The best way to Earn Bitcoins By means of Mining: A Fast Information

Beneath, we’ll discover modifications in cryptocurrency mining, Bitcoin’s prospects, and the components driving this bull run. In the event you’re keen to start out mining straight away, right here’s a step-by-step information.

Right here’s what you’ll want to do to configure your GPU for mining and, if wanted, convert the mined cash into bitcoins:

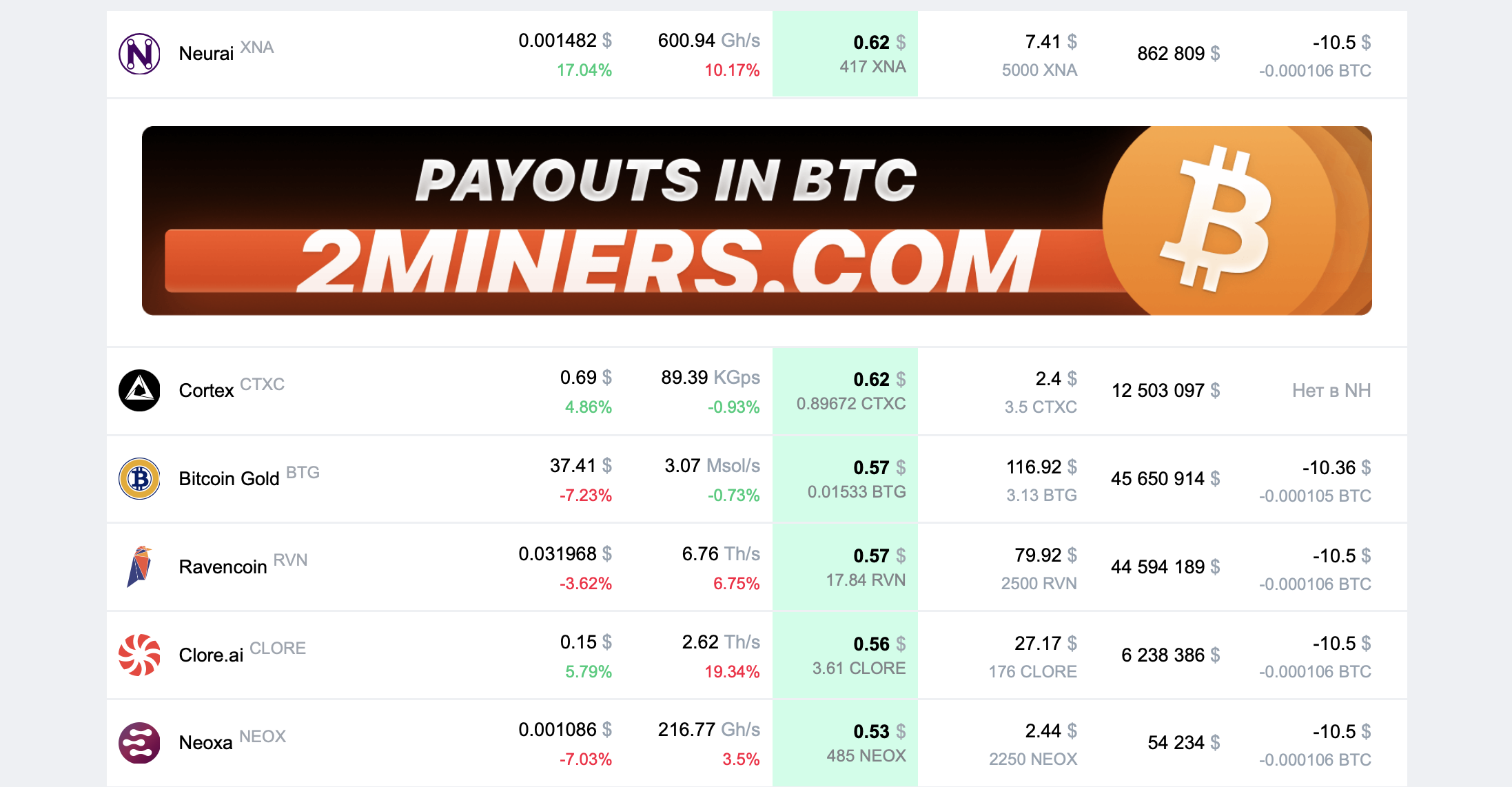

Go to a mining profitability calculator and enter your GPU mannequin—for instance, Nvidia GeForce RTX 3070. Choose your GPU to view an inventory of essentially the most worthwhile cryptocurrencies to mine.

As an example, Naurai XNA mining generates about $0.62 day by day (excluding electrical energy prices). What’s subsequent?

- Open the Naurai XNA mining assist web page.

- Create a pockets utilizing the offered hyperlinks. In the event you choose, use an handle from a cryptocurrency alternate.

- Obtain a mining program from this archive (password: 2miners). For Nvidia GPUs, select T-Rex or GMiner; for AMD GPUs, use NBMiner or TeamRedMiner.

- Edit the .bat file to incorporate your pockets handle. If you’d like the mining pool to robotically convert your rewards into BTC and ship them to you, specify a Bitcoin handle.

- Run the miner, depart your pc operating, and revel in receiving cash over time. In the event you’ve specified a Bitcoin handle, the payouts might be in BTC.

We’ve detailed the method of incomes bitcoins by means of mining in a separate article. Test it out if you happen to’re new to mining.

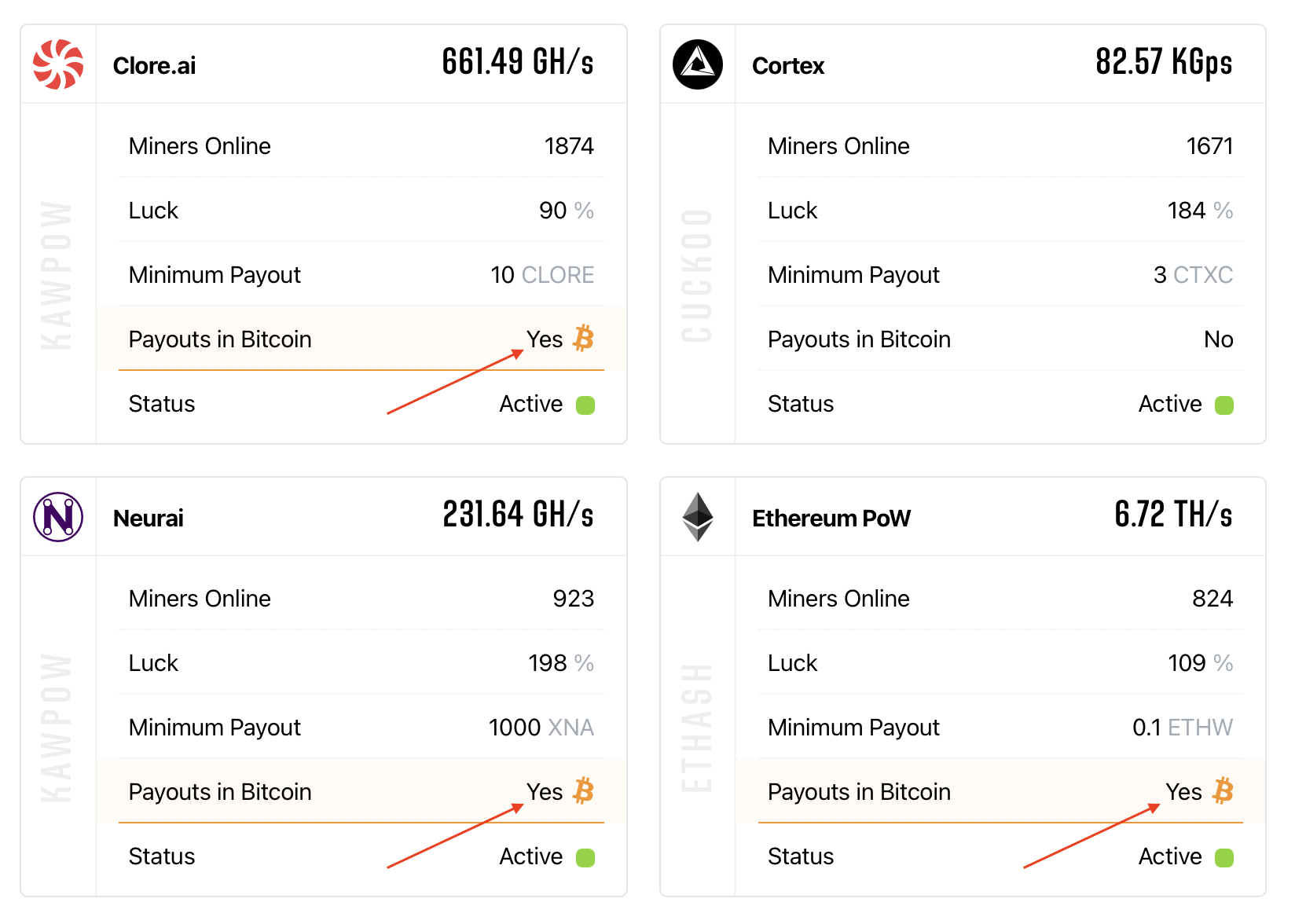

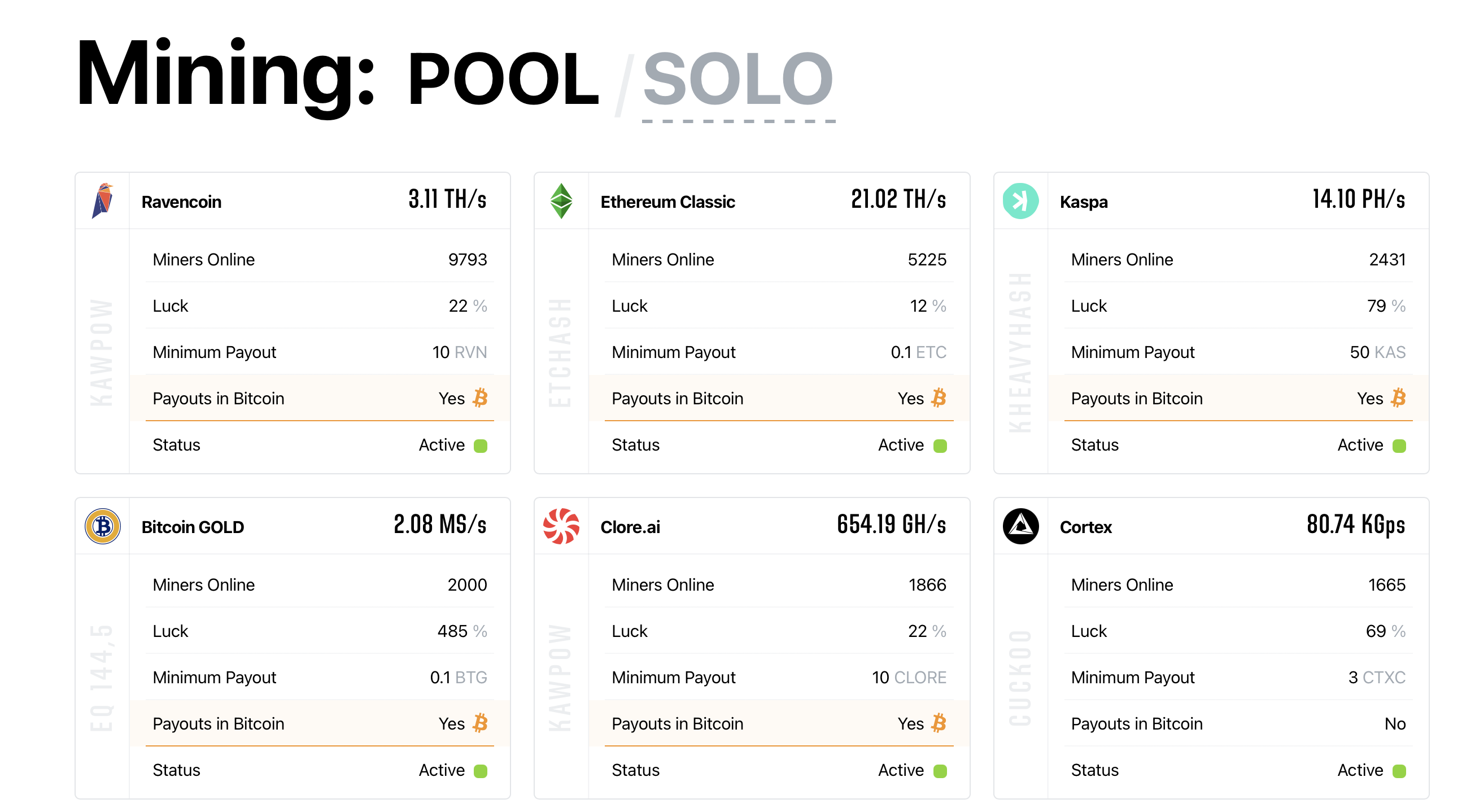

Most cash on the 2Miners pool permit BTC payouts. You possibly can examine for this characteristic on their homepage.

The best way to Begin Incomes Bitcoin and Cryptocurrency in 2025

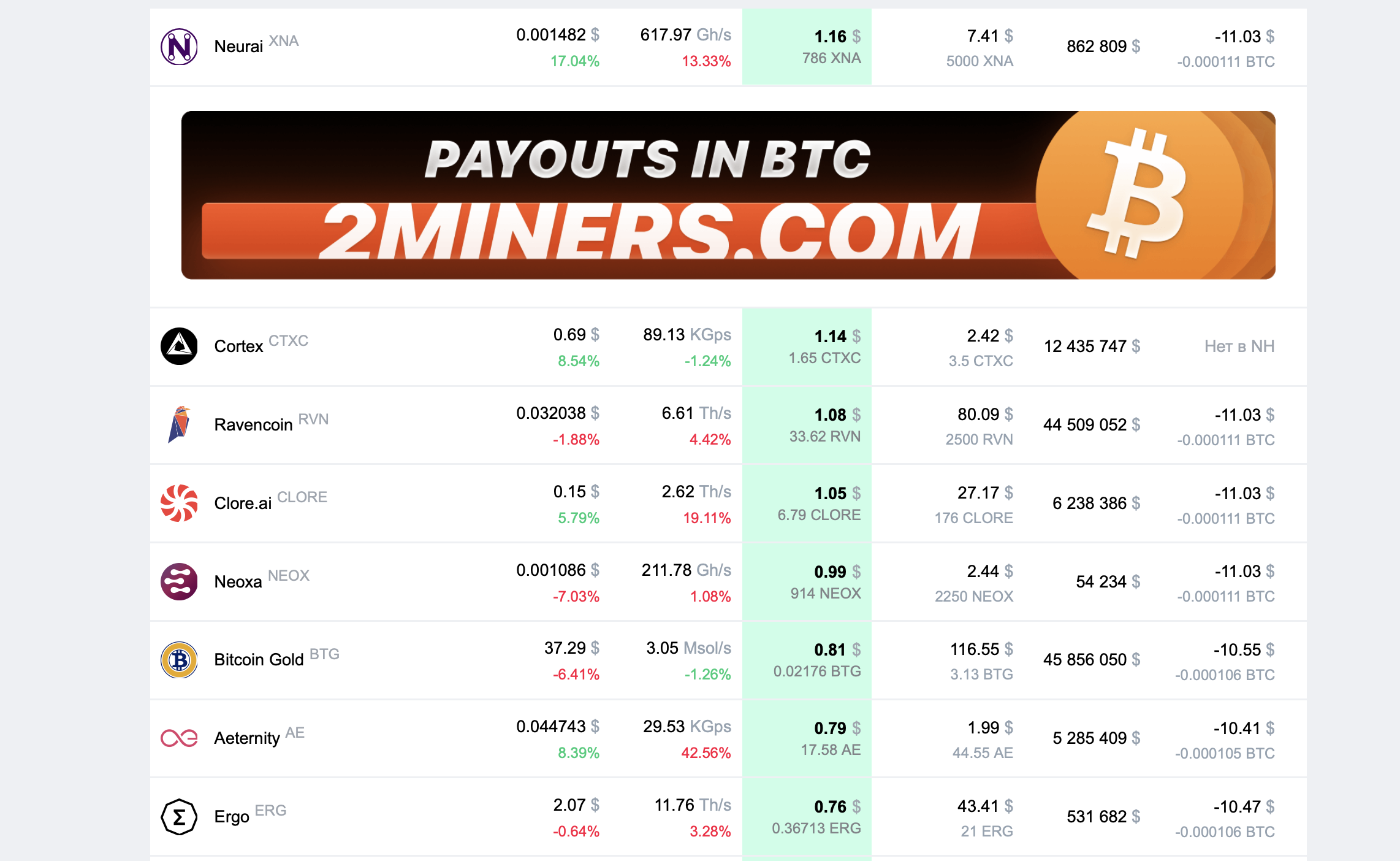

How a lot are you able to earn in {dollars} by means of mining? Use the calculator with a extra highly effective GPU, just like the Nvidia GeForce RTX 3090.

At present, this GPU earns about $1.16 day by day. After electrical energy prices (which fluctuate by location), you may count on roughly $30 month-to-month or $350 yearly.

Is that this further earnings worthwhile? Positively. Can Bitcoin or different cash develop by tens or a whole bunch of % in months? Completely.

Begin mining now to capitalize on the bull run. Bear in mind, the bull market gained’t final endlessly, so your GPU gained’t must run for a complete 12 months.

Now, let’s dive into the small print.

What’s Modified in Cryptocurrency Mining Over the Years?

Ethereum used to dominate mining as a result of its accessibility with GPUs as a substitute of noisy, specialised ASICs. Nevertheless, in September 2022, Ethereum transitioned to a Proof-of-Stake (PoS) consensus algorithm, eliminating GPU mining.

Validators now safe the community by locking 32 ETH in a deposit contract, operating validator shoppers, and performing duties beforehand dealt with by miners. Customers may also be a part of staking swimming pools with smaller quantities of ETH.

This shift left tens of millions of GPUs unemployed, prompting their homeowners to mine different cryptocurrencies, considerably decreasing profitability.

Regardless of these challenges, mining has developed, with new Proof-of-Work (PoW) initiatives rising. These cash are traded on exchanges, making it simple to transform mining rewards into on a regular basis necessities.

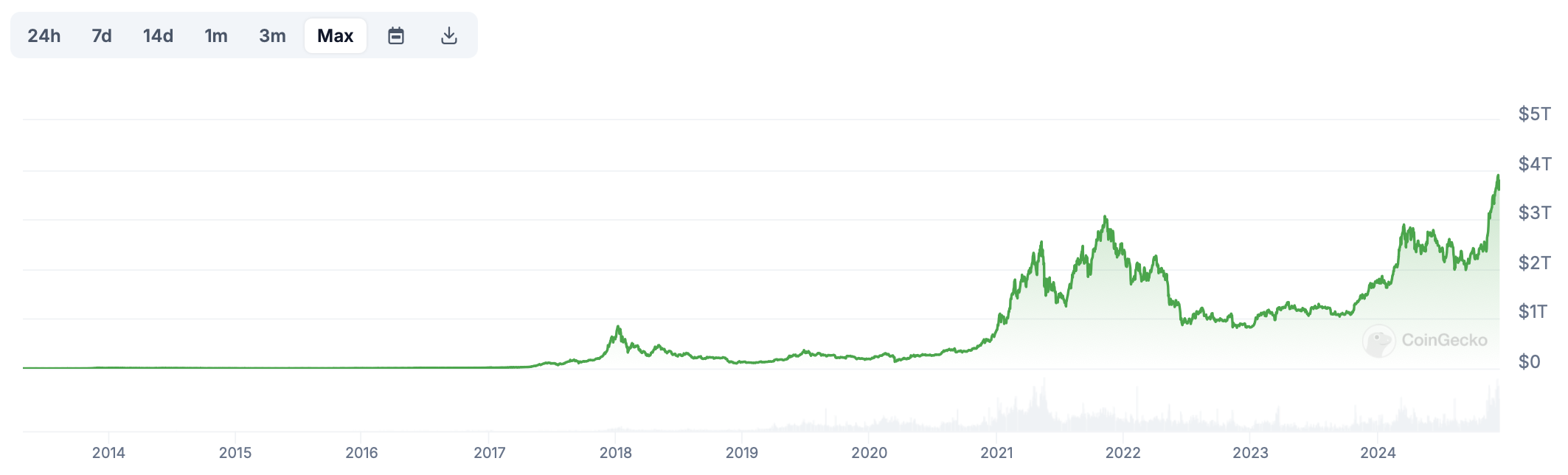

Cryptocurrencies at the moment are experiencing fast development, attracting new buyers. As an example, the crypto market capitalization has surpassed earlier all-time highs from 2021 and continues to climb.

What Can Bitcoin’s Peak Worth Be This Cycle?

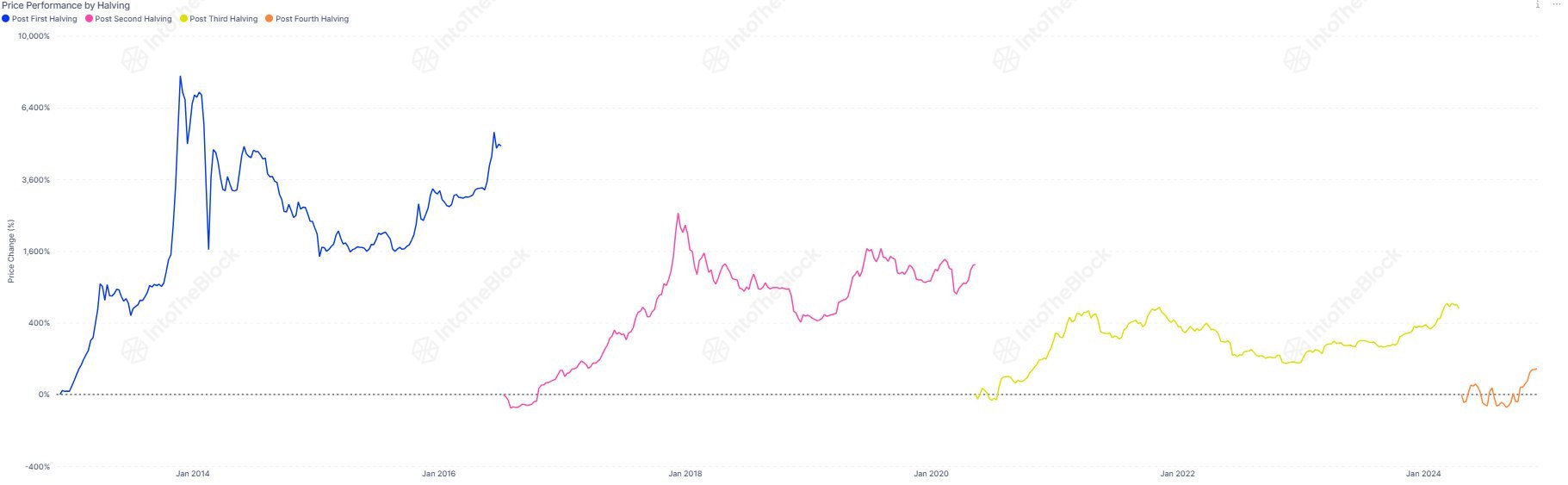

Analysts at IntoTheBlock studied Bitcoin’s previous efficiency, analyzing development after halving occasions (block reward reductions occurring each 4 years):

- 2013 cycle: Bitcoin grew by 7,900%.

- 2017 cycle: Bitcoin surged by 2,560%.

- 2021 cycle: Bitcoin rose by 594%.

With every cycle, Bitcoin’s development fee decreases as a result of its rising market capitalization, now at $1.9 trillion. IntoTheBlock analysts predict BTC might rise 100–200% from its April 2024 halving value, probably reaching $130,000–$190,000 this bull run.

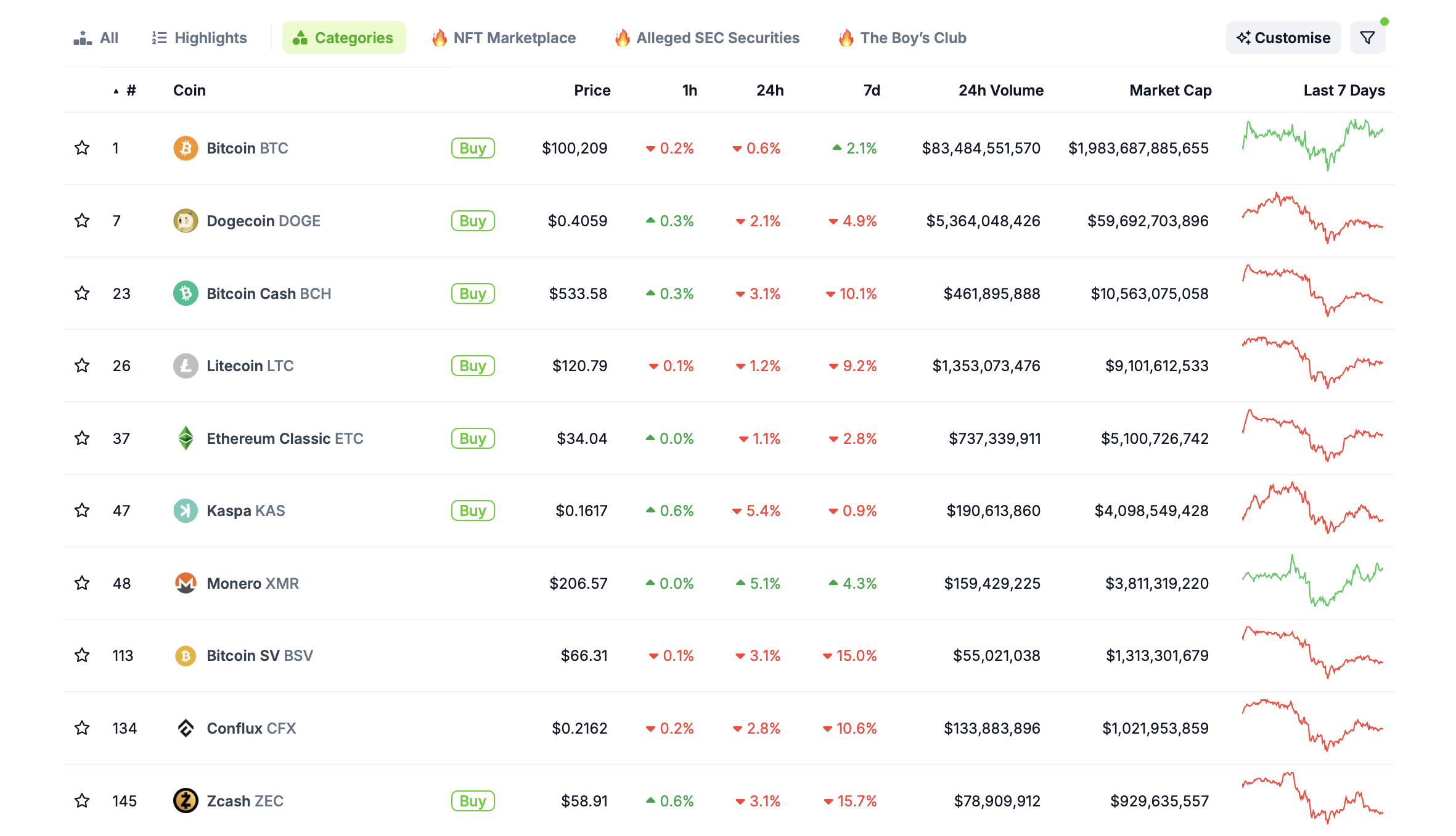

Which Cash Can You Mine in 2025?

There are many PoW cash to mine. Right here’s an inventory of standard choices with important market caps, led by Bitcoin.

Their mixed market capitalization is $2.08 trillion, with a day by day buying and selling quantity of $92 billion.

On the 2Miners pool, favorites embrace Ravencoin, Ethereum Traditional, Kaspa, Clore, Cortex, and others. For profitability, use the 2CryptoCalc software.

Ravencoin surged 44% in a month, ETC rose 56%, Clore jumped 43%, and Cortex delivered 239% month-to-month development. In the meantime, Kaspa (KAS) noticed its value multiply by 11x inside 18 months.

Precisely a 12 months and a half in the past — June 6, 2023 — 1 KAS was value simply 1.4 cents. Immediately, the coin is valued at $0.16, marking an elevenfold enhance. And that’s removed from the cryptocurrency’s all-time excessive.

Skilled gamers would possibly nicely maintain onto their mined altcoins and promote them later. Sudden spikes in coin values should not unusual within the crypto business.

Why mining nonetheless is smart

Some individuals would possibly assume it’s already too late to get entangled with cash, believing their first buy will inevitably set off a market crash and even usher in a bearish development in crypto.

Nevertheless, that’s not fully true, as there are loads of causes to count on the bull run to proceed.

Right here they’re:

- Donald Trump gained the U.S. presidential election. Throughout his marketing campaign, he expressed help for the crypto business and promised to implement cheap rules for digital belongings within the nation. This may be unprecedented in America, main buyers to anticipate additional international adoption of cryptocurrencies.

- The management of the Securities and Alternate Fee (SEC) is ready to alter. The brand new chairman might be Paul Atkins, recognized for his favorable stance towards cryptocurrencies. It’s cheap to imagine that the SEC will put an finish to the pointless lawsuits in opposition to quite a few blockchain corporations which have plagued the business in recent times.

- Earlier it was introduced that Trump has chosen a candidate for the place overseeing AI and cryptocurrency coverage. The position might be stuffed by former PayPal COO David Sacks, who will deal with growing the nation’s cryptocurrency regulatory framework.

- There’s ongoing dialogue within the U.S. and different nations about creating nationwide Bitcoin reserves. For instance, a invoice proposed by Senator Cynthia Lummis suggests buying a million BTC to be held for no less than 20 years.

- MicroStrategy, led by Michael Saylor, continues to make huge investments in Bitcoin. On Monday, the corporate introduced the acquisition of 21,550 BTC value $2.1 billion. Furthermore, it plans to lift an extra $42 billion within the coming years to buy extra cash.

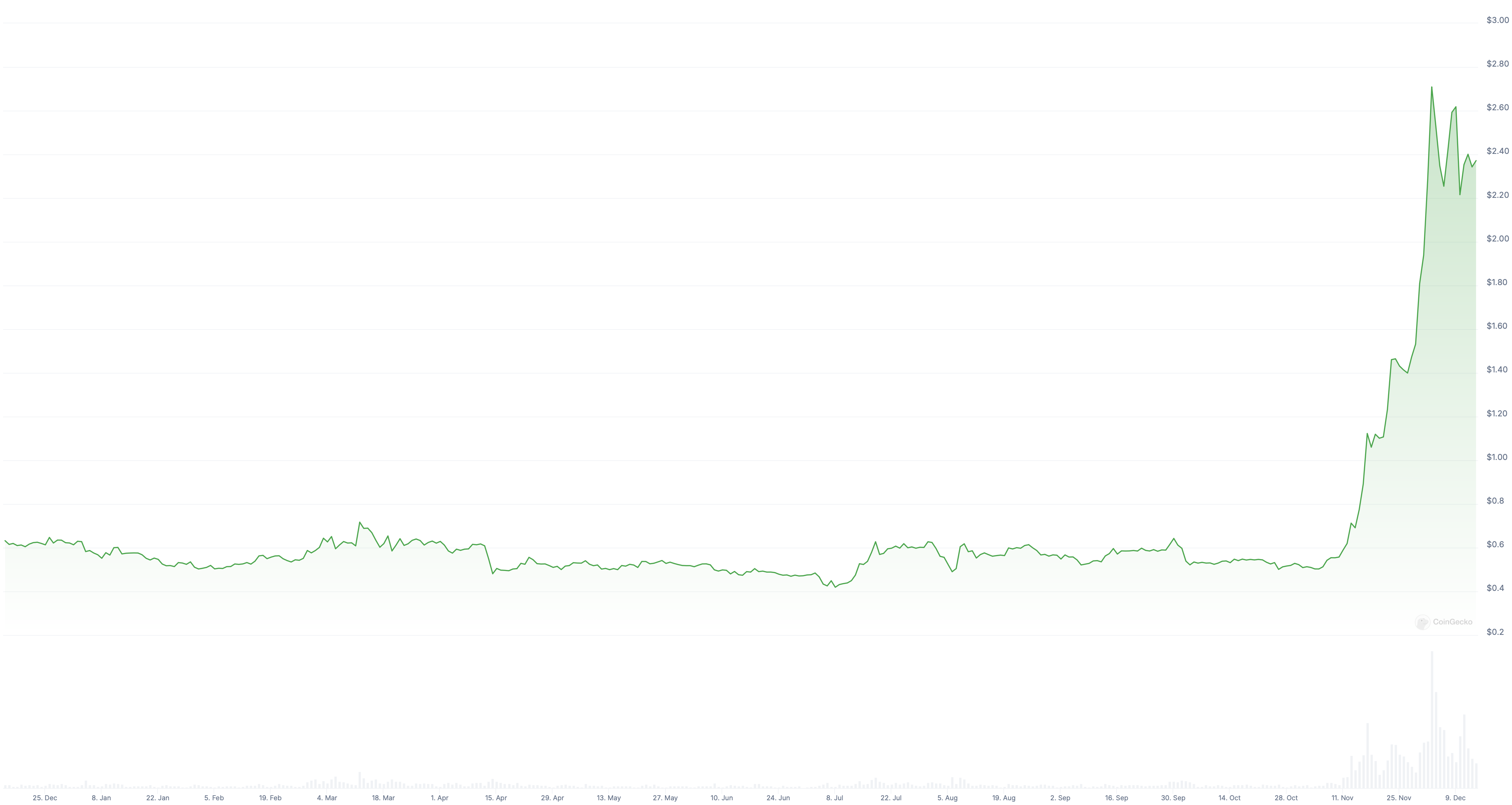

The present optimism in crypto typically results in absurd value surges. A major instance in current weeks has been XRP by Ripple.

This month alone, the coin has jumped by 251%, multiplying in worth a number of occasions. Right here’s what XRP’s chart seems like over the previous 12 months:

Accumulating Bitcoin and different cryptocurrencies beneath present circumstances looks as if a strong concept.

Ought to You Convert Mining Rewards to Bitcoin?

Some crypto buyers are hesitant to have interaction with altcoins — that’s, any cash aside from Bitcoin. Whereas altcoins usually supply increased returns, this cautious method is comprehensible.

First, altcoins are inclined to have higher volatility, which means their costs fluctuate far more often — together with downward. This makes them extra unpredictable. New buyers are unlikely to be ready for such swings, so beginning their crypto journey with Bitcoin is an affordable alternative.

Second, long-term investments in altcoins are riskier than these in Bitcoin. Many altcoin initiatives fail to outlive market downturns or so-called bear tendencies. They lose investor curiosity, see buying and selling volumes drop to mere a whole bunch of hundreds of {dollars}, and ultimately, the coin might develop into irrelevant.

Is mining nonetheless worthwhile in 2025

A option to mitigate this danger is thru the distinctive characteristic of the 2Miners mining pool: Bitcoin payouts. As talked about earlier, rewards earned in different cash might be robotically transformed to BTC and despatched to the designated pockets handle.

Nevertheless, when you’ve got expertise investing in numerous cryptocurrencies and the talent to promote them at pre-determined value ranges, mining altcoins can nonetheless be a viable choice.

Conclusion: Why Mining is Price Making an attempt

A bull run is one of the best time for cryptocurrency mining. Coin costs are actively rising, mining generates no losses, and it even lets you accumulate cash. These cash, in flip, might be robotically transformed into Bitcoin.

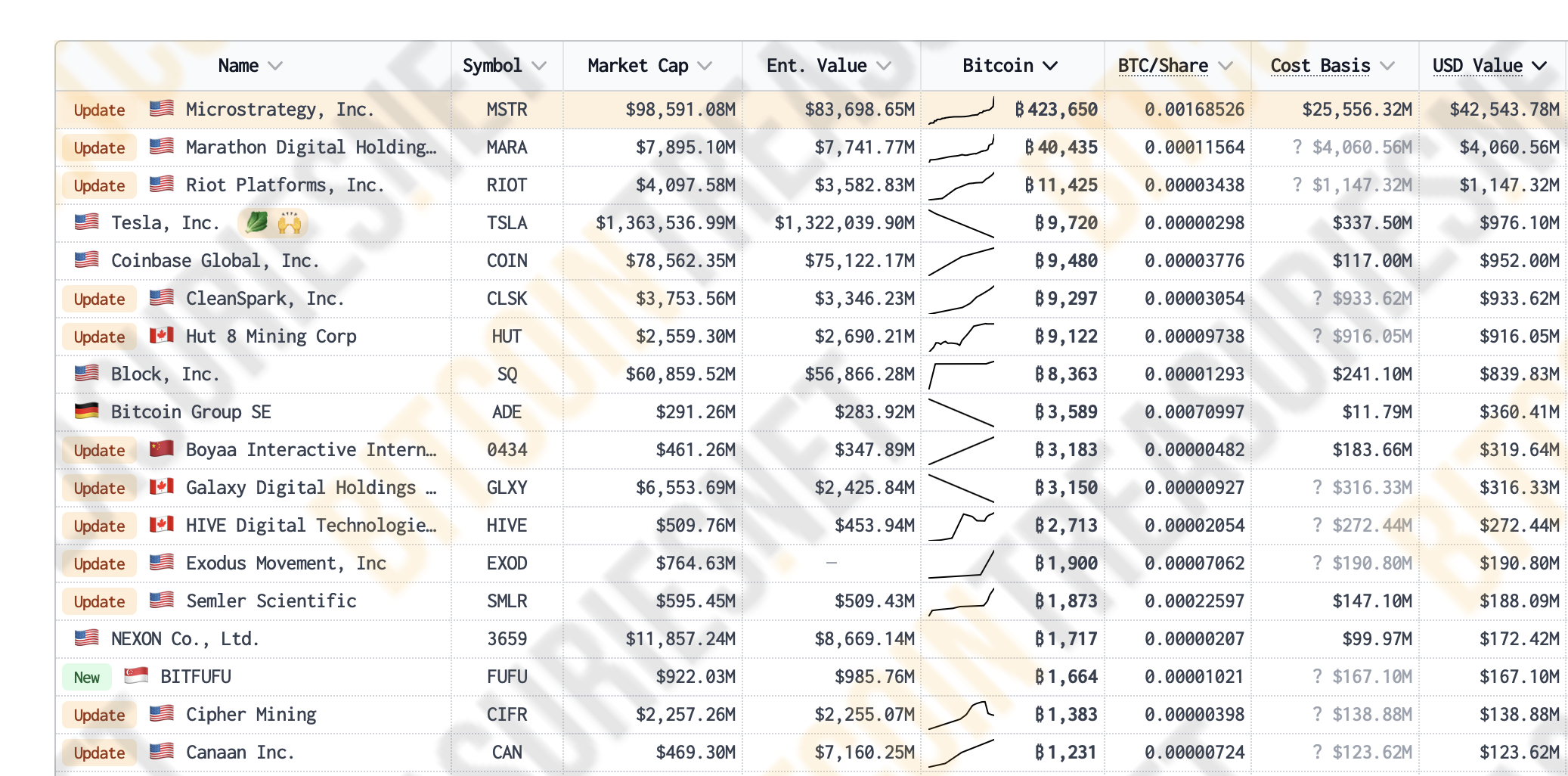

A major success story is MicroStrategy. The corporate invested $25.5 billion in its 423,650 BTC holdings so far, and their worth has now grown to $42.5 billion. This implies unrealized earnings of almost $17 billion, making the dangers of a novice mining new cash appear negligible in comparison with MicroStrategy’s daring technique.

Furthermore, mining is comparatively easy and gained’t burn out your GPU. As a bonus, you’ll obtain a gentle stream of Bitcoin, which might be safely held for a number of years with out worry.

As at all times, we stay dedicated to supporting your mining actions. Keep up to date by means of our X (Twitter) and Telegram miner neighborhood. Comfortable mining!