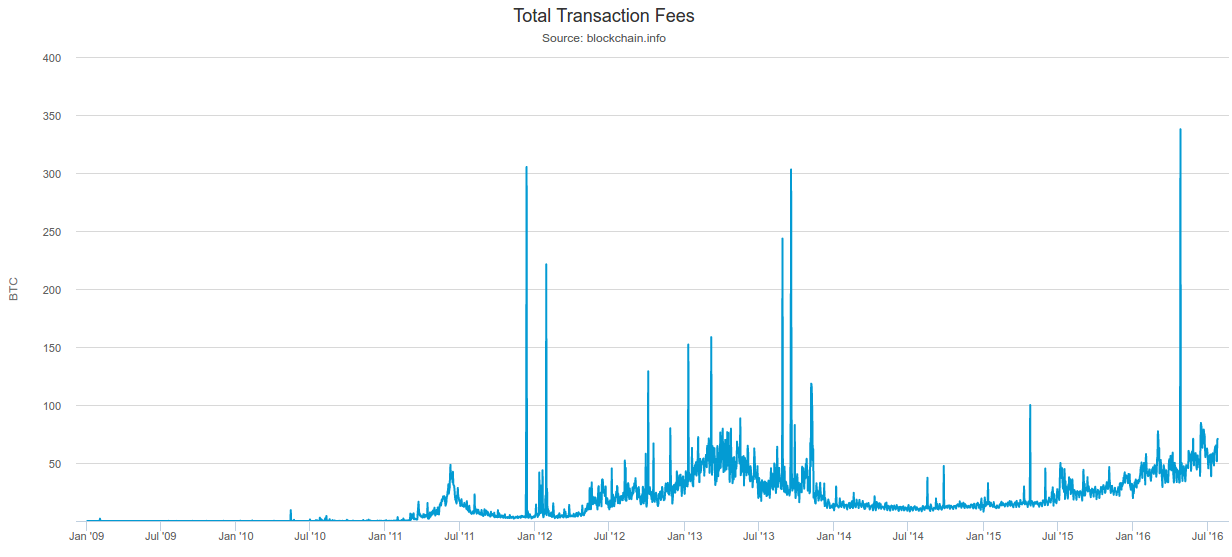

To supply some empirical information for the subsequent part, allow us to take into account bitcoin for instance. Over the previous few years, bitcoin transaction revenues have been within the vary of 15-75 BTC per day, or about 0.35 BTC per block (or 1.4% of present mining rewards), and this has remained true all through massive adjustments within the stage of adoption.

It isn’t tough to see why this can be the case: will increase in BTC adoption will enhance the whole sum of USD-denominated charges (whether or not by transaction quantity will increase or common charge will increase or a mixture of each) but additionally lower the quantity of BTC in a given amount of USD, so it’s completely affordable that, absent exogenous block dimension crises, adjustments in adoption that don’t include adjustments to underlying market construction will merely go away the BTC-denominanted whole transaction charge ranges largely unchanged.

In 25 years, bitcoin mining rewards are going to virtually disappear; therefore, the 0.35 BTC per block would be the solely income. At as we speak’s costs, this works out to ~$35000 per day or $10 million per 12 months. We will estimate the price of shopping for up sufficient mining energy to take over the community given these circumstances in a number of methods.

First, we are able to have a look at the community hashpower and the price of client miners. The community presently has 1471723 TH/s of hashpower, one of the best accessible miners price $100 per 1 TH/s, so shopping for sufficient of those miners to overwhelm the present community will price ~$147 million USD. If we take away mining rewards, revenues will lower by an element of 36, so the mining ecosystem will in the long run lower by an element of 36, so the fee turns into $4.08m USD. Be aware that that is if you’re shopping for new miners; if you’re prepared to purchase current miners, then you must solely purchase half the community, knocking the price of what Tim Swanson calls a “Maginot line” assault all the best way right down to ~$2.04m USD.

Nevertheless, skilled mining farms are seemingly in a position to acquire miners at considerably cheaper than client prices. We will have a look at the accessible data on Bitfury’s $100 million information middle, which is anticipated to eat 100 MW of electrical energy. The farm will include a mixture of 28nm and 16nm chips; the 16nm chips “obtain power effectivity of 0.06 joules per gigahash”. Since we care about figuring out the fee for a brand new attacker, we’ll assume that an attacker replicating Bitfury’s feat will use 16nm chips solely. 100 MW at 0.06 joules per gigahash (physics reminder: 1 joule per GH = 1 watt per GH/sec) is 1.67 billion GH/s, or 1.67M TH/s. Therefore, Bitfury was in a position to do $60 per TH/s, a statistic that may give a $2.45m price of attacking “from exterior” and a $1.22m price from shopping for current miners.

Therefore, we’ve $1.2-4m as an approximate estimate for a “Maginot line assault” towards a fee-only community. Cheaper assaults (eg. “renting” {hardware}) could price 10-100 instances much less. If the bitcoin ecosystem will increase in dimension, then this worth will after all enhance, however then the scale of transactions performed over the community can even enhance and so the motivation to assault can even enhance. Is that this stage of safety sufficient as a way to safe the blockchain towards assaults? It’s laborious to inform; it’s my very own opinion that the danger may be very excessive that that is inadequate and so it’s harmful for a blockchain protocol to commit itself to this stage of safety with no method of accelerating it (word that Ethereum’s present proof of labor carries no elementary enhancements to Bitcoin’s on this regard; for this reason I personally haven’t been prepared to decide to an ether provide cap at this level).

In a proof of stake context, safety is prone to be considerably greater. To see why, word that the ratio between the computed price of taking on the bitcoin community, and the annual mining income ($932 million at present BTC value ranges), is extraordinarily low: the capital prices are solely value about two months of income. In a proof of stake context, the price of deposits ought to be equal to the infinite future discounted sum of the returns; that’s, assuming a risk-adjusted low cost fee of, say, 5%, the capital prices are value 20 years of income. Be aware that if ASIC miners consumed no electrical energy and lasted eternally, the equilibrium in proof of labor could be the identical (with the exception that proof of labor would nonetheless be extra “wasteful” than proof of stake in an financial sense, and restoration from profitable assaults could be more durable); nonetheless, as a result of electrical energy and particularly {hardware} depreciation do make up the good bulk of the prices of ASIC mining, the massive discrepancy exists. Therefore, with proof of stake, we may even see an assault price of $20-100 million for a community the scale of Bitcoin; therefore it’s extra seemingly that the extent of safety might be sufficient, however nonetheless not sure.

The Ramsey Downside

Allow us to suppose that relying purely on present transaction charges is inadequate to safe the community. There are two methods to lift extra income. One is to extend transaction charges by constraining provide to beneath environment friendly ranges, and the opposite is so as to add inflation. How will we select which one, or what proportions of each, to make use of?

Luckily, there may be a longtime rule in economics for fixing the issue in a method that minimizes financial deadweight loss, referred to as Ramsey pricing. Ramsey’s unique situation was as follows. Suppose that there’s a regulated monopoly that has the requirement to realize a selected revenue goal (probably to interrupt even after paying mounted prices), and aggressive pricing (ie. the place the worth of a very good was set to equal the marginal price of manufacturing another unit of the nice) wouldn’t be enough to realize that requirement. The Ramsey rule says that markup ought to be inversely proportional to demand elasticity, ie. if a 1% enhance in value in good A causes a 2% discount in demand, whereas a 1% enhance in value in good B causes a 4% discount in demand, then the socially optimum factor to do is to have the markup on good A be twice as excessive because the markup on good B (it’s possible you’ll discover that this primarily decreases demand uniformly).

The explanation why this sort of balanced method is taken, fairly than simply placing all the markup on essentially the most inelastic a part of the demand, is that the hurt from charging costs above marginal price goes up with the sq. of the markup. Suppose {that a} given merchandise takes $20 to supply, and also you cost $21. There are seemingly a couple of individuals who worth the merchandise at someplace between $20 and $21 (we’ll say common of $20.5), and it’s a tragic loss to society that these folks won’t be able to purchase the merchandise although they might achieve extra from having it than the vendor would lose from giving it up. Nevertheless, the variety of folks is small and the online loss (common $0.5) is small. Now, suppose that you simply cost $30. There at the moment are seemingly ten instances extra folks with “reserve costs” between $20 and $30, and their common valuation is probably going round $25; therefore, there are ten instances extra individuals who endure, and the common social loss from every one in every of them is now $5 as a substitute of $0.5, and so the online social loss is 100x higher. Due to this superlinear progress, taking just a little from everyone seems to be much less unhealthy than taking quite a bit from one small group.

Discover how the “deadweight loss” part is a triangle. As you (hopefully) bear in mind from math class, the world of a triangle is width * size / 2, so doubling the scale quadruples the world.

In Bitcoin’s case, proper now we see that transaction charges are and persistently have been within the neighborhood of ~50 BTC per day, or ~18000 BTC per 12 months, which is ~0.1% of the coin provide. We will estimate as a primary approximation that, say, a 2x charge enhance would cut back transaction load by 20%. In observe, it looks as if bitcoin charges are up ~2x since a 12 months in the past and it appears believable that transaction load is now ~20% stunted in comparison with what it could be with out the charge enhance (see this tough projection); these estimates are extremely unscientific however they’re a good first approximation.

Now, suppose that 0.5% annual inflation would cut back curiosity in holding BTC by maybe 10%, however we’ll conservatively say 25%. If in some unspecified time in the future the Bitcoin group decides that it desires to extend safety expenditures by ~200,000 BTC per 12 months, then underneath these estimates, and assuming that present txfees are optimum earlier than taking into consideration safety expenditure concerns, the optimum could be to push up charges by 2.96x and introduce 0.784% annual inflation. Different estimates of those measures would give different outcomes, however in any case the optimum stage of each the charge enhance and the inflation could be nonzero. I take advantage of Bitcoin for instance as a result of it’s the one case the place we are able to truly attempt to observe the consequences of rising utilization restrained by a set cap, however similar arguments apply to Ethereum as properly.

Sport-Theoretic Assaults

There’s additionally one other argument to bolster the case for inflation. That is that counting on transaction charges an excessive amount of opens up the enjoying subject for a really massive and difficult-to-analyze class of game-theoretic assaults. The elemental trigger is easy: for those who act in a method that stops one other block from stepping into the chain, then you may steal that block’s transactions. Therefore there may be an incentive for a validator to not simply assist themselves, but additionally to harm others. That is much more direct than selfish-mining assaults, as within the case of egocentric mining you harm a selected validator to the good thing about all different validators, whereas right here there are sometimes alternatives for the attacker to profit solely.

In proof of labor, one easy assault could be that for those who see a block with a excessive charge, you try and mine a sister block containing the identical transactions, after which supply a bounty of 1 BTC to the subsequent miner to mine on prime of your block, in order that subsequent validators have the motivation to incorporate your block and never the unique. After all, the unique miner can then observe up by growing the bounty additional, beginning a bidding warfare, and the miner may additionally pre-empt such assaults by voluntarily giving up many of the charge to the creator of the subsequent block; the tip result’s laborious to foretell and it is by no means clear that it’s wherever near environment friendly for the community. In proof of stake, related assaults are attainable.

distribute charges?

Even given a selected distribution of revenues from inflation and revenues from transaction charges, there may be a further selection of how the transaction charges are collected. Although most protocols to this point have taken one single route, there may be truly fairly a little bit of latitude right here. The three main selections are:

- Charges go to the validator/miner that created the block

- Charges go to the validators equally

- Charges are burned

Arguably, the extra salient distinction is between the primary and the second; the distinction between the second and the third may be described as a concentrating on coverage selection, and so we’ll take care of this concern individually in a later part. The distinction between the primary two choices is that this: if the validator that creates a block will get the charges, that validator has an incentive equal to the scale of the charges to incorporate as many transactions as attainable. If it is the validators equally, every one has a negligible incentive.

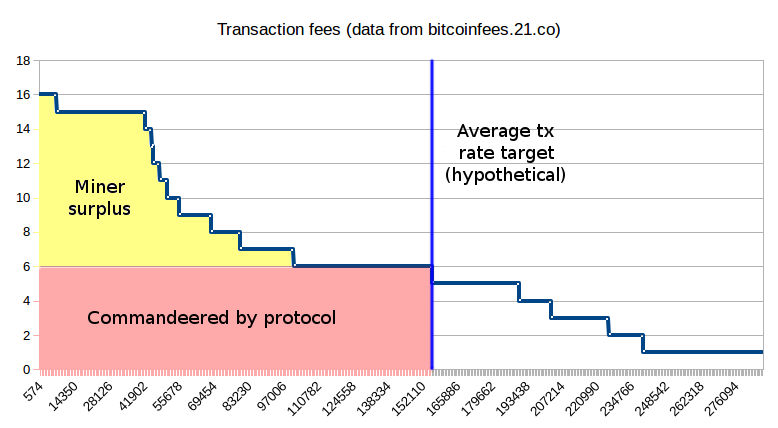

Be aware that actually redistributing 100% of charges (or, for that matter, any mounted proportion of charges) is infeasible because of “tax evasion” assaults by way of side-channel fee: as a substitute of including a transaction charge utilizing the usual mechanism, transaction senders will put a zero or near-zero “official charge” and pay validators instantly by way of different cryptocurrencies (and even PayPal), permitting validators to gather 100% of the income. Nevertheless, we are able to get what we would like through the use of one other trick: decide in protocol a minimal charge that transactions should pay, and have the protocol “confiscate” that portion however let the miners preserve all the extra (alternatively, miners preserve all transaction charges however should in flip pay a charge per byte or unit fuel to the protocol; this a mathematically equal formulation). This removes tax evasion incentives, whereas nonetheless inserting a big portion of transaction charge income underneath the management of the protocol, permitting us to maintain fee-based issuance with out introducing the game-theoretic malicentives of a standard pure-fee mannequin.

The protocol can not take all the transaction charge revenues as a result of the extent of charges may be very uneven and since it can not price-discriminate, however it could possibly take a portion massive sufficient that in-protocol mechanisms have sufficient income allocating energy to work with to counteract game-theoretic considerations with conventional fee-only safety.

One attainable algorithm for figuring out this minimal charge could be a difficulty-like adjustment course of that targets a medium-term common fuel utilization equal to 1/3 of the protocol fuel restrict, reducing the minimal charge if common utilization is beneath this worth and growing the minimal charge if common utilization is greater.

We will prolong this mannequin additional to supply different attention-grabbing properties. One chance is that of a versatile fuel restrict: as a substitute of a tough fuel restrict that blocks can not exceed, we’ve a gentle restrict G1 and a tough restrict G2 (say, G2 = 2 * G1). Suppose that the protocol charge is 20 shannon per fuel (in non-Ethereum contexts, substitute different cryptocurrency items and “bytes” or different block useful resource limits as wanted). All transactions as much as G1 must pay 20 shannon per fuel. Above that time, nonetheless, charges would enhance: at (G2 + G1) / 2, the marginal unit of fuel would price 40 shannon, at (3 * G2 + G1) / 4 it could go as much as 80 shannon, and so forth till hitting a restrict of infinity at G2. This might give the chain a restricted potential to broaden capability to satisfy sudden spikes in demand, lowering the worth shock (a characteristic that some critics of the idea of a “charge market” could discover engaging).

What to Goal

Allow us to suppose that we agree with the factors above. Then, a query nonetheless stays: how will we goal our coverage variables, and significantly inflation? Can we goal a set stage of participation in proof of stake (eg. 30% of all ether), and regulate rates of interest to compensate? Can we goal a set stage of whole inflation? Or will we simply set a set rate of interest, and permit participation and inflation to regulate? Or will we take some center street the place higher curiosity in collaborating results in a mixture of elevated inflation, elevated participation and a decrease rate of interest?

Typically, tradeoffs between concentrating on guidelines are basically tradeoffs about what sorts of uncertainty we’re extra prepared to just accept, and what variables we need to cut back volatility on. The primary motive to focus on a set stage of participation is to have certainty concerning the stage of safety. The primary motive to focus on a set stage of inflation is to fulfill the calls for of some token holders for provide predictability, and on the similar time have a weaker however nonetheless current assure about safety (it’s theoretically attainable that in equilibrium solely 5% of ether could be collaborating, however in that case it could be getting a excessive rate of interest, making a partial counter-pressure). The primary motive to focus on a set rate of interest is to attenuate selfish-validating dangers, as there could be no method for a validator to profit themselves just by hurting the pursuits of different validators. A hybrid route in proof of stake may mix these ensures, for instance offering egocentric mining safety if attainable however sticking to a tough minimal goal of 5% stake participation.

Now, we are able to additionally get to discussing the distinction between redistributing and burning transaction charges. It’s clear that, in expectation, the 2 are equal: redistributing 50 ETH per day and inflating 50 ETH per day is identical as burning 50 ETH per day and inflating 100 ETH per day. The tradeoff, as soon as once more, comes within the variance. If charges are redistributed, then we’ve extra certainty concerning the provide, however much less certainty concerning the stage of safety, as we’ve certainty concerning the dimension of the validation incentive. If charges are burned, we lose certainty concerning the provide, however achieve certainty concerning the dimension of the validation incentive and therefore the extent of safety. Burning charges additionally has the profit that it minimizes cartel dangers, as validators can not achieve as a lot by artificially pushing transaction charges up (eg. by censorship, or by way of capacity-restriction gentle forks). As soon as once more, a hybrid route is feasible and could be optimum, although at current it looks as if an method focused extra towards burning charges, and thereby accepting an unsure cryptocurrency provide which will properly see low decreases on internet throughout high-usage instances and low will increase on internet throughout low-usage instances, is finest. If utilization is excessive sufficient, this will likely even result in low deflation on common.