Analyst and dealer Michaël van de Poppe is flipping bullish on digital property following an enormous crypto market correction.

Van de Poppe tells his 770,900 followers on the social media platform X that altcoins have skilled a “capitulation” as crypto property price billions of {dollars} had been liquidated amid the imposition of tariffs on Canada, Mexico and China by the US.

On what to anticipate for the crypto market following the substantial correction, the extensively adopted analyst says,

“Bear markets and traits finish in all these days.

Large, illiquid wicks to the draw back.

Fast bounce upwards, and rally after.”

In keeping with the extensively adopted analyst, the deep correction is paying homage to the crypto market crash in March of 2020 when Bitcoin (BTC) fell by round 60% of its worth in days amid the Covid-19 pandemic. Altcoins additionally plunged considerably on the time.

However after the correction, Bitcoin and crypto ignited a multi-year uptrend.

“This feels lots just like the COVID-19 Black Swan crash, because the markets have witnessed a greater than 50% wipeout on altcoins.

Everyone knows what occurred after, and I believe that’s the identical thesis right here.”

Roughly $2.27 billion price of crypto has been liquidated over the previous 24 hours, per cryptocurrency futures knowledge platform CoinGlass.

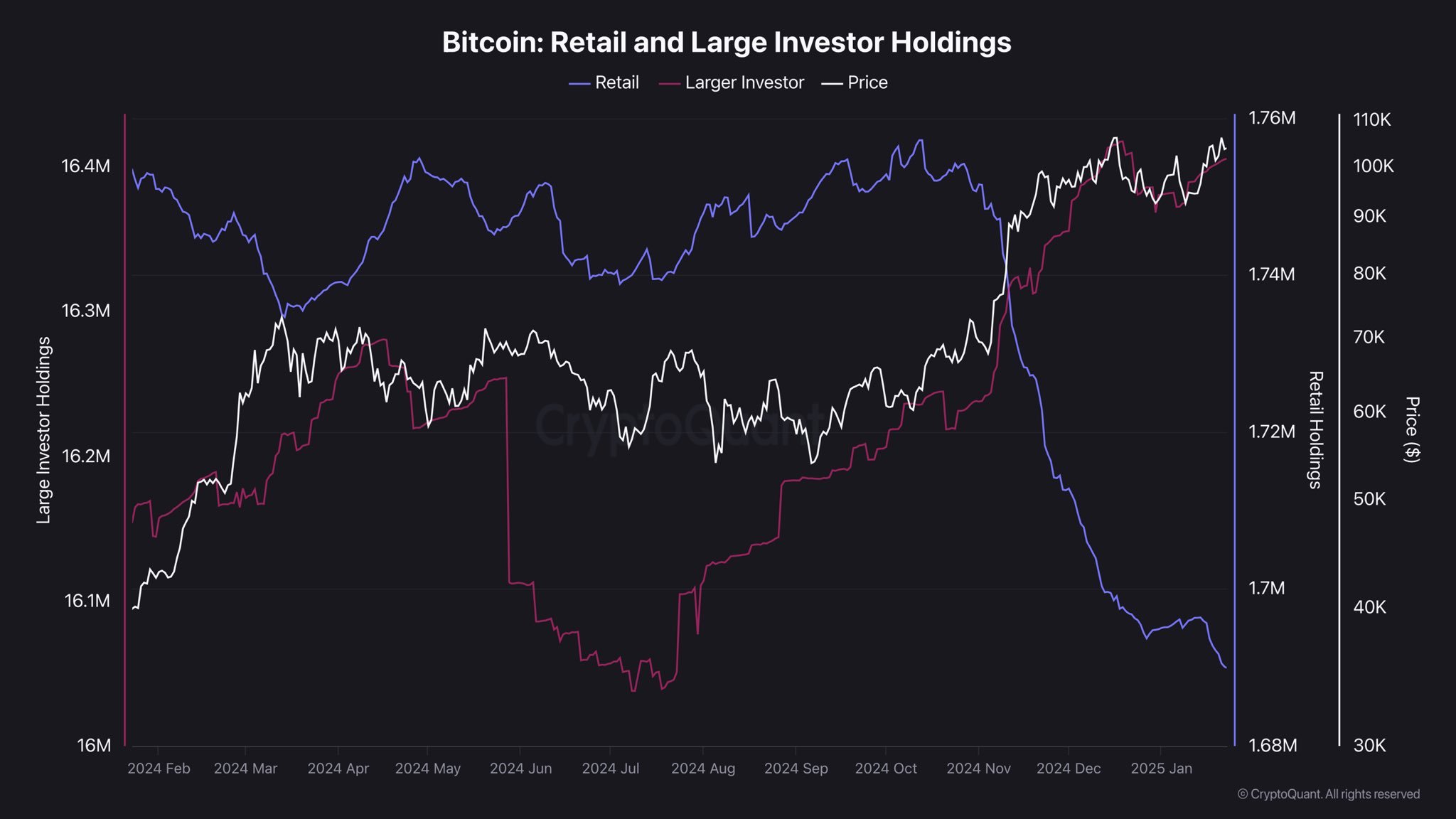

Going ahead, Van de Poppe says retail crypto buyers ought to undertake the methods employed by deep-pocketed buyers.

“Throughout occasions of panic and uncertainty, market makers and whales accumulate extra from retail.

Retail buyers have been promoting.

Massive buyers have been shopping for.

Be like a big investor: purchase Bitcoin and altcoins and maintain.”

Bitcoin is buying and selling at $101,103 at time of writing.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Comply with us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney