In a latest evaluation, James Coutts, Chief Crypto Analyst at Realvision, signaled a possible bullish flip in Bitcoin’s close to future, attributing the forecasted change to shifts in world liquidity measures, particularly the World Cash Provide (M2) index which is broadly seen as most necessary value catalyst. Coutts detailed this anticipation in a thread on X, the place he examined the connection between main financial indicators and Bitcoin’s value cycles.

World Cash Provide And Its Correlation With Bitcoin

Coutts’ evaluation begins with the M2 cash aggregates, which consist of money, checking deposits, and simply convertible close to cash. He tracks these aggregates throughout the 12 largest economies, all adjusted to USD. This measure, he suggests, is central to understanding liquidity flows throughout the world fiat, credit-based monetary system. In response to Coutts, “The cash inventory usually strikes in a single course, with important drops like these seen in 2022 being uncommon and usually transient.”

Associated Studying

At the moment, the World M2 is impartial, however Coutts predicts imminent adjustments: “There’s a sea of purple throughout my macro & liquidity dashboard, however indicators are rising that that is about to alter. World M2 holds the important thing for the following leg of the cycle on account of its excessive correlation with $BTC bull cycles.”

The speed of change in M2 cash provide is extra crucial than its nominal worth. Coutts famous, “The chart confirms what our MSI efficiency desk suggests: Bitcoin normally strikes with shifts in M2 momentum.” He defined that regardless of the worldwide cash provide MSI indicator being in an uptrend, the momentum stays sluggish, sustaining a Impartial MSI. For a shift to a bullish MSI sign, a rise in momentum is critical, requiring a mixture of greenback depreciation, credit score enlargement, and elevated authorities debt issuance.

Coutts identified the essential function of credit score circumstances, as evidenced by company bond spreads (BBB/Baa) in comparison with the US 10-year Treasury yield, which have traditionally aligned with important inflections in Bitcoin’s cycle. “These spreads are at the moment narrowing, indicating that companies are managing to difficulty and roll over debt regardless of the excessive rates of interest ensuing from the report hikes in 2022 and 2023,” he noticed.

Associated Studying

Utilizing the chameleon pattern indicator on the company unfold index, Coutts suggests a technique: “Lengthy Bitcoin when the index exhibits a bearish pattern (purple) and keep alert for potential pattern reversals (turning inexperienced).”

The Position Of the Greenback And Future Outlook

A key to this cycle, in line with Coutts, is the habits of the DXY (Greenback Index), which measures the US greenback in opposition to a basket of foreign currency echange. “The Greenback is range-bound. A break under 101 can be rocket gasoline for Bitcoin,” he asserted, emphasizing that market sentiment on liquidity is commonly mirrored in real-time by DXY actions.

Coutts additionally touched upon the US debt state of affairs, suggesting that with out a conservative shift in Congress advocating for fiscal accountability, extra deficit spending is probably going on the horizon, which might additional affect liquidity circumstances favorable to Bitcoin.

Coutts concluded with a observe of warning blended with optimism: “Whereas my framework wants 2/3 MSI indicators to show Bullish for macro headwinds to show into tailwinds, Bitcoin value motion will most likely sniff out this inflection within the macro earlier than most indicators react.”

His evaluation means that if Bitcoin breaks above its all-time highs, it will be unwise to wager in opposition to it, anticipating potential climbs in the direction of $150,000 on this cycle. “The DXY holds the important thing to the Bitcoin cycle because it costs in mkt expectations on liquidity in actual time. And liquidity is coming. Watch the 101/102 degree on DXY If that breaks, then we should always see ~$150k btc this cycle,” he remarked.

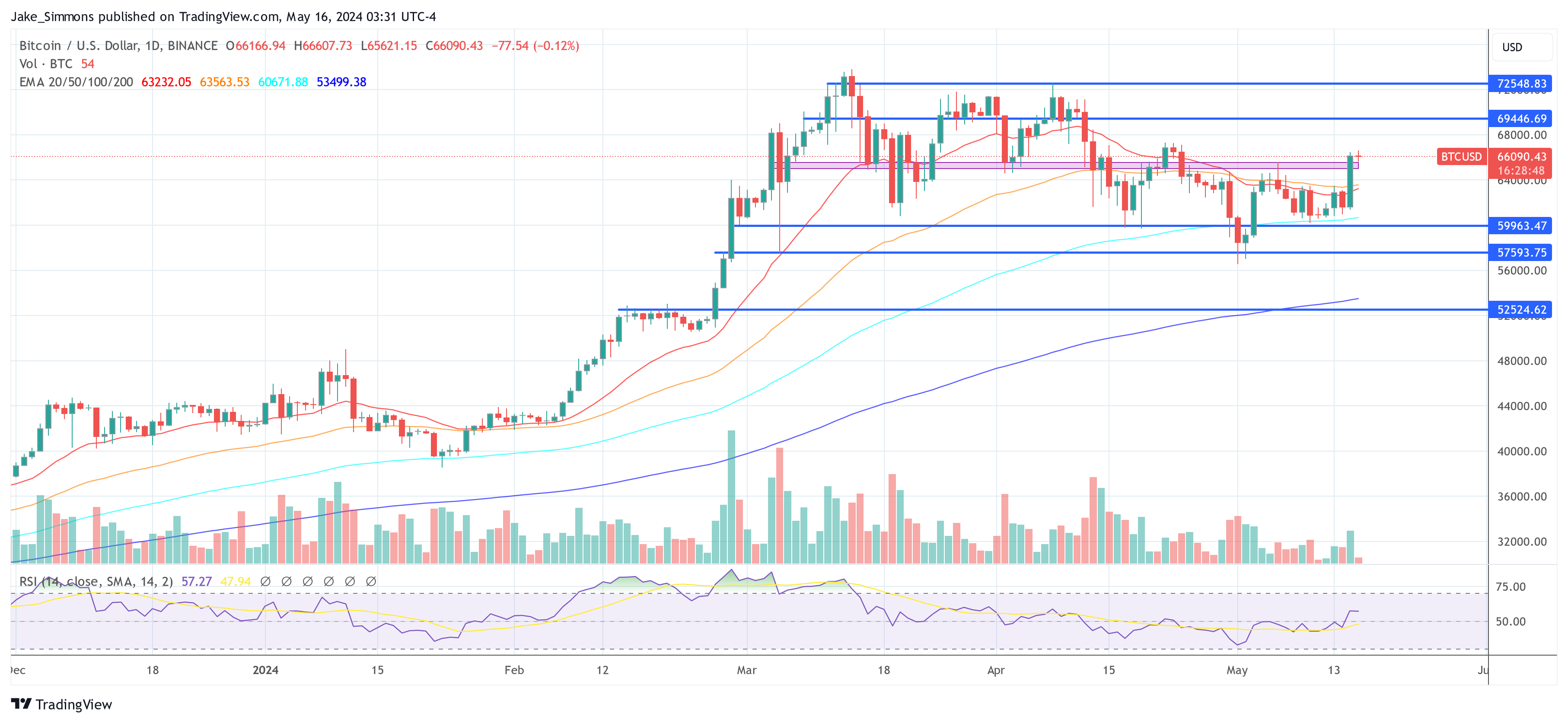

At press time, BTC traded at $66,090.

Featured picture created with DALL·E, chart from TradingView.com