Fast Take

The marketplace for Bitcoin ETFs is witnessing an uptick in curiosity from institutional buyers.

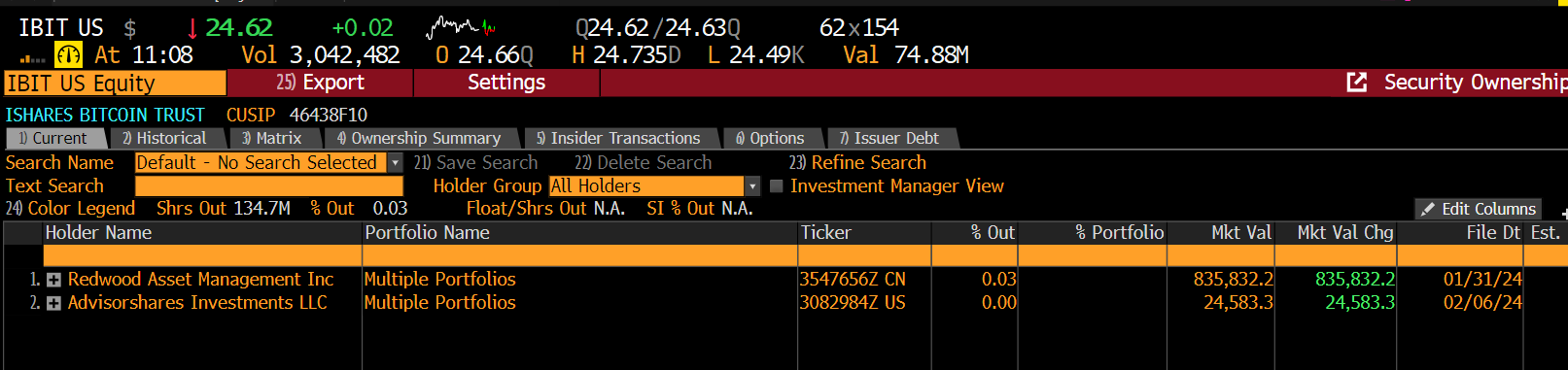

BlackRock lately seen an enlargement within the holder record of its ETF, IBIT. The brand new entrants embrace Redwood Asset Administration Inc. and Advisorshares Investments LLC, in keeping with ETF Bloomberg analyst Eric Balchunas.

This might doubtlessly function a precursor for elevated institutional acceptance of Bitcoin ETFs as a brand new asset class.

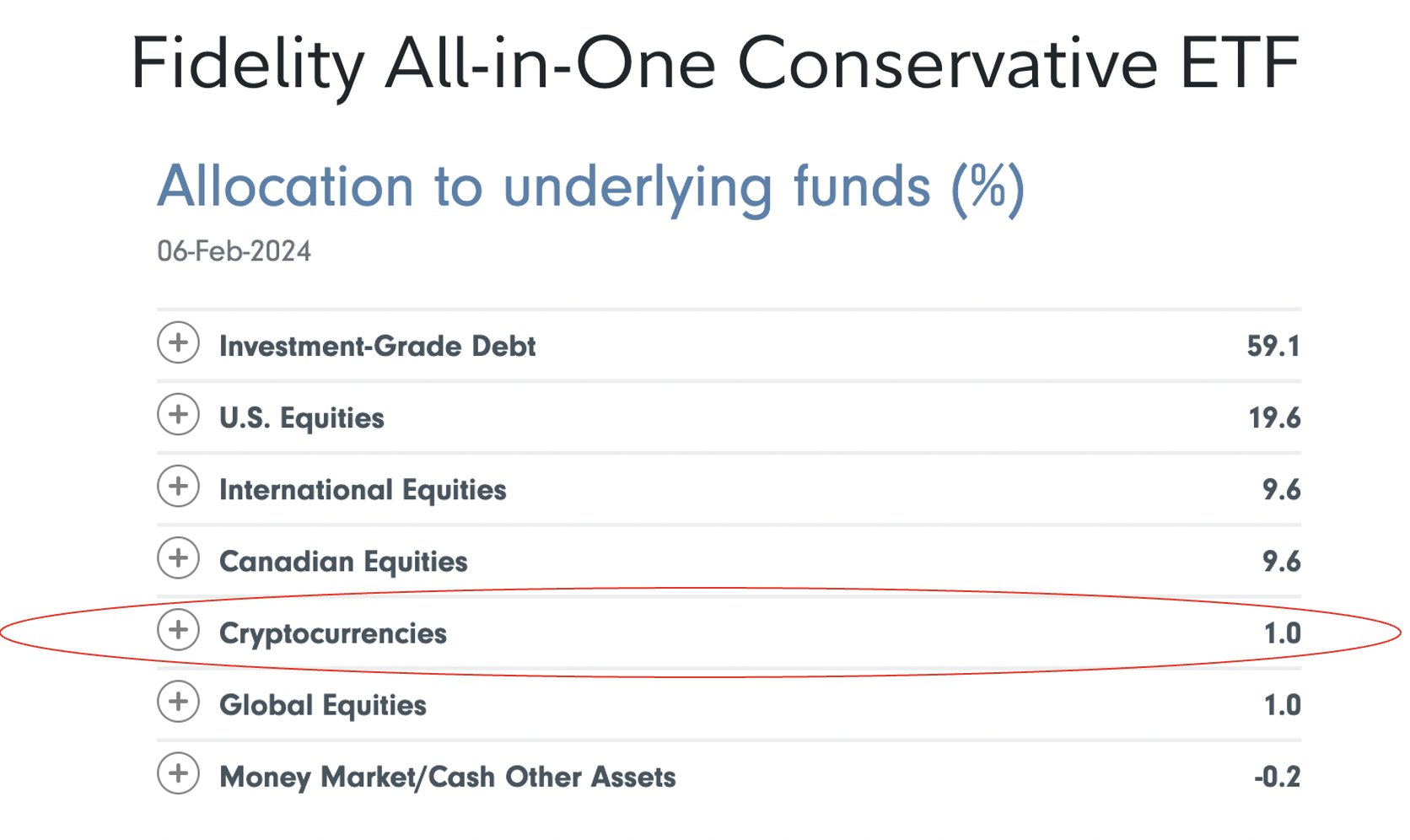

In a parallel growth, Constancy Canada has included a share of Bitcoin allocation of their “All-in-One” asset allocation funds, using spot Bitcoin ETFs.

Based on Bitwise Make investments CIO Matt Hougan, these allocations vary from a modest 1% of their conservative portfolio to a extra assertive 3.1% within the aggressive portfolio.

These developments spotlight the burgeoning curiosity of establishments in Bitcoin ETFs, and it’s anticipated that this development will proceed to evolve.

The publish Main establishments sign rising curiosity in Bitcoin ETFs appeared first on CryptoSlate.