Miners characterize the muse of the Bitcoin market. Their habits is likely one of the finest indicators of market well being and can be utilized as a gauge for market sentiment.

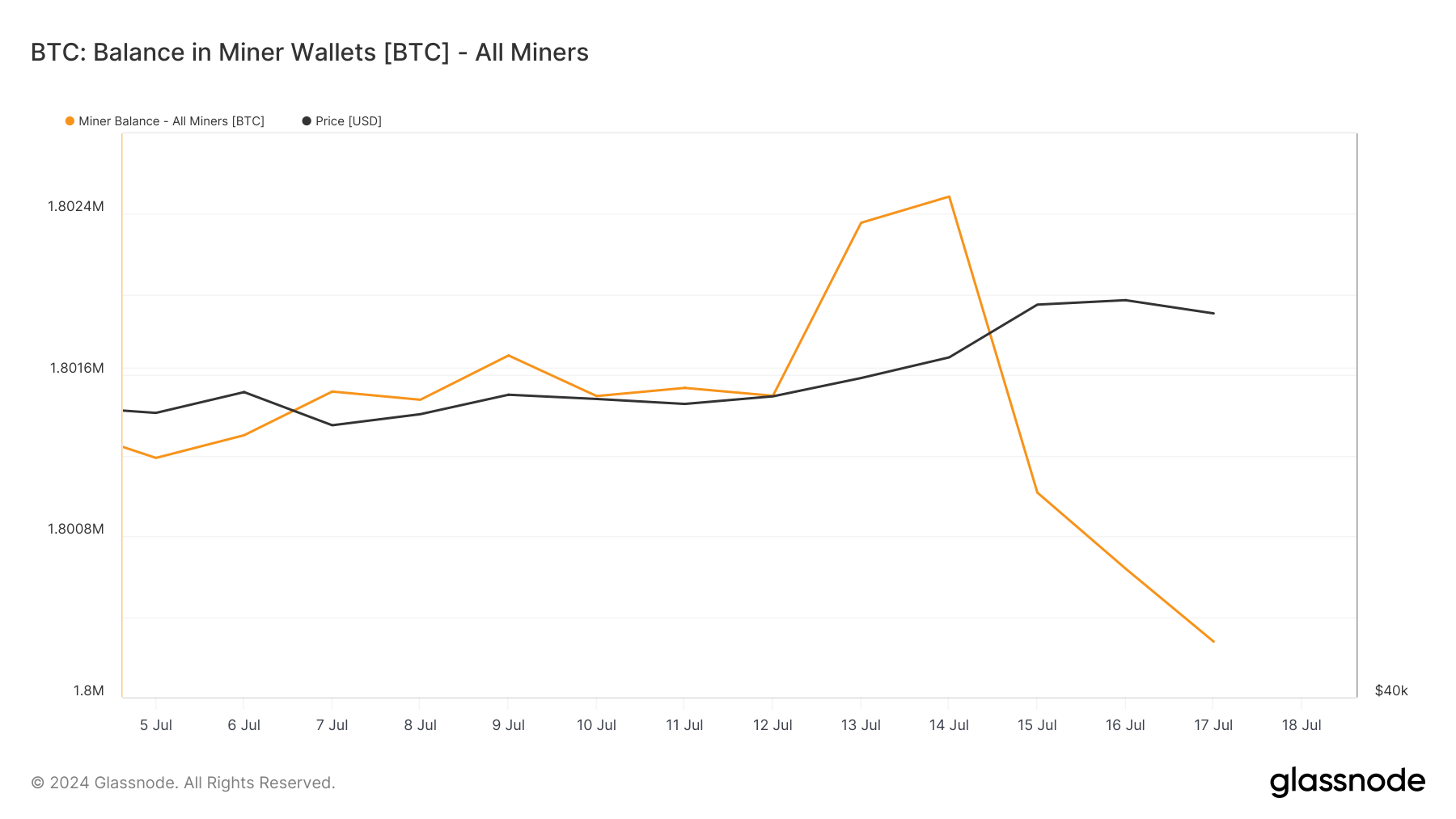

Miner balances replicate the whole quantity of BTC held by miners. They function one of many main indicators of promoting strain since they’re frequent sellers because of the must cowl operational prices.

Nevertheless, miners are additionally in a race to remain as worthwhile as attainable, so that they often don’t promote or distribute their holdings if Bitcoin’s value is just too low. When miners maintain onto their BTC, it may be an indication of confidence in future value will increase. Conversely, when miners promote, it signifies they’re taking income whereas costs are excessive sufficient or that they could count on a value decline.

Up to now week, miner balances decreased by round 1,260 BTC. This discount continues the long-term pattern of lowering miner balances, which have been dropping since October 2023. Present miner balances have reached ranges not seen since April 2019. And whereas the lower we’ve seen over the previous week isn’t alarming, it displays a broader sample of miners progressively lowering their holdings.

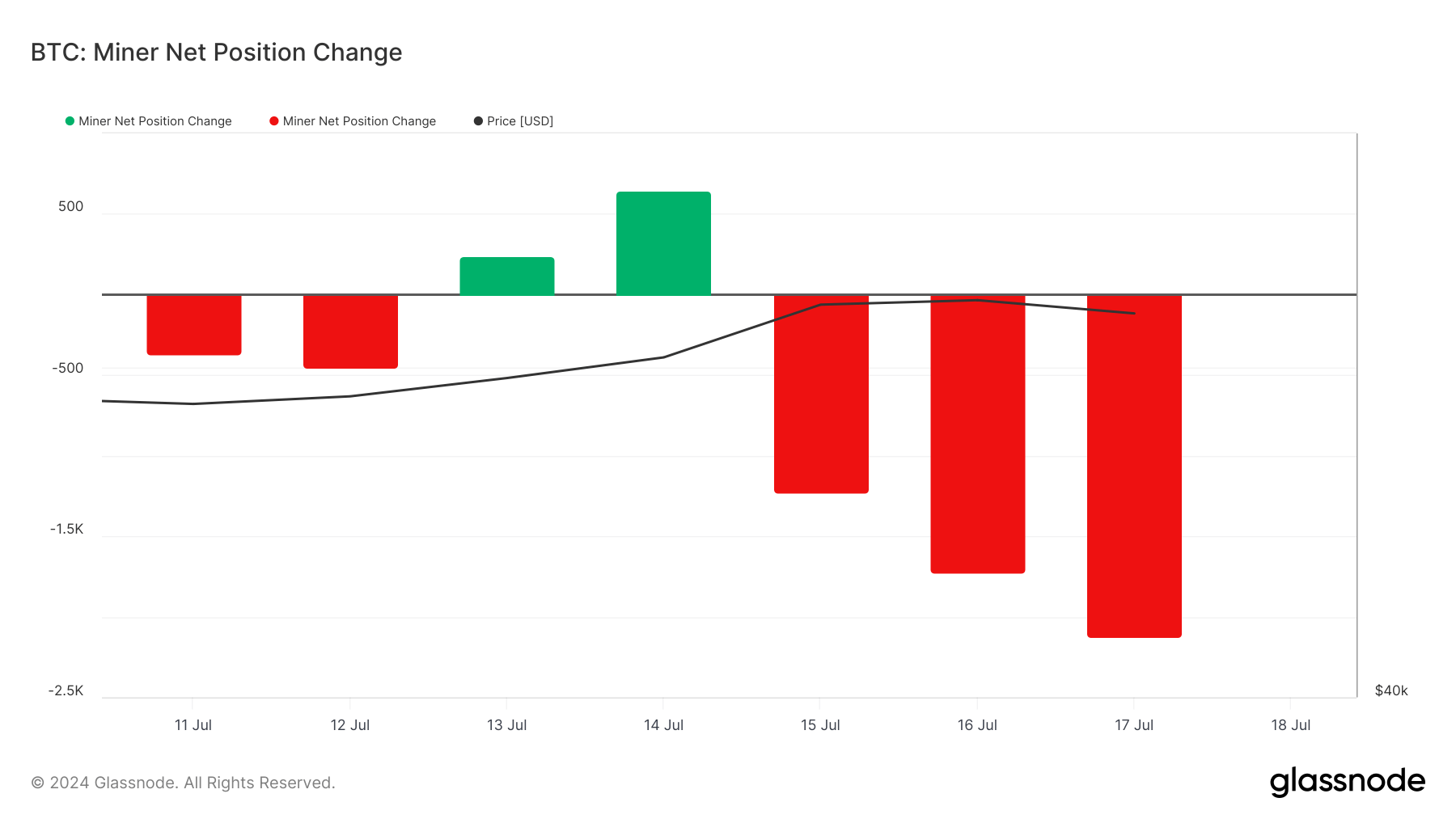

Wanting on the miner internet place change, we see fluctuations over the previous week. Breaking the three-month-long pattern of internet outflows, July 13 and July 14 noticed internet inflows of 241 BTC and 645 BTC, respectively, exhibiting momentary accumulation.

This was adopted by vital internet outflows that lasted till July 17, when miners offered 2,126 BTC. The sharp improve in promoting lately correlates with a notable rise in Bitcoin’s value, peaking at $65,172 on July 16 earlier than barely dropping to $64,120 the following day.

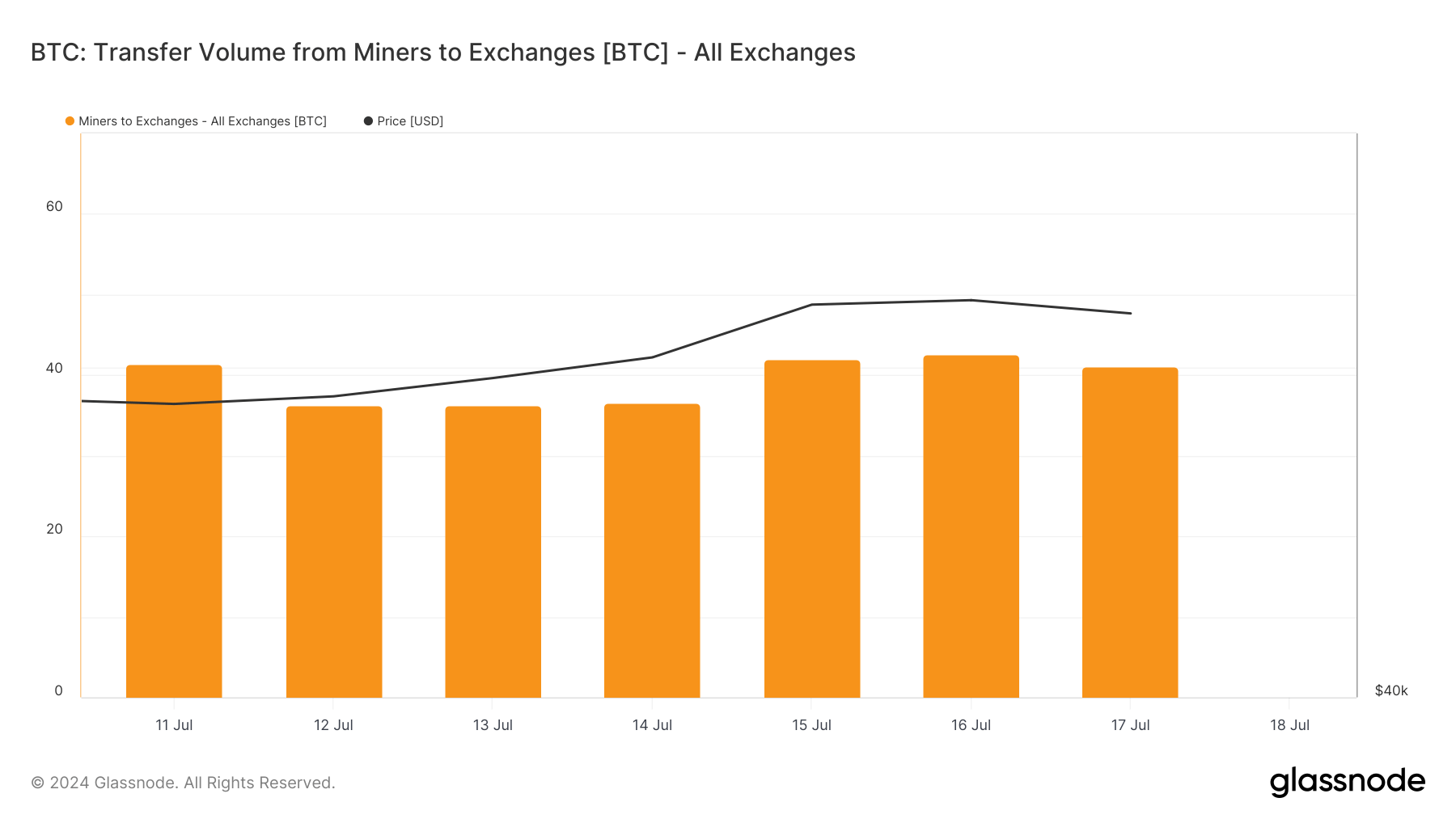

The switch quantity from miners to exchanges remained comparatively steady, starting from 36 BTC to 42 BTC each day. This stability means that miners aren’t considerably growing their direct gross sales to exchanges, whilst their general outflows improve.

The very best switch quantity to exchanges previously three months was 262 BTC on June 13, indicating that current volumes are inside regular ranges. A lower in miner balances alongside comparatively low transfers to exchanges suggests miners could be promoting their Bitcoin via over-the-counter (OTC) transactions somewhat than on public exchanges.

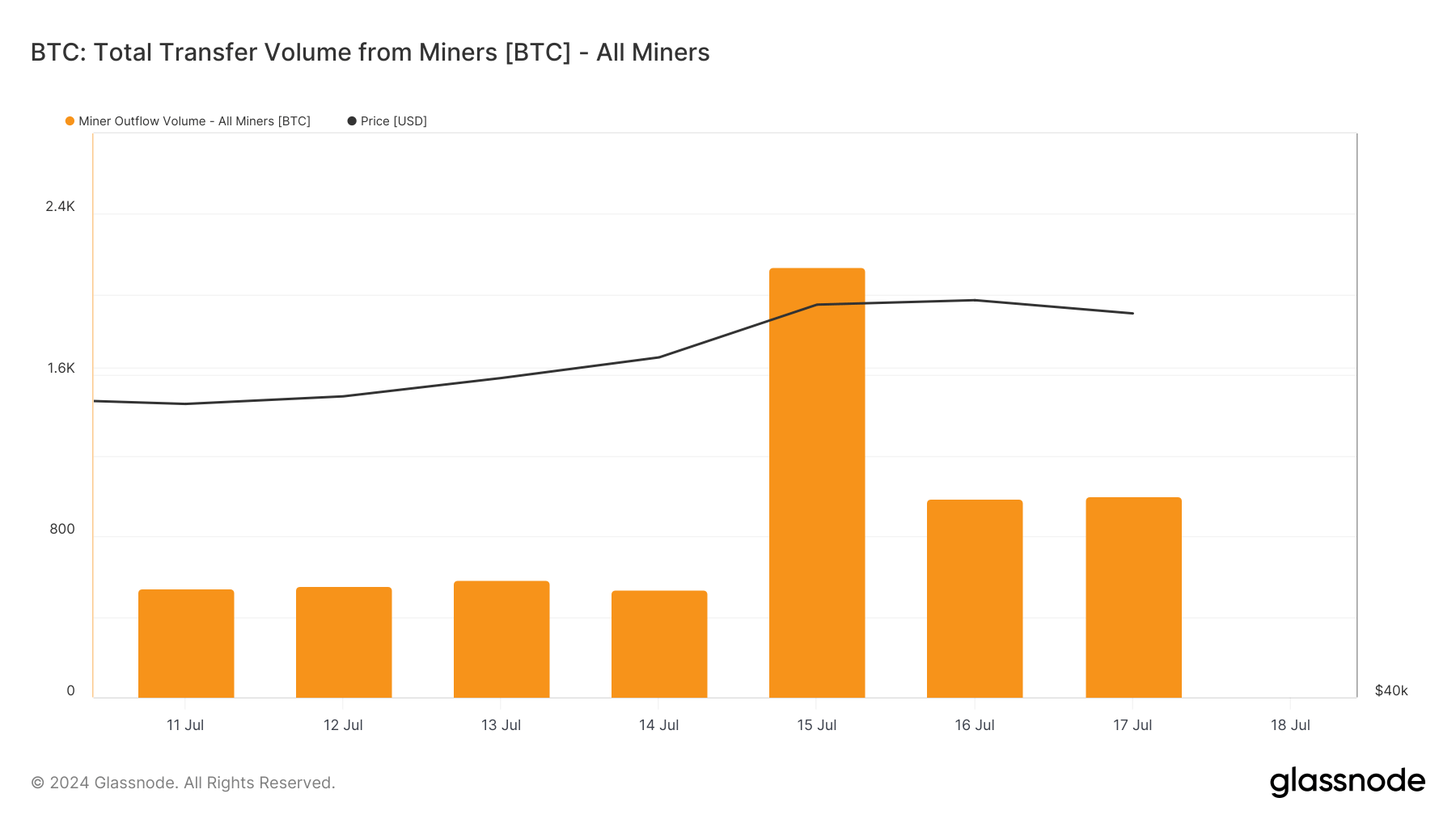

Switch volumes from miners present extra variability, with a major spike on July 15 at 2,136.10 BTC, the second highest previously 30 days. This spike aligns with a pointy value improve, exhibiting miners took benefit of upper costs to maneuver substantial quantities of BTC. The outflows of 985.60 BTC on July 16 and 1,001.63 BTC on July 17 additional affirm this pattern.

The info means that miners are lowering their general holdings to maximise their returns throughout value will increase. This strategic promoting contributes to market liquidity and might affect short-term value fluctuations.

The put up Miners scale back holdings amid rising costs appeared first on CryptoSlate.