Bitcoin fanatics could must mood their expectations for a speedy ascent to $70,000. On January 28, a crypto analyst thinks the world’s most precious coin should fall again to $30,000, a vital help stage, earlier than resuming its uptrend.

Bitcoin Should Fall: Path To $30,000?

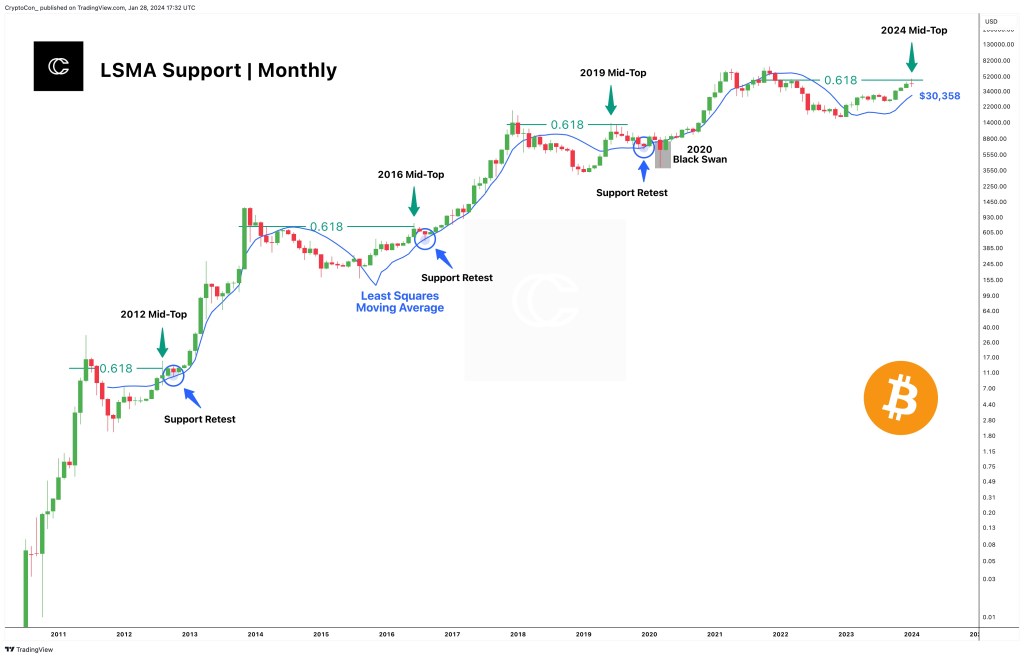

CryptoCon, a crypto analyst, cites historic value efficiency to help this assertion. Particularly, the argument is that no Bitcoin cycle has reached its current excessive with out first revisiting the month-to-month least sq. shifting common (MA).

Presently, this MA is at $30,358. If previous efficiency guides, CryptoCon believes Bitcoin may probably dip to this stage earlier than costs get better sharply.

The Bitcoin analyst notes that the MA has constantly acted as a ground for Bitcoin costs, even during times of excessive volatility. CryptoCon asserts that the one outlier was the 2019 bear market, triggered by the Black Swan occasion of COVID-19.

The analyst additional acknowledges that although some observers say Bitcoin has bottomed, additional confirmations may be required. Based mostly on CryptoCon’s evaluation, inadequate information helps this declare. The analyst asserts that by how costs have behaved up to now, it’s extremely probably that the coin will drop to as little as $30,000 by February or March.

A Contrarian Place: Wall Avenue Accumulating BTC

This prediction could disappoint some Bitcoin holders eagerly anticipating a pointy restoration to $70,000 and past. This optimistic preview comes after the US Securities and Alternate Fee (SEC) lately permitted a number of spot Bitcoin Alternate-Traded Funds (ETFs).

Although costs fell, pinned to the huge liquidation of Grayscale Bitcoin Belief (GBTC) shares by, amongst different buyers, FTX–the defunct trade, costs recovered over the weekend. Spot Bitcoin ETF issuers, together with Constancy and BlackRock, have been shopping for BTC en-masse over the previous weeks. Analysts have interpreted this as a internet constructive for costs. This improvement may elevate sentiment and drive the coin to January 2023 highs quickly.

Nonetheless, CryptoCon’s preview, it seems the analyst is taking a contrarian place, anticipating costs to maneuver in opposition to most people. Whether or not this retracement will assist anchor BTC and construct a extra sustainable long-term pattern stays to be seen.

From the sentiment chart, Concern-and-Greed Index, bulls anticipate costs to extend within the classes forward. Based on Coinstats, the index’s studying is 55, up from 50 final week.

Function picture from Canva, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site totally at your personal threat.