Market Outlook #246 (twentieth November 2023)

Hi there, and welcome to the 246th instalment of my Market Outlook.

On this week’s publish, I can be protecting Bitcoin, Ethereum, Polygon, Avalanche, Uniswap, Beam, Sushi and LayerAI.

Most of those have been reader requests this week – as ever, ship these throughout to me for subsequent week’s inclusion if there’s one thing particular you need taking a look at.

Bitcoin:

Weekly:

Day by day:

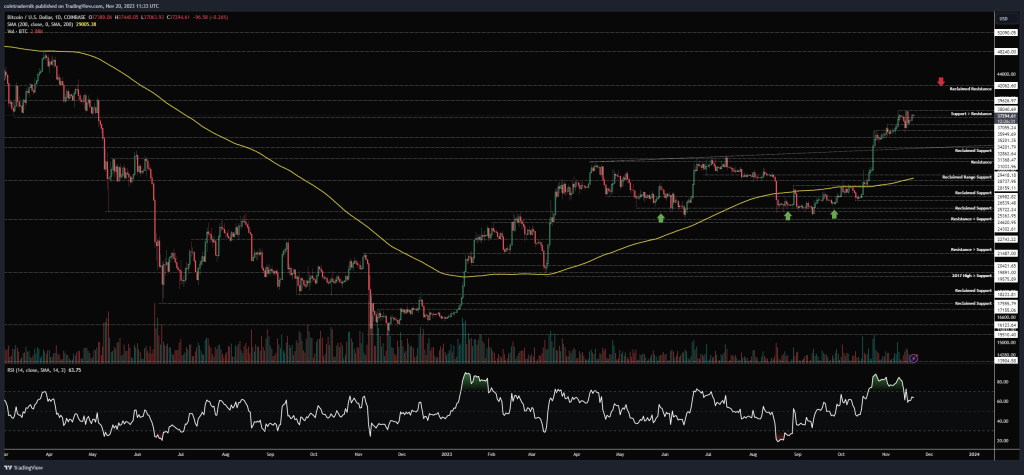

Worth: $37.263

Market Cap: $728.411bn

Ideas: If we start by taking a look at BTC/USD, on the weekly timeframe we are able to see that worth closed final week at marginal new yearly highs, having depraved decrease in the direction of the prior weekly low earlier than bouncing again above the $36k space and shutting shy of $38k resistance. While this was an important present of energy from bulls and there are nonetheless no indicators but that we’ve got topped on this timeframe, the very fact we now have three consecutive weekly lows unswept because the breakout candle is one thing to bear in mind for once we inevitably do mark out an area high. We’re sat proper round prior help right here and above $38k we’ve got no resistance into $39.6k, which I feel could be a pit cease earlier than the inevitable run into that main confluence of resistance at $42k: that is the place we’ve got an necessary historic stage in addition to the 50% fib retracement of your entire bear market. Little doubt, if we are able to settle for above final week’s excessive this week, then that’s the extent we’re headed for earlier than marking out any high. If, nevertheless, we wick above $38k and shut the weekly again beneath it, I feel it seems extra seemingly we want some type of sweep of draw back liquidity earlier than continuation.

Turning to the each day, we are able to see that worth is making greater lows on the each day having reset RSI after the momentum divergence, and prior resistance has grow to be help at $36k. Holding above that early this week is essential – break beneath it and I feel we’re taking a look at a transfer again in the direction of $34.2k as a minimum. Above it, nevertheless, I feel we proceed to push, with each day closes above $38k opening up the subsequent leg greater after this consolidation in the direction of $39.6k after which $42k. Nothing else so as to add right here actually besides that, if we do get a dip after this large rally, I’d be trying on the vary between $31k-34k as a primary shopping for alternative for 2024.

Ethereum:

ETH/USD

Weekly:

Day by day:

ETH/BTC

Weekly:

Day by day:

Worth: $2029 (0.05447 BTC)

Market Cap: $244.205bn

Ideas: If we start by taking a look at ETH/USD, we are able to see from the weekly that worth moved decrease to retest the trendline as help, bouncing and shutting proper again close to the weekly open, just under reclaimed resistance at $2037. There may be nothing about this that at the moment seems bearish to me: we’ve got a powerful trendline breakout, with that trendline appearing as help, and consolidation proper at an necessary resistance stage. Above $1850, this stays the case, for my part. If we shut the weekly again beneath $1850, it’s seemingly we transfer to retest that $1717-1740 vary as help, the place bulls would search to type a higher-low. However for now, I count on to see any acceptance above $2037 this week result in $2172 giving method after which a squeeze to fill within the hole into $2425. Dropping into the each day, we are able to see that RSI has reset as worth retraced into resistance turned help, failing to shut beneath $1957 on a number of makes an attempt. From there, worth has pushed up into $2036, which is essential resistance. Bulls wish to see a each day shut above this adopted by that stage appearing as help. If we see that, lengthy your longs in the direction of $2425. On this timeframe, indicators of weak spot could be rejection right here adopted by a each day shut beneath $1957.

Turning to ETH/BTC, we are able to see that worth rejected above the 200wMA once more final week, with 0.0577 appearing as resistance and sending the pair again beneath 0.055, with it closing at 0.0538. We’re at the moment sat between reclaimed help at 0.053 and the 200wMA as resistance. Clearly, the bullish situation right here could be a weekly reclaim of 0.055 as help – in that situation, I feel we see ETH outperform for a number of weeks, pushing up into that trendline. Nevertheless, if we now reject the 200wMA once more and begin closing beneath 0.053, I feel the yearly lows at 0.051 get taken out and worth runs into 0.0487. Trying on the each day, we are able to see how 0.0533 is appearing pretty much as good help at current however each day construction is bearish following the break again beneath 0.055; bulls actually need to see that stage flipped as help as soon as once more after which we are able to count on to see one other take a look at of 0.0577. Very clear construction right here.

Polygon:

MATIC/USD

Weekly:

Day by day:

MATIC/BTC

Weekly:

Day by day:

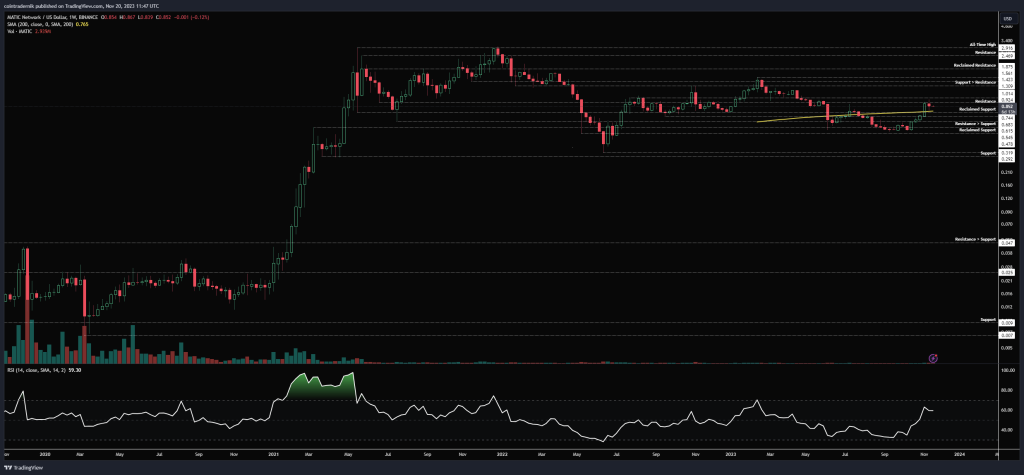

Worth: $0.858 (2303 satoshis)

Market Cap: $7.972bn

Ideas: If we start by taking a look at MATIC/USD, on the weekly we are able to see from the weekly that worth has rallied for a number of weeks after forming a backside above reclaimed help at $0.47, pushing by means of the 200wMA a few weeks in the past after which rejecting simply shy of $1 resistance final week, with worth now sat above reclaimed help at $0.75 and beneath $0.93 as resistance. From right here, I’d count on to see the 200wMA act as help if that is to stay short-term bullish, with any weekly shut again beneath $0.75 opening up a deeper retracement in the direction of $0.62 to type a higher-low above the September-October backside there. If $0.75 holds this week, I’d count on one other crack at $1 to observe with nothing above that for one more 30% into $1.31. Dropping into the each day, we are able to see how worth rejected proper across the 38.2% retracement of the bear market, with the 50% confluent with that $1 space. Clearly, for bulls, $0.92 can not now act as resistance on a retest from beneath, else we’ve got a decrease excessive and one would think about a deeper pull-back would observe, with the 200dMA aligned with reclaimed help at $0.68 as a primary space of curiosity. Settle for again above $0.92 and that is gonna squeeze a lot greater, for my part.

Turning to MATIC/BTC, we are able to see right here that worth rejected beneath the 200wMA, confirming it as resistance at 2450 satoshis and is now sandwiched between reclaimed help at 2100 and that 200wMA and prior help. Closing the weekly again above this might be a vastly promising signal for bulls, and I’d count on a spot fill to observe again in the direction of 3200 satoshis from there. If we shut the weekly again beneath 2100, that invalidates loads of this construction and bulls are again at sq. one, with the multi-year lows at 1700 satoshis in plain sight…

Avalanche:

AVAX/USD

Weekly:

Day by day:

AVAX/BTC

Weekly:

Day by day:

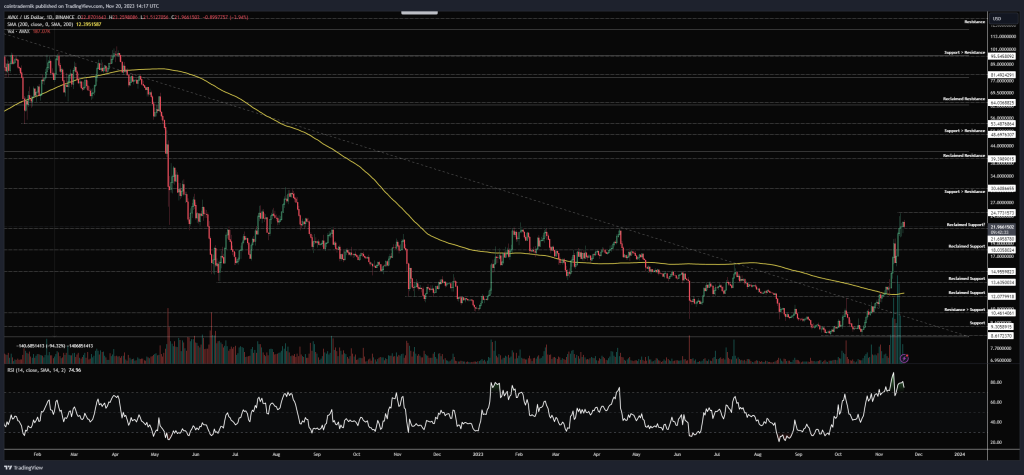

Worth: $22.17 (59,514 satoshis)

Market Cap: $7.926bn

Ideas: Starting with AVAX/USD, we are able to see from the weekly that worth has been on a tear this previous few months, rallying from the multi-year lows at $8.60 all the way in which into $24.77 final week, closing marginally above help turned resistance at $21.70 that had capped the highs all 12 months. Quantity continues to develop but when we now see worth break again beneath $21.70, I’d be in search of $18 to carry as a higher-low given the energy of the rally. Trying on the each day for extra readability, we are able to see how above this stage there may be little or no resistance in any respect again into $30, so any alternative to get lengthy on a pull-back right here could be golden; there may be some momentum exhaustion creeping in and if we do see worth retrace into $18, I can be in search of indicators to get lengthy on the decrease timeframes, with a view to carry for that $30 stage. Beneath $18, a deeper pull-back would have us trying on the vary between $12-15 for entries. In fact, if we aren’t gifted a pull-back in any respect and $21 acts as help this week, a each day shut above $25 will seemingly result in the remainder of that vary getting crammed in fairly shortly.

Turning to AVAX/BTC, we are able to see that worth has rallied proper into a serious stage of prior help turned resistance, proper on the Might 2022 backside round 60k satoshis. Final week, worth depraved above this stage however closed again on the stage, and we now have a extremely robust vary of reclaimed help beneath at 48.5-41k satoshis the place a higher-low might look to type. If we do see that higher-low formation, and that aligns with an entry based mostly on the Greenback pair, the subsequent space of resistance above 60k is that trendline and the 23.6% fib retracement at 84k satoshis…

Uniswap:

UNI/USD

Weekly:

Day by day:

UNI/BTC

Weekly:

Day by day:

Worth: $5.26 (14,109 satoshis)

Market Cap: $3.969bn

Ideas: Starting with UNI/USD, we are able to see that worth has lastly turned market construction bullish once more on the weekly after deviation beneath help at $4.21 led to a bounce off trendline resistance turned help and subsequent rally again above the extent, with worth closing firmly above $4.75 and persevering with greater. We are actually sat with $4.75 having acted as help final week and $5.68 as resistance above; if we are able to maintain above $4.75, I’d count on this minor resistance to offer method with $6.30 the main stage above to look at for. Nevertheless, if we see worth break beneath that reclaimed help finally week’s low, I’m in search of a return to $4.21 for a chance at a leveraged lengthy. I do have a spot place however I want to get levered publicity as near $4.21 as I can get it if doable. Dropping into the each day, we are able to see how worth reclaimed the 200dMA which is now appearing as help, however given how that performed out final time (August) it offers confluence for the significance of holding above $4.75 right here for bulls. Above $5.68, there may be air into $6.30 after which into $7.50. Let’s see if we get the golden alternative for a leveraged lengthy…

Turning to UNI/BTC, we are able to see that worth broke beneath the double backside at 14.4k satoshis a number of weeks in the past, capitulating into multi-year help at 12k satoshis after which reclaiming 14k satoshis as help since. Worth is now sandwiched in between prior help turned resistance at 15.3k satoshis and help at 14k. If this stage offers method once more, I feel 12k is getting taken out and worth runs the all-time low at 9.9k satoshis, which might be an unbelievable long-term shopping for alternative if we’re to count on UNI to stay necessary subsequent cycle. Till that is again above 17k satoshis, nevertheless, I don’t suppose it seems notably robust.

Beam / Advantage Circle:

BEAMX/USD

Day by day:

Worth: $0.0092 (25 satoshis)

Market Cap: $400.281mn

Ideas: While I’m conscious MC is now BEAM or BEAMX, for the needs of study I’ve shared the MC/USD chart right here in order that we are able to see all of price-history.

this, we are able to see how robust the reversal has been since turning the 200dMA into help, with worth now pushing up once more $0.93 as resistance, with that stage additionally being the final main resistance stage between right here and the subsequent stage – 100% greater at $1.88. We’re seeing some momentum exhaustion right here as we come into this resistance, so if we’re to mark out an area high it could seemingly be round right here, however I’d count on any pull-back into $0.60 to be wolfed up given the energy proven to this point. For these in search of an entry, I’d search for $0.60-0.65 as a primary space of curiosity for spot, adopted by $0.44 in case you are fortunate sufficient to get it. For these already on the prepare, benefit from the journey, as I’m anticipating at the least $4 to be hit in 2024.

Sushi:

SUSHI/USD

Weekly:

Day by day:

SUSHI/BTC

Weekly:

Day by day:

Worth: $1.08 (2892 satoshis)

Market Cap: $208.653mn

Ideas: Starting with SUSHI/USD, we are able to see from the weekly that worth has performed out its bear market in a textbook style, capitulating into $0.48 (simply above the all-time lows) in Might earlier than forming a multi-month vary above this stage. Worth then ripped greater, rallying by means of $0.75 to show weekly construction bullish and persevering with by means of the year-long help for, 2022 at $0.90. Worth has since been consolidating above that stage as reclaimed help, and persevering with to carry above this stage could be very promising certainly for SUSHI bulls. If we do get a pull-back, look ahead to a pointy wick beneath $0.90 in the direction of $0.75 and fast reclaim of the extent as help. That will be a sign to get lengthy if we see it. If we drop into the each day for readability, we are able to see how a swift transfer into $0.75 would additionally mark out a retest of prior resistance and the 200dMA as help, however I don’t know if we’re going to be granted such a chance. If not, I’d be in search of a each day shut above $1.30 after which look to lengthy the subsequent pull-back for the vary play again into $2.

Turning to SUSHI/BTC, we are able to see that in contrast to the Greenback pair that is nonetheless capped by trendline resistance from the 2021 highs, however weekly construction is now bullish and worth is consolidating above prior resistance at 2700 satoshis. Clearly, the important thing right here for bulls is to carry this stage as help after which see a excessive quantity breakout above the trendline, reclaiming the Might 2022 lows at 3900 satoshis as help within the course of. If and once we see that, little doubt the start of SUSHI’s subsequent bull cycle is underway, for my part. If this trendline caps worth right here nevertheless and we transfer again beneath 2700, I feel we see the all-time lows retested, with a deviation and reclaim of 1830 being the golden alternative and certain the spring for the subsequent cycle to start. Let’s see how issues unfold…

LayerAI:

LAI/USD

Day by day:

Worth: $0.0124 (33 satoshis)

Market Cap: $3.951mn

Ideas: Lastly, let’s check out LayerAI – a microcap that has began trying very promising, notably given the AI narrative that’s certain to develop in 2024.

If we take a look at LAI/USD, we cam see that worth misplaced 97% of its worth from the all-time excessive again in March into an all-time low at $0.005 in October, then rallying off that low to reclaim the June help at $0.0082 a number of weeks in the past on rising quantity. Worth additionally closed above trendline resistance, turning it into help, and has since been consolidating between $0.0082 as help and resistance at $0.012, the place the 200dMA can be sat. We’ve got each day bullish construction right here additionally, and I’ve been shopping for inside this vary the previous week, trying so as to add on acceptance above $0.014, with a view to carry for a full cycle (new all-time highs seemingly, for my part). Invalidation is a detailed again beneath $0.0082.

And that concludes this week’s Market Outlook.

I hope you’ve discovered worth within the learn and thanks for supporting my work!

As ever, be happy to go away any feedback or questions beneath, or e-mail me immediately at nik@altcointradershandbook.com.