RUNE, the native token of the cross-chain decentralized alternate, THORChain, is beneath stress. From the every day chart, the token is down almost 60% from Might highs and stays flat even because the broader crypto market recovers.

Whilst RUNE flatlines, there’s confidence that costs might rally within the coming days primarily due to basic elements and efforts made by the event staff.

THORChain Income Rising After Swap Payment Increment

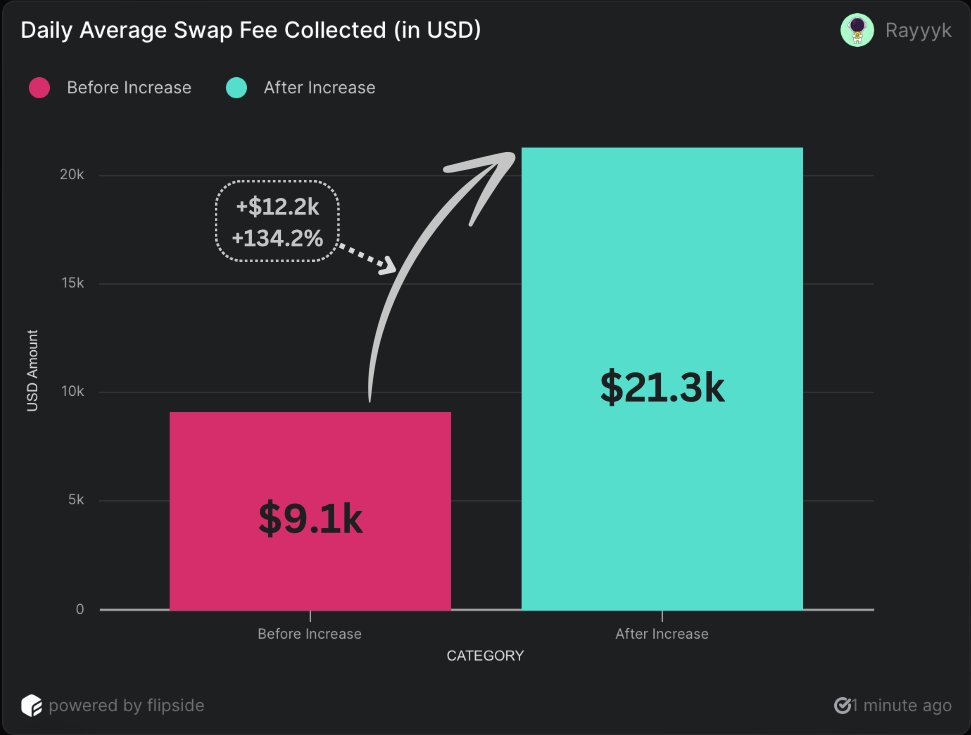

In a submit on X, one analyst famous that THORChain has almost doubled its income prior to now two days following the group’s choice to extend the minimal swap charge on the DEX.

Lately, THORChain node operators authorized and carried out a proposal to extend the swap charge for layer-1 native exchanges to 0.05%. The seemingly minor change, the analyst notes, has profoundly impacted THORChain’s protocol, rising every day income by almost 100%.

Curiously, the analyst famous that whereas charge increments in protocol are inclined to affect person expertise negatively, it had the alternative impact on THORChain. Whereas the swap charge rose, customers weren’t deterred. As an alternative, swap quantity steadied whereas the common charge from each transaction surged.

As transaction charges rise, weekly liquidity charges on THORChain now exceed block reward, a significant milestone for the DEX. Notably, the numerous shift in income era would additional drive the RUNE burning price as soon as ADR 17, a group proposal, is carried out within the coming days.

The extra RUNE is taken out of circulation, the scarcer the token turns into, lifting costs increased. As soon as ADR 17 is carried out, the protocol will purchase and burn $1 price of RUNE for each $10,000 income generated. Because of this, rising income because of the swap charge improve means extra RUNE can be torched.

Influence Of RUNEPool On Liquidity: Will RUNE Break $5?

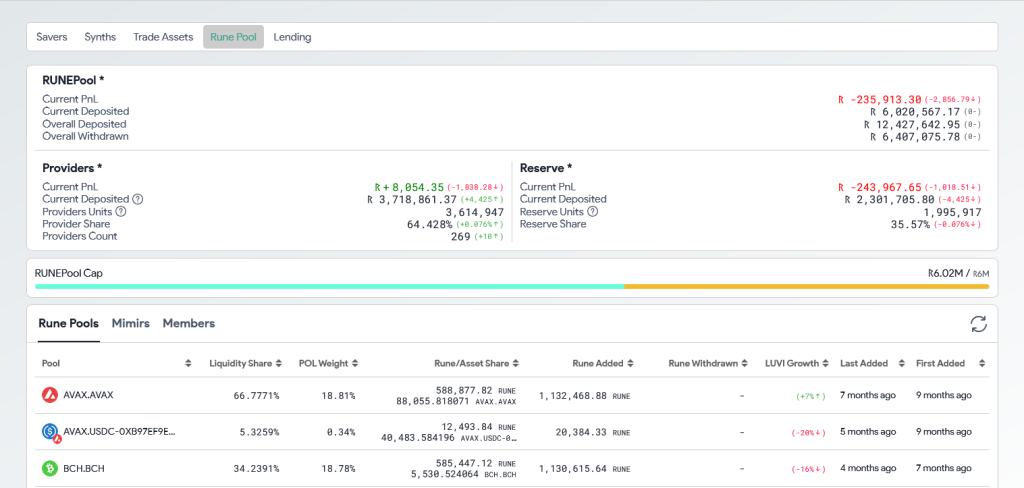

In late July, THORChain additionally launched RUNEPool to assist additional incentivize liquidity provision. Customers can freely deposit their RUNE through THORSwap and THORWallet interfaces right into a pool of diversified tokens by way of this function.

On this method, they assist scale back the dangers of impermanent loss whereas rising liquidity. As of August 9, over 3.7 million RUNE have been deposited by 265 liquidity suppliers into the RUNEPool.

Regardless of these adjustments, RUNE stays beneath immense promoting stress, though it’s regular at press time. Following the bear breakout in early August, pushing costs beneath July lows, the token has struggled. Nonetheless, if there’s a restoration from spot charges to above July highs of round $5, the coin may surge to over $7.5.