Blockchain protocol MakerDAO (MKR) continues to see vital positive factors, sustaining a powerful upward development all year long. MKR has seen vital progress of over 358%, accompanied by constructive metrics reflecting elevated adoption and utilization of the protocol.

As well as, upcoming voting initiatives intention to additional enhance the platform’s advantages for its stakeholders.

MakerDAO Declares Plans For Charge System Modifications

In a current announcement, MakerDAO acknowledged that it intently displays developments within the cryptocurrency market and has gained a greater understanding of the influence of current proposals.

In consequence, the protocol is recommending the following set of modifications to its fee system. MakerDAO emphasised that additional changes will doubtless be launched shortly, contingent upon market dynamics, resembling costs, leverage demand, and the exterior fee atmosphere encompassing centralized finance (CeFi) funding charges and decentralized (DeFi) efficient borrowing charges.

The protocol additional famous that the Maker fee system will probably be adjusted accordingly if the exterior fee atmosphere continues to exhibit indicators of decline.

Efforts are underway to replace the speed system language throughout the Stability Scope, together with growing a brand new iteration of the Publicity mannequin. These updates intention to make sure that the system can regulate charges extra progressively and successfully sooner or later.

Based mostly on suggestions from BA Labs, a blockchain infrastructure supplier, the Stability Facilitator proposes varied parameter modifications to the Maker Charge system, which will probably be topic to an upcoming Govt vote.

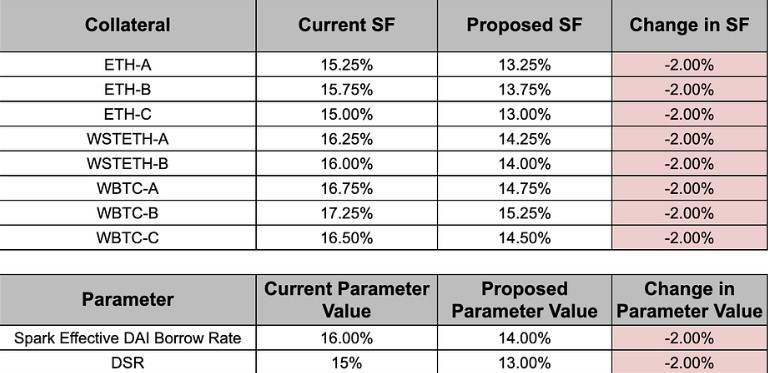

As proven within the desk above, the proposed modifications embody lowering the Stability Charge by 2 share factors for varied collateral varieties resembling ETH-A, ETH-B, ETH-C, WSTETH-A, WSTETH-B, WBTC-A, WBTC-B, WBTC-C. As well as, the Dai Financial savings Charge (DSR) and the Efficient DAI Borrowing Charge for Spark can even be decreased by 2 share factors.

Nevertheless, one energetic protocol person supplied an alternate viewpoint, suggesting utilizing the demand shock alternative to broaden the web curiosity margin. Whereas agreeing with the proposed 2% curiosity fee discount for debtors, the person advocates for a bigger 4% discount within the DSR, which he believes will additional profit MakerDAO’s internet curiosity margin.

In the end, the end result of the voting course of will decide whether or not these proposed modifications are carried out and profit the stakeholders of MakerDAO. Additional choices concerning charges and costs will probably be made based mostly on the outcomes.

Market Cap Skyrockets

Based on knowledge from Token Terminal, MakerDAO has demonstrated vital progress and constructive efficiency throughout varied key metrics over the previous 30 days.

When it comes to market capitalization, MakerDAO’s absolutely diluted market cap has reached roughly $3.07 billion, reflecting a notable enhance of 40.9% over the previous 30 days. The circulating market cap is round $2.82 billion, displaying an analogous progress fee of 41.1%.

On one other notice, the whole worth locked (TVL) in MakerDAO has elevated by 10.1% over the previous 30 days to roughly $7.05 billion.

The token buying and selling quantity for MakerDAO has surged 126.6% over the previous month, reaching roughly $4.35 billion. This enhance in buying and selling quantity suggests heightened market exercise and curiosity within the protocol.

When it comes to person exercise, MakerDAO has seen a rise in each day energetic customers, with a rise of 32.2% to 193 customers. Then again, weekly energetic customers decreased by 22.6% to 783 customers. Nevertheless, month-to-month energetic customers have proven a constructive progress fee of 10.0%, reaching 2.88k customers.

Brief-Time period Outlook For MKR

Concerning value motion, MKR is at present buying and selling at $3,158, reflecting a 4.8% progress previously 24 hours, 10% previously seven days, and a powerful 49% enhance previously fourteen and thirty-day time frames.

The token has encountered a help wall for the brief time period at $3,048. This help degree is important for the token’s progress prospects. One other key help degree is at $2,884, which additional contributes to the token’s short-term stability and potential progress.

Then again, the closest resistance degree is noticed at its 28-month excessive of $3,321. This degree represents the best level reached by the token since November 2021.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site fully at your personal danger.