Because the approval of Bitcoin ETF purposes by the US Securities and Alternate Fee (SEC) on January 11, adopted by the graduation of buying and selling a day later, the ETF race has witnessed spectacular buying and selling volumes on every buying and selling day.

Because the market recovers from a pointy correction, latest developments point out a notable slowdown in Grayscale promoting, which might probably sign a rebound for the Bitcoin worth following the latest 20% drop.

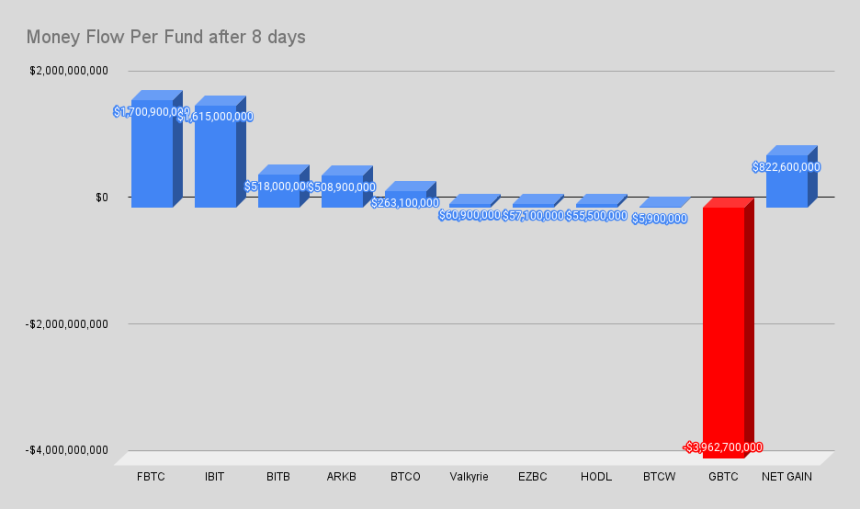

Market skilled James Mullarney and Bloomberg ETF skilled Erich Balchunas present key insights into Bitcoin ETF fund flows after 8 days, shedding mild on the evolving dynamics and investor sentiments surrounding this growth.

Hope For Bitcoin Bulls

One of many key observations made by James Mullarney is the deceleration in Grayscale’s promoting actions. Whereas Grayscale continues to promote, the tempo of their promoting has considerably decreased, indicating a possible shift of their technique.

That is seen as a optimistic signal for the market, as a slowdown in Grayscale promoting might contribute to stabilizing Bitcoin costs and restoring investor confidence.

Amidst this backdrop, main gamers within the asset administration trade, equivalent to BlackRock and Constancy, have showcased their resilience and dedication to Bitcoin.

BlackRock, one of many world’s largest asset managers, presently holds 44,000 BTC in property underneath administration (AUM), indicating their rising publicity to the cryptocurrency.

Equally, Bitcoin ETF issuer Constancy, famend for its digital asset providers, stands sturdy with 40,000 BTC AUM, demonstrating their continued confidence in Bitcoin and its long-term potential.

Furthermore, the dynamics of the latest sell-off are noteworthy. Nearly all of the promoting strain noticed out there concerned FTX, which accomplished day 8 of buying and selling.

Nevertheless, because the market enters day 9, the expectation is for a big discount in promoting strain from FTX and Grayscale, probably contributing to a extra secure market setting, based on Mullarney.

The emergence of Bitcoin ETFs as vital holders of the cryptocurrency is one other optimistic facet to contemplate. ETFs haven’t solely absorbed the 101,600 BTC offered by Grayscale however have additionally elevated their holdings by an extra 21,100 BTC in simply 8 days.

In response to Mullarney, this means rising institutional curiosity in Bitcoin, as ETFs proceed to build up vital quantities of the cryptocurrency.

Bitcoin ETF Issuers Counter Grayscale Promoting

Regardless of Grasycale’s promoting spree, Mullarney highlights that the Bitcoin ETF managers alone are buying 15 instances the every day Bitcoin provide, surpassing 13,444 BTC towards the 900 BTC every day creation price.

This notable influx of BTC demonstrates the sturdy demand from institutional traders and highlights the potential impression of ETFs on the general Bitcoin market.

Apparently, the brand new ETFs have absorbed a internet complete of 122,000 BTC in simply 8 days, overcoming the impression of Grayscale’s launch and contributing to a optimistic internet influx.

Bloomberg ETF skilled Erich Balchunas provides additional insights to the evaluation. Balchunas notes that the amount of Grayscale Bitcoin Belief (GBTC) has decreased, which might be an indication of exhaustion in promoting.

Nevertheless, $515 million was withdrawn from GBTC yesterday, leading to a complete outflow of $3.96 billion since its conversion to an ETF. On a extra optimistic be aware, there was a internet influx of $409 million on the ninth day, indicating renewed investor curiosity.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site completely at your individual danger.