As Bitcoin (BTC) continues its unprecedented uptrend, surging to a brand new all-time excessive (ATH) of $72,300, software program firm MicroStrategy stays steadfast in its imaginative and prescient. It’s reaping substantial rewards from its strategic funding within the largest cryptocurrency out there.

MicroStrategy, led by famend Bitcoin supporter and former CEO Michael Saylor, not too long ago made a significant acquisition, additional solidifying its place within the digital asset market.

MicroStrategy Bitcoin Funding Pays Off

In line with a submitting with the US Securities and Change Fee (SEC), MicroStrategy acquired roughly 12,000 BTC between February 26, 2024, and March 10, 2024, for about $821.7 million in money. The common buy worth per Bitcoin was $68,400.

Moreover, MicroStrategy not too long ago accomplished an providing of convertible senior notes due 2030, elevating $800 million in funds. With this newest acquisition, MicroStrategy’s Bitcoin holdings now stand at a staggering 205,000 BTC, acquired for $6.9 billion.

MicroStrategy’s inventory trades at $1,557, representing a exceptional 9% achieve inside 24 hours. The corporate’s shares have demonstrated a sustained and steady upward trajectory since February 26, coinciding with Bitcoin’s $50,000 consolidation section breakthrough.

Over two weeks, Bitcoin surged to its current buying and selling worth, establishing a notable correlation between the main cryptocurrency and MicroStrategy. This correlation has additional solidified the corporate’s technique and contributed to its inventory’s efficiency.

MicroStrategy’s strategic funding in Bitcoin has yielded exceptional outcomes. The corporate now boasts a revenue of $7.7 billion on its Bitcoin holdings, which interprets to a exceptional return of 112% as far as Bitcoin breaks new all-time highs.

ETF Knowledgeable Astounded By Bitcoin ETF Success

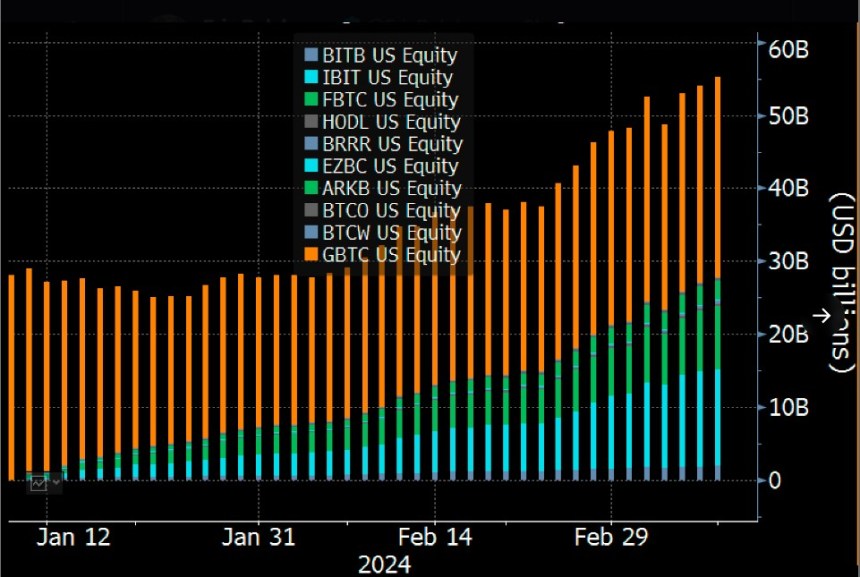

The fast rise of Bitcoin Change-Traded Funds (ETFs) has surpassed even essentially the most optimistic projections. Bloomberg ETF professional Eric Balchunas highlighted the expansion of those funds in a latest put up on social media web site X (previously Twitter). The professional famous that belongings underneath administration (AUM) surpassed $55 billion, and buying and selling quantity reached a powerful $110 billion.

Balchunas acknowledged that reaching such numbers in simply two months was nothing in need of “absurd,” far exceeding what would usually be thought of profitable even on the finish of a full 12 months.

As well as, in a shocking flip of occasions for the ETF professional, Blackrock’s IBIT ETF and Constancy’s FBTC have emerged because the leaders amongst all ETFs when it comes to year-to-date (YTD) flows by means of the center of March. This sudden feat positions these Bitcoin ETF choices as main gamers within the ETF market, attracting the eye and curiosity of buyers searching for publicity to the digital asset.

Presently, BTC continues its uptrend, aiming to solidify and consolidate above the $70,000 threshold, which might put the cryptocurrency in a very good place to succeed in the $100,000 mark in the remainder of the 12 months.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal threat.