In line with a current report by Messari, sensible contract platform Algorand (ALGO), showcased notable development and outperformed the final crypto market in the course of the fourth quarter of 2023.

Algorand Outperforms Crypto Market Progress

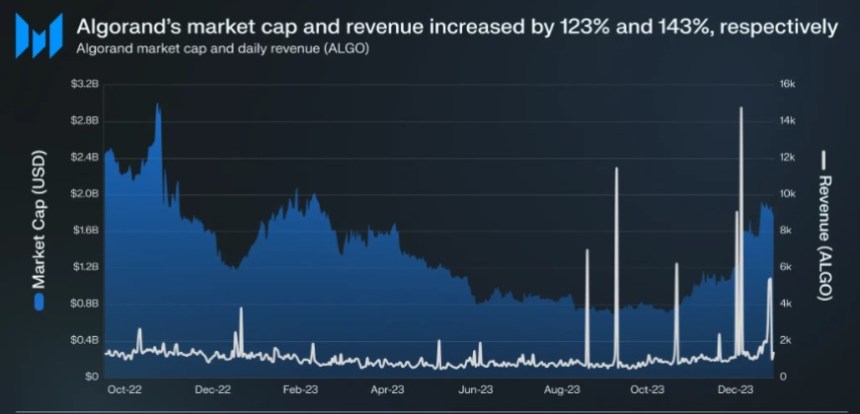

Per the report, Algorand skilled a surge in market capitalization throughout This fall 2023, with a major development charge of 123%. This substantial enhance will be attributed to the general constructive momentum of the crypto market, which witnessed a 53% development in market capitalization throughout the identical interval.

Transactions on the Algorand community additionally noticed a major uptick, growing by 58% quarter-on-quarter (QoQ). Consequently, payment income rose by 60%, reaching its highest stage in a 12 months when measured in ALGO phrases, whereas income in USD phrases surged by a formidable 143%.

In line with Messari, Algorand’s success will be attributed to its “thriving” ecosystem, which noticed the launch of a number of modern functions in This fall 2023. These functions lined numerous areas akin to regulated and programmable euro, tokenized farmland, and a developer market for promoting code snippets.

The introduction of those functions additional solidified Algorand’s place as a “dynamic and versatile” platform, attracting customers from numerous domains, in accordance with the report.

Furthermore, Algorand witnessed a considerable enhance in consumer adoption throughout This fall 2023, with the addition of 1.9 million new addresses, representing a 72% QoQ development.

The platform additionally skilled a surge in transaction quantity, with transactions surpassing 5.5 million in the direction of the tip of the quarter, marking the very best quantity recorded prior to now 12 months. Notably, ALGO transactions elevated by 43% QoQ.

Messari additional means that the rise in transactions will be attributed to the recognition of sticky functions like Lofty.ai, which boasted over 7,000 month-to-month energetic customers, and TravelX, which issued over 2 million NFT airplane tickets, with over 1 million issued in This fall alone.

Lower In Staked ALGO

Regardless of development in key metrics, the report highlighted a decline within the quantity of staked ALGO throughout This fall, with a 49% year-on-year (YoY) lower. Messari attributed this decline to the discount in rewards per governance interval.

The diminishing rewards point out a choice amongst customers to make the most of the native asset for transactions relatively than committing it to governance. That is additional supported by the notable 58% QoQ enhance in transactions on the Algorand community.

Equally, Algorand’s stablecoin market cap skilled a gentle decline all year long, with a QoQ lower of 43% and a YoY lower of 74%.

Notably, Tether’s USDT stablecoin skilled a extra extreme fall on Algorand, with over $100 million withdrawn in Q3. Nonetheless, Quantoz launched EURD on Algorand, issuing over 1 million euro-backed tokens in This fall, contributing to 1.4% of the stablecoin market cap on the platform.

Regardless of earlier declines, Algorand’s decentralized finance (DeFi) whole worth locked (TVL) witnessed a major development of 109% in This fall 2023.

The platform’s DeFi ecosystem rebounded from a current downturn, reaching its second-highest stage prior to now 12 months, with a 12% YoY enhance. Notably, People Finance skilled substantial development, doubling its market share worth from 55% to 58%, whereas Pact and Tinyman accounted for about 14% of every of the DeFi TVL market share in This fall.

As of the most recent replace, the ALGO token is at the moment buying and selling at $0.1753. It has skilled vital declines throughout numerous time frames, with notable decreases of 8.7%, 12.4%, and 18.5% prior to now fourteen days, thirty days, and one 12 months, respectively.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site totally at your individual danger.