An analyst has defined why the latest excessive in Bitcoin has skilled completely different market circumstances than these noticed in the course of the 2021 bull run peak.

Bitcoin Liquidations Have Been Quick-Dominated In Current Market Excessive

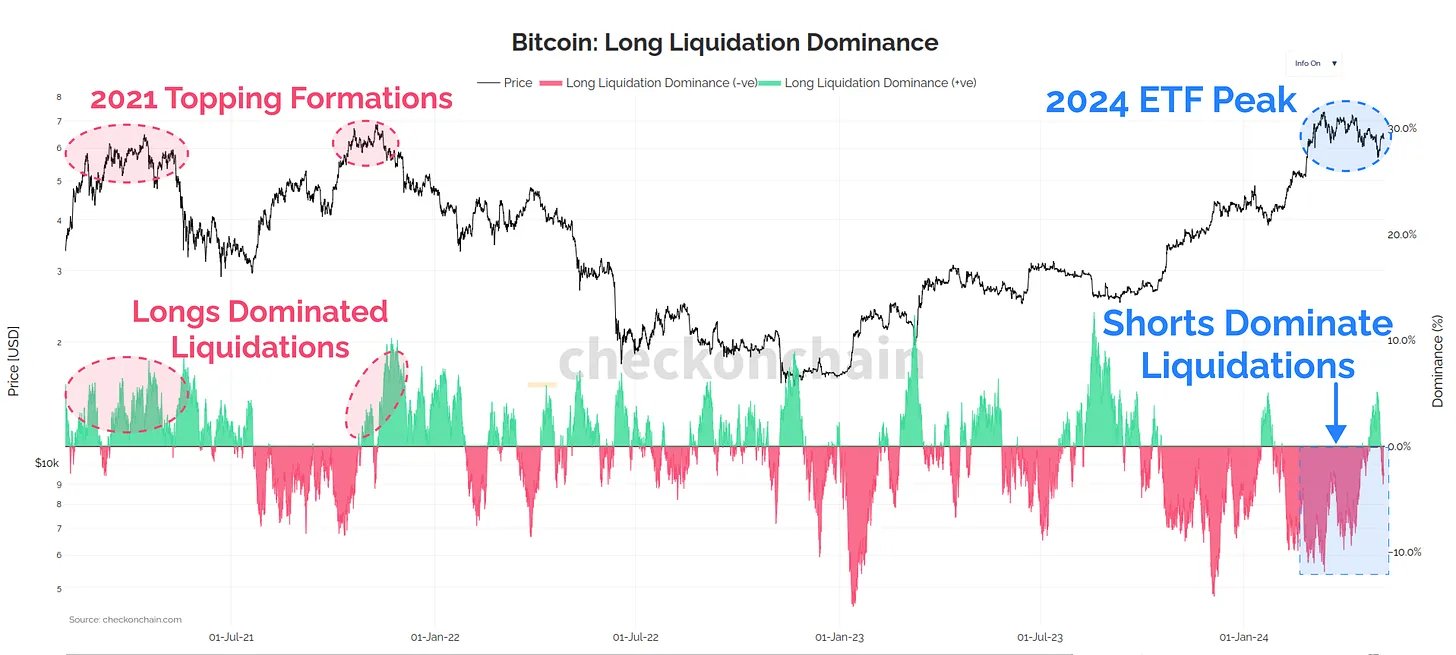

In a brand new submit on X, on-chain analyst Checkmate identified how the most recent 2024 excessive achieved following the spot exchange-traded fund (ETF) inflows has a serious distinction when in comparison with the 2021 peak.

Associated Studying

The distinction lies within the development registered on derivatives markets. Under is the chart shared by the analyst that exhibits the development within the dominance of lengthy liquidations within the sector over the previous couple of years.

The distribution of liquidations on derivatives market over the previous couple of years | Supply: @_Checkmatey_ on X

“Liquidation” right here naturally refers back to the act of forceful closure that any derivatives market contract undergoes on an alternate when it accumulates losses of a sure diploma.

The chance of a contract getting liquidated turns into increased, and the extra risky the asset worth will get. Throughout sharp rallies and crashes, big quantities of liquidation can pile up out there.

From the chart, it’s seen that because the rally within the cryptocurrency had occurred this yr, the quick holders had been taking a beating. This was solely pure as surges pile up losses for these traders betting on a decline, so worth development as speedy because the one witnessed would have pushed many of those contracts towards liquidation.

Curiously, the size of the quick dominance maintained all through the run, implying that the traders didn’t fairly imagine the run would proceed any additional at each level of the rally, so that they wager towards it.

This has additionally remained true within the latest stagnation following the highest, as quick liquidations have outweighed the lengthy ones although the worth has decreased.

As is obvious within the graph, the 2021 peaks noticed a special development. Longs have been getting liquidated as Bitcoin topped out throughout each the primary half of the 2021 peak and the second half.

In these durations, the traders had develop into too grasping and have been solely betting on the rise to proceed even when the asset had slowed down. This greed seems to haven’t overtaken the market within the bull run.

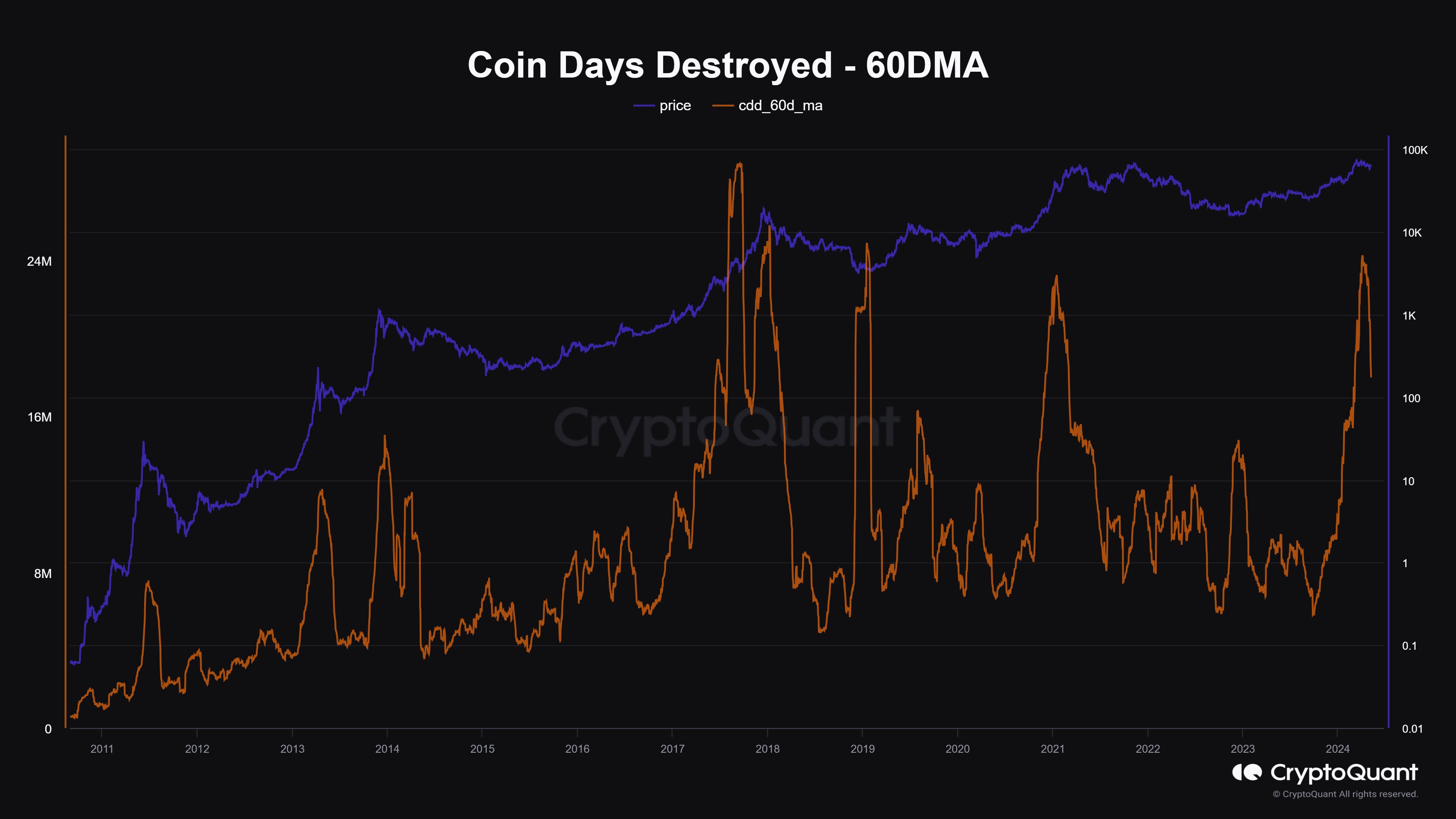

Whereas the present Bitcoin rally differs from the final one on this metric, analyst Maartunn has identified in an X submit one other indicator the place the development seems to be much like that noticed in earlier peaks.

Seems like the worth of the metric has been plunging in latest days | Supply: @JA_Maartun on X

This indicator is the Coin Days Destroyed (CDD), which mainly tells us concerning the scale of dormant coin motion that’s taking place out there proper now. It will seem that this metric had attained very excessive ranges just lately.

Associated Studying

“Coin Days Destroyed has most likely peaked,” says Maartunn. “Bitcoin’s worth usually reaches its peak across the identical time.” It needs to be famous that though this has been true for a number of the tops, the 2021 peak took months to type after the metric peaked.

BTC Value

On the time of writing, Bitcoin is floating round $62,200, up greater than 5% over the previous week.

BTC seems to have been sliding off in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, checkonchain.com, CryptoQuant.com, chart from TradingView.com