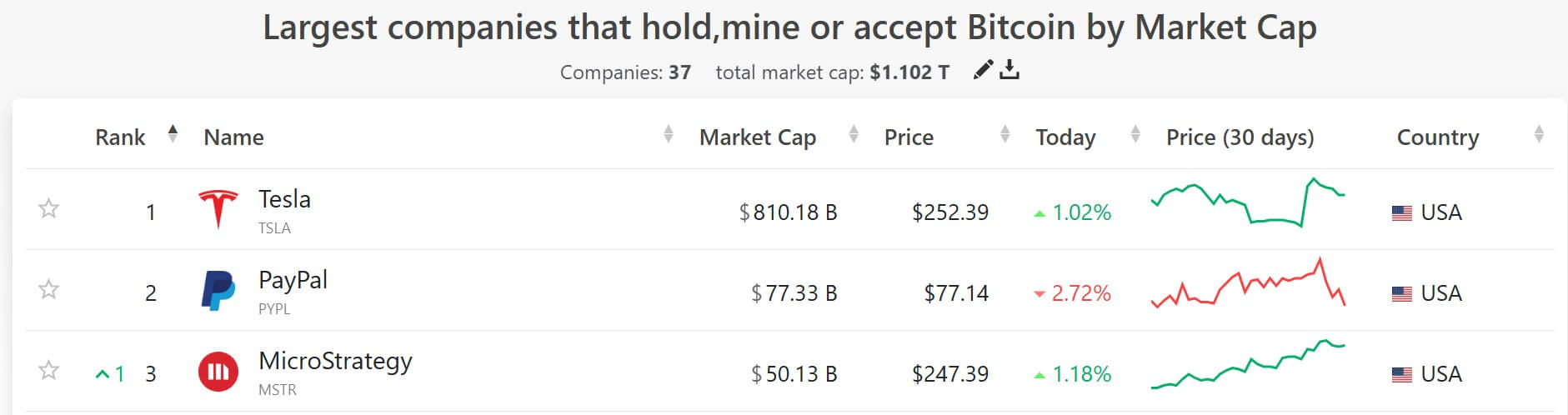

The market capitalization of MicroStrategy, the outstanding Bitcoin-focused funding agency, has now exceeded that of Coinbase, the biggest crypto trade within the US.

In keeping with information from Yahoo Finance, MicroStrategy (MSTR) is at present valued at over $50 billion, surpassing Coinbase (COIN), which stands at roughly $46.5 billion.

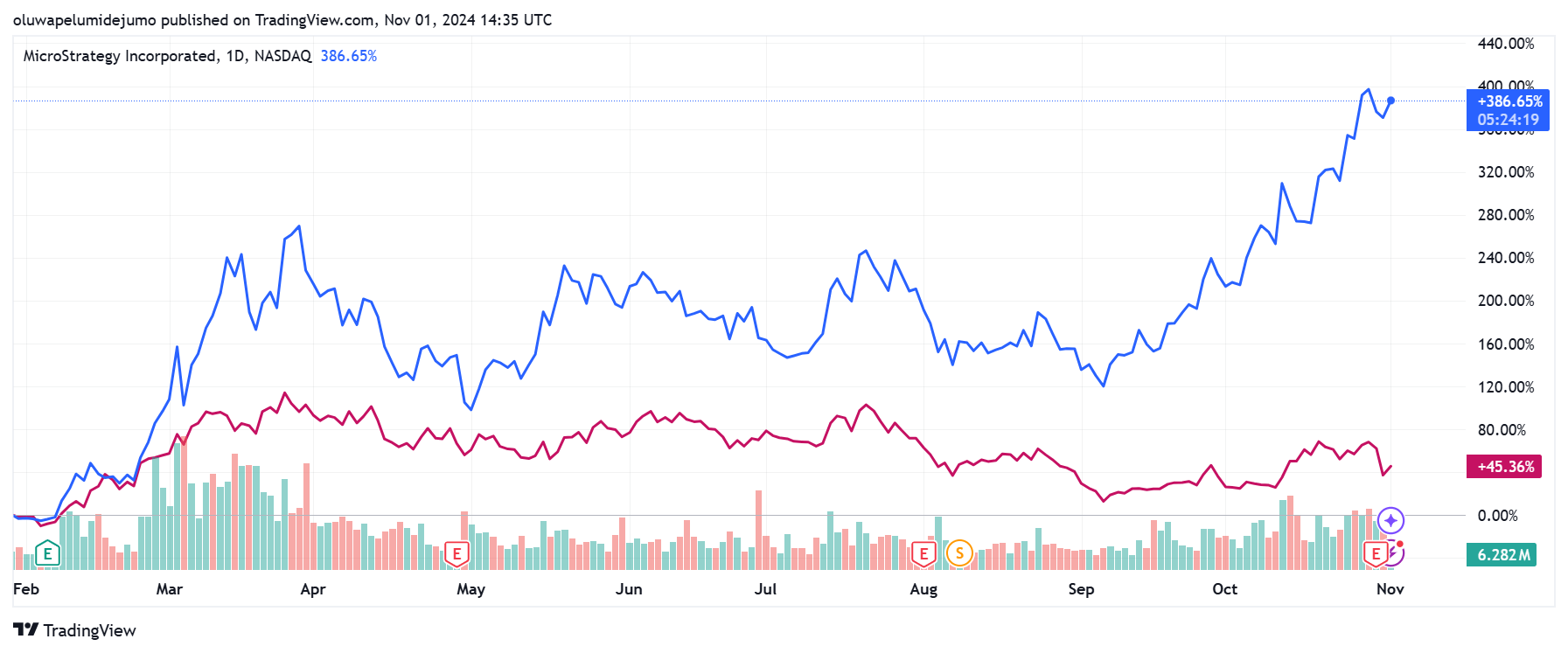

This shift is no surprise, given MicroStrategy’s inventory’s exceptional efficiency. Over the previous 12 months, shares have surged by roughly 400% to a two-decade excessive of round $250.

In distinction, Brian Armstrong-led Coinbase has risen by a strong however comparatively extra modest 40% resulting from heightened competitors in North America. The trade has lately misplaced market share to the quickly rising Crypto.com and has seen decreased buying and selling exercise because of the introduction of spot Bitcoin ETFs.

Additional, this variation displays the market’s response to the third-quarter earnings studies from each corporations. MicroStrategy introduced an bold plan to lift $42 billion to buy Bitcoin, whereas Coinbase revealed intentions for a $1 billion inventory buyback. Some crypto specialists argue that the trade ought to have invested in Bitcoin relatively than its personal shares.

Total, MicroStrategy now ranks among the many prime three corporations by market capitalization holding, mining, or accepting Bitcoin. It’s trailing solely digital automotive maker Tesla and cost large PayPal.