Bitcoin has been on a bumpy experience in latest days. The world’s hottest cryptocurrency has seen its value steadily decline, elevating issues a couple of extended bear market. Nevertheless, beneath the floor, some analysts are detecting faint bullish whispers that would sign a possible reversal.

Associated Studying

Shopping for Stress Emerges, However Can It Overcome The Downtrend?

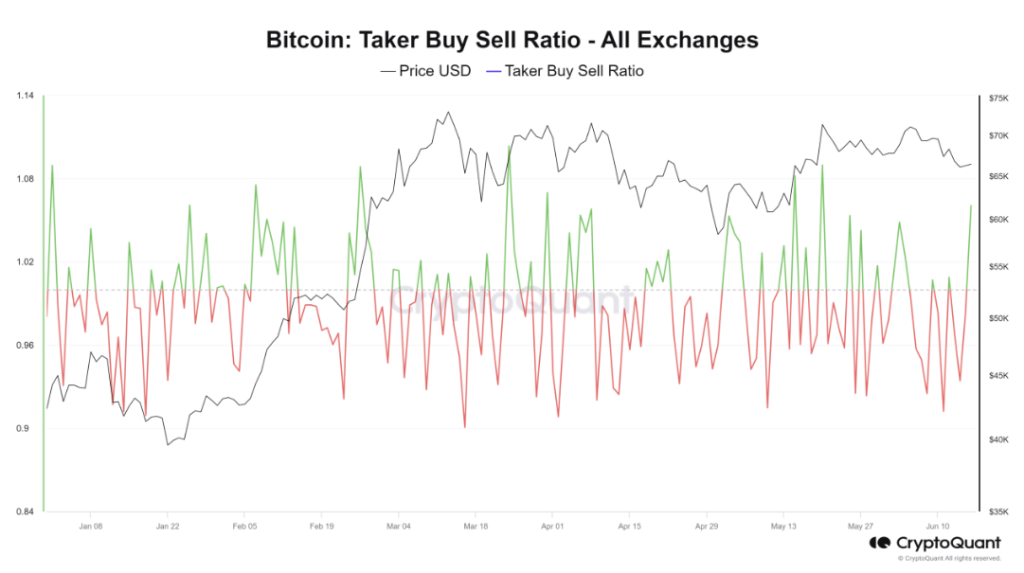

One glimmer of hope comes from the Bitcoin Taker Purchase Promote Ratio, a metric that tracks the steadiness between purchase and promote orders on exchanges. In response to NewBTC’s evaluation, this ratio has just lately dipped beneath one, indicating a bearish sentiment.

On a number of exchanges, the ratio is rising again above one, suggesting that the pattern is recovering. This means a change within the psychology of the market, as extra consumers than sellers are making orders.

It is a optimistic growth, the information exhibits. It signifies that some buyers are seeing the latest value drop as a possibility to build up Bitcoin at a reduction. Nevertheless, it’s essential to keep in mind that this is only one metric, and the general pattern stays bearish.

Alternate Inflows: The Different Narrative

One other attention-grabbing wrinkle within the story comes from Bitcoin’s change netflow. This metric measures the distinction between Bitcoins getting into and leaving exchanges. A optimistic netflow signifies extra Bitcoins flowing into exchanges, which is often seen as a bearish sign as a result of it might signify buyers making ready to promote.

Nevertheless, the present influx appears comparatively low in comparison with previous outflows, suggesting that the general pattern of accumulation may nonetheless be intact.

That is the opposite a part of the narrative, analysts mentioned. On the one hand, elevated change inflows might result in promoting stress. However, the comparatively low quantity in comparison with previous outflows means that some buyers is likely to be transferring their holdings to non-public wallets for safekeeping, which could possibly be a bullish indicator in the long term.

A Cautious Outlook

Regardless of the emergence of those bullish whispers, the general sentiment surrounding Bitcoin stays cautious. The value continues its downward trajectory, with the present assist stage of $65,000 underneath immense stress. If this stage breaks, it might set off an additional sell-off and exacerbate the bearish pattern.

Associated Studying

Bitcoin is at a essential juncture, and the latest indicators of shopping for stress and change inflows are encouraging, however they should be backed by a sustained value restoration. Till then, buyers ought to undertake a cautious strategy and be ready for continued volatility.

The approaching days shall be essential in figuring out the destiny of Bitcoin’s present value motion. Whether or not the bullish whispers can remodel into a powerful roar or get drowned out by the bearish undercurrent stays to be seen.

Featured picture from Getty Photos, chart from TradingView