Anticipation is at a excessive diploma because the 2024 Bitcoin Convention attracts close to, pushed not simply by technical developments but additionally by the stunning backing of an influential particular person: Donald Trump.

Associated Studying

The stunning acceptance of Bitcoin by the previous president could change the crypto scene and throw prolonged shadows over political debate and market projections. Here’s a have a look at how Trump’s potential presidency can impression the route of the crypto.

The Bitcoin Turnaround Of Trump

As soon as a powerful opponent of Bitcoin, Donald Trump has modified his language dramatically. Even suggesting Bitcoin as a potential reserve forex alongside the US greenback, his marketing campaign has aggressively embraced the digital asset. This recent zeal differs enormously from his previous posture, the place he wrote out Bitcoin as a “rip-off.”

In current discussions, the previous president has labeled Bitcoin as “digital gold.” His marketing campaign vows to spice up the digital asset’s acceptability. This may give corporations and buyers extra confidence, including extra attraction to Bitcoin.

Regulatory Change And Financial Results

Trump’s potential impression on Bitcoin is usually depending on his angle to regulation. Given JD Vance’s pro-crypto posture, Trump’s alternative of working mate suggests a probable tsunami of favorable crypto legal guidelines. Clearer guidelines and extra institutional Bitcoin funding may discover their path on this regulatory local weather.

One other essential factor for the dynamics of Bitcoin’s value is likely to be Trump’s financial plans. His platform emphasizes on decreasing inflation and enhancing financial stability—qualities that instantly affect the worth of Bitcoin.

Trump’s financial insurance policies had been blamed with a considerably constant funding surroundings over his previous presidency. Ought to he achieve success in fostering a greater financial local weather, Bitcoin would acquire from extra liquidity and investor confidence.

Conjecture And Market Responses

The marketplace for Bitcoin is pushed by hypothesis, therefore Trump’s shut relationship with the crypto asset has magnified this affect. Latest occasions, just like the tried homicide of Trump, have demonstrated how drastically market temper could reply to political modifications. After the episode, the crypto loved an enormous surge; meme cash and market temper mirrored the nice stakes of Trump’s involvement.

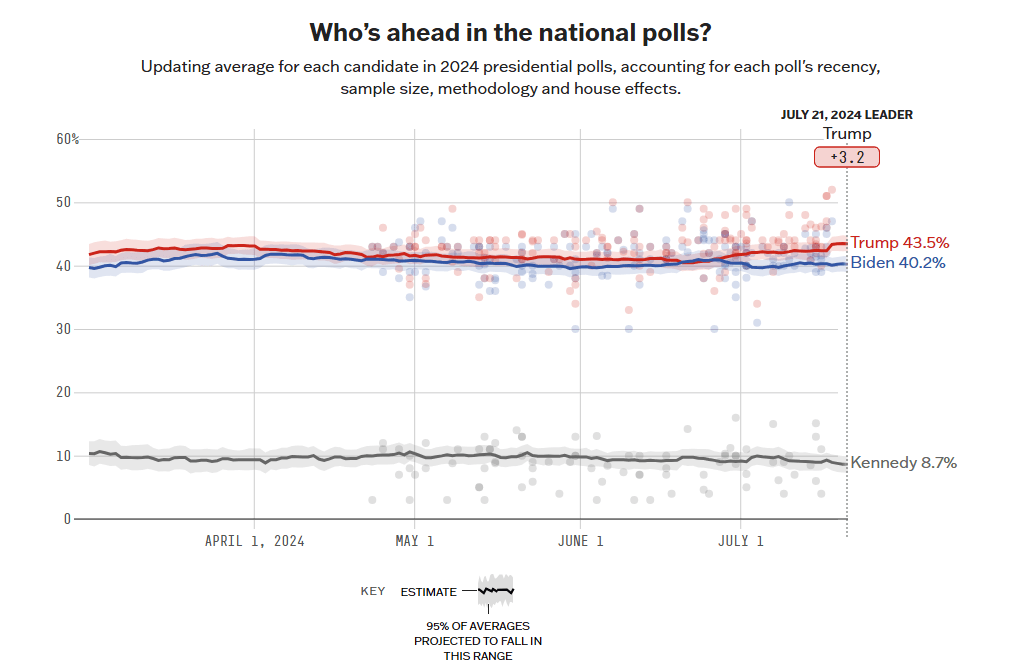

In the meantime, post-assassination try, the previous commander in chief’s rankings in opposition to Biden rose considerably (see chart under).

Trump’s erratic political path fuels much more conjecture about his potential administration. The results of the election remains to be unknown even when Kamala Harris is changing into a powerful competitor. Harris’s opinion on Bitcoin may doubtlessly have an effect on market dynamics, subsequently including even one other stage of intricacy to the way forward for the forex.

Analyses disagree on the potential impact of a Trump win on the value of Bitcoin because the election will get close to. Whereas some see a constructive pattern with Bitcoin perhaps skyrocketing above $100,000, others stay cautious anticipating firmer indications from Trump’s marketing campaign and plans.

BTC Worth Forecast

Technical indicators present Bitcoin will rise considerably within the following week. The cryptocurrency is buying and selling 33% under our month-to-month projection, predicting a comeback if market circumstances enhance. Bullish indications like a rising transferring common and a stronger Relative Energy Index (RSI) suggest BTC may rectify its undervaluation and attain the forecasted value aim.

Associated Studying

Bitcoin’s anticipated three-month rise of 536% and six-month progress of 53% exhibits investor confidence. Analysts count on a 148% progress in BTC over one yr, indicating its long-term potential. Constructive trendline breakouts and strong assist ranges again this projection. Institutional curiosity and beneficial macroeconomic situations may enhance Bitcoin’s value in the long term.

Featured picture from Getty Pictures, chart from TradingView