The cryptocurrency market is presently experiencing vital turbulence, prompting a shift in investor conduct in direction of Bitcoin, which has historically been seen because the most secure asset throughout the digital foreign money ecosystem.

Associated Studying

Flight To Security: Bitcoin’s Rising Dominance

In instances of market uncertainty, buyers typically gravitate in direction of what they understand as safer property. This conduct is clear within the latest crypto market dynamics, the place Bitcoin has turn out to be the popular selection for buyers trying to climate the storm.

The broader market sell-off, which noticed a staggering $110 billion in market worth vanish in only one week, has notably impacted altcoins. Initiatives reminiscent of Akash Community, Floki, and Chiliz have skilled vital declines, every plummeting over 30%.

The Enchantment Of Bitcoin

Bitcoin’s attraction lies in its established observe file and perceived stability in comparison with newer, extra risky altcoins. This notion has pushed many buyers to hunt refuge in Bitcoin, whereas altcoins are left uncovered to harsh market circumstances. This shift in desire underscores a broader perception that Bitcoin gives a safer haven in periods of market misery.

Lengthy-Time period Perspective On Bitcoin’s Dominance

Regardless of Bitcoin’s present dominance, some analysts advise warning. Jelle, a seasoned crypto dealer, means that Bitcoin’s dominance won’t be sustainable in the long term.

#Bitcoin dominance continues to lose steam as value consolidates proper under all-time highs.

Nearly as if #Altcoins will outperform as quickly as BTC breaks out.

Nearly. pic.twitter.com/tjVOaUHskm

— Jelle (@CryptoJelleNL) June 17, 2024

He argues that altcoins, with their revolutionary options and potential for vital development, may reclaim their misplaced floor as soon as Bitcoin surpasses its earlier all-time excessive of $74,000. This attitude highlights the cyclical nature of the crypto market, the place completely different property can outperform at completely different instances.

Market Sentiment And Future Prospects

The broader market’s present downturn has led to a bearish sentiment, with Bitcoin struggling to keep up its footing inside a vital help zone round $64,500. The prevailing sentiment is one in every of warning, because the market grapples with uncertainty.

Nonetheless, there are glimmers of hope on the horizon. Curiously, whereas the crypto market has been experiencing a decline, tech shares have been performing properly, marking their seventh consecutive day of positive aspects. This divergence means that the present downturn is likely to be particular to the crypto market quite than indicative of a broader financial malaise.

Volatility And Potential Reversals

The infamous volatility of the crypto market signifies that swift reversals are all the time a chance. Traditionally, digital property have been vulnerable to dramatic swings, and what goes down can simply as rapidly return up.

Associated Studying

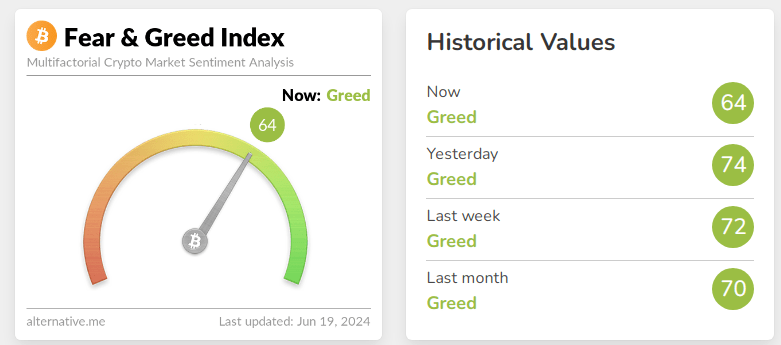

This inherent volatility is each a threat and a chance for buyers. The latest uptick within the Concern & Greed Index to 64 signifies that regardless of the sell-off, some buyers stay optimistic, exhibiting a level of irrational exuberance.

Featured picture from Photlurg, chart from TradingView